Hello everybody, Hope you all are fine and in good health!

My this post is a Homework Task assigned by professor @reddileep which is about Triangular Arbitrage

1- Define Arbitrage Trading in your own words.

Arbitrage trading

source

Q:2 What are the types of Arbitrage Trading and define at least 3 Arbitrage types

After few hours’ research on Arbitrage trading and its various types I have listed following types. All the types are real time arbitrage strategies that are being used in the crypto market and have various benefits and drawbacks.

- Covered interest arbitrage

- Uncovered interest arbitrage

- Index arbitrage

- Currency arbitrage

- Convertible arbitrage

- Future arbitrage

- Triangular arbitrage

- Cryptocurrency arbitrage

- Statistical arbitrage

Future Arbitrage

As we can realize the meaning of this method by its name it’s a future trading strategy. This trade has a fixed price for a particular digital currency considering it to sell or buy in future. In this trading strategy, two parties are involved one which is agreed to sell a specific asset on fixed price and other one is buyer. So, they make an future agreement of buying and selling of an asset on fixed agreed price, without realizing the market situations, they would be liable to make the transaction on the agreed date and time.

source

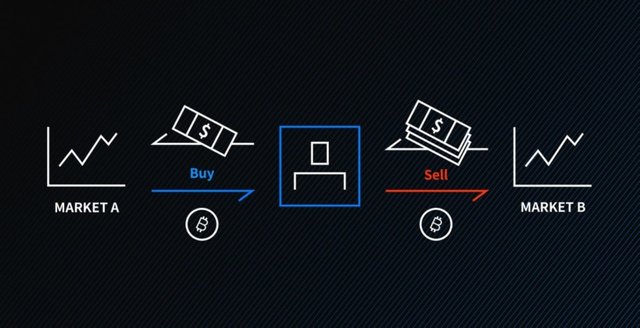

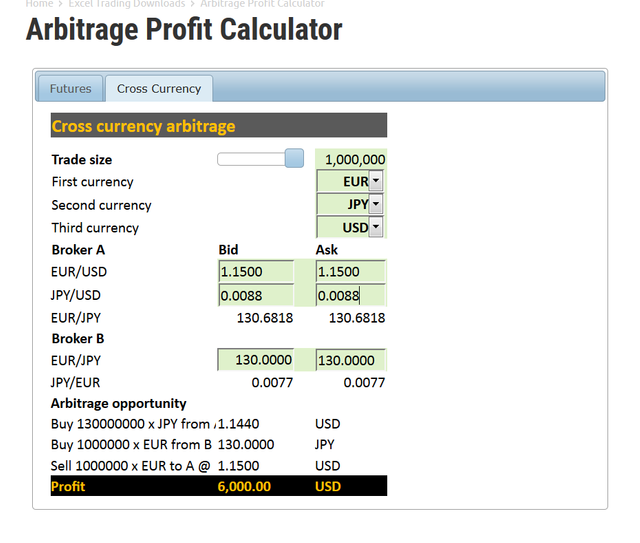

Currency arbitrage

It can be define as a trading strategy in which crypto traders are associated with trading brokers to get benefits from different spread opportunities offered by the brokers in the market. Also, each spread posses different ask and bid price in the market. Currency Arbitrage traders can be involved with multiple brokers for buying and selling currency pairs to make profit from a mispriced rates for a particular currency.

source

Triangular arbitrage

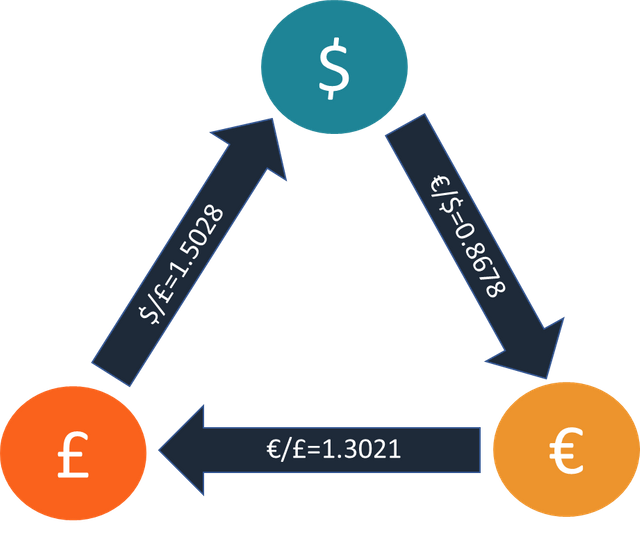

Triangular arbitrage trading involved in three digital currencies and the key is fact in this strategy is their price discrepancies in the market. This strategy can be implemented by traders when they got realized about the different exchanges prices for particular assets.

To understand it completely let me assume an example as in the following.

Implementing triangular arbitrage strategy, i have EUR/GBP for a price of $100 and then convert that asset into EUR/USD for a different price and finally converted my EUR/GBP. I need to make profit by playing with price differences in each exchange. Also, transaction fee can lower your profit in the process.

source

Q 3- Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

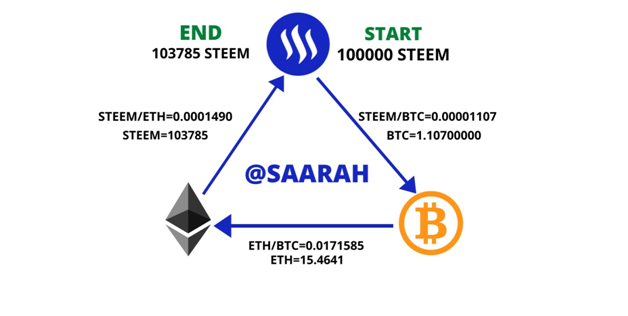

In this arbitrage strategy three currency are involved to make multiple transactions in the process. As you can see in the below screenshot that how a Triangular Arbitrage Strategy was demonstrated in the first place.

Initially I had 100000 Steem and sold my Steem for BTC at the rate of 0.00001107 and 1.110700000 BTC received in wallet. After that BTC was bought at the rate of 0.017158 to get ETH 15.4641 as can be seen in the above screen shot.

Finally, its time to sell ETH for Steem at the rate of 0.0001490. You can see I received 103785 Steem at the end of this transaction.

Conclusion From above real time transaction you can see I made of profit of 3785 Steem by using Rectangular Arbitrage Strategy. I managed to make profit by quick actions and correct selection of market which was offering less transaction fee. In this strategy, you should be smart enough while selecting an exchange and time duration of these real time transactions.

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

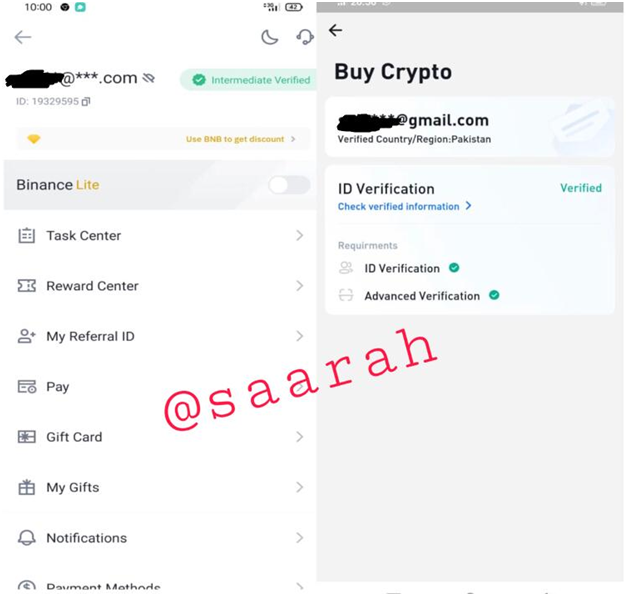

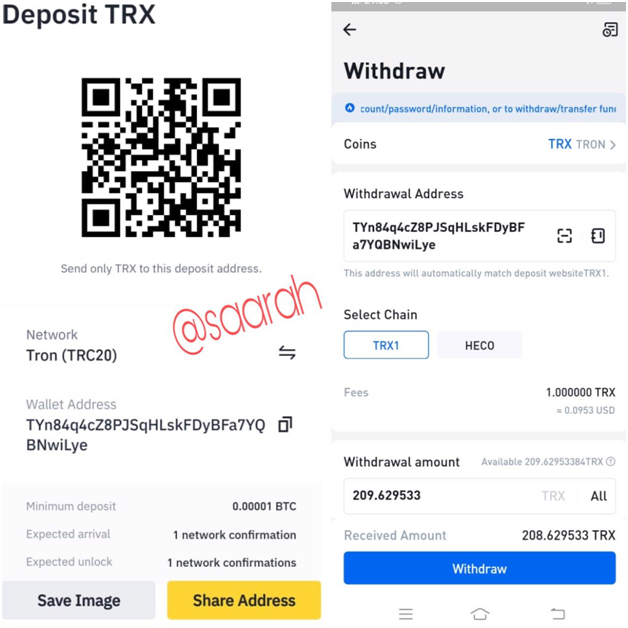

I am going to make a transaction and I need to login in my verified exchange as you can see in below screens shot. It my Binance exchange account.

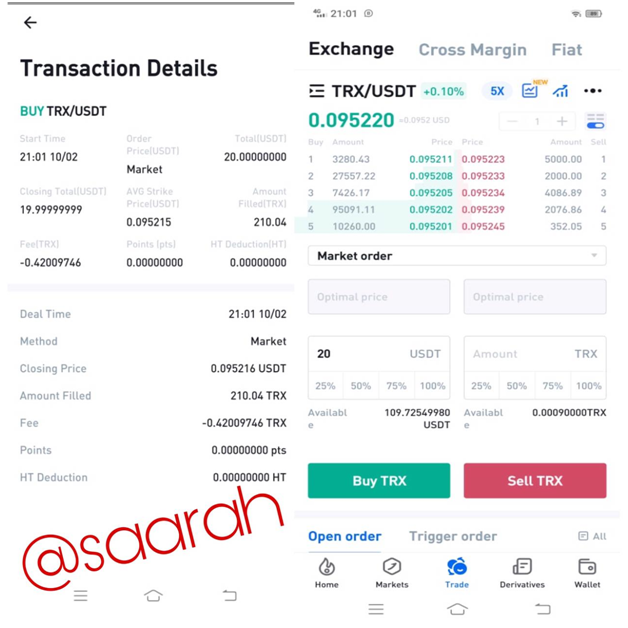

Amount that need to buy is being selected and you can see the TRX/USDT pair in above screen shot. I have bought 20 USDT from exchange and transaction history is shared.

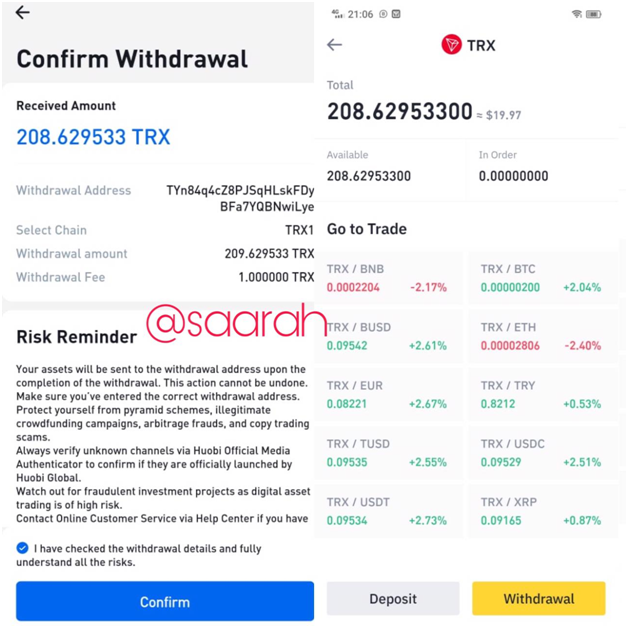

Now I have TRON in my wallet as you can see in the screenshot and then copied my TRON wallet address. TRON wallet address then pasted in Huobi exchange to withdraw TRX. Clicked on the button of withdraw and here made a successful transaction.

Now, you can see in my Binance exchange account deposited TRX 208.62953300 successfully.

Then need to click on confirm button and transaction confirmed.

5- Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Crypto currency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

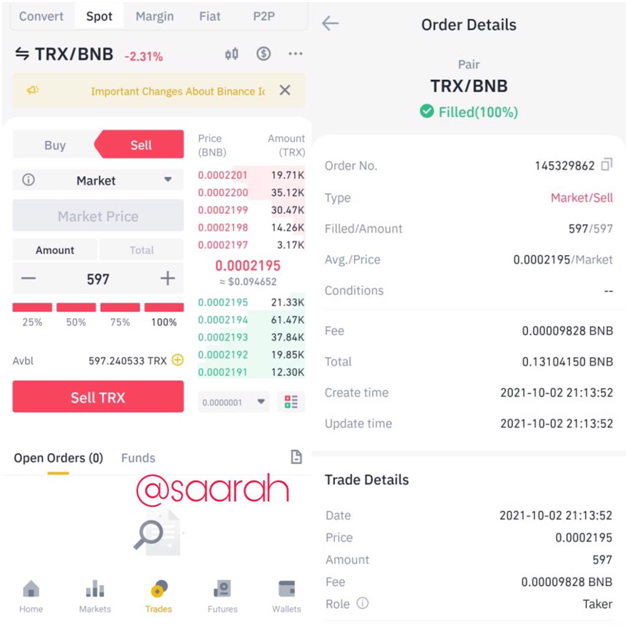

Now, we need to do a transaction by executing arbitrage strategy and demonstrated well with the help of screen shot.

I am going to sell TRX/BNB 597 at the market rate 0.0002195 and converted into 0.00009828 BNB after the transaction.

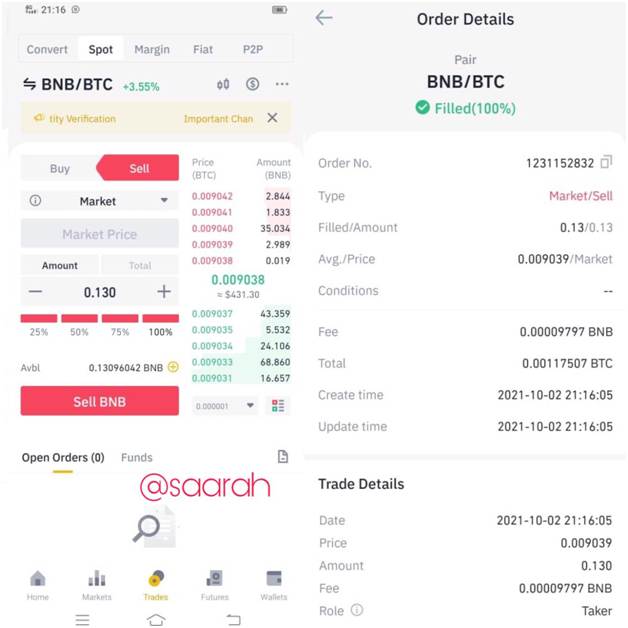

In the above screenshot I sold my 0.00009797 BNB to get BTC at the rate of 0.009039 and converted into 0.00117507 BTC as you can see in the screenshot.

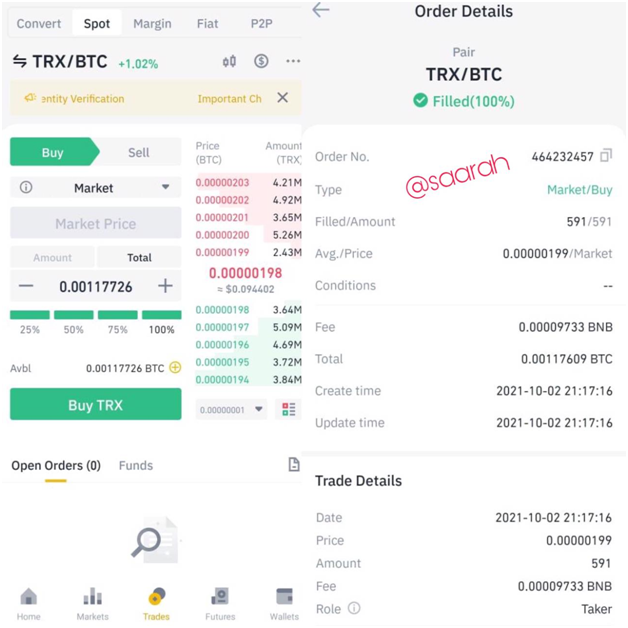

After getting BNB now its time to buy TRX and I have selected the total amount that need to use in this transaction which is 0.00117726 BTC at the rate of 0.00117726. I received 591 TRX as you can see in the transaction details.

Conclusion From the above transaction history we know that we been is loss situation. Loss happened due to two main reasons one is transaction fee which was occurred during the transactions and second one is market was not liquid at the time of transaction. So, we need to be always efficient and quick enough to different market transaction fees and market situation. In this way we can make the profit .

Q:6 Explain advantages and disadvantages of arbitrage trading

Advantages of arbitrage trading

Arbitrage trading is considered to be a trusted method and very popular among the crypto traders due to less potential risks involved in the execution of this method, which makes it a good method to make profit.

Another advantage of this method is that you don’t need to keep the currency for a long term to make profit. Before executing this strategy traders already analysed the prices for a particular asset in different markets. Trader needs to be very efficient while executing buying and selling assets in different markets at the better price. Keeping an asset for a longer period is not a healthy approach in this method of trading.

Disadvantages of Arbitrage trading

To make profit in this method, traders must have a good analytical skills to read the market and price analysis for the same crypto asset. Lacking in this matter trader can lose its profitability.

Another disadvantage of this trading, you need to be very vigilant and it does require many hours research and analysis of different markets for a same asset.

Also, no doubt digital currency market needs more improvements and technology enhancements in order to remove fix the bugs and price differences. Many work has been done and still major corporations are doing their best to make markets and asset price analysis. So, there would be less opportunities for these types of trading.

Finally, the profit margin in this trading is very low, but if you do make huge transaction by this method you can make slightly higher profit. Large financial institutions or individual with large buying and selling can make more profit as compare to the little amount transactions.

Conclusion

From all of the above discussion on arbitrage trading, we can conclude that this method is highly recommended for those traders or individuals who posses strong analytical skills and capabilities to analyse the different markets and price analysis for the same digital asset. Although, profit ratio is not high but still this way of trading have multiple advantages.

Regard

@saarah