|

|---|

INTRODUCTION |

There is one particular toy every loves to play on in a game park, the Roller Coaster. A roller coaster goes up and down with twists and turns, keeping everyone on the edge of their seats, some happy, while some scared. Well, the world of finance and investments has such a roller coaster and it's called "volatility". So buckle up your seat belts as we go into the details of this roller coaster.

In your own words, how does volatility affect cryptocurrencies? Is it beneficial or detrimental. |

|---|

In its literal meaning, Volatility is the tendency for something to change rapidly. It's like when something is very unstable and can go up and down, in other words, "fluctuate" a lot. It is about those unexpected twists and turns, hence volatility refers to how much something can change in a short period.

Relating it to cryptocurrency, volatility is all about the quick and unstable changes in the price of a cryptocurrency such as Steem, Bitcoin, Ethereum, Litecoin, etc.

|

|---|

Cryptocurrency markets are well known for their high volatility, that is, the value of assets goes up and down dramatically in a short period. However, this rapid up-and-down movement in price (Volatility) is influenced by factors such as;

Demand and Supply:

As we've come to learn in basic economics laws demand and supply will always impact the price of a commodity, therefore, it applies to cryptocurrencies too. The demand for a particular asset can impact its price greatly because when there is an increase in demand, the price tends to go up. Likewise, when there is a decrease in demand the price drops.

Investor's Sentiment:

This is a driving factor to investors' demands, it is the emotions and perceptions of cryptocurrency investors. Therefore, it can have a substantial impact on market volatility as positive news or developments can create a sense of optimism, leading to an increase in demand, leading to price spikes. Whereas, negative news or regulatory concerns can trigger fear and selling, resulting in prices diving.

Regulatory News:

From the previous factor, we can see how news can affect market sentiment, which in turn affects demand and price. This shows that government regulations and policies regarding cryptocurrencies can seriously affect the value of a cryptocurrency as news of new regulations or restrictions can create uncertainty leading to volatility in the market. Let's say, a country bans or restricts the use of cryptocurrencies, this can lead to a significant drop in price and vice versa.

Technological Advancements:

Technological developments such as upgrades, innovations, and security advancements of a cryptocurrency can also influence market volatility as all this can lead to price fluctuations.

Market Manipulation:

Unfortunately, the cryptocurrency market is not free from manipulation as large investors and groups can influence asset prices by buying or selling large amounts of the asset, this in turn causes panic among smaller investors leading to rapid price movements and increasing the asset volatility.

Global Economic Factors:

The Cryptocurrency market is also affected by economic factors such as inflation, interest rates, and geopolitical events causing instability or uncertainty that can push investors towards digital assets as an alternative investment, leading to increased volatility.

But then, how does the volatile nature of the crypto market affect cryptocurrencies? Volatility impacts the cryptocurrency market in various ways such as;

Providing Trading Opportunities:

Volatility in the cryptocurrency market creates trading opportunities for investors as investors look to make profits from these price fluctuations by buying low and selling high. Hence, traders who can anticipate the volatility of a cryptocurrency take advantage and capitalize on these price movements.

Increased Risk:

Volatility also increases the risk associated with investing in cryptocurrencies as the unpredictable price swings can lead to considerable losses if investments are not carefully managed.

Investor Sentiment:

Volatility also has the power to impact investors' sentiment and confidence in the cryptocurrency market as sharp price drops can create panic selling, while substantial price increments can attract more investors which in turn leads to further amplifying the volatility, as investor actions can drive prices even higher or lower.

Market Liquidity:

Volatility can affect the liquidity of the cryptocurrency because, periods of high volatility, may lead to increased trading volume and liquidity, as more investors enter the market to take advantage of price movements.

Regulatory Scrutiny:

The volatility in the cryptocurrency market can attract regulatory attention from governments and financial institutions to implement stricter regulations due to concerns about market stability and to protect investors.

Provides Profit Potential:

Volatility in cryptocurrencies creates prospects for traders and investors alike to make profits by buying low and selling high by taking advantage of the volatility.

Market Growth:

Cryptocurrencies have gained popularity partly because of their volatile nature. The potential for significant price swings attracts more investors, which leads to increased market liquidity and growth.

Innovation and Development:

The dynamic nature of the cryptocurrency market, driven by volatility, encourages innovation and the development of new technologies. It pushes companies to find creative solutions and improve the overall cryptocurrency ecosystem.

Risky Business:

Volatility brings risks to trading as the rapid price fluctuations can lead to substantial losses if one is not careful, therefore, it is important to manage our investments wisely and have a solid risk management strategy in place.

Investor Uncertainty:

High volatility can be discouraging for investors, as they hesitate to enter the market with the fear of losing their investment while also discouraging others from participating in the cryptocurrency space.

Regulatory Concerns:

Volatility may lead to governments and financial institutions implementing stricter regulations to increase market stability and protect investors hoping these regulations provide a safer environment, in turn, it may also limit the cryptocurrency market.

Hence, whether volatility is useful or harmful relies on the investor's point of view as some investors make a lot of profit when prices go up and down quickly by buying low and selling high, so it's good for them whereas, others lose their investment when prices go down, so it's bad for them.

However, it would be better if the price of a cryptocurrency grew steadily as this would cause people to trust it more bringing more people to invest in it.

In conclusion, trading cryptocurrencies can be risky, especially when the prices keep changing a lot. Hence, it's important to be careful, study the market, manage risks, and stay up-to-date with the latest happenings to help increase our chances of making informed decisions and minimizing potential losses.

Name and describe a technical indicator that measures the market volatility of an asset. |

|---|

Technical indicators are tools that assist investors and traders alike in analyzing market volatility. However, it's important to use them in conjunction with other technical analysis tools and consider the overall market conditions. There are several technical indicators that traders often use, they include the likes of;

- Bollinger Bands

- Average True Range (ATR)

- Volatility Index (VIX)

- Relative Volatility Index (RVI)

Bollinger Bands:

Bollinger Bands consists of three lines (one above, one in the middle, and one believe) plotted on a price chart. The middle line is the moving average, while the upper and lower lines or bands are calculated based on standard deviations. When the three lines or bands are closely packed (narrow), it suggests low volatility, while when they widen, it indicates higher volatility.

Average True Range (ATR):

The ATR measures the average range between the highest and lowest prices of an asset over a specific period. ATR indicates the asset's volatility by evaluating price gaps and intraday price movements. The higher the ATR values the greater the volatility, while lower ATR values indicate low volatility.

Volatility Index (VIX):

The VIX often referred to as the "fear gauge" is a measure of the expected volatility of an asset. The VIX uses alternative prices to calculate market sentiment and investors' anticipations. Hence, when the VIX is high, it indicates higher anticipated volatility and vice versa.

Relative Volatility Index (RVI):

The RVI is a technical analysis tool that compares the closing prices of assets to their price range over a specific period. It is usually used to identify overbought or oversold conditions which can also be used to measure volatility shifts.

Describe the step-by-step to be able to include this indicator in the STEEM/USDT chart. You can use the Tradingview platform. Show screenshots. |

|---|

Here's a step-by-step guide to including these indicators in the STEEM/USDT chart on the Tradingview platform, I will be applying the Average True Range (ATR) indicator.

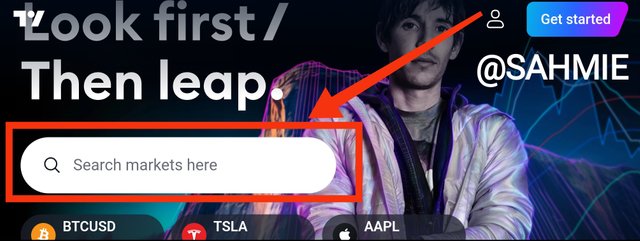

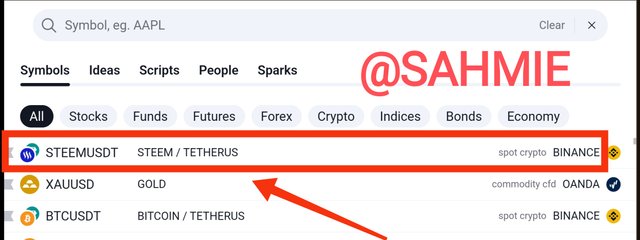

Step 1: Open the Tradingview platform on your preferred device and search for the STEEM/USDT trading pair in the search bar at the top of the screen.

|

|---|

|

|---|

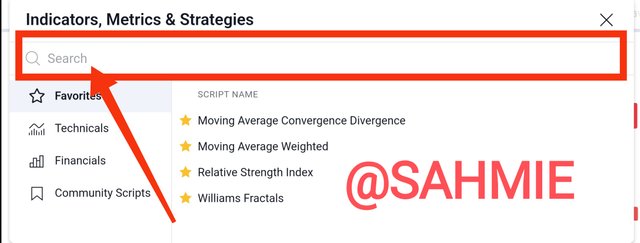

Step 2: Once you have the chart displayed, locate the "Indicators" button, usually located near the top of the chart.

|

|---|

Step 3: Click on the "Indicators" button to open the indicator menu.

|

|---|

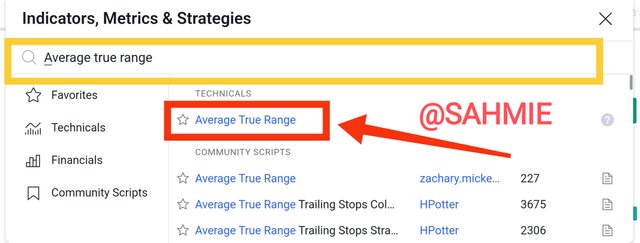

Step 4: In the search bar within the indicator menu, type the name of the indicator you want to add, such as "Average True Range."

|

|---|

Step 5: Select the desired indicator from the search results, click the "Apply" or "OK" button to apply them to the chart.

|

|---|

Step 6: The indicators should now be displayed on the STEEM/USDT chart, providing you with insights into market volatility.

|

|---|

One additional benefit is that you can use two or more indicators at once, to do that, repeat steps 3-6 for each additional indicator you want to include.

|

|---|

Explain in your own words, what happened to the volatility in the last month of the STEEM/USDT chart. |

|---|

Volatility is the excitement of the market, hence, when there's high volatility, it means things are moving around a lot and there's a lot of action, whereas, low volatility means things are more calm and stable.

Analyzing using the Average True Range (ATR) indicator, in the last month, the volatility of the STEEM/USDT chart went through a radical movement to a more stable and calm state.

|

|---|

From the Screenshot above, taking today, into account, the last month dates back to 7th November 2023, the market was exciting as the price of STEEM/USDT moved up and down more rapidly, as seen by the ATR indicator. The indicator showed a high peak value in the range of 0.0225, and according to the ATR indicator, high values signifies high volatility, meaning the Steem/USDT market was very volatility as at 7th November, 2023.

This increased movement indicates higher volatility as the market got a burst of energy and started making bigger swings as news of STEEM/USDT being accepted as future trading pairs on MEXC and later Binance.

In the later stages of the month, from around 20th November till date, things got calm, with a lower ATR figure betweeen 0.0035 - 0.007 meant the price didn't fluctuate much, and there wasn't a lot of action happening indicating more stability (less volatility) in the STEEM/USDT market.

Do you think the future of cryptocurrencies is more stable? Give your own opinion. |

|---|

Well, in my opinion, the future of anything is hard to predict, and cryptocurrencies aren't left out l, as the erratic nature of cryptocurrencies makes it difficult. However, there are beliefs that cryptocurrencies will be more stable over time if certain factors are put in place, factors such as;

Increased Adoption:

As more people and businesses start using cryptocurrencies for everyday transactions, it can help stabilize the market. When cryptocurrencies become more widely accepted and integrated into the global economy, their value may become less dependent on speculation and more tied to real-world utility.

Regulatory Clarity:

As governments and regulatory bodies establish clearer guidelines and regulations around cryptocurrencies, it can provide a sense of stability to the market. This can help reduce fraud and illegal activities, making cryptocurrencies a more trustworthy and reliable investment option.

Improved Infrastructure:

The development of robust and user-friendly infrastructure, such as secure wallets, decentralized exchanges, and blockchain scalability solutions, can enhance the stability of the crypto market. These advancements can make transactions faster, cheaper, and more secure, boosting confidence in the overall system.

Market Maturity:

Over time, as the crypto market matures and becomes more established, it may experience reduced price fluctuations and volatility. This could be due to a more educated and experienced investor base, better risk management practices, and a deeper understanding of market dynamics.

Economic Stability:

Broader economic stability can also contribute to a more stable crypto market. When traditional financial systems are stable and economies are growing, it can create a positive environment for cryptocurrencies to thrive.

CONCLUSION |

In conclusion, volatility in cryptocurrency is like a roller coaster ride characterized by rapid price swings, uncertainty, and the potential for both profits and losses.

I wish to invite @starrchris, @yancar, @ngoenyi and @suboohi

Thank You for your Time

NOTE: Always have a smile on your face, as you are never fully dressed without one.

@sahmie Your post is like a crypto roller coaster ride making the wild world of volatility so relatable! Your clear breakdown of factors influencing crypto ups and downs along with the real-life STEEM/USDT chart makes it easy for everyone to understand. Explaining technical indicators like ATR with a step-by-step guide and screenshots is super helpful – demystifying the complex for us. Your insights on the future of cryptocurrencies are on point balancing the challenges and potential stability factors. Loved the analogy of the roller coaster – it really paints the picture! Wishing you the best of luck in the contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend.

Thank you so much for your awesome feedback, I'm glad you found my post relatable and easy to understand. It's always my goal to break down complex concepts and make them more accessible.

I'm also thrilled that the step-by-step guide and screenshots were helpful in demystifying technical indicators. And I'm glad you liked the roller coaster analogy. It's a fun way to describe the ups and downs of the crypto world.

Thanks for your well wishes in the contest, I really do appreciate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Saludos gran amigo sahmie, muchas gracias por la invitación, casualmente en estos momentos me encuentro realizando mi participación para poder publicarla mas tarde.

Buena explicación sobre la volatilidad, sobre sus beneficios y sobre sus riesgos, buen uso de los gráficos colocando una ATR suavizada con una RMA, cuando los indicadores son usados combinados su efectividad aumenta.

Feliz y bendecida tarde, éxitos amigo.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot for the kind words, my friend! I'm glad you found my explanation of volatility, its benefits, and risks helpful. Using charts with a smoothed ATR and RMA is indeed a great way to enhance the effectiveness of indicators when used together.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A detailed explanation from your side and the images you have provided for adding indicator to the chart are very simple and are from proper basic which is really helpful.

There are many technical indicators to measure volatility in the market and you have mentioned many indicators like ATR and Bollinger bands which is good. I also believe that future of cryptocurrencies will be more stable.

Good luck for the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your kind words! I'm glad you found my explanation and the provided images helpful. It's always great to hear that the information I shared was easy to understand and useful to you.

You're absolutely right that there are many technical indicators to measure market volatility, and I mentioned a couple of them like ATR and Bollinger Bands. These indicators can be valuable tools for analyzing price movements and making informed trading decisions.

As for the future of cryptocurrencies, it's an exciting and evolving space. While cryptocurrencies have experienced volatility in the past, some believe that as the market matures, we may see increased stability. It'll be interesting to see how things unfold!

I appreciate the good wishes and your time. Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Let see what happens in the future and It will definitely be interesting to see how crypto market performs in the future. I believe It will show some kind of stability in the future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Absolutely! Let's keep an eye on the future and see how the crypto market unfolds. It's going to be interesting to see how things play out. And we might see some stability in the future. Fingers crossed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Отличная работа, друг! Наверное надо попробовать тоже принять участие!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Absolutely, my friend. You should definitely give it a try as it could be a wonderful experience to learn the impact of volatility in the cryptocurrency space. I'm sure you have experience on it, so go for it, and if you don't, you can actually learn something new

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@sahmie

Fluctuations are common in cryptocurrencies but here we clearly know that they have a certain type of signal when the signal turns green, it means the market is going up. goes away but when it turns red then it's a warning sign that means the market is going down, meanwhile people start buying things i.e. cryptocurrency and when it's green So there people sell them and earn huge profit here this is the principle of crypto currency so its life it will always go on and every time I read your post I learn something from something. and my prayers keep climbing the ladder of success with you and always keep commenting on other friends' posts. AllahHafiz.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for sharing your insights on cryptocurrency fluctuations! It's true that in the crypto world, green signals indicate the market is going up, while red signals warn of a market downturn.

It's fascinating how people take advantage of these signals to buy and sell cryptocurrencies for profit. I'm really glad that you find value in my posts and continue to learn from them. Your prayers and well wishes mean a lot to me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

La montaña rusa es una buena analogía para entender la volatilidad, aunque la diversión es solo para los ganadores en mercado cripto. ¡Ja Ja!

Estoy de acuerdo con las razones que provocan la volatilidad como el sentimiento del mercado o ciclo de emociones, noticias reguladoras, avances tecnológicos, manipulación de las ballenas, factores globales económicos, geopolíticos, guerras, liquidez baja del mercado, etc.

Así mismo nos describes los aspectos beneficiosos y perjudiciales de la volatilidad que aportan información valiosa en tu contenido del cual se aprende mucho.

El uso de ATR está bien explicado paso a paso, es un indicador fácil de usar y de interpretar para medir la volatilidad.

Estoy de acuerdo con tu visión de la estabilidad futura de las criptomonedas dejando claro que dependerá de diferentes aspectos como una mayor adopción, claridad en la legislación, mayor escalabilidad, seguridad y descentralización de la blockchain, madurez del mercado, estabilidad económica mundial.

Has hecho un excelente trabajo que aporta mucho conocimiento.

Gracias por compartir, te deseo mucho éxito.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm glad you agree with the reasons behind volatility, like market feelings, news, and stuff. And thanks for saying my explanation of ATR was easy to follow. It's a cool tool to measure volatility.

When it comes to the future of cryptocurrencies, it depends on things like more people using them, clear rules, better tech, and a stable global economy. It's a lot to consider.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

¡Excelente amigo! sigues ganándote mi apoyo como referente.

Saludos y bendiciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow!, I'm flattered by your nice words. Thank you though and have fun.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello brother @sahmie a very detailed and well-structured analysis of cryptocurrency volatility! You clearly explain how volatility can be beneficial and harmful, and provide specific examples of how it affects the cryptocurrency market. The comparison to a roller coaster is visually effective and easy to understand for anyone, even if they are not familiar with the world of finance.

You rightly highlight the factors that contribute to volatility in the cryptocurrency market, such as supply and demand, investor sentiment, regulatory news, and technological advancements. You also highlight how volatility can offer trading opportunities, but at the same time, increases the risks associated with investing in cryptocurrencies.

Your analysis of the beneficial and detrimental aspects of volatility provides a balanced view, recognizing that while it can offer opportunities for profit, it also carries significant risks and can create uncertainty for investors.

Overall, an excellent work that understandably addresses a complex topic. Well done🌸💗

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for your kind words and feedback on my analysis of cryptocurrency volatility. I'm glad you found it detailed and well-structured.

It's important to highlight both the benefits and drawbacks of volatility, as it can be a double-edged sword in the crypto market. I appreciate your recognition of the risks involved and the uncertainty it can create for investors. Your support means a lot to me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much friend for your participation in this engagement challenge you tried to answer all the questions in the best way as well as you explain more than requirement so that everyone may understand your concepts in more clear way

In first question you have explained factors influenced at volatility and I really agree with you that market manipulation as well as global economic conditions are really matters a lot when we talk about ups and downs in Crypto market. I wish good luck and success to you in this engagement challenge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey friend, Thank you so much for your kind words and appreciation. I'm thrilled that you found my answers helpful and easy to understand.

Volatility in the crypto market is definitely influenced by factors like market manipulation and global economic conditions. It's crucial to consider these aspects when analyzing the ups and downs in the market.

I really appreciate your support and well wishes for the engagement challenge. Wishing you all the best and success too.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey man just as I have expected you wrote excellently on this topic in fact you covered it and either ride range related topics in just one post I must say that is amazing

Yes man I would say that's indeed big wheel s in the market uses that big funds or network to alter and manipulate the outcome of a crypto asset and also change the current trend of some crypto asset by causing a bullish trend when there is a bearish trend.

Thanks for sharing wishing you success please engage on my entry https://steemit.com/hive-108451/@starrchris/steemit-crypto-academy-contest-s14w2-volatility-in-cryptocurrencies

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey, man! Thanks so much for your kind words! I'm glad you found my response on learning to be excellent and comprehensive. You're absolutely right about the big players in the market who have the resources and networks to influence the outcome of crypto assets.

It's unfortunate that some might use their power to manipulate trends, causing a shift from bearish to bullish. It's definitely a complex and ever-evolving aspect of the crypto world.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I understand 😊 and appreciate your hardwork boss

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot, I really appreciate your understanding and kind words as they means a lot to me. Keep up the great work too.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings 🤗

Its a pleasure to read your well written post about the volatility of crypto currencies. You have nicely break down the whole topic and explained each and every point in a very interesting manner. You have also told us about the factors which can affect the market volatility. Thank you so much for sharing with us 😊

Beat wishes 💫

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit