Hey guys!

It's all about the crypto academy week 7 homework task @gbenga. I'm very glad participating in this contest and also, all thanks to Prof @gbenga for the brief lesson on DeFi.

DeFi is an acronym for Decentralized Finance. It's a finance in a blockchain based form that doesn't depends on intermediaries like exchanges, banks or brokerages to offer aged financial instrument, thus, utilizes smart contracts on blockchains.

The evolution of DeFi begins in the early 2018, where a group of expect worked together to build an alternative financial system, hoping they will be able to address fairness, transparency and equity issues that the existing system faces.

Ethereum is the most widely use blockchain, thus, majority of DEFI transactions are based on it.

Get ETH into your address. Any wrong address type after transaction can't be retrieve, and make sure the private key to that wallet is in your care.

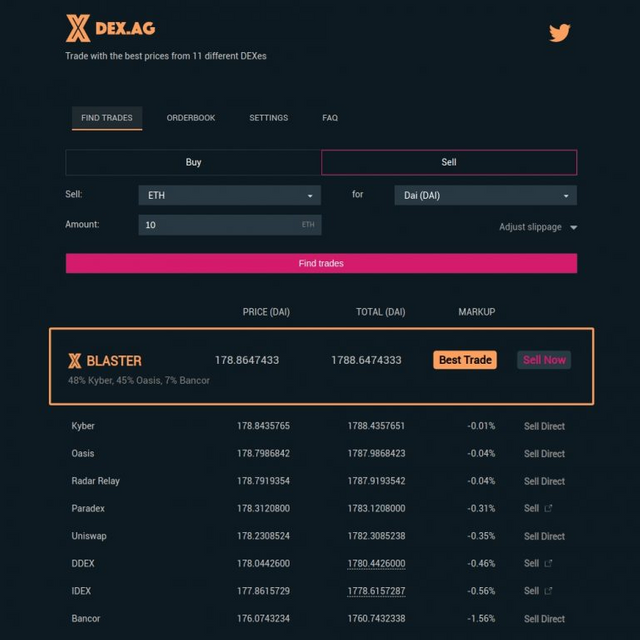

Move to DEX.AG and getting some of the ETH for DAI.

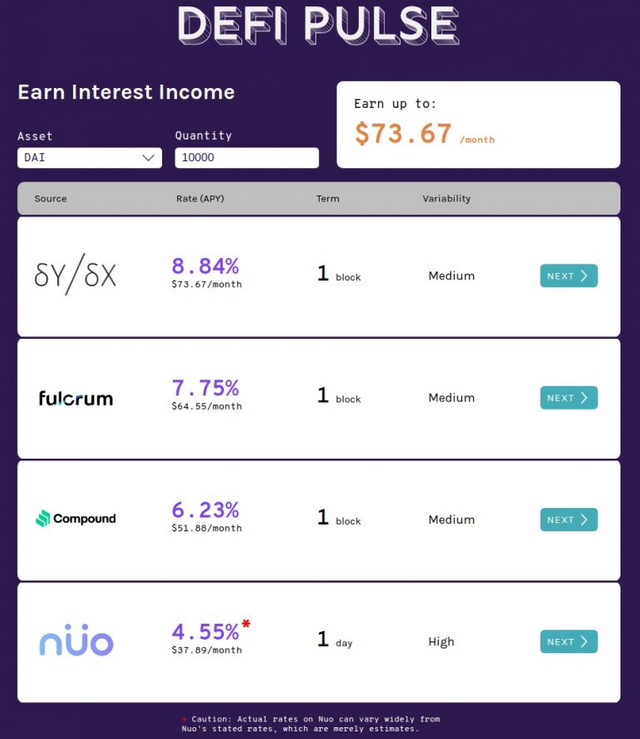

- Go to DEFI pulse's, a site where you can find the ranking and analytics of DEFI protocols.

- Pick a leading protocol and start earning interest.

The decentralized finance since established has under gone through several projects, one of these projects is uniswap.

Uniswap is a decentralized finance protocol with the basic aim of exchanging cryptocurrencies. Uniswap represent the name of the institution that first formulate the Uniswap project. It seeks to facilitates automated transactions between cryptocurrency tokens on the Ethereum blockchain through the use of smart contracts. By daily trading volume in October 2020 Uniswap was presume to be biggest decentralized exchange a d fourth in the crypto market. The liquidity providers who seeks to enhance in liquid market for cryptocurrencies being exchanged start to generate a fees of approximated value US$ 2.5-3 in March this year.

UNISWAP PROTOCOL

Most exchage project companies support the serving as market makers but Uniswap prefers liquidity pools rather than serving as market maker. To create an efficient market, liquidity providers giveout liquidity to the exchange, they do so by adding tokens to a smart contract which can be purchased and sold by different users. The liquidity providers get a percentage of the trading fees earn per each trade. A calculated amount is removed from the pool for an amount of the additional tokens per each trade which changes the price.

DeFi exchanges like curve Finance and Uniswap when it rise

source

In CEFI system there is no private key which gives you access to your wallet, all the orders trade are channeled through a central exchange govern by a reasonable people.

There is exchange involvement in centralized finance while Decentralized Finance is technological based.

Intermediaries operates in centralized finance while decentralized finance operates technologically

In centralized finance (CeFi) tokens are managed by intermediaries and they also face any risk involvement, while beneficiaries have access to their tokens in decentralized finance (DeFi)

In centralized finance (CeFi) one needs to go through the KYC/AML verification process before getting access to his/her tokens, but in decentralized finance (DeFi) you only need your private key.

In my opinion, decentralized finance (DeFi) has a healthy future since all institutions, individuals and almost everyone is trading with it.

All thanks to Prof @gbenga for the detailed lesson on week 7.

Thanks for being a part of my class and for participating in this week's assignment. I hope you learned from the class as the aim of the school is to teach and allow people to learn alongside.

Remark

Copy/paste, Spinning isn't welcomed on the Steem blockchain. You should quote and reference posts that aren't yours. Also, the post should be written in your words and not changing of all or part of another author's content, it is regarded as spinning.

Your post

Spun content

Source: https://en.wikipedia.org/wiki/Decentralized_finance

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Decentralized finance

Decentralized finance (commonly referred to as DeFi) is a blockchain-based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial instruments, and instead utilizes smart contracts on blockchains, the most common being Ethereum. DeFi platforms allow people to lend or borrow funds from others, speculate on price movements on a range of assets using derivatives, trade cryptocurrencies, insure against risks, and earn interest in savings-like accounts. Some DeFi applications promote high interest rates but are subject to high risk. By October 2020, over $11 billion (worth in cryptocurrency) was deposited in various decentralized finance protocols, which represented more than a tenfold growth during the course of 2020.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please Prof @gbenga, can I make editing for you to review my work again

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit