Hello Everyone...!!!

I am much grateful participating in this week homework post by prof @fredquantum. The detailed lesson provided on Crypto Trading Strategy with Triple Exponential Moving Average (TEMA) indicator was very comprehensive.

1. What is your understanding of Triple Exponential Moving Average (TEMA)?

Triple Exponential Moving Average Indicator is a trend-based indicator that was created by Patrick Mulloy. This technical indicator is preferred by most trades as it gives accurate and early signals.

The triple exponential moving average consists of a single oscillating line that closely follow Current Price fluctuations in the market, and calculated from the combination of three exponential moving averages of same period, with this, TEMA can easily identify current and future trend without any lag.

TEMA has a a smoothing parameter which is generated form its calculation and help eliminates random price fluctuation, lags and noise that is produce during price movement to give a clear and understandable representation of the indicator readings with respect to price movement. It looks similar to Moving Average but its functionalities differ. TEMA emit signals on the bases of multiple exponential averages of EMA and also remove the lags along. This gives TEMA variety of functionalities in identifying present trend, reversal trend, support and resistance levels.

As I mention already, TEMA is much similar to EMA and also identifies trend based on TEMA slop of its oscillating line. When the TEMA makes an upward angle slop with price above the oscillating line, then it signifies a bullish market. When TEMA makes a downward angle slop with price below the oscillating line, then it signifies a bearish trend. In shot, TEMA rise in a rising market and fall in a bearish market.

.png)

On the chart above, we can see TEMA serving as support and resistance swings for price action. It is very appreciable in short-term trades as it reacts fast to price movement and small trend changes.

2. How is TEMA calculated? Add TEMA to the crypto chart and explain its settings. (Screenshots required).

Here, I will demonstrate how we cam calculate triple moving exponential average indicator and also add it to a crypto chart along with configuring its settings.

The triple exponential moving average has a general mathematical expression that is used in its calculation and it is stated as shown below.

TEMA = (3 × EMA1) - (3 × EMA2) + EMA3

Where,

EMA1 = the exponential moving average

EMA2 = the EMA of EMA1

EMA3 = the EMA of EMA2

As seen on the mathematical expression stated above, to obtain a unique data for TEMA, it requires three exponential moving average of same period. Also, a smoothing multiplier of 3 which I talked about earlier, in its EMA 1 and 2 to make sure that product values obtained are lag free across the specified period.

Adding TEMA to Price Chart

To add TEMA indicator just like any other indicator, you need to visit any price chart platform that has access to indicators. I will be using TradingView price chart platform to perform this task.

Visit the tradingview platform and access the chart feature.

Choose any crypto pair and click on indicators and strategies (fx)

.png)

- At the search both type TEMA indicator and select from the pop-up menu that appears.

.png)

- We can clearly see TEMA indicator being added to our chart with its default settings.

.png)

Configuring the TEMA indicator's Parameters

- We first have to click on TEMA settings at the top left corner of our chart window.

.png)

- Input tab: at the input tab, we have the default period of TEMA to be 9 which gives fast reaction to price movement and so very good for short-term traders, but can sometimes give false signals. With higher periods like 20 and above are more suitable to be used by the TEMA indicator. So, I have chosen a length period of 20, to give a clear representation of the indicator with respect to price.

.png)

- Style tab: at this point, we can change the color of TEMA indicator, Its size and precision.

.png)

3. Compare TEMA with other Moving Averages. You can use one or two Moving Averages for in-depth comparison with TEMA.

I will highlight some of the differences and similarities between triple exponential moving average and other moving average types. I will compare SMA EMA and TEMA indicators.

| TEMA | EMA | SMA |

|---|---|---|

| TEMA reacts fast and quick to small trend change and signal with respect to price | EMA reacts fast to recent price movement | SMA lags behind recent price movement |

| TEMA is seen to be very close to price action since it reacts fast and quick to price action | EMA is closer to price action than SMA | SMA is wide a little from price movement |

| A more accurate and reliable signals are given when a little higher period values of 20 to 25 are used since it shows better indication of price | More accurate and reliable signals are given when a lower period values are used since it calculated based on current price movement | A more accurate and reliable signals are given when periods of higher values are used since longer days price data points to identify false signals |

| In an uptrend, TEMA serves as dynamic resistance to price as a result of its fast reaction to price | In an uptrend, EMA acts as dynamic support to price movement | In an uptrend, SMA acts as dynamic support to price movement. |

| TEMA reacts faster to price movement and so suitable for short-term traders | EMA is also suitable for short-term trades since it relies on current price to identify trend | SMA is suitable for long-term traders as it moves ahead of price action |

| TEMA was initiated to eliminates the lags of EMA | EMA was initiated to eliminates the lags of SMA | calculates the average true value of price |

Below is a chart of BTCUSDT that composed of TEMA, SMA and EMA indicators for clear understanding.

.png)

On the chart above, I have represented TEMA with a blue color, SMA with red color and EMA with green color. TEMA is the closest to price action since it reacts fast to price change, SMA is wide from price line since it lags behind price and EMA is in-between the two indicators. This is a clear point that TEMA eliminates the lags of EMA.

4. Explain the Trend Identification/Confirmation in both bearish and bullish trends with TEMA (Use separate charts). Explain Support & Resistance with TEMA (On separate charts). (Screenshots required).

I will clearly demonstrate with charts on how to identify trend with triple exponential moving average indicator. As I mentioned already, TEMA indicator uses the angle of slope in identifying current trend of any asset market. The direction of the oscillating line determines the trend of the market.

Identifying Bullish Trend using the TEMA Indicator

In a bullish trend, the oscillating line of TEMA indicator is seen to be projecting upwards along price movement in an uptrend. To confirm trend identified, price action should be moving above TEMA indicator line in a bullish trend of any asset. See illustration a chart below.

.png)

As seen the chart above, TEMA indicator identifies a bullish trend by rising along price movement in an upward direction. The identified trend was confirmed as price action stays above TEMA indicator.

Identifying Bearish Trend using the TEMA Indicator

In a bearish trend, the oscillating line of TEMA indicator is seen to be projecting downwards along price movement in a downtrend. To confirm trend identified, price action should be moving below TEMA indicator line in a bearish trend of any asset. See illustration a chart below.

.png)

As seen the chart above, TEMA indicator identifies a bearish trend by falling along price movement in a downward direction. The identified trend was confirmed as price action stays below TEMA indicator.

Upon demonstrating on bullish and bearish trend identification and confirmation with charts, I will now identify support and resistance using TEMA indicator with charts.

Identifying Resistance levels Using TEMA indicator

In an uptrend market, TEMA indicator serves as dynamic resistance to price movement as a result of fast reaction to price movement, contrary to other indicators that form a support a long price in an uptrend. When price moves towards the dynamic resistance and get rejected, then a possible signal for bullish to bearish reversal trend is given. A buy trade can be executed after a pullback line once rejected by price.

.png)

As seen on the chart above, TEMA indicator line is serving as dynamic resistance to price in bullish trend. At the dynamic resistance level, it can be seen that price was rejected and a pullback occurred before the continuation of the bullish trend. The pullback after the resistance point can be use as good entry position for buying opportunities.

Identifying Support levels Using TEMA indicator

In a downtrend market, TEMA indicator serves as dynamic support to price movement as a result of fast reaction to price movement, contrary to other indicators that form a resistance a long price in a downtrend. When price moves towards the dynamic support and gets rejected, then a possible signal for bearish to bullish reversal trend is given. A sell entry trade can be executed after a pullback line once rejected by price. See illustration on the chart below.

.png)

As seen on the chart above, TEMA indicator line is serving as dynamic support to price in bearish trend. At the dynamic support level, it can be seen that price was rejected and a pullback occurred before the continuation of the bearish trend. The pullback after the support point can be use as good entry position for selling opportunities.

5- Explain the combination of two TEMAs at different periods and several signals that can be extracted from it. Note: Use another period combination other than the one used in the lecture, explain your choice of the period. (Screenshots required).

In here, I will make good use of the combination of two TEMA of different periods trading strategy, one of higher period and the other of lower period. A higher period TEMA reacts slow to price movement while lower period reacts fast to price movement.

When two TEMA indicators are combined with different periods, traders get to use this strategy to identify buying and selling opportunities in the market. I will be using a TEMA of period 20 and TEMA period of 50 as lower and higher periods respectively. This is completely different from that of the professors. The period chosen smoothly represents price movement in an average term.

Identifying Buying Opportunity Using 50- period TEMA and 20-period TEMA

To identify a buy opportunity price movement should be in an uptrend. In an uptrend when a shorter TEMA (20-period) crosses above a higher TEMA (50-period), then it signifies a possible bullish trend in the market and transfer of momentum from bears to bulls. An entry for buy position can be executed after the cross of the two period lines and also when the dynamic support is being rejected by price. See illustration on chart below.

.png)

As seen on the chart above, the 20-period TEMA crosses above the 50-period TEMA indicating buying pressure and entry position was marked after the cross. The bullish trend continuation was maintained as price was making higher-highs pattern.

Identifying Selling Opportunity Using 50- period TEMA and 20-period TEMA

To identify a sell opportunity price movement should be in a downtrend. In a downtrend when a higher TEMA (50-period) crosses above a shorter TEMA (20-period), then it signifies a possible bearish trend in the market and transfer of momentum from bulls to bears. An entry for sell position can be executed after the cross of the two period lines and also when the dynamic resistance is being rejected by price. See illustration on chart below.

.png)

As seen on the chart above, the 50-period TEMA crosses above the 20-period TEMA indicating selling pressure and exit position was marked after the cross. The bearish trend continuation was maintained as price was making lower-lows pattern.

6. What are the Trade Entry and Exit criteria using TEMA? Explain with Charts. (Screenshots required).

Here, I will demonstrate the condition necessary for an entry and exit point using TEMA indicator. I am making good use of the TEMA crossover strategy and below are the conditions.

The Buy Trade entry and exit criteria Using TEMA Indicator

Add two TEMA indicator of shorter and higher period to a crypto chart you desire.

After a downtrend move by price, wait for the shorter period TEMA to cross above the higher period TEMA signifying the presence of buying pressure.

After the cross of the two lines, wait for price to trade above TEMA indicators and a break of at least two candlesticks for bullish trend continuation.

After executing the buy order, you can wait for price to trade closer to the resistance level alongside the TEMA indicator line. Set a risk management trade of stop loss and take profit in a ratio of 2:1 to make profit and stop further loss.

.png)

A seen on the chart above, after the end of the bearish trend, the shorter period crossed over the higher period indicating a buying pressure for bullish trend confirmation. A buy trade was executed after the formation two bullish candlesticks in price movement. A take profit level triggered to target the nearest resistance and stop loss marked below the previous low swing.

The Sell Trade entry and exit criteria Using TEMA Indicator

Add two TEMA indicator of shorter and higher period to a crypto chart you desire.

After an uptrend move by price, wait for the higher period TEMA to cross above the shorter period TEMA signifying the presence of selling pressure.

After the cross of the two lines, wait for price to trade below TEMA indicators and a break of at least two bearish candlesticks for bullish trend continuation.

After executing the sell order, you can wait for price to trade closer to the support level alongside the TEMA indicator line. Set a risk management trade of stop loss and take profit in a ratio of 2:1 to make profit and stop further loss.

.png)

As seen on the chart above, after the end of the bullish trend, the higher period crossed over the shorter period indicating a selling pressure for bearish trend confirmation. A sell trade was executed after the formation two bearish candlesticks in price movement. A take profit level triggered to target the nearest support and stop loss marked below the previous high swing.

7. Use an indicator of choice in addition to crossovers between two TEMAs to place at least one demo trade and a real margin trade on an exchange (as little as $1 would do). Ideally, buy and sell positions (Apply proper trade management). Use only a 5 - 15 mins time frame. (Screenshots required).

Here, I will combine the TEMA indicator crossover strategy with RSI indicator. Relative strength index (RSI) analysis market behavior with the condition of oversold and overbought. When price trades above the 70 mark of RSI, then we have an overbought region and when price trades below the 30 mark, the we have an oversold region. When price fall below the mid-mark (50), then price is in bearish trend and also when price rise above the mid-mark (50), then price is in bullish trend.

In the combination strategy, the two indicators must satisfy the crossover condition and for buy and sell entry and exit criterial. I will perform this task using TRXUSDT chart of 15-minutes.

1. A Demo Sell trade for TRXUSDT using 15 MINS Chart

.png)

As seen on the chart above, 50-period TEMA crosses above 20-period TEMA indicating a selling pressure at the moment of BTCUSDT. Confirming from the RSI indicator, we saw that the RSI line was below the mid-mark (50) which gives a confluence to our TEMA crossover strategy. I open a sell order at the price $0.06381 with a take profit level at $0.06294 and stop loss at $0.06424. 1:2 in the risk to reward ratio.

Sell Order trade Executed

.png)

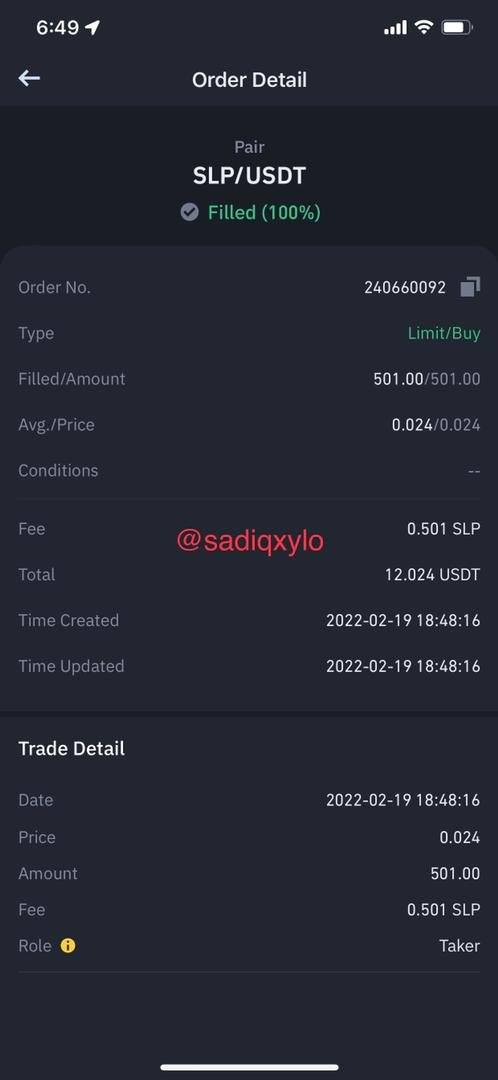

2. Real Buy Trade for SLPUSDT using margin trade on a 15-MINS Chart

.png)

As seen on the chart above, 20-period TEMA crosses above 50-period TEMA indicating a buying pressure at the moment of BTCUSDT. Confirming from the RSI indicator, we saw that the RSI line was above the mid-mark (50) which gives a confluence to our TEMA crossover strategy. I open a buy order in my exchange account at the price $0.024 with a take profit level at $0.0254 and stop loss at $0.0233. 1:2 in the risk to reward ratio.

Buy Order trade Executed

8. What are the advantages and disadvantages of TEMA?

Here, I will highlight some key advantages and disadvantages of triple exponential moving average indicator.

Advantages of the Triple Exponential Moving Average Indicator

We can use the crossover trading strategy to identify buying and selling opportunities in the market to make profits.

TEMA indicator can be used to identify dynamic support and resistance points which help in spotting key entry and exit position with respect to price movement in the market.

TEMA indicator generates smoothing function in its calculation which help gives a clear representation of the indicator and reacts faster to little trend changes.

TEMA indicator has only a single oscillating line which move along price action making it very easy to use in identifying trend.

TEMA can be use together with other indicators to confirm signals and eliminate noise.

Disadvantages of the Triple Exponential Moving Average indicator

TEMA is a trend-based indicator and so in ranging market, the indicator gives false signal.

TEMA gives invisible and unidentifiable signals in a volatile market as a result of the reduced lags making it to react very fast to price movement.

TEMA response fast to price action and sometimes changes dynamic support to resistance and vice versa, which can create false entry points in some situations.

TEMA work best when combine with different indicators.

CONCLUSION

Triple exponential moving average was initiated to solve the problem of lags from the other moving average indicators and so react very fast to price movement and every little trend change.

TEMA consist of a single oscillating line that rise and fall with respect to price movement and can identify important points like support and resistance, reversal trend, buy and sell position.