Edited with Logo Designer

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?

What is "Risk management"

Risk management refers to the mechanisms taken by investors to control the ups and downs due to price fluctuations by analysing the possible risks involved and providing the necessary mechanisms to avoid or minimize them. Risk management should be practiced in any form of investment, be it crypto, stock, forex, real estate, and many more. It helps traders to minimize the risk they may have encountered, which will therefore minimize their losses.

Traders practice risk management by identifying, analyzing, and minimizing the risk involved in their trades. With regards to cryptocurrencies, the fluctuations in prices of the various assets make it a risky investment. That is why it is good to always practice risk management. You can practice risk management by trading with a relatively low percentage of your capital, setting stop loss/take profit and using a good risk-to-reward ratio that would not affect your emotions when you lose.

It is advisable to follow the 1% percent rule, which involves risking no more than one percent of your investment. When all these are considered, it will not be too distructive when you record a loss. Because the outcome of every trade is either a gain or a loss, it is important to practice risk management so that the random losses you may incur do not have a negative impact on your investment.Investors risk losing everything if risk management is not considered in their investments.

Importance of Risk Management

There are uncountable reasons why investors and traders should practice risk management. I have highlighted some of them in the points below;

The first thing I'll mention is that, practicing risk management will help prevent investors from losing their trading or investing capital. When the market is volatile, it is obvious that there is a high likelihood of losing a large portion or all of one's investment capital when risk management is taken into account.

Implementing the 1% rule, which involves risking no more than 1% of investment capital, will help control the capital as a single loss will not be as distructive as someone who invests without implementing it. For instance, if I invest 10% and record a loss on my first trade, I'll only lose $1 from my investment, which is not huge enough to affect my trade as compared to someone who invests the same amount without implementing it.

Implementing other strategies like the take profit/stop loss will help traders to record more profits than losses, which increases their return on investment.

Diversifying our crypto assets by not putting all investments in one asset is also a risk management strategy and it will help reduce the chances of losing when some of the assets are not performing well, others may do.

Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

The 1% Rule

The 1% rule is a risk management strategy that is implemented by traders to guarantee that their trades are not exposed to any risk greater than 1% of their trading capital. This should be included in any trade setup to ensure that the trades are protected and it will not cause destructive loss to the trader. Even if he/she records consecutive losing trades, the physiological effect of consecutive losing trades will be less excessive as compared to those who fail to implement this rule, and they even face the chance of losing all of their trading capital. This further helps the trader to be able to revise their trading plans with the remaining trading capital.

A case Scenario,

Let's consider two traders, A and B. In three consecutive trades, they all invest 100 percent in their respective trades on an asset.Trader A implemented the 1% rule on all of his trades by setting his stop loss when the price of the asset falls beyond 1% of 100. Trader B, on the other hand, agreed to risk 10% on all his trades. The calculations of their returns in all the three trades for both traders are shown below, with the assumption that all the 3 trades result in losses.

Trader A with trading capital of $100

Trader A

| Trades | result | amount remaining |

|---|---|---|

| 1st trade | Loss | $100-$1=99 |

| 2nd Trade | Loss | $99-0.99=98.01 |

| 3rd Trade | Loss | 98.01-0.98=~97 |

After all the 3 trades, the trader will have a remaining trading capital of 97. He can still enter the trade with this amount by re-strategizing his trading activities.

Trader B

| Trades | result | amount remaining |

|---|---|---|

| 1st trade | Loss | $100-$10=90 |

| 2nd Trade | Loss | $90-9.9=80.1 |

| 3rd Trade | Loss | $80.1-8.09=~72 |

Trader B, on the other hand, was left with $72 after 3 losses, which is a significant drop in price from his trading capital. This will affect his trade as compared to trader A. That is why it is always good to implement the 1% rule in every trade.

Risk Reward Ratio

In trading, the risk-to-reward ratio is the proportionality of the risk incurred on a trade to the expected reward from the trade.Traders use the risk reward ratio to ensure that the risk that they take in their trades can be earned back at a particular ratio. With the risk-reward ratio, we can know whether the expected profit is greater than the potential risk (the loss that may incurr).

For example, if you were required to make a guess on a question, you would be rewarded with 2 marks, but if your guess is wrong, you'll lose 1 mark. In this case, the risk-reward ratio is 2:1, and that is applied equally to trading. If a trader places his profit at a point twice less than his stop loss, he has used the 1:2 risk reward.

When it comes to cryptocurrecies, it is good to use a risk reward ratio where the potential reward is greater than the potential loss. For instance, most traders also prefer to use a 1:3 risk reward ratio, which means that their potential reward is thrice the potential risk. Using the 1:1 risk reward ratio or anything less than that is not advisable as it means both the risk and reward are set proportionally equal. With this, the trader can easily lose his trading capital as compared to the 1:2 and 1:3.

A Case Scenario

Let's consider trader A whose trading capital is $1000. The table below shows his three consecutive trades, and he used a 1:3 risk-reward ratio in all of them.

Trader A

| Trades | result | amount remaining |

|---|---|---|

| 1st trade | Loss | $990 |

| 2nd Trade | Loss | ~$980 |

| 3rd Trade | Profit | ~1007 |

From the table above, trader A used the 1% rule on all his trades, and both his first and second trades resulted in losses. The third trade was a profit trade as he implemented the 1% rule. He risked 1% of 980, thus, $9. With a risk reward ratio of 1:3, the profit target is expected to be 9 * 3 = 27. After the 3rd trade was a profit trade, his trading capital will now be approximately $1007, which is greater than his initial capital. Assuming he used the 1:1 risk-reward ratio, his trading capital after the 3rd trade would be about 990 dollars, which is less than his initial capital. That is why it is very important to use the right risk-to-reward ratio.

Take Profit and Stop Loss

The stop loss and take profit are exit targets set on single trades. They are collectively referred to as "exit positions." The stop loss indicates the point you're okay with the risk and willing to exit the trade if the price declines to that level. On the other hand, the take profit indicates the point you are satisfied with the profit and will exit the trade if the price rises to that level. When the stoploss and take profit are set, the position is automatically triggered if the price hits the target. Setting the stop loss helps to avoid significant losses in trades when the market goes wrong, as it is usually set at a price level that the trader is willing to lose.

On the other hand, take profit helps traders to take profit when the price hits the target so that they can plan other trades. Setting these targets helps to keep the traded assets protected as the crypto market is usually volatile. To set a stop loss and take profit, it is good to consider the 1% rule and the risk reward ratio. Implementing all these will help manage the risks involved in the trade.

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required). a) Trend Reversal using Market Structure. b) Trend Continuation using Market Structure

a) Trend Reversal using Market Structure

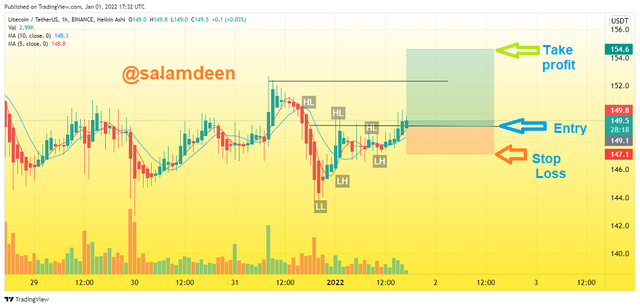

In order to accomplish this task, I used the LTC/USDT (1Hour)chart from tradingview.com with the 5 and 10 Moving Average lines for more accuracy).

The LTC/USDT (1hour) chart

LTC/USDT chart on tradingview.com

Entry Criteria

When you closely observe the chart, you will see that it was moving in a downtrend by forming lower highs and lower lows. There was a contraction in the candles, which is signal of a trend reversal as the candles begin to form Lower Highs(LH) and Higher Lows (HL). The entry was set at $149.3 when the bullish candles formed and broke the resistance line to form a new higher high. I placed a buy order at $149.6.

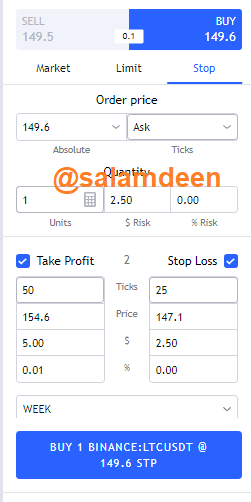

Risk on $100 Account portfolio

I used the 1% rule to control the risk in the trade by taking a risk of 1% of the trade capital. This means that, I am ready to risk $1 of my $100 trading capital.

Exit Criteria

I used the stop loss and take profit target as my exit criteria, placing my stop loss just below the previous higher low at a price of $147.1, 25 ticks below the entry point, using the 1% rule and a risk reward ratio of 1:2.Because I am using a risk-reward ratio of 1:2, the take profit was set at a profit target that was twice the risk amount, resulting in a take profit of $154.6, 50 ticks above the entry point.

The Trade Setup

LTC/USDT chart and order setup on tradingview.com

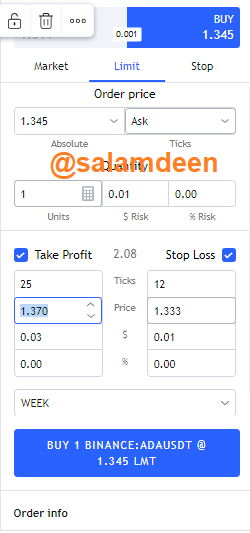

b) Trend Continuation using Market Structure

Here, I used the ADA/USDT 15min chart from tradingiew.com with the 5 and 10 simple moving average lines, which signaled a bullish trend continuation as the 10 SMA line crossed the 5 SMA line.

ADA/USDT chart on tradinview.com

ADA/USDT chart on tradingview.com

Entry Criteria

As the chart was in an uptrend, It was forming Higher highs and Higher Lows. The entry was observed when the bullish candle broke the resistance line and a new Higher High was formed. My entry point was set at $1.345, as another bullish candle was formed.

Risk on $100 Account portfolio

I used the 1% rule to control the risk in the trade by taking a risk of 1% of the trade capital. This means that, I am ready to risk $1 of my $100 trading capital.

Exit Criteria

Similar to the previous trade, I used the stop loss and take profit as my exit strategies, and they were both set according to the 1% rule and the 1:2 risk reward ratio.

The Stop Loss was set closer to the previous Higher Low, 12 ticks below the entry point at a price of $1.333. With the 1:2 risk reward ratio, the take profit target was set $1.370, 25 ticks above the entry point.

The trade setup

ADA/USDT chart and order setup on tradingview.com

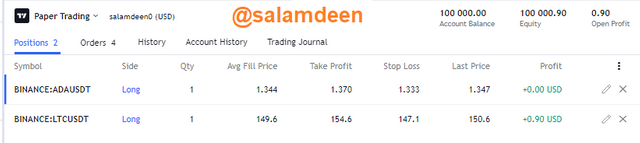

The Executions of both Trades with Tradingview Paper Trading

Conclusion

Risk management is very necessary for every trader, as it will help protect your funds and also maximize your gains. Maximum attention should be given in setting up a trade to ensure that the necessary risk management tools are implemented. This lecture really impacted some of us very well as the professor added practicals to ensure that we all got hand in hand with the real-life scenario of setting up this target. I will stop here by thanking the professor for this important lecture.

Hello @salamdeen , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

There's no trend identified on this chart as you marked.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit