Source: canva.com

Once again I am extremely delighted to participate in the @pelon53 homework Solana blockchain as it is of vital significance for the dissemination of blockchain technology among the masses as we progress to the world of smart and efficient living.

Backgound

Solana is an open-source project that is been under the radar of different developers and institutions around the world because of its ability to build decentralized applications (DApps). It is currently run by the Swiss-based Solana Foundation and is lead by Anatoly Yakovenko. Solana has gained unusual attention in the blockchain arena by offering something that its competitor Ethereum blockchain has so far been unable to deliver; faster operation and lower transaction fees. Solana which goes by the symbol (SOL) is a PoS (proof of stake) blockchain, which makes it more environmentally friendly than the widely popular PoW (proof of work) protocol blockchains like that of Ethereum and Bitcoin. The proof of stake protocol used by Solana is currently an ideal protocol in the cryptocurrency space. Unlike the proof of work which requires massive energy to run a blockchain validation, proof of stake makes the validator nodes on the network to stake Token. In the case of Solana, the validators stake the (SOL) tokens. Although the validators also consume power to operate but their power consumption is far lower than that of Ethereum and bitcoin.

Source: forkast.com

Question number 1

Explain in detail the PoH of Solana.

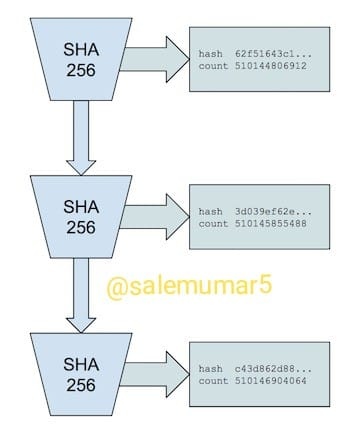

We don't have to read tons of technical material to understand what Solana proof of history is. The simple explanation is that it's a smart clock for Solana that orders transactions based on timestamps. Before proof of history, POH was introduced by Solana, different blockchains had a hard time agreeing on when an event happened. That's because distributed systems can't refer to third-party sources of information lest they compromise the blockchain's integrity. Most blockchains get around this by sending the message in question through the network until most nodes sign off on it. Then, the transmission of the message network-wide takes place. Therefore, it should be no surprise that blockchains using this system to organize transactions are super slow. It is for this reason, Ethereum can only handle up to roughly 15 transactions per second. Solana bypass the roundabout by way of organizing transactions by simply making the timestamp logged with each event trustworthy in itself. If we can all come to an agreement ahead of time that X event happened at Y time, we can save plenty of time and process transactions faster. Proof of history uses a secure hash algorithm (SHA 256) encryption to hash events, thus organizing them neatly for validators who add them to blocks. By taking the work of ordering transactions out of the hands of validators, they spend less time authenticating, making the entire network more efficient. Remember, efficiency equals speed. Because of proof of history, Solana can process 50,000 transactions per second, making it the world’s highest-performing layer one blockchain. But it’s essential to distinguish here — proof of history comes before proof of stake consensus. All PoH does is get transactions organized ahead of consensus, cutting down the time and work needed all around.

Source: medium.com

Question number 2

Explain at least 2 cases of use of Solana.

ORCA Dex

Source: orca.so

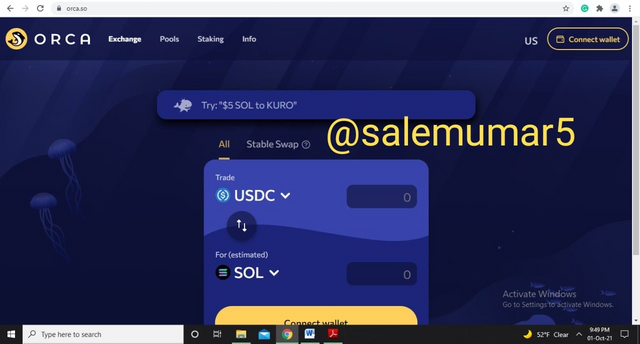

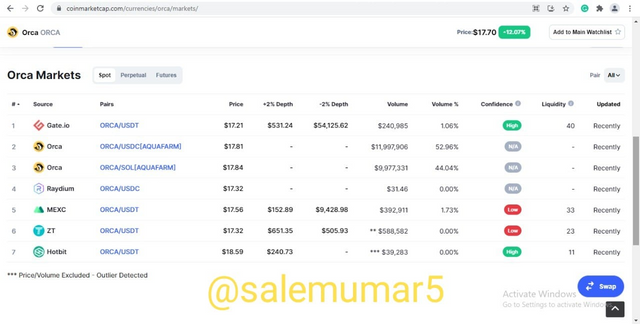

Orca, a DEX powered by the Solana protocol, has recently made headlines when it raises $18 million in Series A funding. Launched in February of this year, Orca has consisted of a two-member team with eight contributors that come from many blue-chip and TradFi companies like Google, Amazon and McKinsey. Since then the orca protocol has reached $750 million in lifetime trade volume, $250 million in total value locked and over 18,000 monthly unique wallets made on the platform. Orca, one of the first decentralized exchange DEXs to be built on Solana, claims it will use these funds of the round to build a capital-efficient and user-friendly automated market maker (AMM) for the DEX. AMM’s are DeFi’s substitute to traditional order books on centralized exchanges, where liquidity is provided by users holding a liquidity provider (LP) token and pricing as well as matching done by programmed algorithms. Orca dex allows lightning-fast swaps and low fees (~1-second settlement, ~$0.00002 gas fees). To LPs, the 0.3% trading fee automatically goes into liquidity pools after every swap. Orca has three main important distinct features.

Swap: Orca allows market participants to swap tokens using its own pool. It does not use Serum as a source of liquidity.

Liquidity pools: Similar to other AMMs, LPs can contribute liquidity to Orca’s pools and receive a part of trading fees as rewards.

Yield Farming Program - Aquafarms: A set of liquidity pools (not all of the pools) will become Aquafarms. Currently, liquidity providers in Orca’s pools earn trading fees. In contrast, liquidity providers in Aquafarms will earn both trading fees and ORCA tokens. ORCA also plans to add functionality that will allow other projects to add their own tokens as rewards in the future.

Source: orca.so

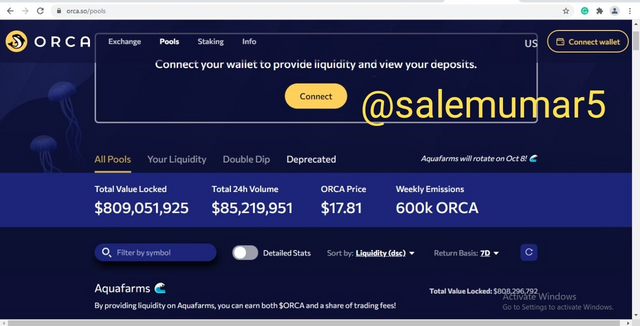

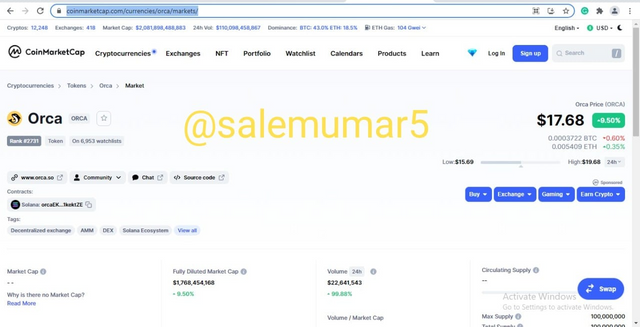

At the time of writing this assignment the value of the total token locked in the liquidity pool was $809,051,925 which is evident of the usefulness of the innovative tech that orca offers. This has translated into the price of the ORCA token to $17.68 with a ranking of 2731. It is also available to trade on various platforms apart from ORCA which can be seen in the below screenshots.

Source: coimarketcap.com

Metaplex

Source: metaplex

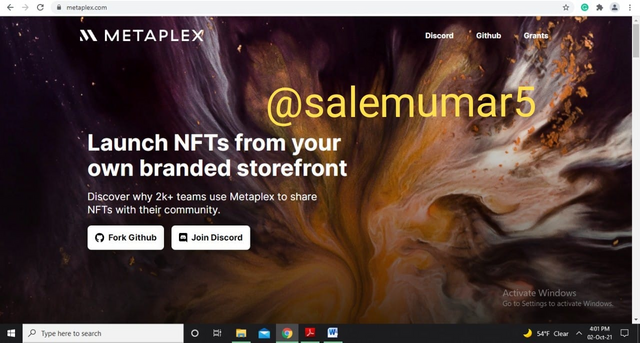

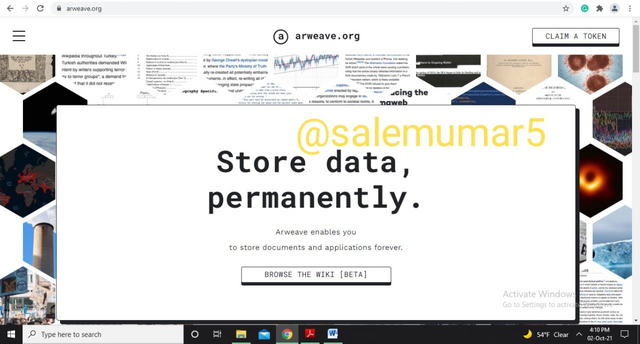

Metaplex is Solana Blockchain’s upcoming stride to make it easy for users with little to no tech background to set up their own NFT Storefront. It enables creators and brands to build a direct and lasting relationship with their audiences. The platform is built on Solana so transaction fees are lower compared to bigger blockchains like Ethereum. To be exact, it only costs $0.35 to mint an NFT and then $3 to run an auction. Users can also program the NFTs such that original artists receive royalties every time the NFT is sold in the secondary market making it a win win case for everyone. The platform offers on-chain building and auctions powered by the Solana blockchain. On-chain building means that the creator can split and long-lasting royalties can be embedded into the NFT. When an auction ends, there will be automatic payouts with self-executing royalties upon resale. All these are carried out without the need for paperwork, trust, or wire transfer. The average minting cost is less than a dollar and attracts zero platform fees. When a storefront is created, it connects to a powerful on-chain program that mints just NFTs.Storefront can administer fully on-chain auctions, taking out the middleman and their fees from NFT transactions. On-chain auctions offer powerful formats, with prompt payouts and NFT transfers. Creators/artists can create limited or open editions for fans or run tiered auctions where collectors have to bid for NFTs assigned to specific tiers. Solana’s integration ensures that transaction fees are pegged at $0.0001.Also, Creators and artists do not have to worry about storage issues. NFT media of any size is stored permanently on Arweave, as seen in the below screen shot another data storage blockchain protocol that supports permanent data storage. Therefore, NFTs minted on Metaplex will be irreversible.

Source: arweave

Question number 3

Detail and explain the SOLA token

The SOL token is the instinctive currency in Solana’s ecosystem. These tokens can be passed onto nodes within the Solana constellation in exchange for running on-chain programs or validating their output. Another use for SOL, is to perform micropayments known as lamports. Leslie B. Lamport pictured below is an American computer scientist who is best known for his influential work in decentralized systems .

Source: wikipedia.org

A lamport is equal to approximately 0.0000000000582 sol.The current circulating supply of SOL is 26 million. The maximum supply of SOL caps at 489 million SOL. SOL also has additional use cases, you can stake the token to earn additional rewards. So Staking is a good way for users to earn profit if they are just looking to hold their tokens. The process of staking is quite simple, it is as follows:

- Transfer tokens to a wallet that supports staking

- Create a staking account

- Select a validator from Solana’s validators

- Delegate your stake to the validator

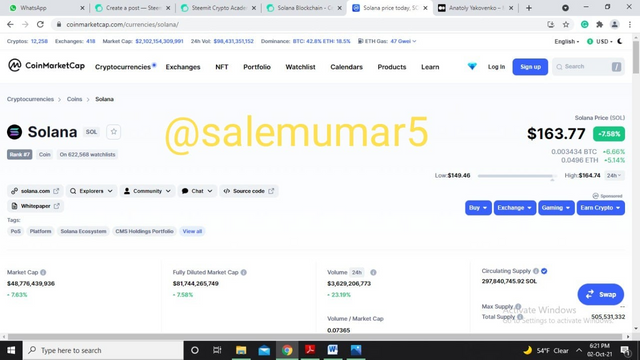

Solana is ranked number 7 in the CoinMarketCap ranking as of September 2021 and the credit of which goes to Anatoly Yakovenko pictured below, who is the main architect behind sol tokenomics.

Source: medium.com

Solana price increased over 700% since mid-July 2021. The launch of the Degenerate Ape NFT collection sent SOL price to an all-time high (ATH) above $60, and it has been mountaineering since, largely due to higher developer activity on the Solana ecosystem, greater institutional interest, growing DeFi ecosystem, and the rise of the NFTs and gaming vertical on Solana. Solana price rose to an ATH of $216 on Sept. 9, 2021 whereas at the time of writing this homework solana $163.77 with a total market cap of $48,776,439,936 with a floating 24 hour volume of $3,629,206,773.

Source: coinmarketcap.com

Question number 4

When did Solana Blockchain see its operations interrupted? Why? Explain.

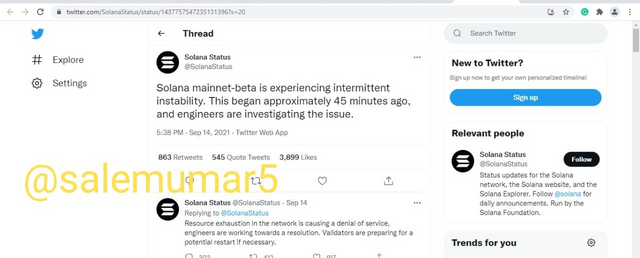

At around September 14, 2021 solana blockchain faces a major interruption in its system of blockchain and this interruption continued for approximately 11 hours which resulted in a sharp drop in the SOL token price drop by about 13%.

Source: twitter.com

The network outage stopped producing blocks and Solana Labs which is in charge of the Solana technical development and the wide community of operation validators worked hard enough to get the blockchain network back online by reviving the blockchai operation right from the beginning.

Upon investigation it was found that Solana’s downtime has been attributed to a flood of transactions sent from bots mainly from Solana-based decentralized finance (DeFi) protocol Raydium , with as many as 400,000 transactions per second. That apparently caused the network to begin splitting into different paths, which overwhelmed the memory of some nodes and caused them to shut down. It is pertinent to note that At approximately 1:46 pm UTC on December 4th, 2020, the Solana Mainnet Beta faces a similar problem and its constellation stopped producing blocks at slot 53,180,900, which prevented any new transactions from being confirmed.The outage lasted roughly five and a half hours before over 200 Solana network validators, representing over 80% of the stake weight of the network, successfully initiated network restart instructions and began producing blocks again.

Question number 5

Check the last block generated in Solana and make an approximate calculation of How many blocks per second have been generated in Solana, taking into account from the initial block to the current one? Justify your answer and show screenshots.

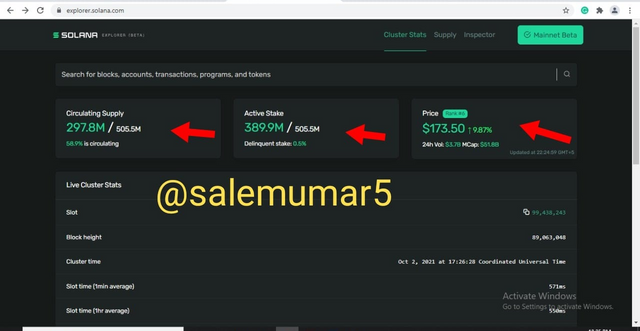

Source: explorer.solana.com

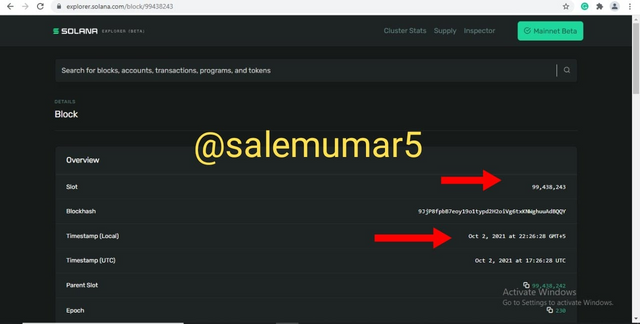

In search of the answer of this question i went into solana explorer. When in the website, the circulating supply,active staked coins and current price of the token can clearly be seen as seen in the above picture. Looking at the slot section by sub clicking it, it will show us the block number produced 99438243 on October 2 at 22:26:28 GMT+5 time when the below screen shot was taken was

Source: explorer.solana.com

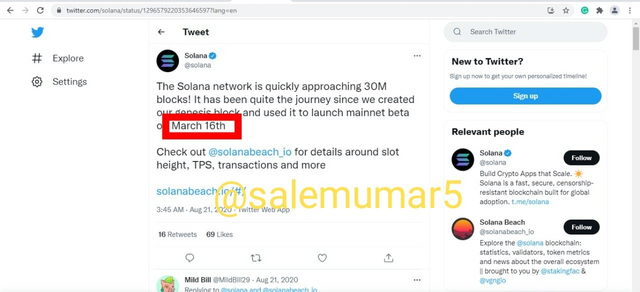

Now if we work on the tokenomics of the solana token, we already know that it takes around approximatley 500 milliseconds to produced one block. So the total seconds which have passed since the genesis block took place on march 16,2020 is as follows.

Source: twitter.com

99438243 * 0.5= 49719121.5 seconds

99438243/49719121.5=2 seconds.

This proves the fact that it takes 2 blocks to produced in 2 seconds. Hence

2 blocks per seconds * 60 seconds= 120 blocks per min

120 blocks per min * 60 min= 7200 blocks per hour

7200 blocks per her * 24 hour= 172800 blocks per day

Now from march 16, 2020 till October 2, 2021 compute to 565 days

Now to get the total numbers of block since the genesis block will be

565 * 172800 = 97632000 blocks till the time of this assignment.

We can further cross check the veracity of this computation by simply putting the seconds passed at the time of the block 99438243 is 49719121.5. By putting this second figure into google calculator will give us 575 days.

575 days back from October 2, 2021 comes down to 6 march, 2020. Since the genesis block was made on 16 march,2020 there comes a difference of ten days. This discrepancy can be treated as an error to the blockchain keeping in view that that the faces several interruption in the past year.

Conclusion

Solana blockchain is but one of the fierce competitors in a saturated world of decentralized app platforms, each with its strengths and weaknesses. It shows a lot of potentials, has a flourishing app ecosystem, and continued support from some of the biggest venture capitalists in the space. It has a long way to go to catch up with Ethereum, but it's well-positioned to snatch a decent share of the decentralized apps market. Anyone interested in decentralized apps and the blockchain space should at least pu their bet on Solana optimistic tech

Gracias por participar en Steemit Crypto Academy Season 4, Semana 4:

El tiempo se agotó:

Esta tarea se ejecutará hasta las 23:59 del 2 de octubre, hora UTC. (7:59 pm hora de Venezuela)

Calificación: 0.0

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit