Hello Everyone,

I’m much grateful participating in this week homework post by prof @reminiscence01. The detailed lesson provided on Trading Cryptocurrencies was very comprehensive.

- Explain the following stating its advantages and

disadvantages : -Spot trading

-Margin trading

-Futures trading

SPOT TRADING

It’s a trading strategy mostly suitable for beginners where the trader acquire the asset after purchasing and can trade it for different assets. This kind of trading strategy can can occur on any exchange platform at anytime. Trader’s involved in this kind of trading strategy mostly purchase the asset as it lowest price and keep hold to the assets while studying its price movements and whenever the price hits an appreciable price they sell to make profit.

In purchasing the asset, the trader must already be holding a different asset in his wallet and so can trader that asset for his/her desire asset. For instance, I always transfer my steem on steemit wallet to my Binance wallet. In a case where I want to enter into BTC market, I would have to trade my steem for BTC, by doing so I have to create STEEM/BTC order pair, where the order will be listed on the orderbook and depending on the type of order placed, the order will be execute accordingly. The amount of steem in my wallet should be greater than the amount of BTC trading for.

| Advantages | Disadvantages |

|---|---|

| Traders can trade all the available assets in the market and can have access to it in their wallets. | Spot trade can only occur on exchange platforms and so traders are required to have exchanged platform wallets before performing this kind of trade. |

| If current price of assets doesn’t favor spot traders they can wait till price move in their favorable direction before purchasing the asset. | spot traders can’t make profit when asset price is depreciating since they will make huge loss and so will have to wait till price favor them. |

| Spot traders can trade crypto assets at a very low start up capital. | In spot users cannot buy assets exceeding their balance |

MARGIN TRADING

In margin trading type, traders borrow startup funds from brokers and exchange platforms in a form of loan to facilitate their trades. Margin traders are able to buy assets greater than their start up capital as a result of the funds acquired from brokers and exchange platforms.

With the greater startup capital, traders can make huge amount of profit depending on the margin of leverage give by the broker. For instance, in a trader has a starting capital of $100, brokers can give a level of 2x, 3x, 5x, 10x etc leverage multiple the trader’s initial capital and in case market favors the trader’s prediction he/she gain profit based on the kind of margin of leverage he/she was given. Same way when market doesn’t favors his/her prediction, he/she suffers a loss base on the margin of leverage given. This type of trading isn’t good for beginners since the risk involves is very high.

| Advantages | Disadvantages |

|---|---|

| Traders can make huge amount of profit should in case market price favors their prediction | Traders can suffer a great loss in case market trend doesn’t favor their prediction. |

| With little startup capital, margin traders can still purchase any assets they desire. | it’s not suitable for beginners since it requires technical study of price movements. |

| Margin traders can diversify their funds into different asset market. | Margin traders pay huge amount of fees to brokers after making profit making their take home profit to be very less. |

FUTURES TRADING

This is a kind of trading strategy in which a buyer and seller come to a consensus on a said future date to purchase or sell a crypto asset at a set price. This mostly requires technical study of market trend of the underlying asset by both parties if they really want to make profit. Leverage is given to traders in this type of traders just like in margin trading to have a chance of acquiring greater assets in order to make profits.

If at the said future date the price of the asset depreciate from the actual set price, the buyer suffers the loss and the seller makes additional profit. Also, if the price increase at the said future date the buyer makes additional profit and the seller suffers the loss.

This trading strategy require technical study of price movement and ability of traders to take and manage risk and so beginners should stay away from it.

| Advantages | Disadvantages |

|---|---|

| Both traders gain profit when market is in bullish trend. | Both traders do not have control over the asset after a consensus have made on the said date. |

| With the leverage give traders can trade with large volume of assets and make huge profits | Require technical study of market trend and so not good for beginners. |

| Traders with small startup capital can make use of leverage trading to acquire large volume of assets | Future traders can suffers a great loss with margin of leverage trading which can eventually lead to asset liquidation as a payback for borrowed funds. |

Question 2

a) Explain the different types of orders in trading.

b) How can a trader manage risk using an OCO order? (technical example needed).

Different Types of Orders in Trading

Market Order

Market order is a type of order in which the trader placed either buy/sell order at the current market price. It usually executes immediately after order is place and may not be seen in the orderbook. This is as a result of small difference between the Bid-ask spread and traders accept the current price in the market without any hesitation. Traders in placing this type of order are in no post of making profit or have already made enough profit and they are known as market takers.

Limit Order

It’s something referred to as a pending order. With this type of order, the trader set a target price slightly above and below the market price for sell and buy order respectively with an aim of making profit. Traders with type of order have to wait till market price tally with their target price before the order will be executed.

For instance, the market price of BNB is $420. With a buy order, the trader can set a limit order to buy BNB at $419. Also, with sell order the trader can set a limit order $421. Limit orders sometimes cancel if market price fails to hit the set target price for very long time.

Stop Limit Order

In this type of pending order, the trader set both stop and limit order. Whenever the market price hit the stop-order then target limi-order will be executed. The limit-order will only execute if and only if the stop-order is reached.

Let’s take this scenario, we want to place a buy order for 1ETH and the current market price is $3,870, we can set a stop-price of $3,865 and a limit price of $3,860. Whenever the market price of ETH depreciates to $3,865 the limit-price of $3,860 will be executed.

OCO

In full term it is known as One-Cancel-the-Other. It is use by traders mostly in volatile market where assets price fluctuate greatly in order to make profit or stop further loss. In this type of order traders place both stop-limit order and a limit-order for both bearish and bullish market respectively.

When on other is executed the other order is canceled and when one order is canceled the other order is canceled as well.

For instance, ETH is approaching a price of $4k and you are in doubt whether it will continue increasing towards this price or will depreciate. You can set a sell limit at $4k to take profit and a stop-limit order at $3,500 to stop further loss in case trend reversed. This means that when the market price of ETH hit $4k the sell-limit order will be executed and the stop—limit order will cancelled and also, if ETH depreciates to $3,500 the stop-limit order will be executed and the sell-limit order will canceled.

How can a trader manage risk using an OCO order?

OCO can help traders to manage risk by setting both limit order and stop-limit order. The trader has a target limit to sell his asset so he set a sell limit-order and also to prevent further loss, the trader will set a stop-limit order in case price move in opposite direction.

If market price of the asset hit the trader’s target price the limit order will execute while the stop-limit order will cancel and the trader will his/her profit. On the other hand, if price depreciates to the set stop-limit, the stop-limit order will execute and the limit-order will cancel. This way, trader can make profit and again prevents further loss.

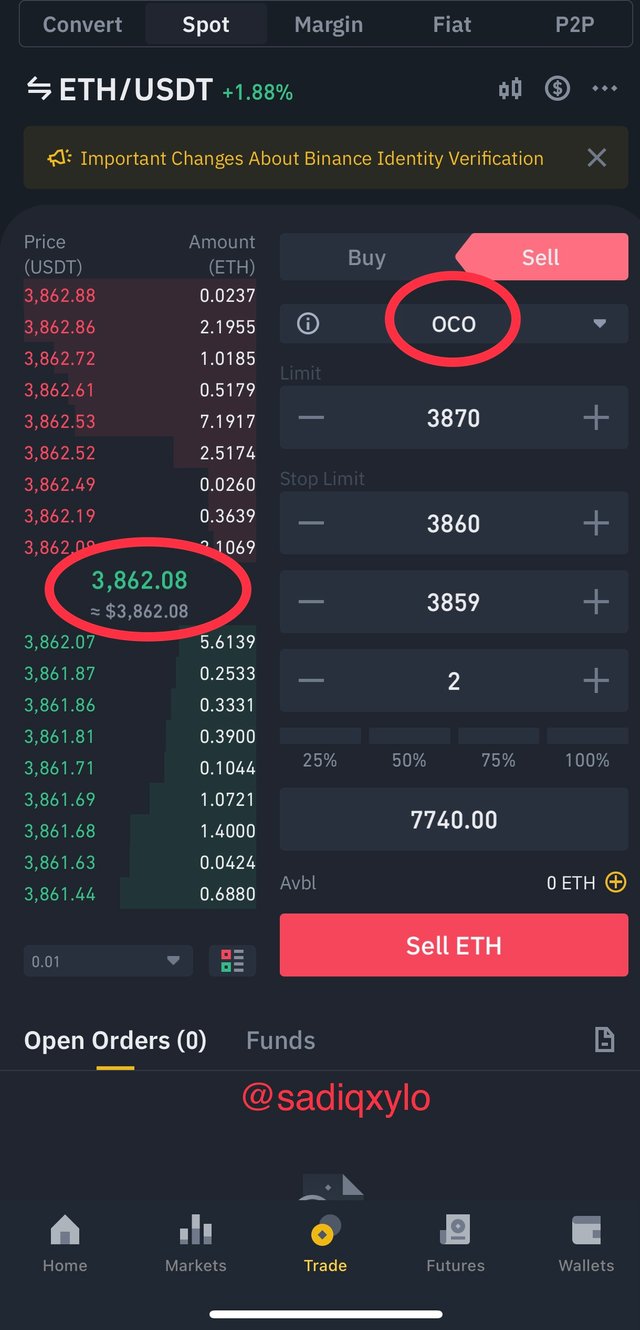

To understand this better, let look at the screenshot below.

In the screenshot above an OCO order is initiated to sell 2ETH. The current price for 1ETH form the screenshot is $3,862.08, I have set a sell limit price at $3,870, a stop price at $3,860 and a stop-limit price at $3,859

This means that if the price of 1ETH hits $3,870 the limit-order will be executed and my 2ETH will be sold given me a profit of $15.84 for the 2ETH, while the stop-limit order will canceled. Also, if 1ETH depreciates to $3,860 my stop-limit order will be executed given me a loss of only $6.16 if price continues to depreciates.

Question 3

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

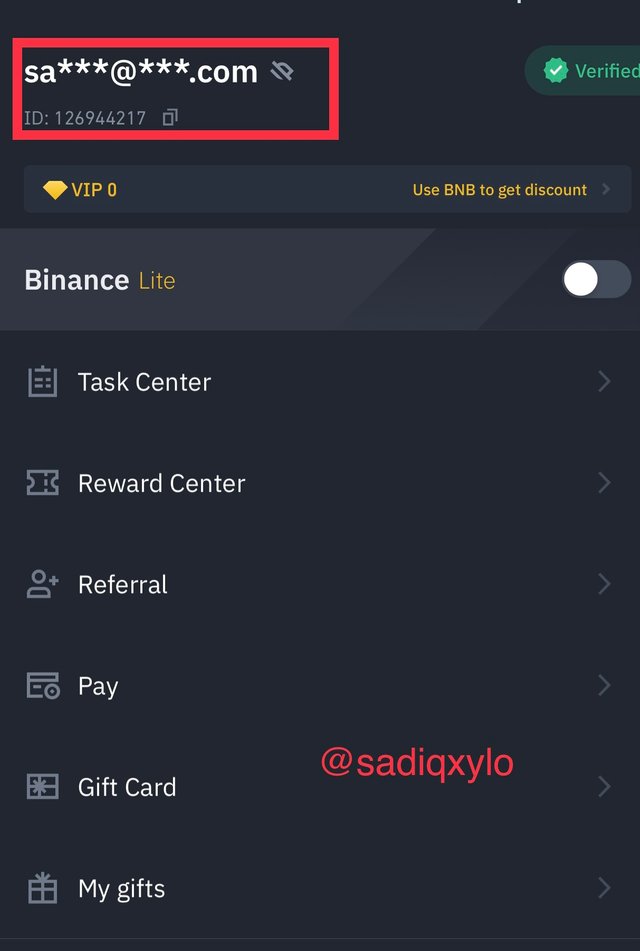

Here, I will open a limit order on TRX/USDT pair using my verified Binance account.

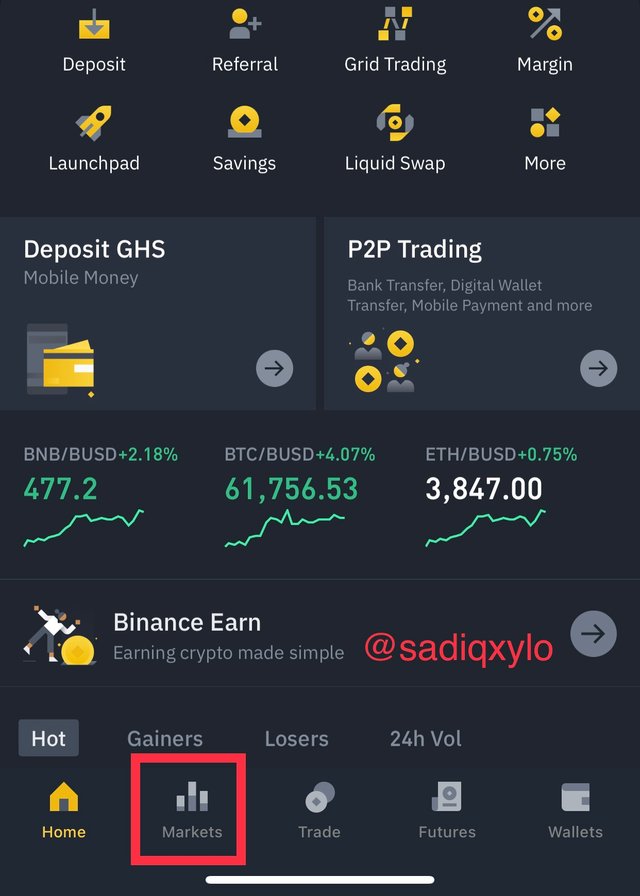

- Select and click on market.

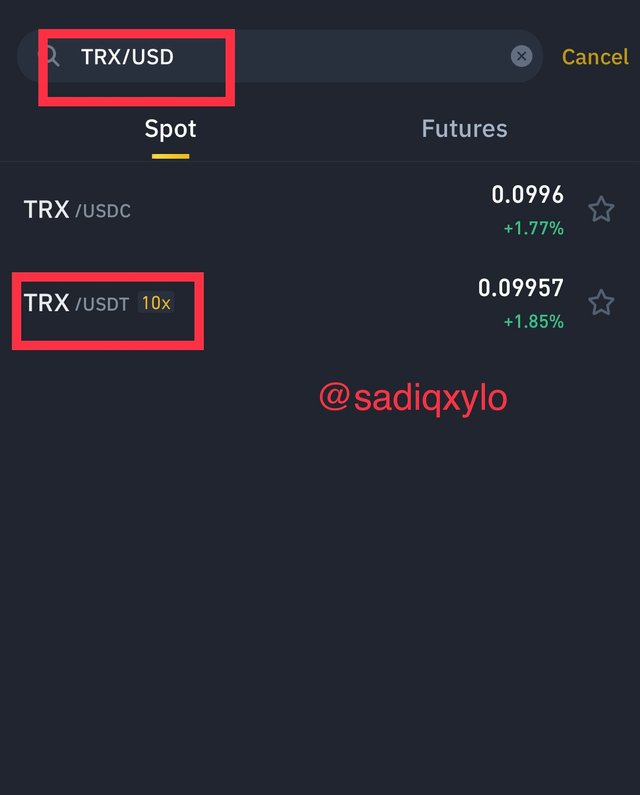

- Choose any crypto pallor of your choice, I will be using TRX/USDT pair so I will search for it in the search box.

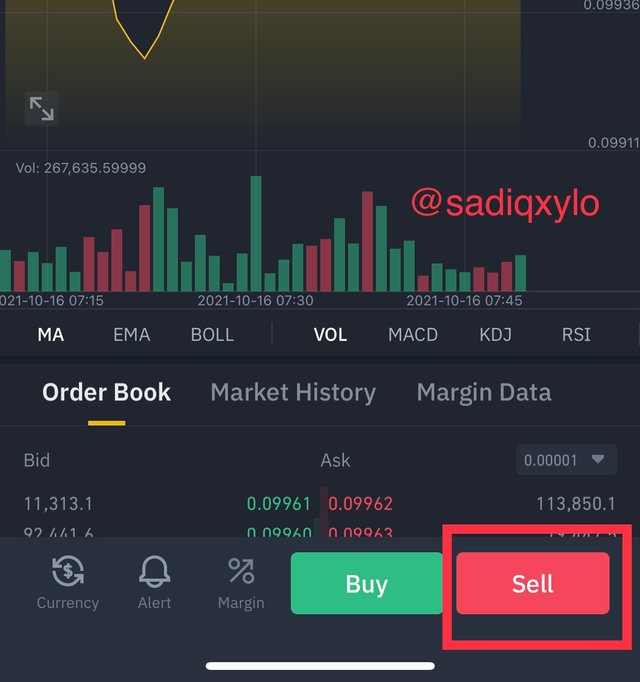

- I’m opening a sell order so I clicked on sell

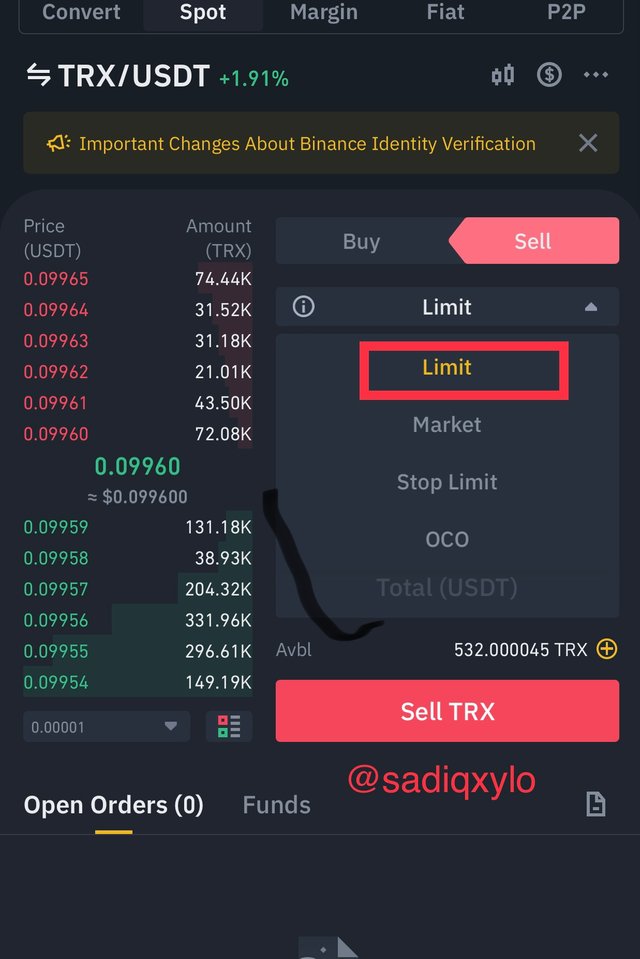

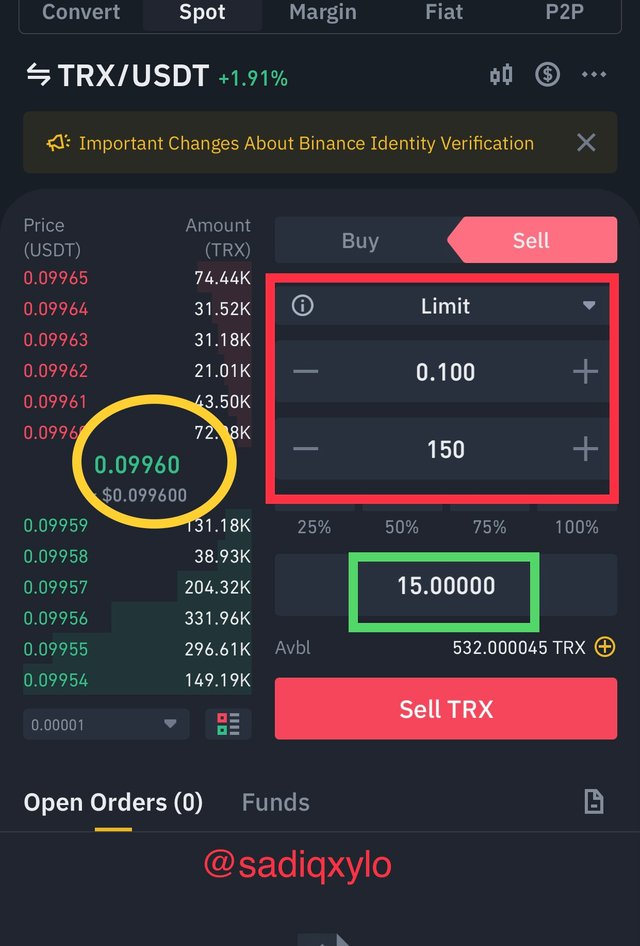

- From the order type section I will choose limit order and set my target price.

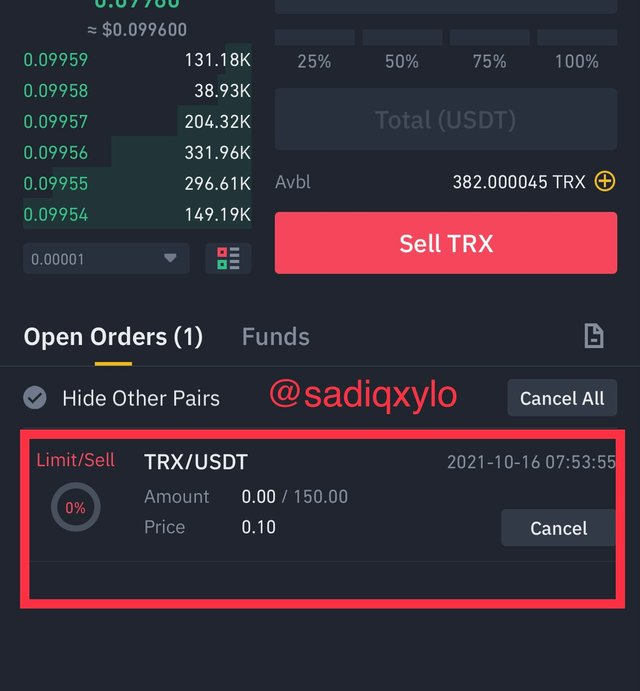

- I inputted my desire amount, 150 TRX which is equivalent to 15USDT and click on sell TRX.

- When market price hit the target price the sell limit order will be executed.

Question 4

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders. (Screenshots required).

I will be using tradinview to perform this task and also a demo trade with the paper trade.

I will use BNB/USDT pair for this task. My reason for choosing BNB are as follows;

BNB is the native token for the biggest cryptocurrency exchange platform, Binance. This exchange platform is widely accepted by most countries making the founders trustworthy and reliable. This makes BNB also reliable as the founders are world known.

Binance coin BNB was launching 2017 after several cryptocurrency in the market and has managed to be ranked #3 due to its significant performance within those period, reaching an all time high of $690.93.

BNB is the third most dominant coin in the world right after BTC and ETH with 3.23% out of the millions of coins existing.

Its price is mostly stable and doesn’t depreciates with BTC even though most of the coins depreciates with BTC.

I will also be using the Bollinger Bands indicator for the technical analysis and below are my reasons.

Bollinger bands consist of three line for its technical analysis, the upper band plotted plus +2 standard deviation above the simple moving average (SMV), the middle band also known as the SMV and the lower band plotted -2 standard deviation below the SMV.

Bollinger band can be use to identify a volatile and non volatile market. When the upper band and lower band are wider from the SMV, it signifies a volatile market and trade can set OCO orders to make profit or cut further loss.

Bollinger bands can be used to identify overbought and oversold which mostly follow by a trend reversal. In an oversold period the price candles will touch the lower band and form a support which usually followed by an upward trend reversal. Also, in overbought period, the price candles will touch the upper band and form a resistance which mostly followed by a down trend reversal. Traders can use this signals to mark entry and exit point.

Bollinger band is amused to identify price breakout. A bollinger squeeze is formed with the upper and lower bands narrowing the moving average. In breakouts price mostly break the initial resistance making it new support and form a new resistance. Assets break its all time high in breakouts. Traders can place a buy order after a bollinger squeeze.

Bollinger band is also used in determining trend of the market, when both the upper and lower bands move in uptrend it signifies a bullish market and also when it moves in downtrend it also signifies a bearish market.

From the BNB/USDT chart graph above, it’s seen that the price candles touches the upper band of the bollinger band indicator and its label as overbought. Right after the overbought region, a downtrend reversal occur and we have to exit the market to gain profit or prevent further loss. This clearly indicates an exit point in the market.

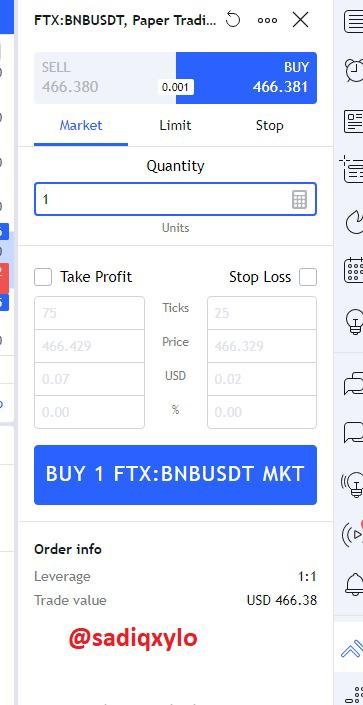

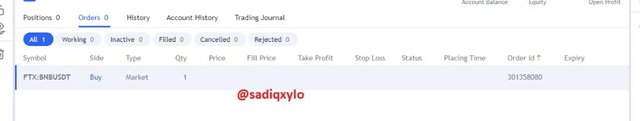

With the 5 minutes BNBUSDT chart graph below, the price was just from an oversold region and so I could only place a buy order since a sell order will create huge loss.

As seen on the chart graph above, as the price candles hit the lower band an oversold region was marked and upward trend reversal occur indicating that market will be bullish. I place a buy market order with 1BNB at $466.381.

As the market continues to be bullish, I will still keep my asset till my indicator signifies a trend reversal and I will the exit the market.

CONCLUSION

In the cryptocurrency market, there a lot of trading strategies that traders can employ in order to make profit even with a little startup capital. Some of these strategies require technical analysis and so beginners are not advised to adopt it.

In margin and future trading type, traders should take note of the type of leverage margin they go for since loss suffered will be multiplied by the leverage chosen.

The OCO order type help traders to manage risk in a volatile market as they can set both limit order and stop-limit order to gain profit and cut further loss.

In techno analysis, several indicators should be use in confirming signals to filter out false signals since no indicator is hundreds percent perfect. For instance, the bollinger band indicator can be use with the RSI to confirm overbought and oversold in order to mark entry and exit points.

Thanks For Your Attention

Hello @sadiqxylo, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the review

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit