Hello crypto Enthusiasts!

Picture Created With Ms paint

1-Define the Order Book and explain its components with Screenshots from Binance.

An Exchange Order Book

An order book in crypto currency exchanges, basically, is an electronic record that represents a set of orders in an exchange. These sets of orders are the different offers from different buyers and sellers for the specific asset pair, like the STEEM/USDT pair on Binance. They show the relationship between the buyers and sellers of the asset pair on an exchange. It enforces transparency in the market and helps us have a generalized view of the current pricing information for that asset. It also helps us visualize the demand and supply pressure on the asset.

The order books of the various crypto exchange platforms are built with similar features as they all perform similar functionalities. The bids represent the buy orders, whilst the "asks" represent the sell orders. Both the bids and asks are clearly shown and are both separated by different colors. In binance, for instance, the bid side is colored green and the ask side is colored red. This helps traders clearly visualize the relationship between the buy and sell orders.

An example of an order book from binance is shown in the picture below:

STEEM/ETH order book in binance

Some Main Components Of An Order Book

The Sell Order or Bid Side

This side of the order book represents all the open buy orders. It occupies the green colored portion of the order book. It contains the bid price and the bid quantity. It covers the left side of the order book above

The bid price

It represents the prices of the various orders placed. The bid prices are arranged in an ascending order (highest bid price on top). I have labeled this part as BP in the picture above.

The bid quantity

This bid quantity represents the amount of the corresponding bid price being ordered. I have labeled this part as BQ in the picture above.

Bid Total

This section is not included in the binance mobile app. But it can be seen in the web version. This section represents the sum of the bid quantity accumulated from the previous best bid prices.

Ask Side

This side is coloured red in binance. It contains the bid prices, the amount, and the total bid. It covers the right side of the order book above

Ask Price

The ask price contains prices of the various the sell orders arranged in an ascending order just like the bid price. I have labeled this part as AP in the picture above.

Ask Quantity.

The ask quantity represents the quantity of the corresponding ask prices being ordered.I have labeled this part as AQ in the picture above.

Total Ask Quantity

This part is not shown in the mobile app, It represents the sum of the ask quantity accumulated from previous ask prices.

2-Who are Market Makers and Market Takers?

Market Makers and Market Takers

Ideally, market makers are those who create the orders that are displayed in the order book. They create limit orders by bidding/ asking their price in the market based on the current bid price or ask price, then wait for it to be filled automatically when the price hits their order. This activity of the market makers adds liquidity to the market. I have served as a market maker if I open the binance order book for the BTC/USDT pair and set a limit at a preferred price, then wait for it to be filled.

Market Takers: They take the market price just as it is. They tend to fill the orders created by the market makers. They use market orders to settle the trade instantly. I will serve as a market taker if I buy the BTC/USDT pair with the market order.

3-What is a Market Order and a Limit order?

Limit Orders and Market Orders

Market order: This is the order that triggers an immediate buy or sell in the order book. This order is less concerned with the execution price but rather more concerned with the execution of the order. The market order’s execution takes the current bid price (in sell order) or ask price (in buy order).

The Limit Order, contrary to the market order, sets a bid price or ask price at a specific price. A buy limit order is executed when the market price hits or goes below the bid price set by the buyer, and a sell order is executed when the market price hits or goes above the ask price set by the seller.

4-Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

There is a symbiotic relationship between the market makers and the market takers. Their actions are dependent on each another.

Trades in the market occur between the market makers and the market takers. Orders placed by the market makers are taken by the market buyers if their orders are matched.

The market makers constantly set awaiting orders to make a ready available market for the market takers. This is what happens repeatedly to keep the market moving. It should be noted that the actions of the market makers add liquidity to the market; hence, they pay fewer fees while the market takers consume the liquidity and they pay more fees than the market makers.

Let’s use a book shop as a case scenario; There is always a supplier who fills the book shelves with items that can be taken as the market maker. He adds items to the book shop at a lower fee. And a consumer who buys the items, he takes items out of the market, hence, has to pay extra fees.

