Hello Everyone,

I deem it a great honour participating in this week homework task by prof @stream4u. the detailed lesson on Reverse Strategy and CoinGecko was very comprehensive.

Technical Details On Reverse Strategy

Reverse strategy as the name suggest, opposite strategy is a strategy employed within the technical analysis of cryptocurrency to distinguish a greatly bullish or bearish of a crypto market for one day before making a speculation choice to appropriately take advantage of the delayed bullish or bearish trend. This strategy happens when investors make profit and decide to leave the market thereby bringing new investors since the market value of that particular asset will decrease. Reverse strategy is very risky to trade within the hours of the day since the price of a cryptocurrency can continue to increase or continue to decrease within the hours of the day. It is not a good time to take sell position at bullish state or buy position at bearish state since whatever decision is made base on this analyses may lead to fail. The best thing to do is to wait for the price to finished the day before initiating reverse strategy. At the end of the day when the price change of an asset is 20% or more, then it is a right time to implement this strategy.

How Reverse Strategy Works

In a situation where crypto market is noticed to be in a bullish or bearish state for a very long time, an investor ought to continuously be quiet enough to be certain about the state and conceivable reversal, this is often continuously critical to investors. What this simply means is that, when a crypto market goes greatly bullish and attained a price change of 20% or more for the day, investors who had made profit turn to leave the market which pull the market price backwards, this pull back of the market price creates a great bearish which appears that buying of crypto assets would be opened sooner and most investors will do so to pick up more profit on the crypto assets acquired.

There are some terminologies we need to explain when using reverse strategy;

Open: This indicates the opening price of the new day.

Close: This indicates the closing price at the end of the day.

High point: This represents the highest price an asset attained within the 24hours of day.

Low point: This represents the lowest price an asset attained within the 24hours of the day.

The strategy solely depends on the closing and opening points or prices in the day. To gain a good buy position, the opening price should be closer to that of the previous closing price. This will give the investor a good position to buy. On the contrary, a good exit of the trading process will be depending on the high points and low points. In a case where the price of a particular crypto asset gets to previous high point and the investor is able to hold on to the asset till it crosses that previous high point, it is a good position for the investor to exit that trade.

A Bullish Reverse Strategy on ETH/USDT

A bullish reverse strategy on ETH/USDT. As seen on the chart above, there is a prolong decline and also the opening price is closer to the closing price of the day which indicates purchase. Investors should buy when the closing price is closer to the opening price. A point where the high point of the day is greater than the high point of the previous day is indicated as sell. Investors will exit the market as they have made profit.

Review Of CoinGecko

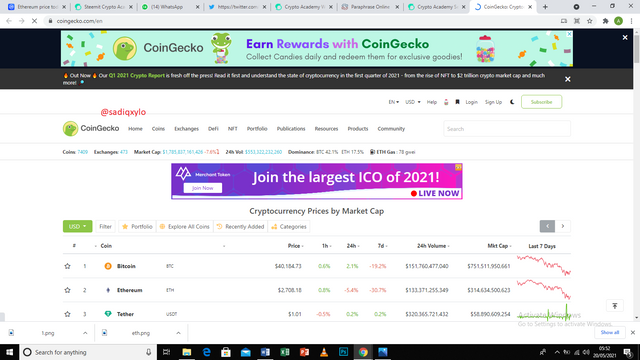

CoinGecko was created by TM Lee and Bobby Ong in the year 2014 and it is based in Singapore. CoinGecko is commonly a platform that gives all the fundamental data of all cryptocurrencies coins within the crypto market. That’s, it gives to its clients all the technical and fundamental points of interest of the crypto market. Cryptocurrency clients gets their required detailed data about the cryptocurrencies they are holding on the coinGecko website, which permits them to analyze the most excellent ones for diverse purposes. In CoinGecko, various cryptocurrencies are arranged based on the capitalization of the market. It also goes further to provide the performance of particular cryptocurrencies in the market. Visit CoinGecko website to explore more.

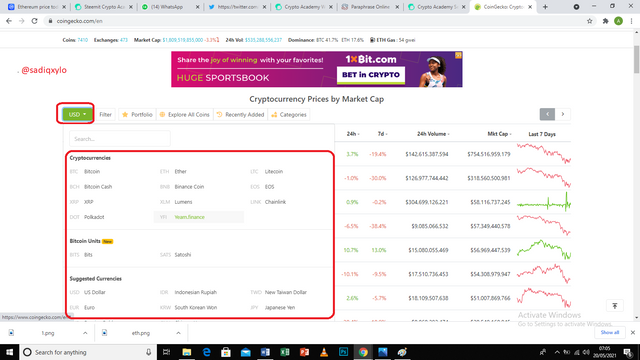

A screenshot below shows the interface of CoinGecko website which presents the number of coins, exchange, market capitalization, volume and so on.

How COINGECKO Can Be Helpful for you in a Crypto Market

Performance Assessment: The Coingecko website gives detailed information about distinctive cryptocurrencies, subsequently showing their performance within the crypto market and this would help an investor to form a great choice as to which crypto asset have a brilliant future.

Volume and Historical Chart: Each cryptocurrency has its volume within the crypto market which are effectively showcased on the CoinGecko site. Historical charts help users to read market trend for a particular period of time so as to buy or sell when the need arise.

Rank and prices of Crypto assets: the rank of a cryptocurrency indicates its performance in the market. Price of a cryptocurrency is carried out by the market capitalization of the cryptocurrency which help users to either invest in it or not.

Explore COINGECKO features with information

coinGecko comprises of many features and each feature has a unique purpose. Below are some of the features and what it entails.

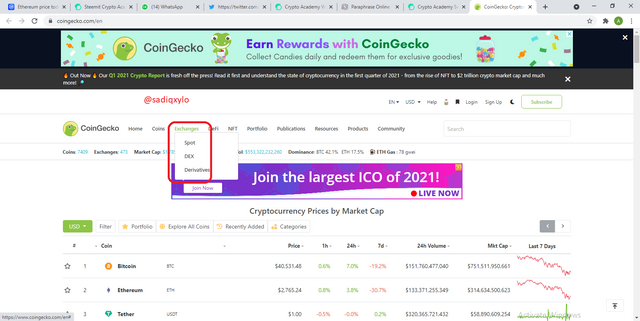

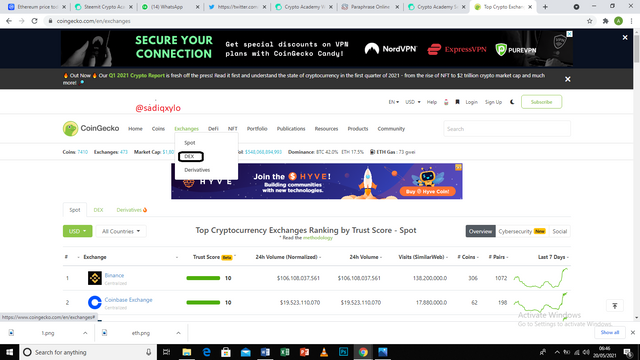

Exchanges

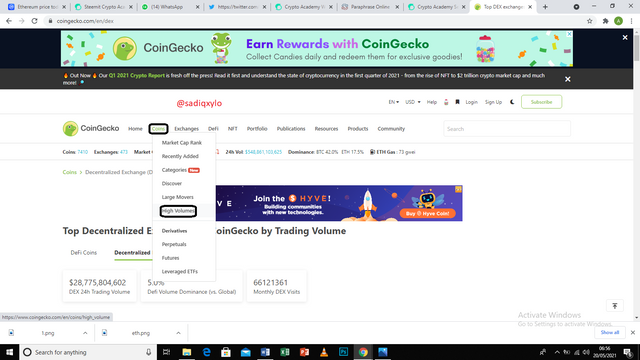

Typically, one of the feature in CoinGecko that I will be investigating. That's with this feature, the client is given the opportunity to choose the preferred service from the menu that pops up. This menu comprises of Spot, DEX and Derivatives. The Spot choice gives data on spot services. The Derivative choice too gives data on trades that gives contract exchanging. The DEX option on the other hand gives data on the list of decentralized exchanges.

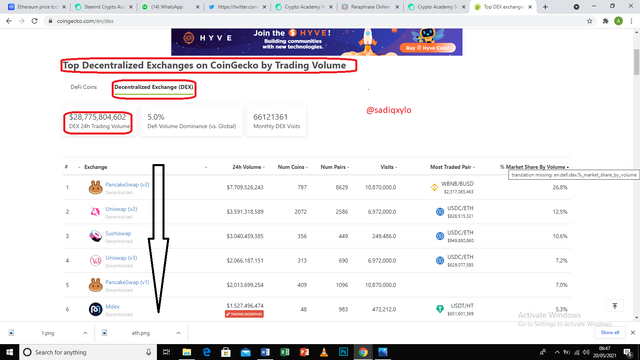

I will choose the Dex option to showcase the decentralized exchanges available on this platform.

Below show the various decentralized exchanges have been ranked below with the total volume shown above.

Developer

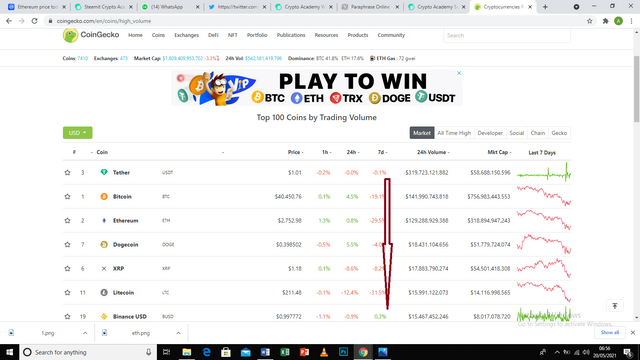

This feature on CoinGecko provides the information on contributions made by developers in a way of making changes to the project. This will enable them to make the website a better one. This feature is made available by Top 100 coins in the Trading Volume.

Below are screenshots

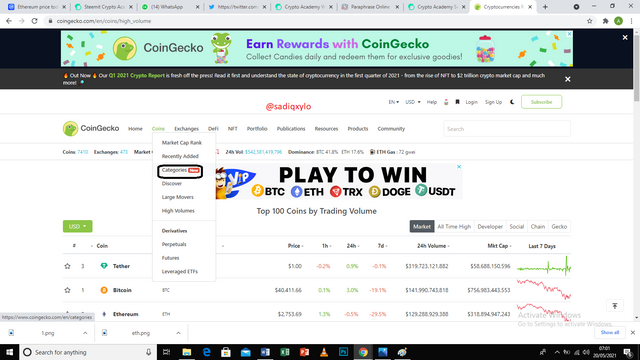

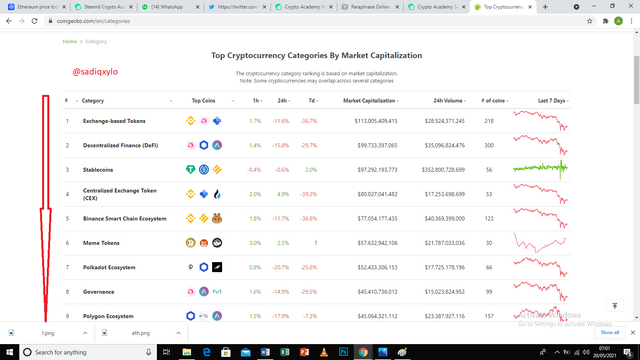

Categories

This feature of CoinGecko allows or shows to the users the type of cryptocurrencies in the crypto market. The category feature has some options which provides information on the market capitalization, the volume and the price value of cryptocurrencies. These options include Decentralized Finance (DeFi), Exchange-based tokens, Centralized Exchange Token (CEX), Stablecoins, Binance Smart Chain Ecosystem and so on.

Screenshots are shown below to practically show the Category Feature

Currency

This feature on CoinGecko enables users to be able to be know the current price of various cryptocurrencies. That is, any currency of your choice is available in this feature. This will enable users not to look out for price convertors.

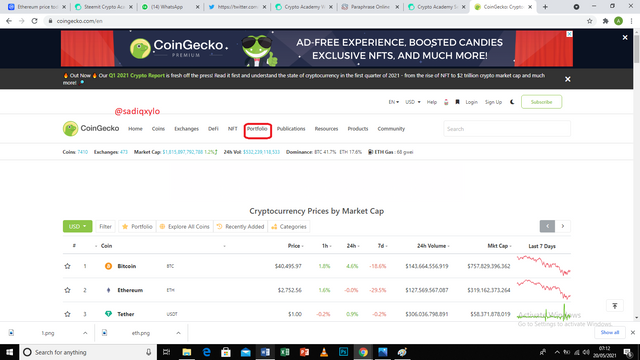

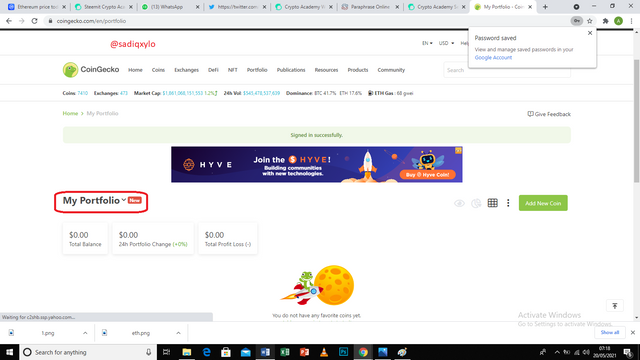

Portfolio

This feature on CoinGecko is exceptionally essential to clients in a way that, it gives to clients the proper strategies in order to track different cryptocurrencies so as to help them in speculations made on them. Moreover, a daily data is given within the price value or changes of different cryptocurrencies in this feature. Benefit and Misfortune strategies are given in this feature to help investors.

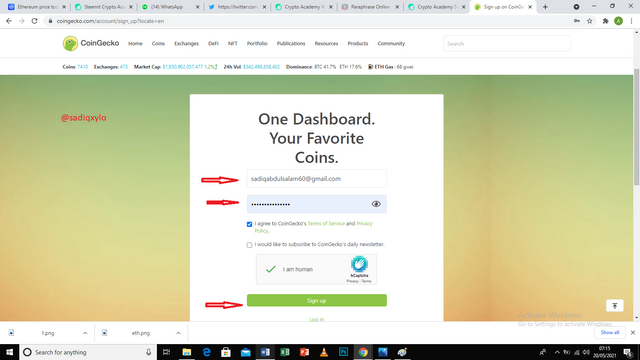

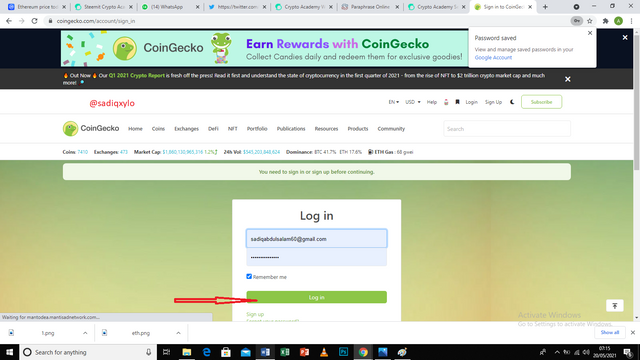

You need an account before visiting your portfolio, so you have to create an account.

Put in your Email and enter your password to sign up.

As you can see, my portfolio has opened.

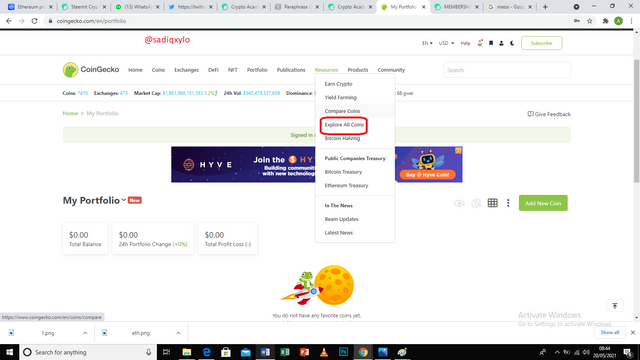

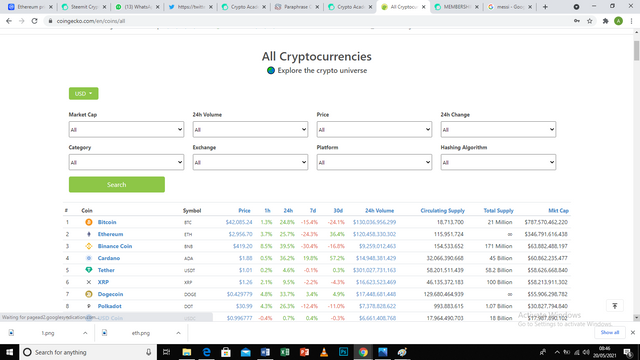

Explore All Coins

This feature in CoinGecko enables the user to have access to all cryptocurrencies present in the crypto market. they are ranked according to their market capitalization and volume. Information on their supply is also provided in this feature.

Screenshots are shown below as to how to get access to this feature

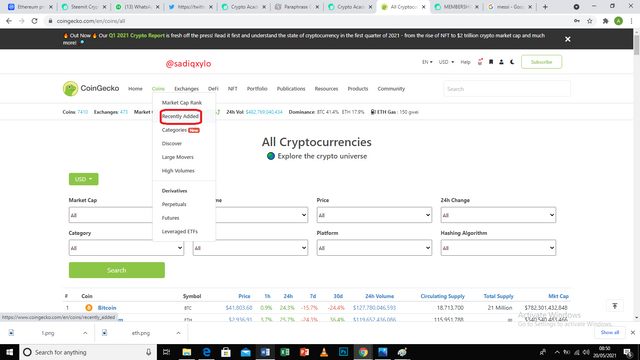

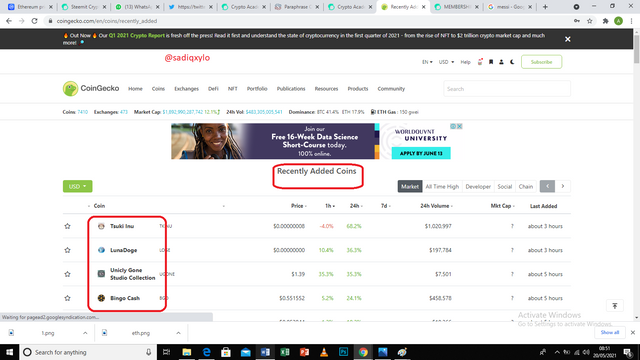

Recently Added Coins

As the name implies, this feature of CoinGecko is used to determine the coins that were added shortly in the platform. There is also information on the volume and other important facts of the various coins added.

Screenshots below are to throw more light

WEEKLY PRICE FORECAST FOR CRYPTO COIN: ETH/USD

From the previous weekly price forecasting, I have been using Ethereum and all my predictions have been great. I still want to keep on with Ethereum, this is because I have been studying it for a very long time.

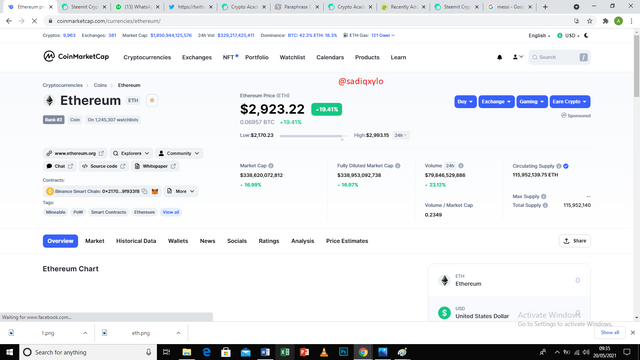

ETHEREUM

It is a decentralized open-source blockchain network with its native coin being ETH. It works as a blockchain network for most other cryptocurrencies and also for execution of smart contracts and DApps. It was created in 2013 but officially launch in 2015 by Vitalik buterin. It is the supremum of all the altcoins, rank at second in terms of market capitalization just behind the mother coin, bitcoin. It uses proof of work consensus algorithm. During my homework submission the current price value of ETH was $2,923.22 with a market capitalization of $338,630,072,812 and volume of $79,846,529,886.

WHY I CHOOSE ETHEREUM (ETH)

As I mention early, ETH is the native token for Ethereun blockchain making it ERC-20 token and I choose this token because of the innovations the ETH network brought to the Crypto ecosystem. Below are some of the features that made me like and choose the ETH token;

A free digital platform that enables users to share digital contents free with no attached charges.

Transaction speed of up to 10 - 15 transactions processed / second.

Low transaction fee on the Ethereum network.

Compatibility with smart contracts.

TECHNICAL ANALYSIS ON ETH/USD

With this aspect, I will be checking out the price value of ETH/USD in order to give me a good position to predict for the next one week. I will also set my resistance and support levels. This will also help give me a good prediction level. As seen from the graph, ETH had a prolong inclination then again prolong declination.

Below is a screenshot of my technical analysis.

Prediction for the next one week

At this point it will be now being okay to give my forecasting of the price value of ETH/USD for the next one week.

Last two weeks, I predicted for the price of ETH to spike to $3,900 in the coming week. It was clear that the price hit this target but has fallen significantly this week due the fallen of the mother coin, Bitcoin. The current price as at the time of my homework submission the price of ETH/USD was $2,923.22.

In the next one week as can be seen from the graph with a black line pointing above, ETH will attain a prolong inclination. I am predicting the price of ETH/USD to spike with a percentage of 35% and above, giving as $3,700 in the next one week.

CONCLUSION

To conclude with, I will like to say that the reversal strategy is a useful technique where investors can use to wisely take an advantage of a bullish or bearish market trend without any fear of investing. And with the CoinGecko it is an excellent tool to learn about several cryptocurrencies and to know how to choose which is the correct investment option, without any doubt.

Thanks For Your Attention

Hi @sadiqxylo

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot Prof for reviewing my work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit