Hello Everyone...!!!

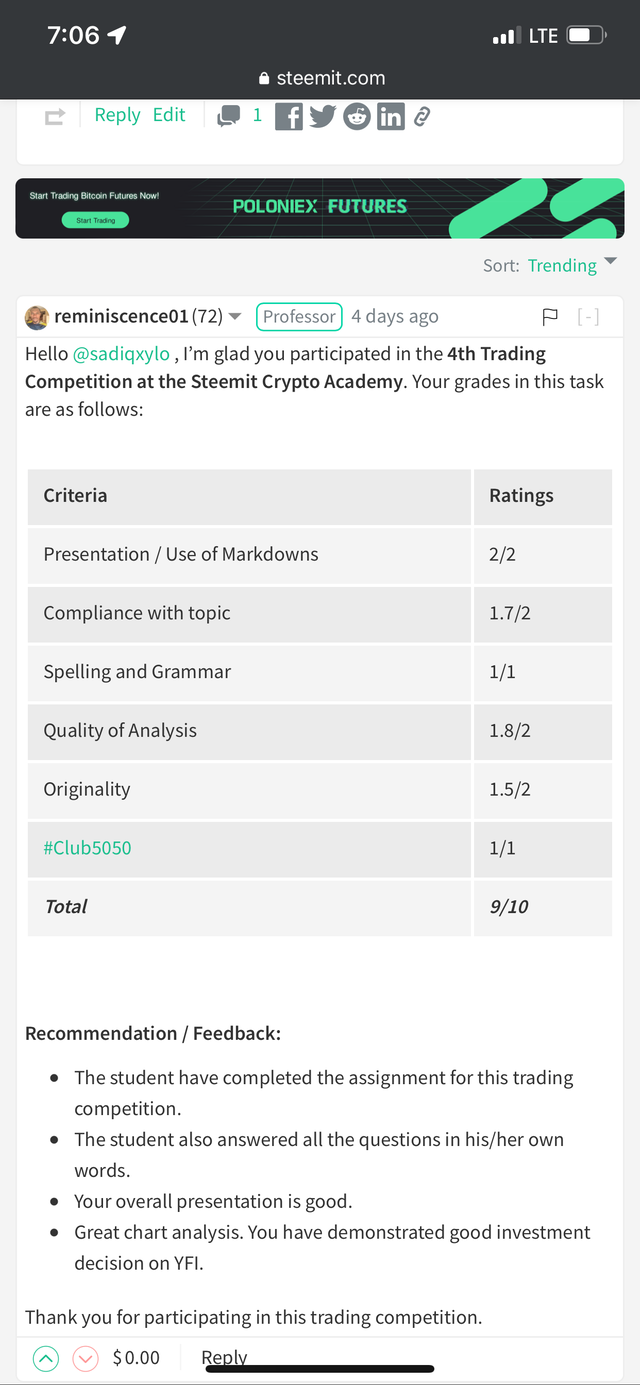

It is the fourth week of the Crypto Academy Trading Competition, which enable us to implement the knowledge acquire from various professors’ lesson in our crypto trading. This is a very good initiative as it will boost our confidence in trading and our ability to take risk. For week four of this competition, I will be joining team, The Team Reminane with professor @nane15 and @reminiscence01.

Introducing the token for the day

Yearn.Finance (YFI)

Yearn.finance is a blockchain platform for decentralized finance (DeFi) investors to maximize profit from yield farming using automation. It focuses on expanding the DeFi space for investors who less committal interact with crypto trades or who lack technical analysis to trade on their own.

The platform was launched in 2020 and has gain a huge growth recently as developers of the project releases the native token YFI. Its project makes use of bespoke tools to act as an aggregator for DeFi protocols to bring those who stake cryptocurrency the highest possible yield.

Users (liquidity providers) lock their assets in the liquidation pool for borrowers to maximize their capitals in trading. Borrowers later pay with interest which is distributed among liquidity providers based on calculated APY value. The platform makes profit by charging withdrawal fees which is currently at 0.5% and a gas subsidized fee at 5%.

Andre Cronje is an independent DeFi developer and founder of the Yearn.finance, he also occupied strong position at smart contract ecosystem Fantom and CryptoBriefing.

YFI can be traded on many exchange platforms like Binance, gate.io, KuCoin, Bitstamp, Poloniex, Bitstamp, OKX, Binance TR ect. I will be trading YFI with my Binance exchange account as it is the most popular and reliable exchange with low trading fee.

.png)

Why am I optimistic about this token today, and how long do I think it can rise?

YFI has currently being ranked #96 from coinmarketcap and its price has recently gained a lot of appreciation in value creating trading opportunities for scalpers.

Yearn.finance has provided and opportunity for investors to lock their assets and earn from interest paid by borrowers. YFI is used to pay gas and withdrawal fees as a means of making profit by the platform.

YFI Statistics

.png)

From the screenshot above, we can clearly see that YFI has a Circulating Supply of 36,637.72 YFI, Market Cap of $849,165,609, ranked #96 and have a price of $23,177.36 at the time of writing this post.

.png)

Also, on the screenshot above We can see that YFI has attained an all-time high price of $93,435.53 which was on May 12, 2021 and all time low at $739.44 on May 12, 2021. With regards to the current price, has an increment of 3051.49% from the all-time low and 75.06% decrement from the all-time high price.

All time price chart of YFI

.png)

YFI has attained its all-time high price a year ago and still at the dip, which makes it a good investment for future benefit. The coin has shown significant rise in recent days creating a lot of trading opportunities as price moves in high-highs.

YFI has a low circulating supply which shows a great potential for future growth. It has attained an all-time price above BTC.

How to analyze the token?

I will Analyze this coin using the YFI/USDT crypto pair on TradingView. I have applied the Japanese candlestick chart which connect sensitive information like opening and closing price, high and low swing points. I have also added EMA crossing strategy and RSI to help identify direction of trend and spot entry position.

First of all, I will be doing a scalping trade and to identify the general trend I have used different timeframes of 30 and 15 minutes.

.png)

.png)

The charts above are 30 and 15 minutes YFIUSDT chart. On both charts, we have seen that three lower points are identify and a support trendline is drawn through these points. Price rebounded on the support trendline several times and bounce upwards for bullish trend continuation. The general trend was identified to be bullish by different timeframes.

I will be doing a scalping trade so I have selected a 5-minutes timeframe of YFIUSDT chart and marked resistance and support level.

.png)

On the chart above, as price was making higher-highs pattern with price rebounding from the support trendline indicating bullish trend continuation, the EMA crossing strategy was employed to identify direction. 20-period EMA (blue) crossed above 50-period EMA (red) indicating the presents of bullish trend. From the RSI indicator, a confirmation was seen when the lined bridged the mid-mark upwards. I marked my entry point at this region.

To further confirmed signal, I added the Ichimoku cloud indicator to the chart.

.png)

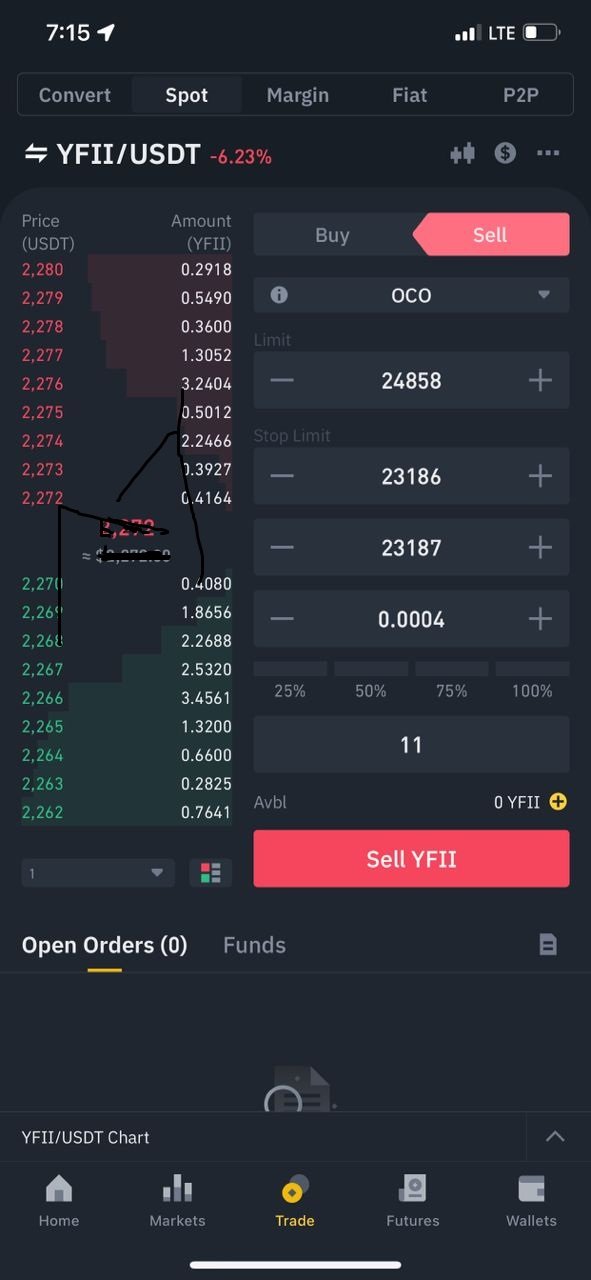

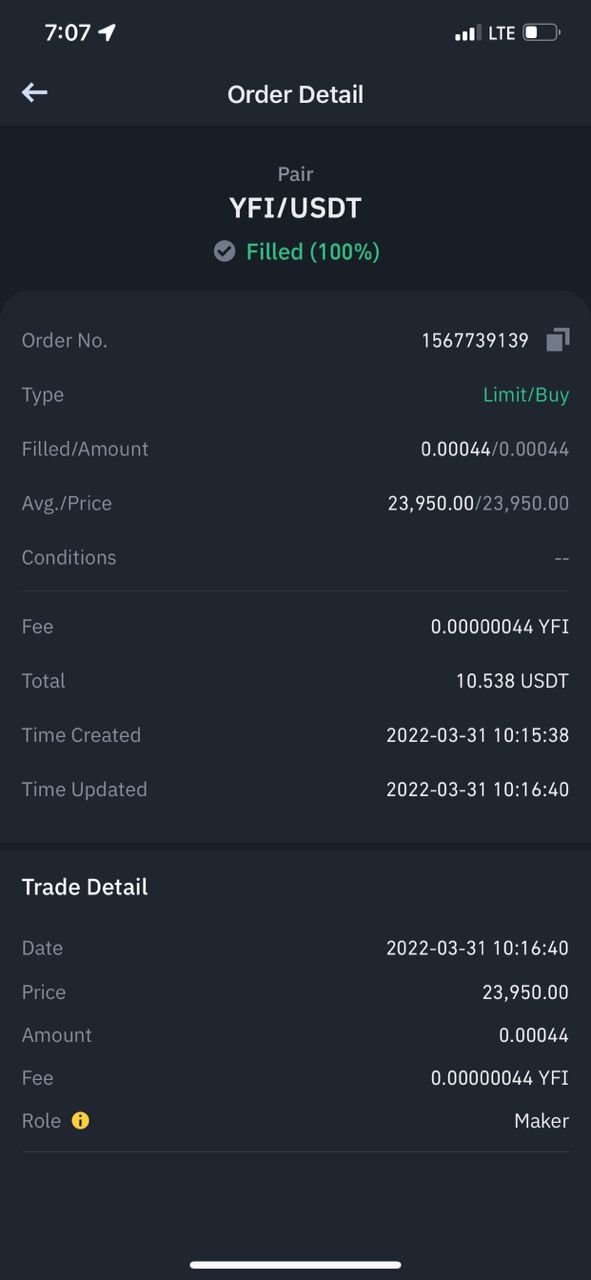

On the same chart above, we saw that Ichimoku cloud started to trade below price and formed green color along, given a confluence to RSI and EMA crossing for bullish trend and confirming my entry position. I marked a take profit level at $24,858.57 little above the previous resistance level and stop loss level at $23,187.30 just below the support trendline.

On my Binance exchange, I open a spot limit order for YFI at $23,950.00. Afterwards, I placed an OCO order to target my take profit at $24,858.57. and stop limit at $23,187.30. Below are my order details.

My Plan to Hold YFI long or Sell

I have marked take profit level and stop loss level on the chart above, this is scalp trading and I will exit the market should in case my take profit level is attained or my stop loss level is hit. I don't have any intentions of holding on to the coin for long term but in case there is trading opportunities in future, I scalp again to make profit. YFI has a promising future which makes it a good potential investment.

Would I recommend people to Buy YFI

The project Yearn.finance aid investors to earn from their assets by locking it in a liquidity pool. To participate in this yield farming practice with Yearn.finance, traders will have to buy YFI as it is used to pay withdrawal fees.

YFI has attained an all-time price higher than BTC and still in great dip. This is a good time to buy and hold onto YFI for future benefit before it triggered to target its all-time high price.

YFI is a volatile token of which scalpers can spot good trading opportunities. YFI can be recommended for both scalpers and swing traders but on the basis of the know-how of technical, fundamental and sentimental analysis.

Other Information about the Token

Yearn.finance network has several social media platforms where we can find the latest news and updates for the project.

.png)

The above screenshot is taken from twitter, from the YFI project account about the latest update of the token.

CONCLUSION

For the fourth week of the trading competition, I have selected and traded on YFI/USDT as my third trade of the week after carefully making my own analysis about the token.