Hello Everyone...!!!

I am much grateful participating in this week homework post by prof @shemul21. The detailed lesson provided on Crypto Trading with Moving Average was very comprehensive.

Explain Your Understanding of Moving Average.

Moving Average is one of the types of trend-based technical indicators that are widely use in crypto trading in identifying the trend (uptrend and downtrend) of an asset market. The indicator determines the average value of an asset price over a specified period and it's based on price data of the market as it calculates the direction of the trend in accordance to the latest price data over a given period of time.

Moving Average indicator is like a chart that that carries sensitive data and as well provide average price data which help in identifying direction of trend and reversal trend as well as price break above and below the moving average.

Moving Average helps identify strong support and resistance level which gives opportunity for trade entry and exit. It provides clear and understandable signal readings as it filters out all noise in a trending market of any price chart.

Moving Average is very easy in identifying trend, when the indicator moves below price, it indicated a bullish trend and also, when the indicator move above price, it indicates a bearish trend. When the price MA indicator changes its position with respect to price, it signals a reversal trend which can be used as a trading opportunity for entry and exit trades.

Adding Moving Average to a Chart

We can add moving average to any crypto chart by visiting any trading chart platform, for this case I will be using tradingview and access the chart feature.

Select any crypto pair of your choice and click on indicators and strategy (fx)

.png)

- From the search box, type MA and select from the pop-up menu that appears.

.png)

- On the chart window, you will clearly see the Moving Average indicator applied to your chart.

.png)

Settings of Moving Average Indicator

Moving average has its default setting but can be customize to suit the trading strategy of the trader. To access the setting, at the top left of the chart window, click on settings.

.png)

At the input tab we can change the timeframe, and also the length/period of the indicator. Per this task, I will leave the default input settings.

.png)

At the style tab we can also change the color of the moving average indicator and also the thickness as well.

.png)

2. What Are The Different Types of Moving Average? Differentiate Between Them.

In general, there are three major types of Moving Average use by traders in technical analysis and these are;

Exponential Moving Average (EMA) Indicator

Simple Moving Average (SMA) Indicator

Weighted Moving Average (WMA) Indicator

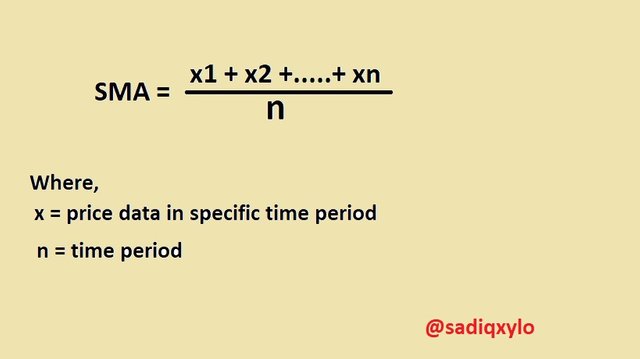

Simple Moving Average (SMA) Indicator

.png)

SMA as the name suggest is the simplest among three MA, and takes into consideration the Average price of an asset in a particular period of time. It helps trades to identify the direction of trend based on the exact true average value of price.

At long-term trade, the SMA is adjusted a little higher in terms of period to cope with price readings, and as well in short-term trade, the SMA is adjusted a little lower in terms of period to cope with price readings.

A signal of bullish trend is given when SMA breaks below price movement, and also a bearish signal when the SMA breaks above price movement.

Formula of Simple Moving Average

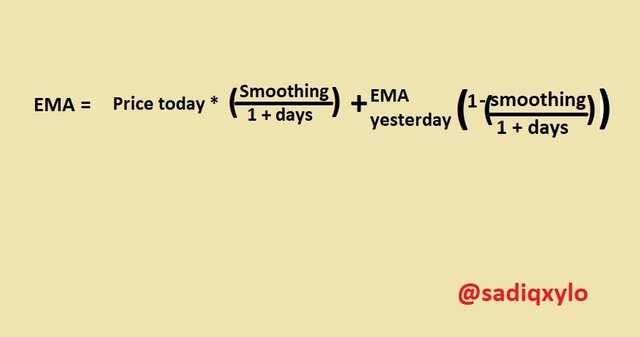

Exponential Moving Average (EMA)

.png)

EMA was initiated as a result of the fall backs of the simple moving average and so it’s much similar to the SMA except that EMA is more weighted to price data in a current trend and aw well help in identifying direction of trend.

EMA predict more precise average data and reacts faster to recent price movement as it takes the accurate value of price data.

Ina bullish trend EMA is projected upwards following price movement and projected downwards following price movement in bearish trend. Entry and exit points can also be identified by EMA in areas of strong support and resistance and reversal trend as well.

Formula of Exponential Moving Average

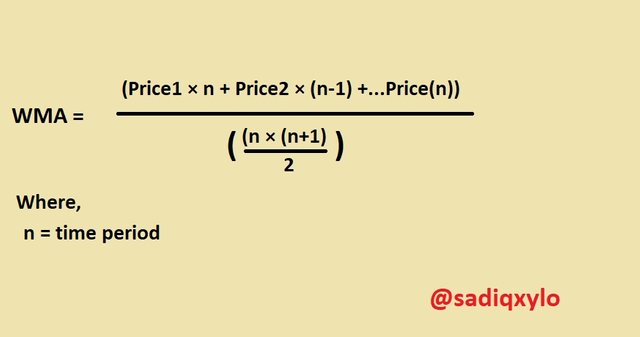

Weighted Moving Average (WMA)

.png)

WMA considered current price more important than previous price, as a result it applies more weight to the recent price data point and less weight to previous price data point to help identify the direction of trend.

It considers the recent price data in identifying the market price movement of any asset and calculates average value by summing up all the result from multiplying the price data. It reacts faster to any price change in the market.

Formula of Exponential Moving Average

Difference between SMA, EMA and WMA

| SMA | EMA | WMA |

|---|---|---|

| It considers the average price over given period | It considers the current price and a multiplier for smoothing | It weighted more to the current price data point and weighted less to the previous price data point. |

| It is the slowest in data reading among the three MAs | It’s faster compared to SMA as its based on current trend price data | It’s faster than both as it gives more weighted to most recent price data point |

| It lags behind price | It reacts faster to current price change | It react faster and more sensitive to every little change |

| It is very reliable and gives more accurate signal with higher period length | It’s very reliable and give more accurate signals with lower period length | It’s reliable and give more accurate signals with any period length |

3. Identify Entry and Exit Points Using Moving Average. (Demonstrate with Screenshots)

When I was given out the differences, I made mention of SMA as very reliable in long term trade and EMA also as very reliable in short term trade. As all the three types of MA has its differences, I will combine them to see its variabilities.

Here, we will combine both SMA and EMA together to identify both short-term and long-term trade and also identify entry and exit point. I will as well combine all the three indicators.

.png)

.png)

As seen on the screenshots above, I have combined all the three indicators, with period of 50 for SMA, EMA and WMA in a single chart. When all these indicators break above price action, a bearish market is signal and also, when all the indicators break below price action a bullish market is signal.

When combine all three moving average we can identify entry and exit points, below is a scenario for both bullish entry and exit point with all the moving average lines.

Entry Point

Here, I will combine EMA and SMA indicators as I mention already is good for long term and short-term trades.

.png)

As seen on the chart above, SMA of 50 period length and EMA of 20 period length are combined on the same chart. When these two indicators break below price action at a point, that point becomes our entry point.

I will combine all the three MAs and identify entry point. See chart below.

.png)

As seen on the chart above all the three MAs are combined with SMA of 50 period lengths EMA of 20 period length and WMA of 30 period length. At the point where all the three MAs breaks below the price action marks our entry point and a suggestion of strong bullish trend move.

At that point, I have opened a buy entry trade at that point as the price start to move in uptrend. A stop lost place just below the support level and take profit triggered to target the previous highs. We can keep taking profit until any the indicators come above price action.

Exit Point

Here, I will combine EMA and SMA indicators as I mention already is good for long term and short-term trades.

.png)

As seen on the chart above, SMA of 50 period length and EMA of 9 period length are combined on the same chart. When these two indicators break above price action at a point, that point becomes exit entry point.

I will again combine all the three MAs and identify exit point. See chart below.

.png)

As seen on the chart above all the three MAs are combined with SMA of 50 period length, EMA of 9 period length and WMA of 30 period length. At the point where all the three MAs breaks above the price action marks our exit point and a suggestion of strong bearish trend move.

At that point, I have opened a sell entry trade at that point as the price start to move in downtrend. A stop lost place just above the support level and take profit triggered to target the previous lows. We can keep taking profit until any the indicators come below price action.

4. What do you understand by Crossover? Explain in Your Own Words.

Moving Average crossover to is simple the cross between to different moving average lines or the same moving average line with different length period.

From the previous question, I combined different MAs and explain what it signifies and also determine entry and exit points. Here I will combine EMAs of different period length and explained what its cross signifies and also identifies entry and exit points.

I will combine EMA of 50 period length and EMA of 200 period length. The 50EMA will be closer to price movement and react faster to price movement and even with small sensitive change than the 200EMA.

As seen on the chart above, I have combined 50 EMA (red) and 200EMA (blue) in a single chart.

.png)

Entry and exit points can easily be identify with the cross of the EMAs of different periods. Now below are the significance of cross between two EMAs of different periods;

If at the point of the cross, a shorter period EMA is above the longer period EMA, the signal will be bullish and we can set up a buy entry.

If at the point of the cross, a longer period EMA is above the shorter period EMA, the signal will be bearish and we can set up and exit position.

Entry Point

Below is a buy trade set up using same EMA of different period cross strategy.

.png)

As seen on the chart above, the 50EMA crosses over the 200EMA and that point is marked as an entry point and price continuous to progress. A stop loss level is placed below the support level and take profit triggered to target the previous high points.

Exit Point

Below is a sell trade set up using same EMA of different period cross strategy.

.png)

As seen on the chart above, the 200EMA crosses over the 50EMA and that point is marked as an exit point and price continuous to depreciate. A stop loss level is placed below the resistance level and take profit triggered to target the previous low points.

5. Explain The Limitations of Moving Average.

As I discuss all the questions above, we saw how beneficial moving average is to traders, as we always say, no indicator is 100% perfect. Moving Average also has some limitations which are discuss below.

At certain periods moving average does not respond to little market fluctuations arbitrary movement of price.

It is easy to understand as it eliminates noise in a price movement, but it also eliminates some sensitive price data signals.

At some sudden move from price movement and little price retracement, the indicator can give false signals.

Moving average only work best in trending market, in a case of ranging phase the indicator emits false signals.

Moving Average is very sensitive with the period length and in case a trader chooses a period with wrong timeframe, then the indicator will give false trading signals.

CONCLUSION

Moving average indicator calculates direction of a trend in accordance to recent price movement over a given period of time. It also provides the average price data of an asset.

Moving Average generally comes in three types Simple Moving Average (SMA) Indicator, Exponential Moving Average (EMA) Indicator and Weighted Moving Average (WMA) Indicator and all help traders in the identification of trend, reversal trend, support and resistance, exit and entry point to take advantage of a trending market.

Moving average can be cross to give reliable signals, either with different type or same type with different period length. Just like other indicators, MA is not perfect and can be use together with other indicators to give confluence and confirm signals.