Hello Everyone,

I am much grateful participating in this week homework post by Prof @kouba01. The detail lesson on Ichimoku-kinko-hyo Indicator - Part 2 was very comprehensive. I will first give a recap of what Ichimoku-kinko-hyo Indicator is.

All chart graphs are taken from tradingview and questions concerning only Kumo, the other Ichimoku-kinko-hyo Indicator line are hidden to provide a clear view of the Kumo lines.

Ichimoku Kinko Hyo indicator is known by its English meaning as The Balance Chart From One Look. This indicator was invented by a Japanese journalist named Hosoda Goichi in the 1930s. What this indicator actually does is that, it calculates momentum, the trend, supports and resistance, other price behaviour of an asset for a particular period.

Everything about this indicator is weired accept the good work it does. Consisting of five different lines as all the previous indicators have only three lines. These lines are Tenkan Sen, Kijun Sen, Senkou Span A, Senkou Span B, and Chikou Span. There is a space between the senkou span A and senkou span B is known as kumo below are the lines and their corresponding English names.

| Japanese | English |

|---|---|

| Tenkan-sen | Conversion Line |

| kijun-sen | Base line |

| Senkou Span A | Leading Span A |

| Senkou Span B | Leading Span B |

| Chikou Span | Lagging Span |

Discuss your understanding of Kumo, as well as its two lines. (Screenshot required)

Kumo is nothing big but the space created between the Senkou Span A and Senkou Span B that helps the trader to determine price momentum, Resistance and support of future and trends in the market. It is known as a cloud because of its resulting shape (Cloud shape) around the price and sometime coloured RED and GREEN for a complete bearish and bullish trend respectively. Kumo is of extraordinary significance because it alone shows a lot of information to be interpreted such as trend, supports, and resistances, trend change, trend strength. Traders sometimes ignore the other three lines of the Ichimoku indicator due to the versatility of the Kumo.

In bearish market, Kumo is projecting downwards and projecting upward in a bullish market. Sometimes Kumio can take a horizontal movement between uptrend and down trend indicating neutral or sideways or ranging market. The two lines that form Kumo will be explain below.

Senkou Span A:this line of the indicator is said to be a line that helps within the measurement of momentum additionally able to supply thoughts on trade based on the support and the resistance levels. It is calculated as (Tenkan-sen + kijun-sen)/2 plotted 26 periods ahead.

Senkou span B: known as leading line B or leading line 2 which forms other edge is calculated as (highest high + lowest low)/2 calculated over the previous 52 periods and plotted 26 periods ahead. This helps provide support and resistance levels.

The other three lines are hidden to show clear view of the Kumo and its lines

What is the relationship between this cloud and the price movement? And how do you determine resistance and support levels using Kumo? (Screenshot required)

Relationship between price and cloud movement

Upward Trend or Bullish Market

When the market price of an asset is in upward movement or bullish market, the Senkou Span A is over the Senkou Span B and Kumo is form below the price or price movement is above the Kumo cloud and Kumo itself stands to move in up trend.

As seen in the BTC/USDT price chart above, as at early December last year the Senkou Span A was above Senkou Span B and the price of BTC begins to increase gradually. Price line of BTC moved above the Kumo cloud and Kumo also moved in an upward trend which result in a price change of BTC from $11,558 to $63,818 in the space of early December last year to 14th of April this year.

Downward Trend or Bearish Market

When the market price of an asset is in downward movement or bearish market, the Senkou Span B is over the Senkou Span A and Kumo is form above the price or price movement is below the Kumo cloud and Kumo itself stands to move in down trend.

As seen in the STEEM/USDT price chart above, as at early 22nd of May this year the Senkou Span B was above Senkou Span A and the price of STEEM begins to decrease gradually. Price line of STEEM moved above the Kumo cloud and Kumo also moved in a downward trend which result in a price change of STEEM from $0.9143 to $0.3011 in the space of 22nd May to 19th of July this year.

Neutral or Sideways or Ranging Market

When Senkou Span A and Senkou Span B are moving in a flat level and don't create range then it is considered to be neutral market by kumo cloud, In such case Kumo will also moving sideways or horizontally amd price may enter within the cloud. So there is no definite pattern of cloud with respect to price line.

Market Volatility

In a great volatile market the Senkou Span A is very wide from that of the Senkou Span B creating a wider cloud. In this case price volatility of an asset is very high. In a less volatile market, Senkou Span A is very close to that of Senkou Span B creating a thicker cloud. In this case price volatility of an asset is very low.

At seen in the screenshot above, on the part indicated as Great market volatility the price ranges from$2,358 to $2,527 for the price of ETH which creates a vast different resulting in a great volatile market of ETH. Also the part indicated as Less market volatility the price ranges from $2,706 to $2,714 with just a few different between the price range of ETH which result into a less volatile market of ETH.

Resistance and support using Kumo

Having understood what upward trend, downward trend and a sideway trend it will be very easy to see Kumo acting as Resistance and Support. Let's see what happen then.

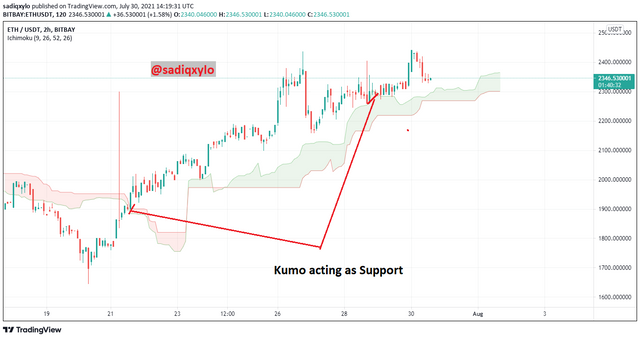

Kumo is form below the price chart line in a bullish market so Kumo will act as a region of support for the price chart and Senkou span A will be over Senkou span B forming Kumo below the chart line. In this case price can take support from both Senkou span A and Senkou span B so there is not a specific line of support. We only have a region of support here.

As seen on the ETH/USD chart, Kumo is acting as support

Kumo is form above the price chart line in a bearish market so Kumo will act as a region of Resistance for the price chart and Senkou span B will be over Senkou span A forming Kumo below the chart line. In this case price can take Resistance from both Senkou span A and Senkou span B so there is not a specific line of Resistance. We only have a region of resistance here.

As seen on the ETH/USD chart again, Kumo is acting as resistance

In a sideway market, when price enters the kumo cloud, the two lines forming the cloud will act as support and resistance below and above respectively.

As seen on the chart above support and resistance taken by price within the cloud.

How and why is the twist formed? And once we've "seen" the twist, how do we use it in our trading? (Screenshot required)

Twist in Ichimoku komu cloud is shaped when Senkou span A cross Senkou span B and vice versa. This may make three distinctive patterns within the market. Uptrend, downtrend and Sideway market. When Kumo become think or when Zone between Senkou span A and Senkou span B diminish at that point there's high likelihood of the formation of a twist.

Twist and Uptrend

When Senkou span A cross Senkou span B and move above it then it is a signal of bullish market that is an uptrend market.

Twist and Down Trend

When Senkou span B cross Senkou span A and move above it then it is a signal of bearish market that is a downtrend market.

Twist and Sideway Trend

When Senkou span A cross Senkou span B several times and move on same level that is horizontal level then it is a signal of sideway market.

Twist in trading :

When a twist occur the space between the SSA and SSB decreases and Kumo becomes thin indicating that price line of an asset will penetrate through the Kumo cloud and turn to take any trend depending on which line crosses the other. When price lines penetrate through the Kumo cloud the two lines form a support and resistance which help traders to take advantage of the market and buy at lesser cost and sell to make profit before the price lines move out of the Kumo cloud.

From the BTC/USDT chart above, we can see a twist where SSA move above SSB which indicates a bullish market. And because of this twist price will penetrate through the kumo cloud that we can see in the price chart, so Kumo will take a strong support and resistance which traders can utilize to buying at lower level and selling at higher level in the cloud only which will provide a lesser profit.

What is the Ichimoku trend confirmation strategy with the cloud (Kumo)? And what are the signals that detect a trend reversal? (Screenshot required)

The market trend of an asset can only be in three different ways, uptrend or bullish market, down trend or bearish market and sideway or neutral trend. With Kumo, it is very easy to detect these trends. For a bullish market or upward trend, Kumo is projected upwards with SSA over SSB and bearish or downward market, Kumo is projected downwards with SSB over SSA. With sideway trend, Kumo moves in horizontal direction with SSA and SSB crossing over each other several times. Sometimes for clear bullish and bearish market, Kumo is indicated by green and red colour respectively. This colour indication by Kumo is very complicated as it's only shows a complete bullish or bearish market. Traders should always try to go with Kumo trend rather than the colour it indicates.

Signals that Detect a Trend Reversal

Twist of SSA and SSB: When there is twist between the two lines of Kumo cloud, depending on which one crosses the other, traders should be expecting a trend reversal.

Price line penetrating through Kumo:Kumo is below price line in bullish market and above the price line in bearish market, after a twist and a price tries to take a trend reversal, the price line penetrates through kumo cloud to move in the opposite trend. When price enters the Kumo cloud the SSA and SSB form a strong resistance and support which easily give trend reversal. After a twist, kumo can take a sideway trend, so until price line penetrates through Kumo cloud, twist alone cannot give a confirmatory trend reversal.

On the screenshot above, it can be seen that after the twist the price chart of BTC penetrate the Kumo cloud and the lines of Kumo form a region of support and resistance which eventually leads to trend reversal.

- Chikou span break through cloud : Break of chikou span through the cloud is another confirmatory signal.

Chikou span crosses Kumo from below of which the BTC price chart was initially in a downward trend, after the cross the trend reversal occur and BTC took an upward trend.

Explain the trading strategy using the cloud and the chikou span together. (Screenshot required)

Trading strategy with both Kumo cloud and the chikou span will give not perfect market trend but nearly accurate trend. This is because market trend does not follow any indicator, as more traders enter the market price chart price chart can be behave abnormally and when traders exit as well.

- In a bullish trend, price chart lines are always seen to be taken an upward movement and as well both Kumo and the chikou span also take an upward movement in bullish trend. When this happens, traders can place themselves in a buy position.

- In a bearish trend, price chart lines are always seen to be taken a downward movement and as well both Kumo and the chikou span also take a downward movement in bearish trend. When this happens, traders can place themselves in a sell position to make profit.

When both Kumo cloud and the chikou takes a reversal trend, traders should not jump into conclusion and follow the trend. They should wait for a little while for price chart to move in same direction before entering the market. This is because, in some case, both Kumo cloud and the chikou can take a trend of which the price chart won’t follow that trend, in that case a false signal is given. Trader should be very caution when it comes to market trend.

Explain the use of the Ichimoku indicator for the scalping trading strategy. (Screenshot required)

Scalp trading refers to a type of trading where a trader does numerous trades in a day and each trade uses small time frame like 5,10,15 minutes to make small profits in market without huge losses. Ichimoku kinko Hyo indicator is exceptionally much valuable in scalping since it can be utilize on any time outline as per necessity by trader.

Scalping Trading Bullish Market with Ichimoku Indicator

The strategy will be same to identify the uptrend and downtrend within the market but in little time outline. So let us take a 5 mint time outline to get it this strategy.

Bullish price market structure, since as it were then we'll gain profit from buy trade.

SSA must be above SSB or twist showing so

Price line has to be above the Kumo.

Chikou span must be directed upwards.

Tenken sen line above kijun sen or crossover showing bullish trend.

Time frame must be small, with this task i#I am using 5 minutes.

As seen on the chart above, all the necessary requirement are met for scalping buy trade. Trades can place their buy order and bid the upcoming price for small profit.

Scalping Trading Bearish Market with Ichimoku Indicator

The requirements for the scalping bearish trade with Ichimoku Indicator are below;

Bearish price market structure, because only then we will gain profit from sell trade.

Price line has to be below the cloud.

SSB must be above SSA or twist showing that SSB over SSA

Chikou span must be directed downwards or crossed cloud from above downwards.

Tenken sen line below kijun sen.

Time frame must be small, with this task 5 minutes.

As seen on the chart above, all the necessary requirement are met for scalping sell trade. trades can place their sell order and bid the upcoming price for small profit. Multiple scalping orders can be placed during the whole trend but few minutes’ intervals.

CONCLUSION

Kumo cloud of the Ichimoku Kinko Hyo indicator plays a vital role when it comes to momentum, the trend, supports and resistance, other price behaviour of an asset with the Ichimoku Kinko Hyo indicator. But traders’ shouldn’t only focus on the Kumo for market trend. Kumo can be used together with Chikou span and the Tenken sen line and kijun sen, sometime can be used with other indicators such as Bollinger bands, RSI and MACD for a near accurate market trend.

Thanks For Your Attention

Hello @sadiqxylo,

Thank you for participating in the 5th Week Crypto Course in its third season and for your efforts to complete the suggested tasks, you deserve a 8.5/10 rating, according to the following scale:

My review :

Good content, through which you were able to cover all aspects of the topic clearly, based on a set of accurate information. However, I have some notes:

Your explanation of the cloud and its lines is understandable and comprehensive, with some lack of analysis.

For the second question, your answers were excellent regarding the relationship of price movement momentum to the cloud as well as how to identify support and resistance levels.

The preferred strategy of Scalping with the Ichimoku indicator is called "Scalping Ichimoku in one minute M1", but we all know that the supports and resistances identified in the higher time frames will have a greater impact on the price trends. This is why the analysis of Ichimoku M15 and M5 is essential.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for reviewing my work and I do appreciate your concern, I will towards that next time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit