Hy steemians hope your are doing well in your respective lifes, today we will understand the deep technical analysis of MACD indicator and the detailed and simple learning I will try to elaborate with you guys. So lets start the homework.

What is the MACD indicator simply? Is the MACD Indicator Good for Trading Cryptocurrencies? Which is better, MACD or RSI?

MACD indicator is a lagging indicator because it generates from moving average thus moving average is originated from price thus fluctuations in price results in changes in average from their the allover stance changes MACD indicator thus it is lagging indicator and because of its accuracy it is seems to be a good indicator although the indicator uses to analysis the data from historical price of asset to check whether the price is up or down.

Is the MACD Indicator Good for Trading Cryptocurrencies?

MACD indicator is good indicator although I prefer it much and gives trades with lagging but the accuracy is awesome you all the crypto world and all heard about the market volatility now a days and MACD is trend saving indicator and we can easily judge the trends in crypto currency by using MACD indicator. Although sometimes MACD give us fast exit and entry points though I recommend it in most of my trading.

Which is better, MACD or RSI?

My opinion about MACD or RSI usually prefer both but best is RSI, reason is that RSI give the trades so fast and comparison with MACD there is multiple indicators signal line, MACD line and histogram which make trade more strong but my experience is lie under RSI indicator everyone have their choice I describes my though usually I use all the indicator including RSI DIAL MACD etc to take the trade most common I use is MACD and RSI and the best among them is RSI. Sometimes RSI also gave us the false indication thus it is our duty to judge and take trades with full research.

How to add the MACD indicator to the chart, what are its settings, and ways to benefit from them?

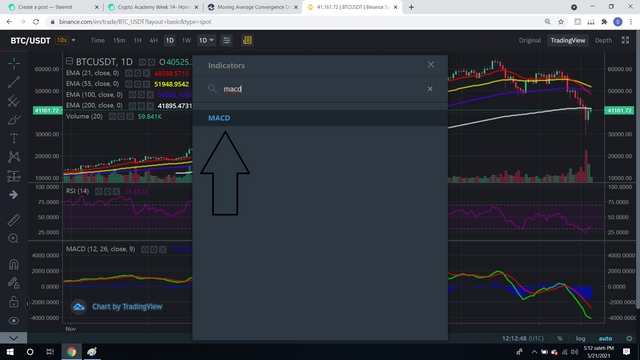

- First go in trading view or binance than you can see indicator symbol click on that.

- Open the indicators bar and than search for MACD click on that sett your setting and one more thing set the styles colour also for your ease I illustrate with you my settings you can use that.

- Open it click on MACD indicator

settings and style:

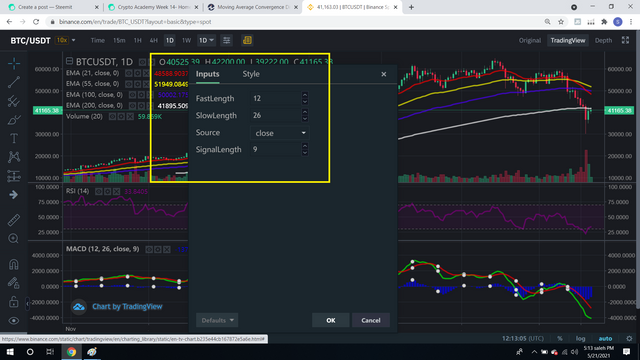

- After that sett the indicator and or prefer the default settings because many traders use this.

- Sett fast length 12 , slow length 26, source close, and signal length 9.

- From the picture we can se three numbers

1: 12 number is a shorter moving average and faster and it indicates the movement in MACD.

2: 26 number is a longer moving average and slower to predicts the price. in MACD.

3: It used to calculate the moving averages of the difference between fast and slow length.

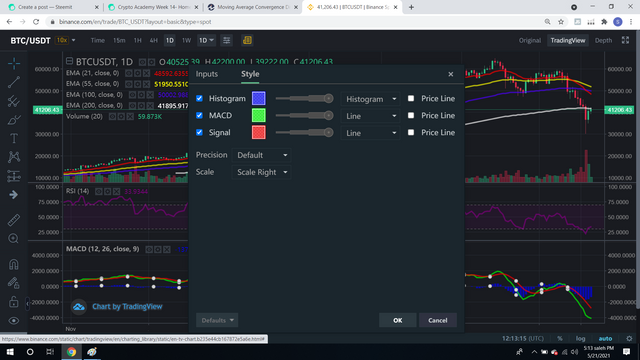

- One more thing sett the line wide and green color for bullish movement and red for bearish.

We can see there are two lines in MACD charts, MACD line and SIGNAL line used indicates the trader about the buying and selling and whenever the both line moving towards 0 line do cross over give us the signal to buy and sell.

DETAILED ELABORATION OF MACD LINE

1: MACD LINE

MACD is the difference of EMA's, MACD is the faster moving average which generally measures the difference of 12 and 26 MACD moving averages. This also called BLUE LINE

2: SIGNAL LINE

It is simply considered slow moving average of MACD 9 period of MACD is used for signal line, signal line stochastic oscillator means judge the closing price of any thing at a particular level of moving averages.

3: HISTOGRAM

You can find histogram oftenly at the distance between MACD and SIGNAAL line. If MACD is above signal line than the histogram will above MACD baseline if its is below SIGNAL line than HISTOGRAM will be below baseline.

4 ZERO LINE

the divergence and convergence in zero line also can be known as midline starts from positive to negative area of the chart, simply MACD line below or above the MACD line is that how can you judge the bearish and bullish cycle in chart.

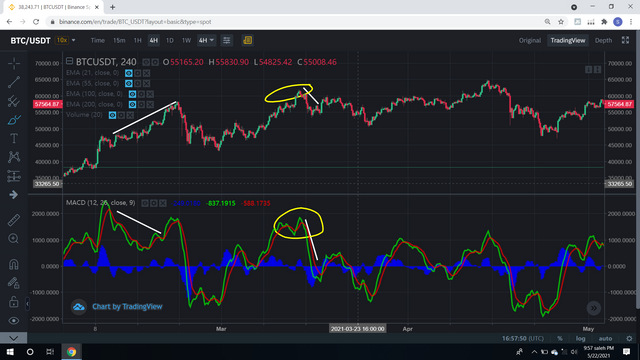

The picture below show us the trend of MACD let prognosis in more detailed, We can se clearly the trend of MACD towards HISOTGRAM in bullish and bearish trend cycle. As when the bull run period is observe in chart we can see that MACD line cross the zero line and make a bullish cross over in first section. Similarly when the trend becomes weaker we can observe there is bearish cycle in chart though MACD cross the zero line clearly in THIRD section.

ways to benefit from them we can easily benefit from them by taking profitable trades as the trend of stronger term can give us the the entry and exit points.

How to use MACD with crossing MACD line and signal line? And How to use the MACD with the crossing of the zero line?

MACD relates with two line MACD LINE AND SIGNAL LINE these line make divergence and convergence between zero line and indicates us the judgement of buying and selling in market and from there cross over make the trend of buying and selling of market. In MACD there are two types of cross over positive also known as bullish cross over and negative

known as bearish cross over.

As I clear you all the points relating MACD and SIGNAL LINES and there nature and movements lets me make it practical work too.

The image below defines that whenever the MACD LINE make a cross SIGNAL LINE from down to up it give us the signal of buying means positive cross over as long as the MACD LINE is above SIGNAL LINE we can say it is BULLISH TREND cycle.

Similarly you can see whenever the MACD cuts the SIGNAL LINE from top to bottom it indicates us that the selling point starts and negative cross over observe with a BEARISH TREND CYCLE as long ass they are in this position it shows us the bearish cycle.

One thing you all made it clear that whenever both lines make a moment in a situation where they both make opposite cross over till that trend is not reversal position.

USING MACD CROSS OVER WITH ZERO LINE

Positive and negative cross over theory illustrate us the relation that;

We can se positive cross over if the cross is above zero line and rather both lines first met with each other below and than make a bull run and move above from zero line give us the signal of strong bullish.

We can se negative cross over if the cross is below zero line and rather both lines first met with each other above zero line and than make a bearish run and move below zero line give us the signal of strong bearish.

One more most important thing that you should understand is that between positive and negative cross over is that whenever positive cross over is below zero line there is never be a strong cross over happens, rather than if both lines breaks the zero line fast trends can be observe although if both lines can't breaks the zero line than we can see WIPSHAW trend same we can see in other side that if both lines is above zero line and can't than no strong bearish signals are seems thus there is WIPSHAW trends can be seen.

WIPSHAW means describes us the sharp increase and decrease price of assets which move towards the existing market price, it is different to other reversal because of the sudden change in price of assets. There is a detailed theory of WIPSHAW I just make your ground to understand what term I used.

How to detect a trend using the MACD? And how to filter out false signals?

How to detect trend using the MACD

We can identify the strong bullish and bearish trends from MACD line through technical analysis of MACD although MACD LINE AND SIGNAL LINE by the divergence and convergence in chart can be detect the strong trends in the market. As you can see the divergence of MACD LINE as it move away from SIGNAL LINE than it give us the signal of strong bullish cycle in market. Same as the shows you the convergence to the signal line this indicates you the bearish trends in market.

You can see the histogram that I deeply make you understand below thus the we can see the new trend in market as the increase of histogram from the image below from 460.8297 and 1010.6176 this make the new trend first bullish than bearish.

The image below shows you the illustration of MACD TREND IN MARKET CYCLE

Filtering false MACD signals

MACD indicator is a lagging indicator as you all know and ain't give clear indication of market and BULLISH AND BEARISH trend of market we can analysis them now lets make it practical and my suggestion to you that use all indicator than take trade.

The pair is with BTC/USDT You can see there is no proper guide line some trends although there you can see the trend is changing but it not indicate us in first time and after wards change in trend shown but signal ain't show us the judgement and indication.

How can the MACD indicator be used to extract points or support and resistance levels on the chart? Use an example to explain the strategy. (Screenshot required)

The support and resistance is also help investor by telling them about the buy and sell positions. On MACD the resistance and support is also present above and below zero line as well as on original chart.

Resistance is the point after which price is likely to go down or follow a bearish trend.

Support is the point after which price likely to go up and follow bullish trend.

However, we need to dig more to know about where can these points found either on chart or MACD .

As you can see in above chart that when MACD line crosses signal line After 05-04 date, the price goes upward forming a support below and after that it peaked just after 2 or 3 days, then MACD line crosses again signal line from upward to lower point, there you can see a very hard resistance formed results in the fall of price.

It again form a higher resistance point ahead as you can see in that the MACD line crosses signal line again from below to top forming a resistance point indicating a fall ahead.

Review the chart of any pair and present the various signals from the MACD.

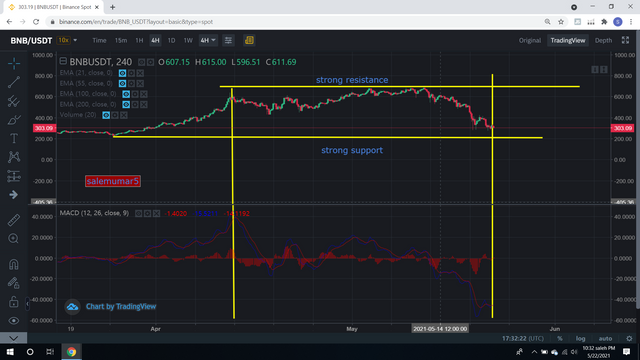

I selected BNB coin and lets do its prognosis in detailed.

First of all we all gonna predict the resistance and support through technical analysis through which can easily interpret the market in our basic medium too. Than we will give the detail explanation by using MACD indicator to make entry and exit points in market.

MAIN THING THAT WE ARE LEARNING MACD IS TO BUY AND SELL THROUGH WHICH WE CAN PREDICT THE MACD SIGNALS TOO there are two ways crossover and divergence these both types are used take trades and predict the market through MACD

POSITIVE CROSSOVER in this we can see in the chart above zero line there is a positive cross over seems than now for buying point view we should check that in candle where crossover is assumed look after the next candle from there buying signal is obtain via MACD and signal line.

Similarly when we trading and want to buy but the chart indicates us that MACD AND SIGNAL lines below zero line than wait until it breaks the zero line and using same formation than it make the same trend pf positive cross above zero line. By this we can safe our self from whipshaw. One thing more same for the stop loss that which MACD AND SIGNAL LINE do breaks the ZERO line stop loss will be that and buying zone forward candles formation simply.

MAIN THING profit book place best time is that MACD negative cross cross over show till that time not book profit as far as you see immediately book the profit.

Now for STOP LOSS we have to look the previous candle through which we gonna decide our stop loss.

image illustrates all the position of MACD trends that I usually explained.

NOTE if you are sensible trader you know the context risk reward ratio that the rule said that your candles difference must be 2%

NEGATIVE CROSSOVER we can see the negative cross over and using MACD LINE and SIGNAL LINE to do selling, you can see in the chart below zero line there is a negative cross assumed though in which candle there is negative cross over seems so selling should be done in forward candles than for stop loss position we have to look up same the previous candle and set the stop loss for high wick of that candle and always checked the difference of both candles and RRR 2% as i mentioned and define you.

Now we have to see that if the CROSSOVER is done above the zero line than ultimately be patient and wait until the CROSS OVER and both lines break the zero line below zero line than do selling same thing we would be safe from WHISHAW.

NOW see when the MACD LINES breaks the ZERO LINE FROM TOP TO BOTTOM than look the candles and do trades and for stop loss look the previous candles high sett your stop loss and notice the RRR % careful.

MAIN THING profit book place always look there is not any sort of positive cross over whenever you see the positive crossover than do book your profit.

Conclusion:

Concluding above written, it can be said that MACD is a very reliable indicator as compared to others due to its different other propositions like signal line, zero line and Bricks forming at zero line which really help to give a useful result. Although it can be more better if it is used with different other indicators and other technical tools. Through which trends knowledge and future acknowledgement follow a right path for investors.

Hi @salemumar5

Thanks for your participation in the Steemit Crypto Academy

Feedback

This is average work done. Improve on the quality of your explanations. I know English is not your native language, but you can try your level best to be more clear in your explanations. Otherwise, thanks for the effort.

Homework task

5

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ok sir thans for your feedback

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit