Good day crypto enthusiasts! My homework presentation for professor @allbert

Created with MS paint

1-Define in your own words what a contractile diagonal is and why it is important to study it. Explain what happens in the market for this chart pattern to occur. (Screenshot required / Bitcoin not allowed)

Contractile diagonals; is a commonly used chart pattern in trading. It is used to spot potential reversals and continuations of price direction. It is also known as wedges. Contractile diagonals is a very effective strategy that can be used in any time frame. Hence, it is good for swing traders, scalp traders and day traders. Just like the Elliot wave theory, the price actions are represented by the waves 1,2,3,4,5 with waves 1,3,5 in the trend direction, thus, they are the impulsive waves whilst waves 2,4 are the correction waves. It is very pertinent to learn the use of the contractile diagonals as their signals can easily be spotted and their entry and exit positions are clearly defined.

In the contractile diagonals pattern, there are two diagonals which are traces of the waves 1,2,3,4 and 5. These diagonals appear to converge at a certain point as the market participants (buyers and sellers) are in the consolidation stages, which leads to the contraction of the waves. This decreases the magnitude of the price movement. This action of the market participants indicates that, the market is not dominating at this moment as there is an indecision on which position to take, hence they are not taking solid decisions, which tends to build pressure on the market. The contractions of the diagonals can be a bearish contraction or a bullish contraction.

A bullish contraction can easily be spotted in the chart as the diagonals will slope upwards and then begin to converge as the waves are contracting. This signals traders a possible break of the chart structure downward. Hence, there is a need to exit the market as it signals a bearish market ahead.

In a bearish contraction, on the other hand, the diagonals will be slopping downward and begin to converge at a certain point. It is a signal of possible break the chart structure upwards. This signals traders to take long entry positions as it is a sign of a bullish market.

To wrap things up, the contractile diagonals pave the way for a change in trend. When the diagonals are slopping downwards, it signals a bullish market and when they are slopping upward, it signals a bearish market.

The picture below is the ADA/USDT chart from tradingview. It can be seen in the chart that the market was bearish until somewhere around 22nd June, when a contraction began as the market was in a consolidation period . The result after the contractions of the waves was a bearish pattern. This is a clear example of the contractile diagonal pattern.

.png)

ADA/USDT chart from tradingview.com

2- Give an example of a contractile diagonal that meets the criteria of operability and an example of a contractile diagonal that does not meet the criteria. (screenshot required / Bitcoin not allowed)

Operability of the contractile diagonal pattern

Before we take a decision with regards to the signal of a contraction, there are some requirements which need to be met. If all these requirements are met, then the pattern formed is operatable and we can take positions based on the signals with a high chance of winning. According to professor @allbert's lecture, these are some of the requirements that must be met.

Wave 1 must be longer than wave 3.

Wave 3 must also be longer than wave 5.

Points 1 and 3 must all be on the same diagonal line.

Point 5 should be on the same diagonal line with 1 and 3. However, there are instances where it will not be on the same line but the result will be feasible. But it should not be too far away from 1 and 3 either.

Points 2 and 4 are supposed to be on one diagonal line.

The diagonal lines should not be parallel; they should seem to converge at a point.

The picture below satisfied all the above requirements, and this makes it operable. It really showed a downtrend after the contractions

.png)

XRP/USDT Chart from tradingview.com

An example of a chart that does not meet the requirements to be an operable contractile diagonal

CELR/USDT chart from tradingview.com

The picture above is the CELR/USDT chart from a trading view. It can be clearly seen that all the points are on the diagonal lines but wave 3 is longer than wave 1 and the two lines are parallel. This invalidates the chart pattern as an operable contractile diagonal, despite the fact that the result is a bearish pattern as expected of a contraction. A chart that does not meet the requirements usually results to wrong signals.

3- Through your verified exchange account, perform one REAL buy operation (15 USD minimum), through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Your purchase data must match your analysis data, such as cryptocurrency and entry price.

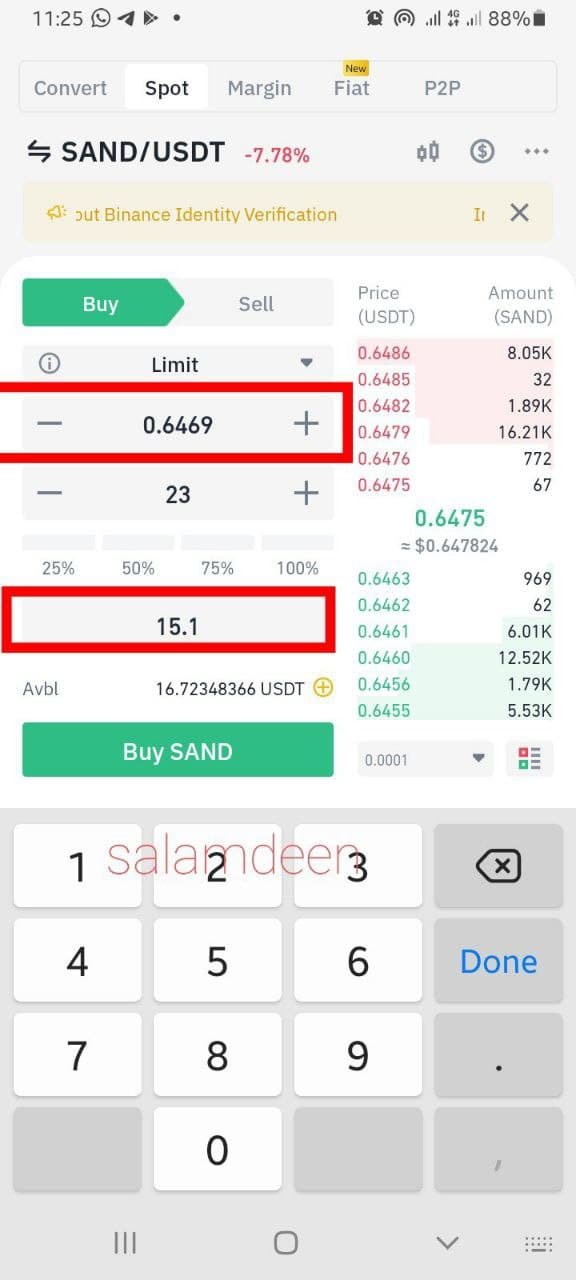

Here, I performed a real buy operation using my verified Binance Account.

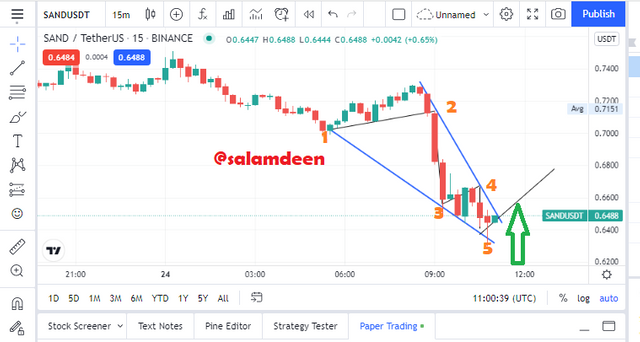

I used the signals of a contractile diagonal on the SAND/USDT chart from tradingview. First of all, I observed the pattern and drew the diagonal lines to verify if the pattern formed met all the requirements. As seen in the picture below, the diagonal pattern has met all the requirements, making it opratable.

SAND/USDT chart from tradingview.com

I noticed a downward trend in the price movement, as well as a contraction.I drew the diagonal lines along the waves and the signal I had was a bullish pattern, I then opened my binance account and set a limit order at 0.6469. The target was hit as the price began to move in the upward direction as expected.

SAND/USDT order book in binance

Green Candles started to form after my entry

SAND/USDT internal chart in Binance

4-Through a DEMO account, perform one sell operation, through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Bitcoin is not allowed.

I performed this task in my tradingview demo account. I firt of all opened my tradingview account.

I then spotted the contractile diagonals in LINK/USDT, Although, a clear signal was not given, but the contractile diagonals bullish and the bearish red candles started to form towards the signal line.

.png)

Screenshot of LINK/USD from tradingview.com

I placed a stop loss and take profit at Point 5 and 2 Respectively. The price dropped to the sell stop limit that I have placed and it was executed.

The Fillled order

from tradingview.com

5- Explain and develop why not all contractile diagonals are operative from a practical point of view. (screenshot required / Bitcoin not allowed)

As I indiacted earlier on, for a contractile diagonal to be operative, certain requirements should be met. However, If all the conditions are met, the risk/reward ratio should be noticed to indicate either it will be risky to comply with the signal or not. If the stop loss margin is greater than the take profit, it is advisable to discard the signal because the risk reward ratio is adverse.

.png)

screenshot ADA/USD chart in tradingview.com

Considering the picture above, the take profit margin is too small as compared to the stop loss, this nullify the pattern as operable with regards to contractile diagonals as the risk reward ratio of it is adverse. Hence, placing an order with this signal is a risky venture

Conclusion

The contrctile diagonals is really a good trading tool. One good thing I have realised about this pattern is that, it is a flexible one for all time frames. Through this assignment, I was able to grasp an understanding of this topic. This is my first time interaction with the contractile diaonal and I can see it's really a cool strategy to learn just that I could'nt find it easy but I believe with contant practice, I will be able to master it and start applying it. All thanks to professor @allbert for this interactive lecture