Question 1

What do you mean by "risk management"? What is the importance of risk management in Crypto Trading?

Risk management

The process of risk management started when you get positive and negative feedbacks from market, since whilst playing in market with different tactics is very effective. If your are a efficient and effective trader who manages the responsibility of profit and loss then you are a effective risk manager. Though risk management in crypto market is very important aspect from which trader suffers losses depression and ultimately feels sad because he cant compete market with risk management. If you want to increase your profitability you must compete the marekt with better risk management by planning (plan marekt by using fundamental) organising(invest and use healthy asset) and controlling (by using tools), though if you able to analyse the market with these strategies you will be good risk controller and your trades demonstrate efficient risk management.

So risk management techniques will run effectively when you use proper asset, tools, strategy and process what is mean by that? Its simple you need high fundamental analysis on coin which are investing your sum then need a reliable platform where you perform your trade finally a good technical indicators and strategies which we learned deeply in our cryptoacademy sessions. If you able to compete market by using such rules you will get maximum profitable trades.

Held if trader able to manage the risk they will beneift from market in high rates because this market is highly volatile and better risk management can provide fruitful for you, As you know Higher the risk higher the reward but Better risk management better reliability on trades

There are some important feature of risk management as you know risk management is basic process for every trader to make their trades effective and efficient so lets elaborate them in detail;

Planning and fundamental:

A trader must have a plan, becuase initiatives are important for every trader to move towards success. Do plane in which coin is preferable at this time to engage in it and extract profitable results from it. Do highly efficient fundamental analysis on coins which coin sustained minimum risk so it will ensure good path for you in trading.

Organisation and tools:

After you select the appropriate coin and platform, take the initiative, you need good knowledge about technical analysis, because better understanding of market is generated through technical tools and strategies. If you organise better analysis by using indicators and strategies you will be in better path of risk management.

Control and avoid:

While you are trading in market avoid false signals and wait for perfect combination of tools and indicators, control on your emotions if ain't control then they will lift you towards horrible loss. Thats why every trader suggest not to do over concentrate on your trade, once you judge the market then sett your position and don't lose it by rumours and other news until your process and risk management tells you.

Rule on crypto volatility:

Since crypto market is highly volatile because risk management taught you the risk reward ratio of your trade and you will be ruling in market by maximum profitable results. So risk management builds good experience and knowledge towards market.

Question 2

Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

Our debate basically formulates the risk management concepts and we need some tools and fundamental to cope up with them. So lets analyse them in detail with examples.

1% Rule

Risk management is all about to manage your trading sentiments. For this 1% rule is very appropriate phenomena for traders to compensate fruitful results and minimal losses. As you know a trader after facing losses got fed up and losses his capital and reliability also, since this rule provides good risk management process which confront and handles your trade position. Lets take an example to visualise this method.

Example

Suppose i have 100$, i pool risking 1% of my capital means(1/100 × 100$) so if i ain't accomplish my trade and losses will be up to1$ since simply by using 1% rule you will be getting 1$ loss its up to you open as much trades as you want, assume i open 10 trades then suffering of 10$ loss will be occur.

From this example you can judge that every single % increases your risk and reduces your capital for this instance you need to calm and patience to trade in market. By using 1$ rule you can analyse better risk management and even in bear market you can suffer and generate your profit easily.

Risk reward ratio

Trader mostly used risk reward ratio strategy to maintain risk management in their trades. Some traders got huge losses because they aint sett proper risk reward ratio and this might usually happend with beginners who ain't advance their trading strategy with risk reward ratio and faces huge losses due to power risk management. Also risk reward ratio basically taught where you take profit and what ratio is best to attempt the trade

Example

Held tou might also heard that 1:1 ratio reward i obtained or 1:2 ratio i obtained this only exaggerate that how much profit you had acquired by adequate risk reward and perfect risk management. , now lets elaborate them in detail with example.

Suppose i have 20$ capital for trading and my profitable position is 40$ at least so this 1:1 strategy what add you get sum of it means 20$ profit but its consider ain't good because it doesn't worth the risk management held market is open for trade use right risk reward tool analyse the market. Thus a good risk reward ratio is considered to be profitable results for any trader and among them 1:2 consider best ratio for setting your trade.

Stop loss and take profit

The stop loss and take profit areas are one of the underlying and foundational skills for risk management where trader, where traders cleverly handle the worst situation and faces the panic situation in market and ultimately feels better by applying this risk management because market gave many incorrect signals that can't be avoid basically for novices they easily get struck by not managing good stop loss and take profit ultimately they consider as a poor risk management trader.

Suppose if you now that market is making panic situation where a the traders are pretending that they will leave the market as soon as possible but ultimately Market changes the position and by applying confidencial risk management tool which is stop loss and take profit can never let you down, if the market structure bear cycle your tool plays a fundamental role where the stop loss is their to acknowledge you it might be filled soon, and keep you out from the bear position instead you can watch some traders faces huge losses. Similarly if you use take profit areas you will be a perfect trader with fruitful results because when you got profit in your capital you don't know where to extract profit from it but take profit area acknowledge you to extract your profit and be a trader not a fool until market again changes the trend.

Example

These tools run best on support and resistance, Support for stop loss and resistance for take profit ultimately use any Indicator and risk reward ratio to analyse the best way to judge the trend and acquired the profitable position.

Simply always remember that take profit is your emotional profit here can't decide to acquire it or hold it for more but stop loss is the amount of your capital that you are ready to sacrifice for your trading.

Question 3

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

a) Trend Reversal using Market Structure.

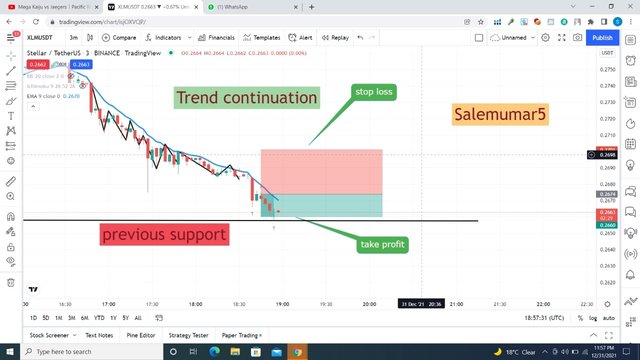

The image below shows xlm/usdt chart of 5mins time frame, where you can see the market structure has been break by the consolidation market cycle which is highlighted. Then market starts making higher high and lower high and continue Upward motion is extract, although i applied bichi strategy from which perfect upward position has been observed on applying risk management tool risk reward ratio of 1:2 the market starts falling down, held after few mins my stop loss has been hit and i am using risk management tools and processes so i am in less danger.

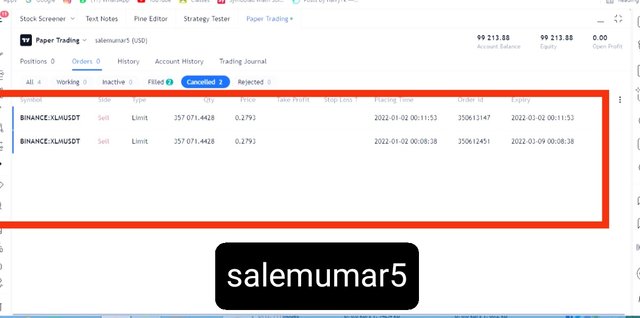

You can see my stop loss has been hit by the following demo trades and after few min ago the marekt starts to bear and changes the structure completely.

Tradingview source

Here is the demo trade and stop loss hit area is also enlightened below which was 0.2737$ of stop loss and entry at 0.2765$ a good risk management is observed by 1:2 ratio risk reward.

b) Trend Continuation using Market Structure.

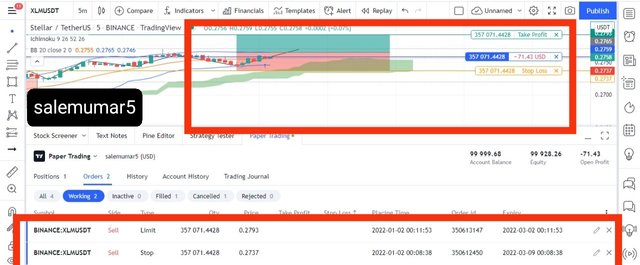

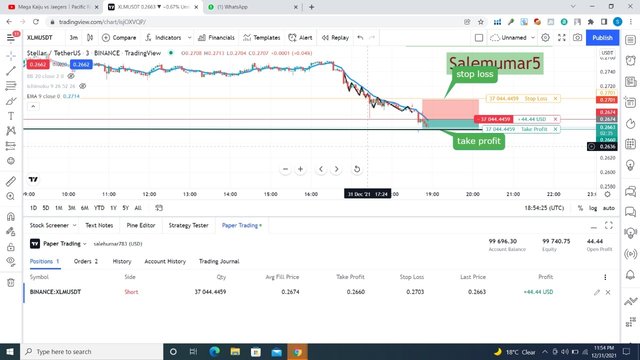

The chart below show us the trend continuation cycle by using risk management precautions, as you see my trade has been strated with the same strategy which i enlightened above using 1:2 risk reward ratio. Furthermore i correlate my take profit area at previous support and thats what my 1:2 ratio of risk management also satisfied. At price 0.2674 xlm $ i started my trade and invests my entry area and after that the market start in continuation of bear cycle, then i wait for my last take profit area to a acquire enough profit.

In this trade i manages maximum profit as i analyst but the trade and cycle is in continuous mode i always modify my trade by setting stop loss level. As you can see 44$ has been generated.

Tradingview source

Here finally my trade is going to complete for trend continuation and 0.2663 $ is soon gonna hit.

My demo trade where i generated 1499$ profit and you can see each and everything is controlled and clear i used two risk management strategies with my indicator EMA and gradually booked my profit with perfect matches.

Above charts show gradual increase profitability ratio by accurate market structure analysis and by using risk management tools to settle and generate profitable results in market.

Conclusion

The lecture design by professor was very effective and knowledgeable, becuase this was the necessary key points and briefings for beginners who ain't sett their goals and objectives before starting the trade, so by using risk management tools and strategies they can avoid from huge losses and less profit acquisition.

Questions were well established and we also embedded our knowledge and experience in question to answer them in a simple and convenient way. All above i truly liked last question which has provided us detailed information of above working, although i generated 1049$ profit by using this strategy, so you guys also need to understand the means and risk management tools generalized your trades in best manner. You can see above the market crashes last night and by using proper risk management tools obatined maximum and healthy profit from bear market, even the market is in panic but i made profit this what a confidential trader do.

Thanks professor @reminiscence01 for providing such a knowledgeable and basic lecture for beginners to advanced their trades in more meaningful way.