This explains the dependency between the two parties and why the market takers add liquidity and market takers utilizes liquidity in the market.

5-Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

In this part of the assignment, we are tasked with having some interactions with the Steem currency market.

The first task is to set a buy order of 1SBD with the current lowest bid price.

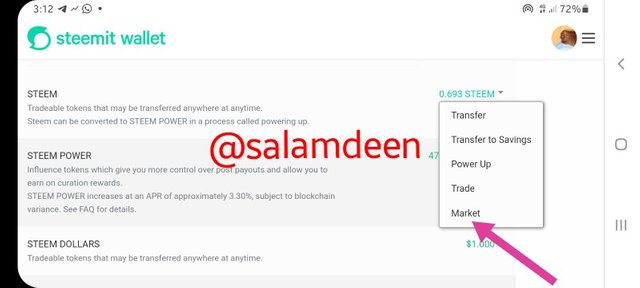

I first logged into my Steemit wallet. I wanted to access the currency market, so I clicked on my steem balance and selected "Market" from the dropdown list.

my Steemit wallet

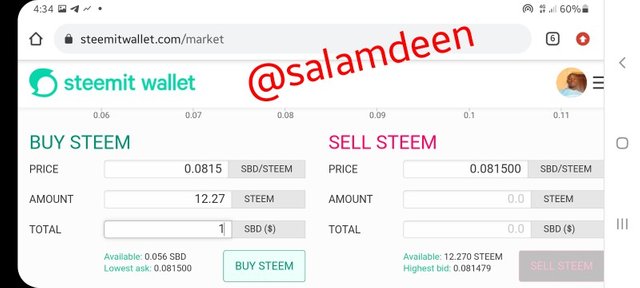

I placed a buy order for the SBD/STEEM pair at the current lowest bid price of 0.081500 at 1 SBD for 12.27 STEEM.

placing a limit order with the lowest bid price

Although, the trade was not instant, it was filled within two minutes' time. This was as a result of a slight price change in the process of setting the order.

The picture below is the history of the order in steemworld.org

Order history in steemworld.org

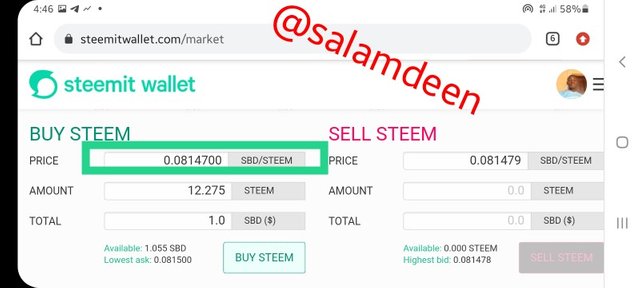

The next task in the STEEM market is to place an order below the lowest bid price (0.081500). I changed the bid price to 0.0815700, which is lower than the lowest bid.

Trading with the limit order in steem currency market

It took a very long time for the order to be filled. The picture below shows the trade history. The order took about 2hours to execute

Trade historyin steemworld.org

6-Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

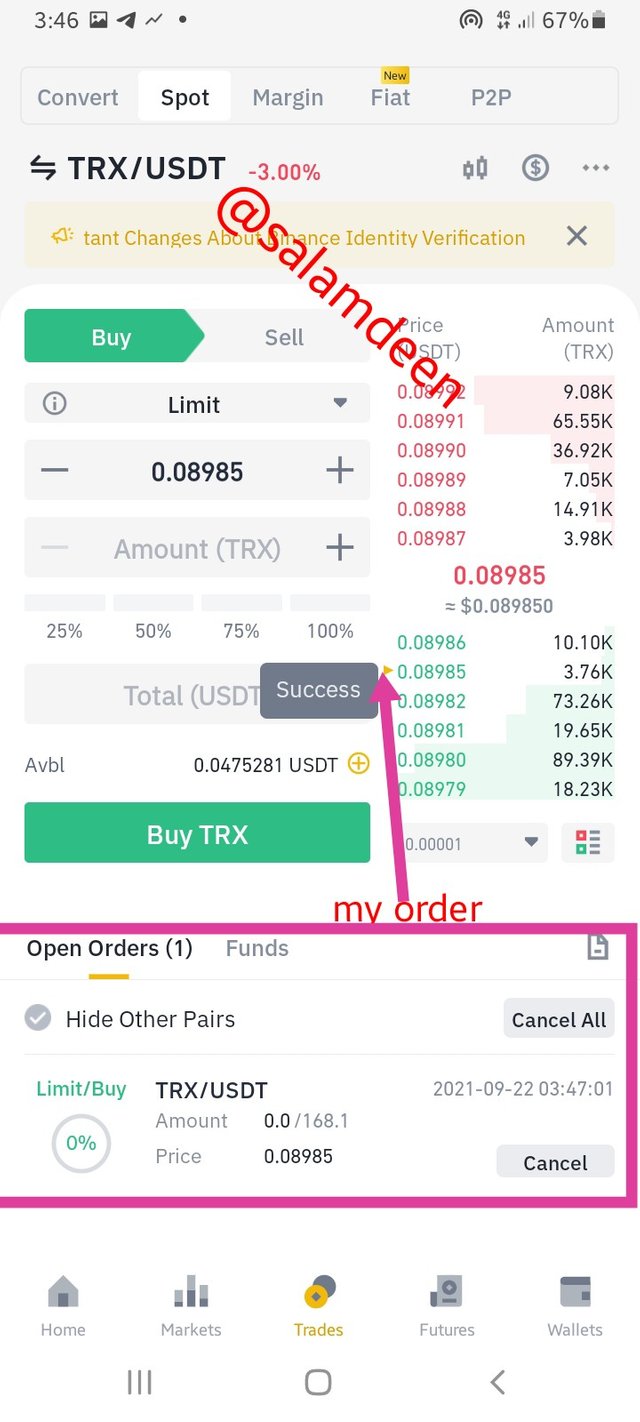

Here, we are tasked with exploring the binance order book, by doing some tasks. Place a TRX/USDT buy limit order.

First of all, I opened my Binance mobile app and searched for TRX/USDT in the binance market.

Binance app

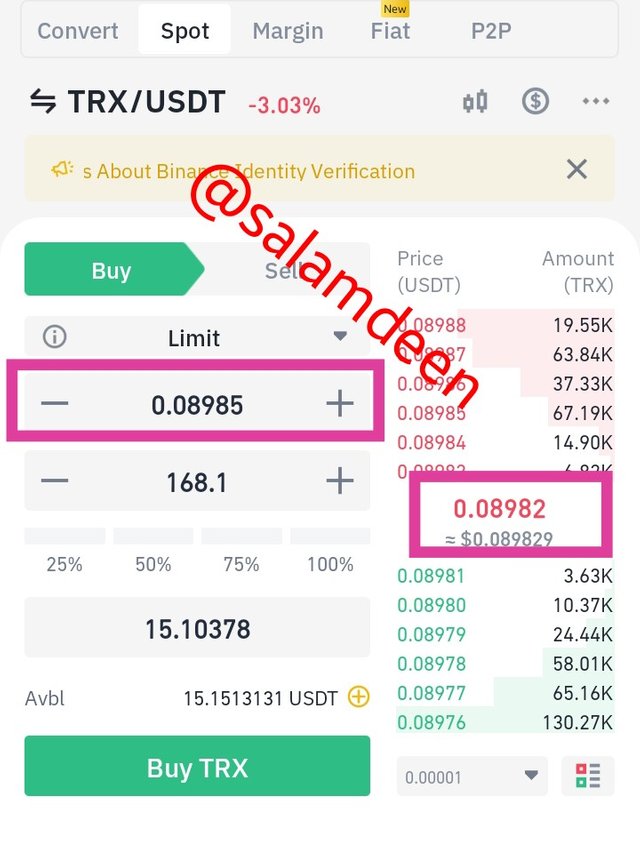

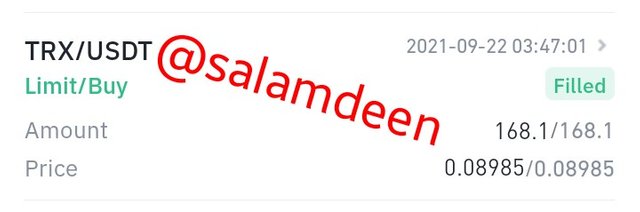

I opened the order book for the TRX/USDT order book and set my buy limit order at 0.08985. A price higher than the current market price.

Buying with limit order in Binance TRX/USDT order book

What I observed was that my order was added to the order lists, and it was triggered when the price hit that limit. This means that I have served as a market maker here and a market taker has taken my order. I have added a bit of liquidity to the market by placing the order limit.

7-Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

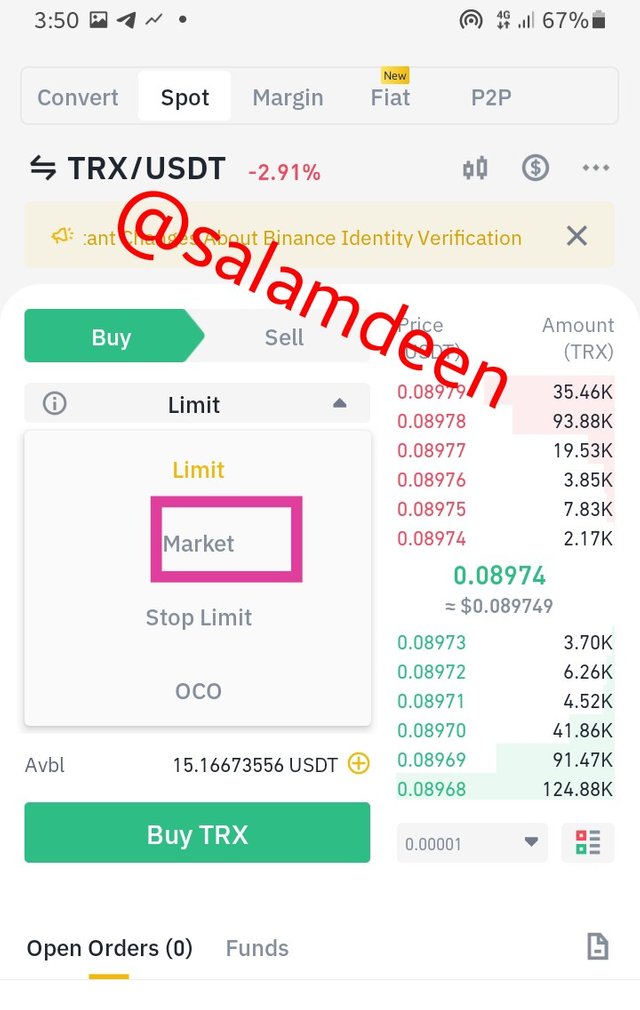

The next task is to place an order with the market price of TRX/USDT.

First of all, I had to change the type of order to a market order. I clicked on limit and selected "Market".

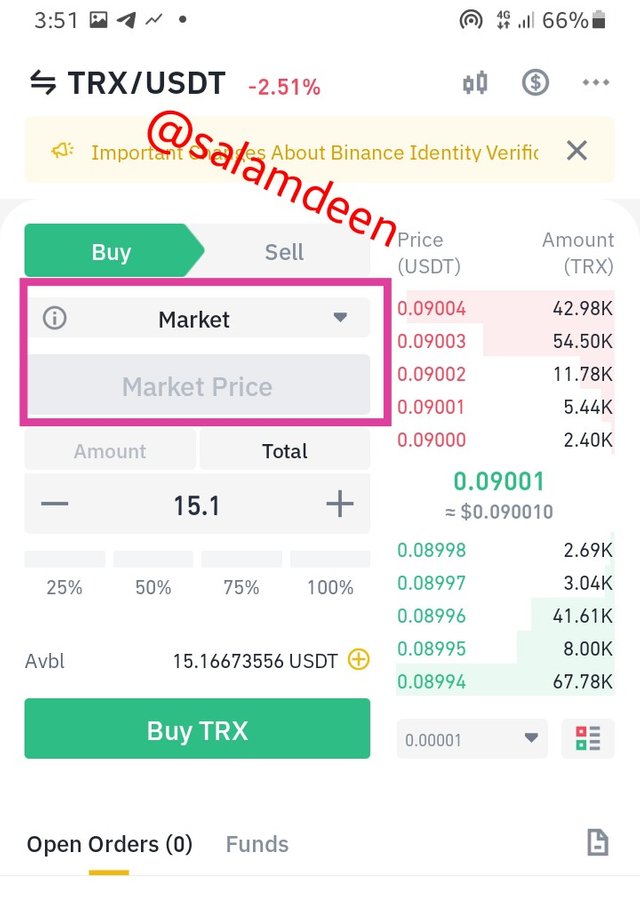

I then placed my buy order at the market price.

The market order I placed

The order was filled immediately

The filled market order

The execution was instant; the impact of this trade is that I have consumed some liquidity here because I have served as a market taker.

8-Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

Calculations of the Bid Ask and Market price

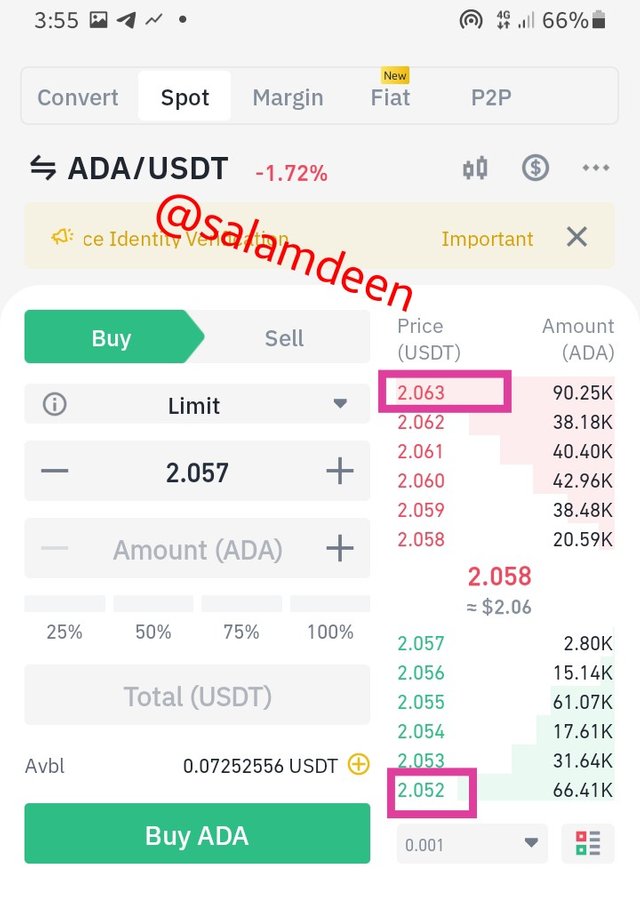

The picture below is the ADA/USDT order book in binance today.

ADA/USDT order book in binance

Parameters from the order book

Highest Bid = 2.052 USDT

Lowest Ask =2.063 USDT

A) Bid Ask = Lowest Ask - Highest Bid

Bid Ask = 2.063 - 2.052

Bid Ask = 0.01 USDT

B) Mid-Market Price = (Highest Bid + Lowest Ask)/2

Mid-Market Price = (2.063+2.052)/2

Mid-Market Price = 2.057 USDT

Conclusion

Indeed, we really needed this. My appreciations to professor @awesononso for this lecture, it has helped students like myself to have a generalized knowledge about the order book. People have lost their funds due to the lack of knowledge of how the order book works. Thank you for feeding us this kind of knowledge, it’s worth learning

Hello @salamdeen,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You have done really really well on this. Great job!

You just missed a point on question 5b.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit