Question 1. Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

The dark pools are not a very new concwpt. These are in use for a long time before the making of cryptocurrencies. Basically, a dark pool is a private place or a private platform where we can perform financial exchanges away from the eyes of public. Due to this feature of dark pools, before the introduction of this concept in crypto business the dark pools was only a matter of time.

The dark pools are essentially the separate private venuses in order to exchange Cryptocurrency assets from general value of exchange. These are the avenuses for the traders for placing last crypto orders with remains anonymous. Basicall, we can see the dark pools as a separate exchange platform for the institutional players in the business of cryptocurrencies.

WORKING OF DARK POOLS:

Many of the dark pools allow traders to place the limit order of huge amounts which are basically the orders that are set at a predetermined price by a trader and they work in this way. Normally the limit orders would visible on public order book of exchange but the limit orders do not visible in case of dark pool orders.

In this case the order book is said to be invisible and separate. By this, the intentions of whales made unknown to the public and this prevents the people from making trading decisions which have bad effect on the market and in the turn there would be a favourable price which fill the orders of whales.

When large orders are placed by the traders, at the same price they get them matched to the orders. The placing of these type of orders is known as block trading and a large amount of assets buy and sell in this. We know that the dark pools are meant for bigger order, there is still a minimum amount which is required to be placed by the traders. The traders in dark pools can only see their own orders. The slippage is avoided since the orders are filled at a predetermined price.

Question 2. Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

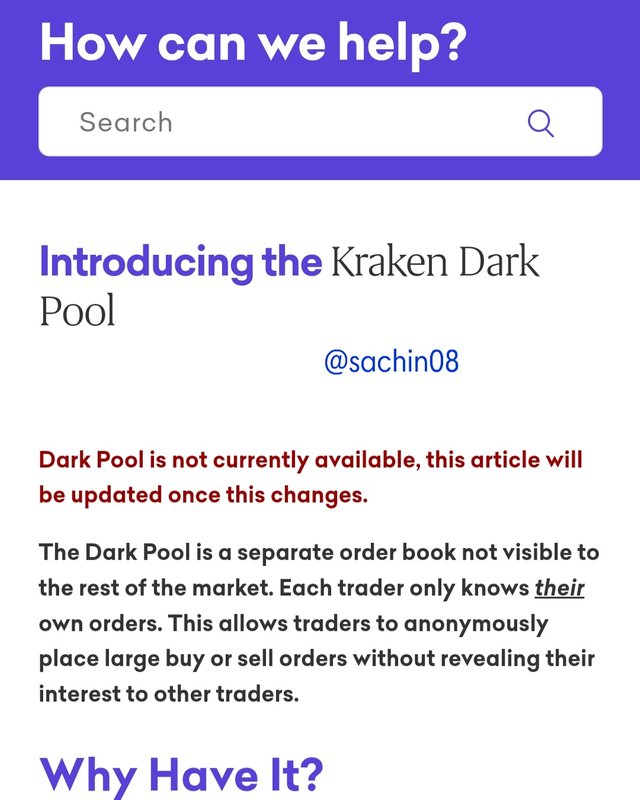

Here, in this question I will discuss about the Kraken Dark Pool.

KRAKEN DARK POOL

The First dark pool in Cryptocurrency was launched in 2016 which was known as the Krakin exchange. After the krakin exchange dark pool, many other dark pools are launched.

There were many traders in the market who wanted to trade bug amount without getting affected by the volatility and slippage of market and because of those traders, the Kraken Dark pool was launched whoch offers the Dark pool of the platform of these traders.

As I have already elaborated above that the Kraken Dark pool works on the limit order. In the limit order, a person does not know about the orders of market and the trader sets the determined price on which he/dhe wants to sell /buy the coin or asset and the order which is set by trader is eliminated in that and the one which matched with the price will be able to see it.

The kraken exchange executes its order keeping safe request by which some other traders do not get to know that cost of any coin which is currently been bought without putting doubt fear of the fear of missing out to other persons.

Question 3. What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

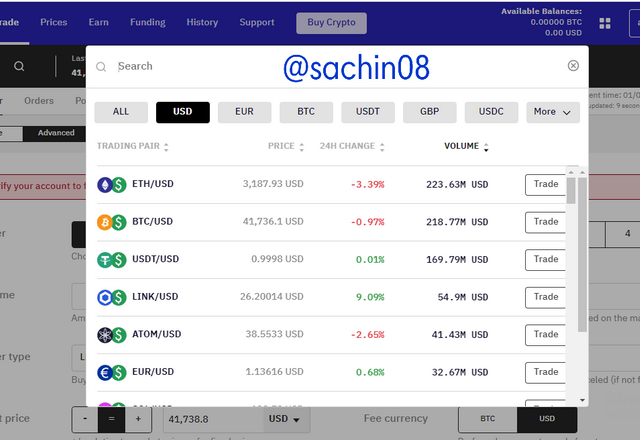

Asset pairs Supported on the Kraken Dark pool

- ETH/BTC

- ETH/USD

- ETH/EUR

- ETH/CAD

- ETH/GBP

- BTC/EUR

- BTC/CAD

- BTC/USD

- BTC/GPB

- ATOM/USD

- LUNA/USD

The BTC, ETH and USDT are the main crypto assets which are on the Kraken Dark pool and other coins are also available on its exchange.

Requirements for getting involved in Kraken's Dark pool

According to the website of Kraken, the requirements for getting involved in the Dark pool of kraken are stated below:

- Only those users can access to it which are Pro level verified.

- For BTC pair, the minimum amount of order size of approximately 100k USD.

- For ETH pair, the minimum amount of order size of approximately 50k USD.

- Market orders are not supported. Only the limit orders are supported.

Fees Attracted in Kraken's Dark pool:

The trading fees for the orders on dark pool range from 0.20% to 0.36%. The rates of trading fees on Kraken Dark pool depends on the 30-day trading volume of the user. More the user trades on the dark pool or Kraken exchange, the lower would be the fees paid.

Question 4. For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required)

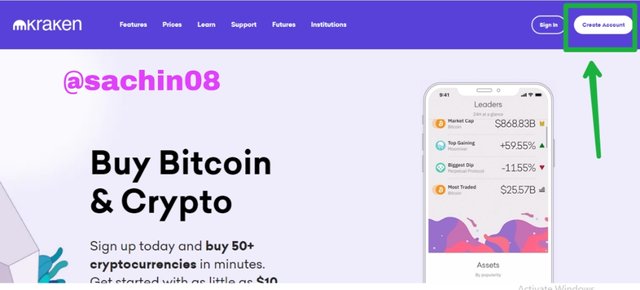

To perform a block trade on the Kraken dark pool exchange, first go to the website of Kraken. You will reach on the homepage of kraken. Then follow the steps given below.

- Click on the Create account button to create an account on kraken.

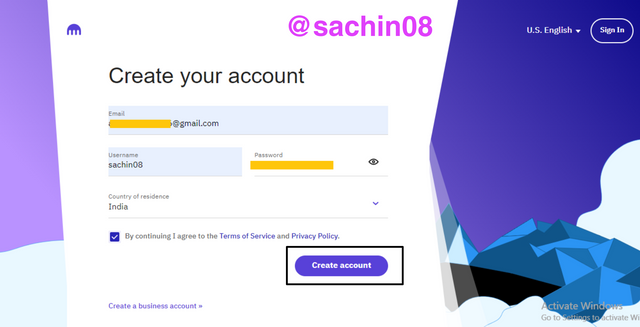

- Enter your email address, username and password in the columns and select your country and click on create account.

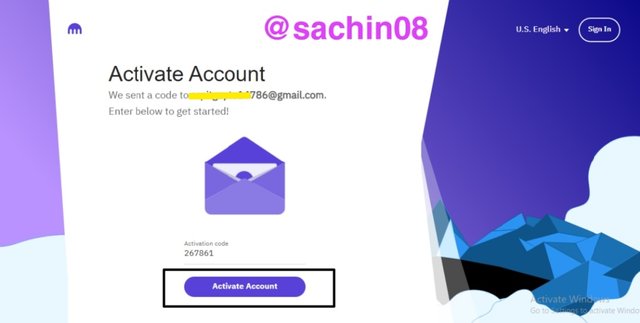

- On the next page, enter the activation code which will be sent to the emal address entered and then click on Activate Account and your account will be created successfully.

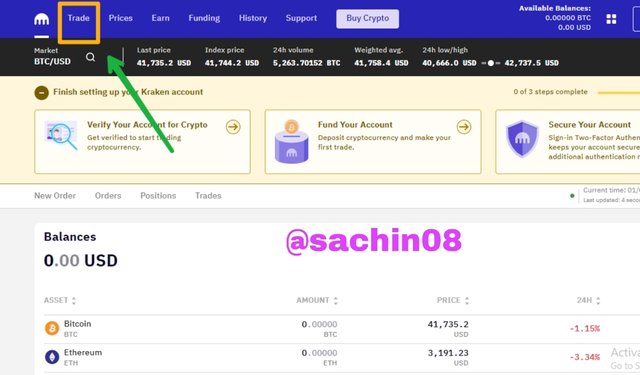

- Now, to place a trade, click on the Trade tab on the top left corner.

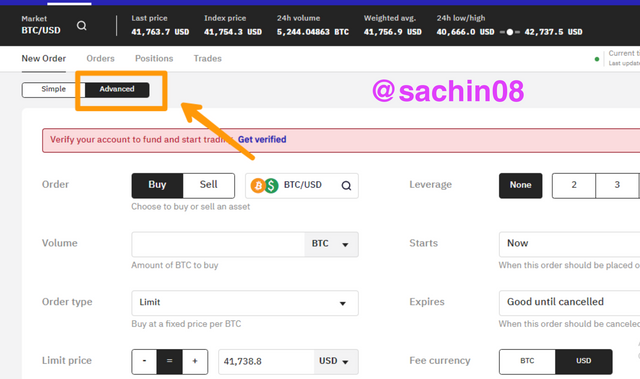

- In the page of new order, select Advanced tab.

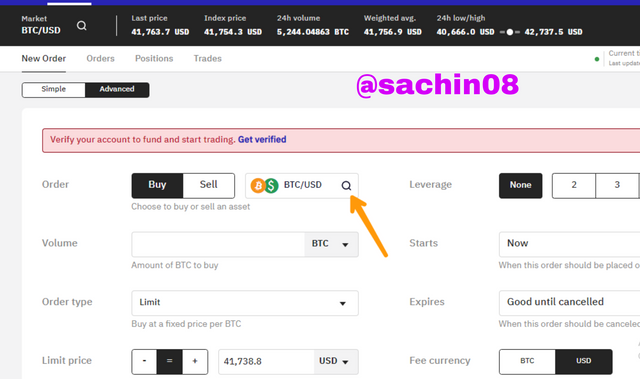

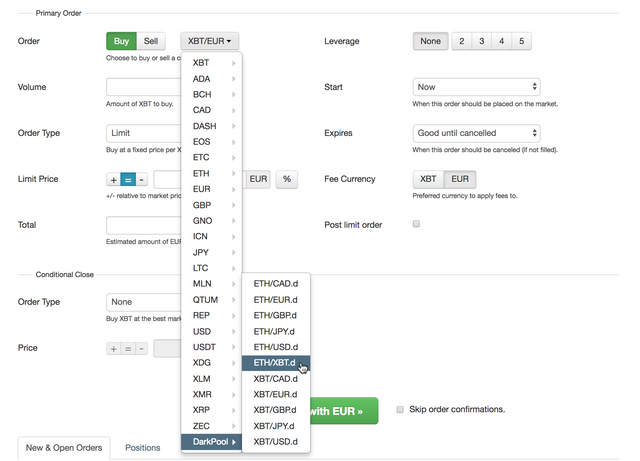

- Then, click on the pair search buttton as shown in the screenshot below to find the different dark pool pairs.

- Select the. Pair that you want.

- As the dark pool is not currently available on krakin exchange, we cannot try this option and when the function is available, then we can use it in this way whivh is given in image below.

Question 5. What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

DECENTRALIZED DARK POOL

In general, a decentralized dark pool is actually have the same concept with with dark pool exchange but there are few differences in functions. The decentralized dark pool in which the traders can privately place their trades of large magnitudes without any other party interaction. So by this we can say that these orders are placed and executed with the decentralized dark pools and they are unknown to public and intermediary (or facilitator). Thus, the decentralized dark pools are private absolutely.

When we place an order in decentralized dark pool, it brokes into very small pieces and these are ready to be matched. These pieces are then received by different nodes and they complete to match them.

The first decentralized pool exchange of the world was launched in the year 2018 by Republic Protocol. The decentralized dark pools have Cryptocurrency orders which are divided into different parts and after that with the use of zero knowledge proof, these are matched with each other by the decentralized dark pools. When the decentralized dark pools are compared with the typical networks of Dark pool, then the decentralized dark pools is seem to have a safer method than typical networks which we talk about digital verification.

Zero-Knowledge Proofs

The Zero-Knowledge Proofs (ZKP) are also known as Zero-Knowledge Protocols. These protocols make it possible for any party involved in a transaction to show the evidence of the occured transaction to present the proof of that transaction and it does not need to disclose the sensitive details of that transaction. This method is authenticated and no one can share the password by which they can not be stolen.

The idea of Zero-Knowledge Proofs had introduced by three researchers very long ago. The idea which the three researchers proposed was that instead of just looking on how can the prover prove knowing a secret, there should be looking of verifiers as well. The Zero-Knowledge Proofs have the main idea that this proof tries to prove that over a hidden information, a party has power over other but this reveal it to be the different party.

There are some of the good properties which the Zero-Knowledge Proofs are comprised of which are;

The first property is that of completeness as there must be a proving by a prover to the verifier that he has the information.

The other thing is that, if the prover could not prove himself/herself, there should be a nature of unconvincity in buyer.

Question 6. State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

Ren Protocol

The ren Protocol is a very popular project which allows to use decentralized dark pool. This protocol was founded by Taiyang Zhang and Loong Wan in the year 2017. At that time, it was named as Republic Protocol but later in 2019, the name was changed to Ren Protocol. The whitepaper of Ren protocol says that the ren Protocol is a decentralized project which was one of the first project to apply the atomic swaps in the concept of dark pool.

Working of Ren Protocol

In the dark pool, when an order is placed by a trader, then shamir secret brokes down it and then it is distributed to the network of dark nodes and then, two ethereum smart contracts named the Registrar and the judge are deployed by this protocol for remaining process.

Then, after the fragmentation and distribution of the order among the dark nodes, they are prevented by the registrar from getting developed again by arranging these nodes in a manner which would make an attempt very difficult to do so. Various computations are performed by the nodes to match the fragments with that of any other order. The integrity of computations are verified by the judge by using a proof of zero knowledge without showing any type of information about them. After the proper matching of the fragments of two orders, an atomic swap is initiated.

Question 7. Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

| Centralized - Kraken | Decentralized - Republic Protocol |

|---|---|

| Involvement of third parties | No involvement of third parties |

| Order book can be viewed by Kraken authorities | No one can see the public book |

| Before using dark pool, it is must for the traders to do the higher Kyc verification | Before using this, no kyc verification is needed |

| Zero-Knowledge Proofs are not used | Zero-Knowledge Proofs are used |

| It is less transparent | It is more transparent |

| No nodes or validators are involved in this | Involvement of nodes or validators is there |

| Crossing of orders | No crossing of orders |

Question 8. Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

I am discussing about the recent huge bitcoin sales in the question. The bitcoin sales occurred on 4th december, 2021 and the sale occurred because many big investors had decided that they will take profit on the bitcoin causing sales of around 1 billlion doller which results many other investors also as they have the fear of doubts which make them to sell many assets that they have.

On that day, the bitcoin wents down much of around 23 percent and the price of bitcoin has decreased from around $57000 to 45900$. This is shown in the screenshot above. In the image, we can see that the sales has affected the market movement of burcoin and prices went down and the bitcoin has not still adjusted its level.

This massive sell would vanish millions of dollers from the market cap and when regular traders check such trades in the order book, the traders start to sell their assets and price fall more.

What difference would it have made if the dark pool was utilized for such sales

The bitcoin big sales that are occurred on the 4th of december, was hardly been utilized on dark pool which has caused much panic to other investors and this is because the sales have not been visible to anay person and no one knew the rate at which the execution of market occured.

Question 9. In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

In normal, when there are large orders shows on the order book, then traders act as sentiments. Large nuber of buy orders cause the traders to buy the money that pumps the asset into market cap and rise the price. In similar way, the large sell orders cause the traders to sell the money from the market cap and drive the price down. This is the application of demand as if the demand is more than the supply, the price will go up and if demand is low, the price will go down.

Now, when we talk about the dark pools, this type of effect does not place. As the trades whoch are performed in dark pool do not appear on the order book. It means that such large trades cannot seen by the other traders and thus they will not act on sentiments and in end, the demand and supply would be equal fairly so there will not be significant changes shown in the price.

There is also a fact given that the trades which are carried in dark pools have a greater magnitude and these trades are expected to affect their own asset's price. A sell trade of large amount of asset would greatly outmatch the small orders which we see on the order books of an exchange that is supposed normally to make the supply more than that of demand and results in falling of price.

By using dark pool, a large amount of sell order is filled when the order is matched with the buy order of a same magnitude and this by this, the forces of demand and supply will balance and the price does not affect.

Question 10. What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages of Dark Pool:

In Cryptocurrency, the dark pool helps to prevent the slippage because with limit orders, the orders are placed at a desired price.

The dark pool helps in facilitating direct trades between the assets which would normally have been not liquid.

The intentions of the whales from the public are hided by the use of dark pools whoch would prevent sentiment and any big price movement.

There is an extra level of privacy added by the use of dark pools for the traders.

Disadvantages of Dark Pool:

Smaller traders are placed at an unfair disadvantages by the use of dark pool as the whales would have a privilage for placing orders at a different price level from price of market and executed at this price.

Transparency is not there because of the fact that the order book is invisible.

The liquidity in the main market would reduce greatly when dark pools are begin to used by the whales.

There is no way to audit these processes since there is no order book.

CONCLUSION

The dark pool is a private platform in which the transactions are performed by the traders without coming in notice to the public. The dark pools are virtually unknown to the general public in current time. Many Cryptocurrency exchange services are provided by the dark pool which can be an attractive business for an exchange platform.

From the lecture of professor @fredquantum , I have learnt much about dark pools in cryptocurrency and the lecture proven much beneficial to me. I am thankful to you for providing this informative and wonderful lecture.

BROTHER I WANT PARTICIPATE IN @steemitcryptoacademy so how can participate in this?

Right now i've only 147 sp

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit