Hello Everyone..!!

It’s yet another week of the steemit engagement challenge and here to present my entry on the topic Cryptocurrency Trading of the steemit crypto academy community.

Discuss in your own words what is cryptocurrency trading.

First of all let’s talk about trading, it is a term used to describe the process of buying and selling of anything either between individuals, companies, services or networks. It can also be in the form of exchange between two parties coming to consensus to exchange their assets. Having understand what trading is, let’s now talk about the other part of the topic, Cryptocurrency. It is a digital transaction verified and validated by blockchain network using cryptography technology, example are BTC, ETH, BNB and many more.

Cryptocurrency trading: involves buying and selling or exchange of crypto assets between traders in the crypto space. This is done through a medium known as blockchain or exchange platform. Cryptocurrency can be bought with our traditional currencies (fiat) and can also be sold to fiat. The major difference between our traditional currencies and cryptocurrencies is market volatility.

Unlike our traditional currencies that are traded physically, cryptocurrency trading is carried out on a digital medium like blockchain network, centralized and decentralized exchange and require cryptocurrency wallets to accomplish these trades. A wallet address is exchanged between two traders who are involved in cryptocurrency trading, where the crypto asset will be transferred to.

Cryptocurrency trading can be done in so many ways and some include; spit trading, future/margin/leverage trading, peer-to-peer trading, arbitrage trading etc.

And tell us what type of traders are or do you see it more effective?

Before I talk about what type of trader I am, I will first explain the different types of traders or trading styles we have. There are four major types of traders which are;

Scalp traders: there are traders that take advantage of market volatility. Make good use of market fluctuations to mark entry and exit positions. They mostly use and hour timeframe to identify general market trend and mark entry and exit positions with a minute, five or thirty minutes timeframe. They don’t keep their positions open above an hour.

Intra-day traders: these traders takes advantage of daily market fluctuations to mark entry and exit positions. They mostly use the daily timeframe to identify general market trend and spot trading opportunities with 1hour, 4hours timeframe. They don’t keep their positions open above a day.

Swing traders: these traders take advantage of monthly market fluctuations mark trading opportunities. They mostly use the monthly timeframe to identify general market trend and spot trading opportunities with daily and weekly timeframes. These traders can sometimes keep their positions open above a month in a case market turn in different direction.

Investors: these trades don’t care about market fluctuations, they buy the asset and hold onto it till market hit their desire prices. They don’t use any timeframe, they only buy low and wait for their target price. Investors can keep their positions open for more than a decade.

Well, having explained the type of traders or trading style, I can nope freely talk about the type of trading style I’m into.

Initially when I joined steemit and had no knowledge about trading, I was a only an investor. I will buy a token especially a penny cryptocurrency and hold onto it till my desire price. Currently I’m still practicing this type of trading style, there are a lot asset about last year which currently holding onto till my desire price is hit.

When I joined the crypto academy community, I gain a little knowledge about trading and began practicing swing trading. I used to watch the trend of the asset and assumed it will rice in the coming days or weeks and purchase the asset via spot trade.

When the trading contest was introduced in the crypto academy, I began daily trading, I used to make my analysis at midnight and enter a position with and OCO order. The challises to be a daily one so in case my position isn’t closed before the day, I will have to close it myself.

So basically, I have experienced trading as an intra-day trader, swing trader and an investor. But currently, I’m only practicing an investor type of trading style as a result of the assets I bought long ago which has lost its value. I’m holding onto these assets till my target price.

Have you tested several time units? What Timeframe and Crypto Asset Pairs Are Best for You? Why?

Well, as I mentioned in the scenarios above, I have experienced with different timeframes, the least timeframe I have ever tested is the 5 minutes timeframe.

During the trading challenge of the crypto academy community I used to spot market trend with an hour timeframe, the use 30-minutes and 15- minutes timeframe for better resistance and support levels and then make an entry with a five minute timeframe. I used to make a lot of losses with this timeframe analysis and so I had to changed to different timeframe.

I then moved to identifying trend with 4hour timeframe and make entry position with an hour timeframe. This timeframe always returned a position little above or below my entry position and didn’t give any profit but better than the previous timeframe.

Then I began intra-day trade which yield a lot of positive results. I would open a trade after identifying the general trend with a daily timeframe chart, identified strong support and resistance levels and mark entry and exit positions within the hours of the day. This timeframe analysis gave me a lot of profits and remains the best timeframe that suited my trading strategy.

With regards to the crypto pairs, my favorite crypto pair is BNB/USDT. The reason I like this pair is that, with a daily trading strategy, BNB/USDT is very volatile providing and lot of trading opportunities for me. I pair I also like aside BNB/UST pair is GALA/USDT, this pair gave me a lot of profits six months ago.

Aside the pairs I mentioned, I also use Binance gainers and losers to spot entry and exit positions for a lot of assets. The pairs I mostly trade with are ADA/USDT, SAND/USDT, SHIB/USDT and Steem/USDT.

Have you had regular trading activity over the last few months?

Yes of cause, for the last few months, there have been a lot volatility in the crypto space of which I tried taken advantage of. The LUNA crashed has caused a lot of fluctuations over the last three months creating a lot of trading opportunities.

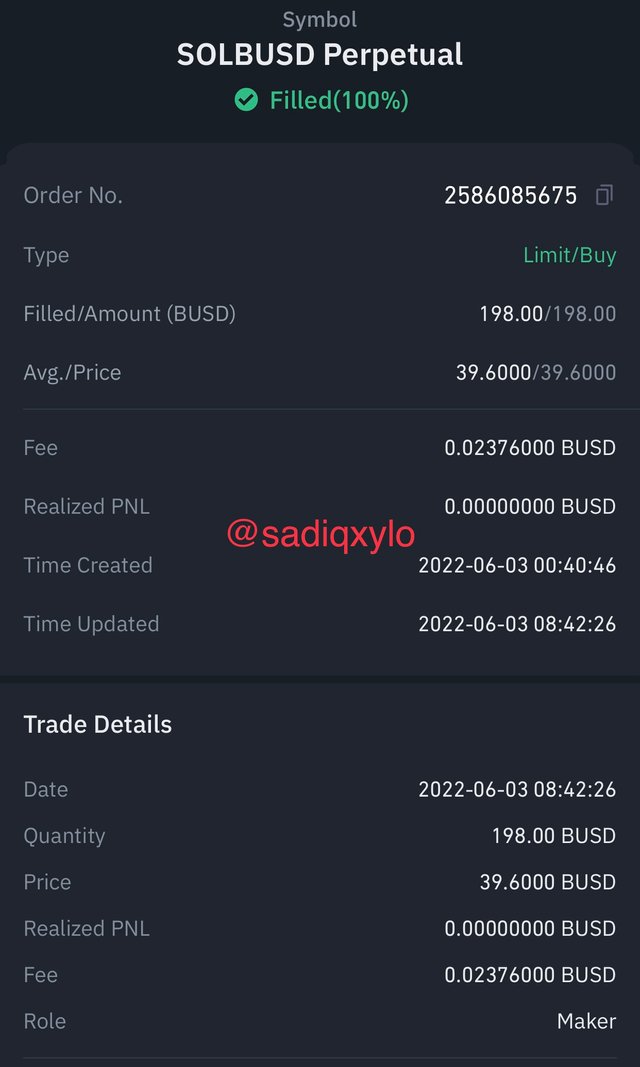

I have engaged in future perpetual trade on SOL/USDT pair using Binance exchange platform. After my analysis, the price was moving in higher highs and upon adding my Ichimoku cloud, it was trading below price chart. This analysis was done with daily chart graph.

The mistake I made was that, I didn’t set stop loss and take profit level. I believed the asset price was very low that it will not move further low, I was being greedy and expected more profit but the market moved in opposite direction and I was liquidated.

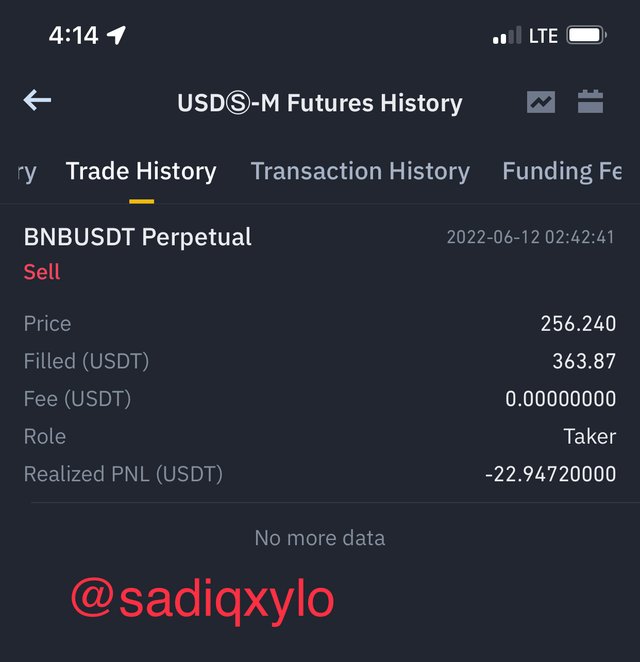

I also entered a position on BNB/USDT future perpetual on the Binance exchange platform. After I made my analysis, the market indicated sell position and I entered the market, I was lucky that the market moved in my direction and I was able to recover my losses.

For the past few months I have opened trade in future perpetual for both sell and buy positions, some resulted into losses while I profited from others. In all, my profits were able to outweigh my losses.

Tell us what you learned from this experience.

From the trades I have made for the past few months, I have a lot of mistakes and also learned a lot from these mistakes, below are some of the things I have learned.

Always set take profit and stop loss level when you open any position: when you open a position, do not be greedy when the market is moving in your direction, set a take profit level to take little profit you’ve made. Also said a stop loss level in case the market move in different direction. Also do not adjust this positions when you’re favored by the market.

Do not enter the market as a result of FOMO: I entered LUNA market as a result of FOMO, my colleagues bought when the price of LUNA hit 0.9 and it rebounded to $6, they made a lot of profits and I didn’t want to be left out. I entered the market and LUNA fall to 0.00009 which made me suffer a loss.

Change a different strategy if what you using doesn’t work for you: initial, I used 5minutes timeframe for my analysis which resulted in a lot is losses, the I changed to 4hours timeframe which wasn’t better enough and the I again changed to a daily timeframe which yield a lot of profits.

What impact does artificial intelligence have on crypto trading in the short and long term?

Artificial intelligence (AI) is simply making a machine or robot think intelligent as the way human think. AI technology has evolved several technologies like expert systems and the like. AI technology has recently been introduced into the crypto space where robots are used to create better trading strategies in maximizing trader’s profits.

Crypto trading bots such as CoinRule, CryptoHopper, TradeSanta etc. are used to continuously monitor market movements and fluctuations and to mark entry position on behalf of traders. Below are some impact of AI in cryptocurrency trading;

Bots are used on exchange platforms like Binance to continuously monitor market fluctuations and create entry position for traders.

Bots are used to create better trading strategies with several trading patterns and indicators to maximize trader’s profit without the trader necessary to constantly monitor the market.

Bots are used to monitor previous market patterns and be able to predict future market movements for traders to enter assets market at early stages.

Bots are used to create a diversify portfolio, managing the resources and select profitable assets for traders.

AI technology has impacted the crypto space a lot as traders have utilized trading bots to spot good entry positions to maximize profit. I have never used a trading bot before for any asset monitoring and I don’t know it is use, but with time as I’m gradually exploring the crypto space, I will learn to used trading bot to help maximize my profit.

CONCLUSION

Cryptocurrency trading involves selling and buying crypto assets between traders via exchange platforms and blockchain networks. There are a lot of trading types such spot trading, future trading etc. which traders employ trading styles like swing trade, scalp trade to take advantage of market fluctuations.

Thank you for publishing an article in the Crypto Academy community today. We have accessed your article and we present the result of the assessment below

Comments/Recommendation

Overall, you have done great in this contest. Your experience in cryptocurrency trading is worthy of emulation and i'm glad you shared your journey so far with us . Thank you for participating in this contest.

Total|7.5/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the feedback, I do appreciate your comments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi sadiqxylo, I don't feel comfortable with trading short time frames either, in my opinion it is stressful and with the volatility of the market, anything can happen and our investment can fly away.

I have not traded the market with bots either, but I agree that it is something positive, especially to save us time and at some point I will have to do it.

Greetings and much success in the challenge.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate you taking time to go through my post. Short term trading is really stressful and requires constant monitoring of the market. Well, with it trading I’m sure we will use it one day as we keep exploring the crypto space. Thanks again for your time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Waooh I can see that you have gain so much experienced in the crypto market from the type of trader that you are. Best of luck to you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have learned a lot from the crypto academy community. Thanks for your time buddy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You wrote beautifully well about cryptocurrency trading and the types of traders we have in cryptocurrency, I also experienced liquidation in my early days with futures trading and the reason was that I did not set a stop loss, since then I have learned to always set my stop loss to minimize my loss. Thank you for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That mistake for not setting a stop loss has caused me a lot and it’s always the first I do now whenever I open a position. Thanks for your time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When you choose USDT as a pair, I think it is very appropriate. Because if we look at the movement, USDT is very stable than other pairs.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, USDT is more stable. Thanks for your tim.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cryptos market are always up and down, sometimes you make profit and sometimes you make loss, it's nice to see you have choosen not to relent despite the 22$ loss, it has strengthen you to bounce back.

The trading contest was also one of the best project in the academy, we all get more trading knowledge and idea as we were able to put the academy knowledge into practice, thank you for sharing your input, Good luck!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I’m also motivated by my losses to cover it up. Thanks for your time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It’s very good you’ve set target prices for your investments bro. Having lost so much from crypto already, it’s very necessary to have target prices.

The body’s could help make trading easier for us but I can’t just help but feel skeptical. I’ll stick to the usual way for now.😅

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your time buddy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The losses and certain mistakes have been somewhat frequent in what has been experienced throughout the journey in the cryptoactive trade, and the implementation of different strategies, thank God the recovery has been timely.

Very good description of the different places where to carry out this activity.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your time

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Saludos

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have written well my friend, if you have issues with time frame such as or 15 minutes during trading, it is quite understandable. The truth is that this time frames can deceive you into entry the market. I prefer larger time frame because it shows a more clearer picture of the market and hence making decision is not too difficult. I wish you success in this entry my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks buddy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit