Source: canva.com

It is my honour to be back in writing for the @pelon53 and I hope to contribute my learning of the (WBTC) wrapped bitcoin that I gained through your post.

Introduction

Source: coinmarketcap.com

It is understood without having an iota of doubt that a cryptocurrency like bitcoin holds a significant market share and is considered an influential factor affecting the price of the other cryptocurrencies also commonly known as an altcoin.

Many investors who hold bitcoin and wants to accumulate others set of cryptocurrencies often want to diversify their portfolio or in simpler words require the bagging of other digital assets, find themselves facing a hurdle of conversion of their bitcoin holding into their desired coin because one bitcoin simply cannot be sent into an ethereum address because both of these are two different assets which are running on two distinct blockchains.

Since they are different, so the bitcoin has to be converted using a middle party and that middle party often charges them a huge amount of fees.

This problem has largely been addressed using wrapped bitcoin. It is an ERC-20 token that runs on the ethereum blockchain and can be term as an equivalence of bitcoin in terms of monetary value meaning one wrapped bitcoin and bitcoin will always have the same value. This ERC-20 token has now enabled the investors who aim to diversify their portfolios. They can convert their bitcoin to a WBTC token and then can proceed to convert it to any other ERC-20 coin of their choice thereby saving gas fees and time. Moreover, wBTC is not only available in the ethereum blockchain but is also available on other blockchains giving investors more freedom and flexibility to choose digital assets from ecosystems other than ethereum which we will look at in our first question.

Question 1

Name at least 2 Blockchains that use the Wrapped BTC, excluding Ethereum, and show screenshots. Explain

Liquid bitcoin

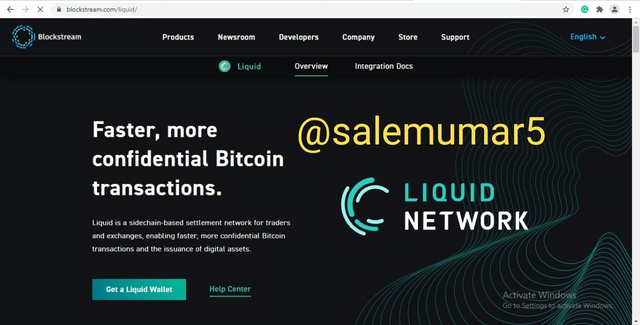

Source: blockstream.com

Speed and scalability have always been the issue with the bitcoin blockchain. The issue arises when the blockchain stretches with time and more transactions are added to it. Since the consensus mechanism of the bitcoin requires to validate each and every transaction right from the beginning of the blockchain till the present, it does so with more time thereby consuming more power. Liquid bitcoin which also goes by the acronym (LBTC) is a wrapped bitcoin (WBTC) version that runs as a sidechain to the bitcoin blockchain and it solves the scalability issue of the original blockchain. A sidechain or child chain is a blockchain that runs in parallel on the top of the original blockchain and derives value from the original bitcoin blockchain.

Consider it two streams of rivers flowing side by side. Both follow the same pattern but are different in the way that the latter is hooked up its value to its original chain in one to one ratio. This essentially means that One LBTC will always be equal to one BTC which is often commonly known as two way pegging mechanism. The main advantage of LBTC is that works as a settlement network for day traders and investors who want to take swift advantage of short term arbitrage opportunities. Such opportunities are short-lived as a trader takes advantage of different prices of the same asset on different exchanges. LBTC enables them to do this more confidently and securely within 2 minutes which was previously not possible with bitcoin due to the slow and high fees of the bitcoin blockchain.

LBTC is maintained by the custodial company Blockstream which develops a range of products and services for the storage and transfer of Bitcoin and other altcoins. It is pertinent to note that just like WBTC, LBTC is not decentralized and is vulnerable to withholding of funds for the purpose of KYC (know your client) or AML (Anti-money laundering) purpose by the custodian.

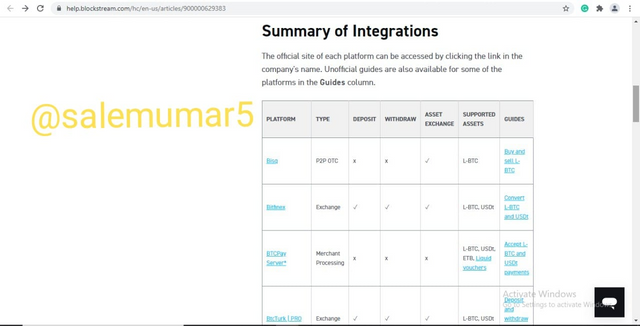

LBTC can be obtained from different exchanges such as bisque, bitfinex, wyre and swideswap etc. The detailed list can be seen in the below screenshot with the features of deposits, withdrawal and asset exchange.

Source: help.blockstream.com

BTCP

Source: binance.com

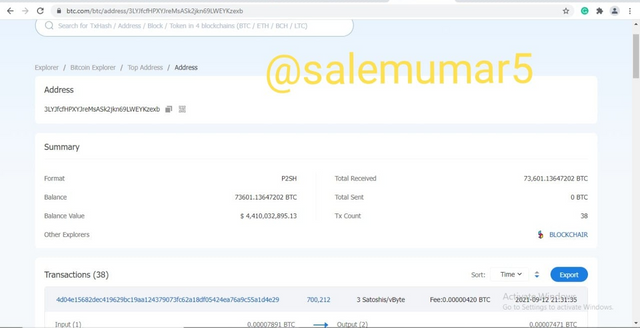

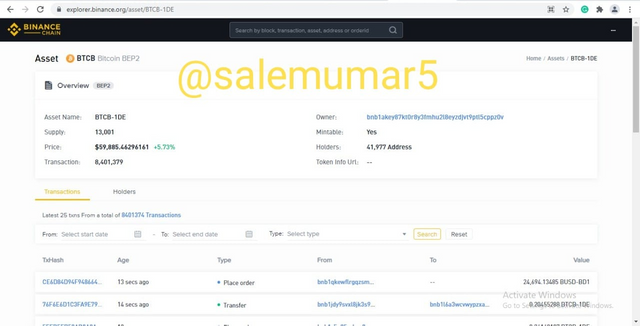

(BTCP) is a tokenized version of bitcoin that is being offered by the Binance chain. Binance Chain is a separate blockchain from that of ethereum. Bitcoin BEP2 just like wrapped bitcoin (WBTC) is a Bitcoin pegged token and is fully backed by bitcoin in a 1:1 reserve of binance. The main reason for making BTCB is to enable the traders to trade other assets on Binance’s decentralized exchange (DEX) Binance DEX in place of Bitcoin in a much faster, reliable and inefficient manner with fewer fees than that of the process of converting the BTC to Ethereum. It is worth mentioning that this is not a decentralized service and Binance reserves the right to withhold funds for KYC/AML purposes. One may think that in the presence of stable coins like tether, why would anyone want to convert their bitcoins to BTCP. The main reason is that crypto pegged coins can easily be audited publicly on block explorer as compare to stable coins. In this BTCP, we can see how much are there in reserve again the issued BTCP. At the time of writing this assignment, the bitcoin reserve against BTCP can be cross-checked live on the following address on BTC explorer.

3LYJfcfHPXYJreMsASk2jkn69LWEYKzexb

Source: btc.com

Whereas as the BTCP supplied or issued at the time of writing this post was 13001 meaning 13001 BTC were received on Binance.

Source: explorer.binance.org

BTCP can be traded against bitcoin or BNP on Binance and the users can do that by making a wallet through their login credentials.

Question 2

What is the difference between the wETH of the Ethereum platform and the wETH of the TRON platform? Explain.

wETH of ethereum

Source: blockchair.com

Wrapped ethereum is the tokenized version of ethereum which comes in a shape of an ERC-20 (ethereum request for comment) token. We know from our previous classes that ether is the cryptocurrency of ethereum and ERC-20 are the smart contracts token standard that runs on the ethereum blockchain. Since both of these token ether and ERC-20 are different in nature and hence cannot be interchanged without a third party intervention as this require converting ether to another token first, which involves the process of gas consumption and is susceptible to price volatility of another token once converted. When we say Gas it essentially means a certain fee that the ethereum network charges from its users when they are opting to perform any function on the ethereum blockchain. These charges often get high with time thereby ethereum less desirable to trade in a Defi environment. With the induction of wETH by BitGo the company behind the creation of this token, this problem has now become part of history. Just like BTC, wETH is also pegged with 1:1 with ethereum meaning the value of one wETH will always be equivalent to one ethereum. Such features of wrapped ethereum makes it an ideal candidate for using it in decentralised apps of the ethereum ecosystem smoothly and without any worry of transaction getting stuck.

wETH of Tron

Source: bitcoinexchangeguide.com

WETH on Tron blockchain was recently launched by its sole custodial authority BitGo with an aim to bring decentralised finance to Tron blockchain. Users of Tron blockchain can now access the world of Defi with one to one 1:1 pegging mechanism, without having to convert or swap their Tron into an ERC-20 token thanks to the presence of TRC-20 token This significance means that one wETH will always be equal to one TRC-20 token is the.TRC-20 token just like the ethereum ERC-20 token is the equivalent of Tron blockchain, which runs on top of the Tron blockchain and provides smart contract features similar to that of the ethereum.

The main difference between the wrapped ethereum (wETH) of the ethereum blockchain and that of the wETH of the Tron blockchain lies in the efficiency and speed of transactions. We know that wETH uses ERC-20 token uses ethereum blockchain and ethereum often suffers delay in processing transaction because of the transaction traffic it handles that comes from thousand of Dapp that are operating on ethereum. Tron blockchain, on the other hand, uses a delegated proof of stake consensus mechanism and it executes transactions within a fraction of a second on its chain. This makes Tron an ideal candidate to operate a Defi environment where speed matters the most and the TRC-20 version of wrapped ethereum bring a better alternative to the table.

Question 3

Make an investment of at least $ 5 of a Wrapped token. Explain the process with screenshots. You can use the JustSwap platform

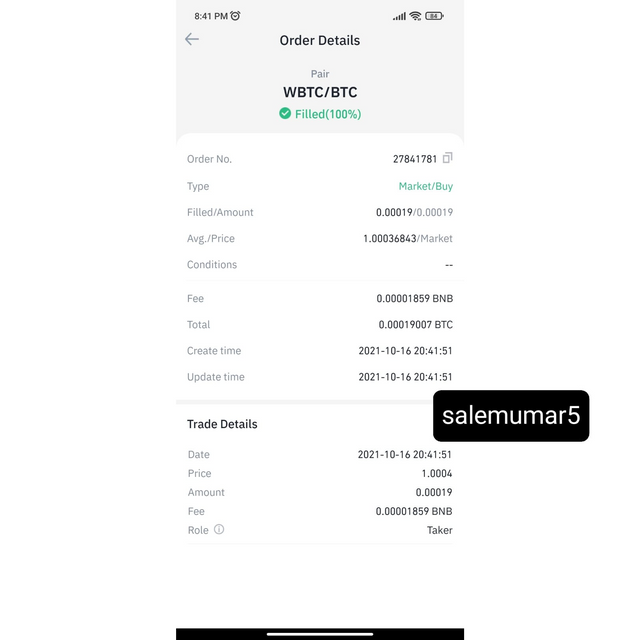

Appologies for not making the purchase on just swap because att the time of writing this post I was unable to connect my wallet to just swap platform. Henceforth, I decided to the needful through binance platform. To purchase the wrapped token which in my case was wBTC, I log into to my binanace account. and went straight to spot trading section. i search for the wBTC token in the search bar and opted to purchase 0.0002 wBTC which roughly amounts $5 worth of btc at the time of writting this post.

Source: binance.com

Question 4

Explain in detail the Wrapped token of the TRON Blockchain. Show screenshot.

Before getting into wrapped token of the tron blockchain it is worth mentioning the kind of standards are used for issuing token on tron blockchain.We all are aware of the wide use of ethereum blockchain standard ERC-20. Tron does that similarly for the deploying its smart contract on its blockchain through the help of TRC-20 standard. Before the arrival of TRC-20 token there was only one standard that tron used and that was TRC-10 token.

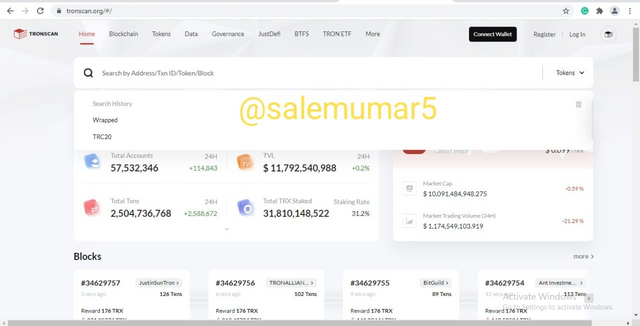

TRC-10 standard is mostly used in payment services with a feature of low transaction fees whereas TRC-20 standard is used in decentralised apps of tron ecosysten with a higher transaction fees but this standard is more flexible from programming point of view and can interact with the smart contracts in a much more efficient manner. It is for this reason many of the wrapped token of the tron blockchain are issued in TRC-20 tokens. It is pertinent to note here that higher transaction fees of TRC-20 token is higher in terms of TRC-10 token and not when it is compare to the ERC-20 token of ethereum blockchain. TRC-20 token is far ahead of it not only in terms of fees but also in scalability and it does not suffer from congestion as much as ethereum does.Wrapped token of tron blockchain can be viewed by visiting tronscan.org as shown in the below screenshot.

Source: tronscan.org

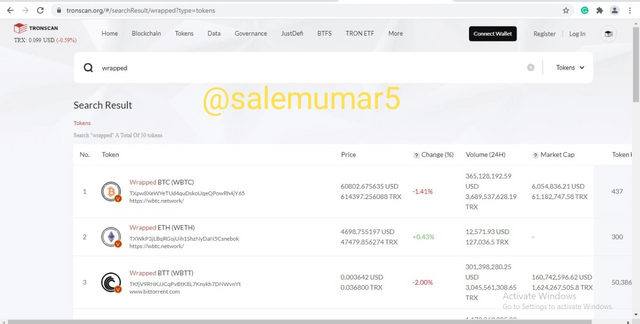

When in the website click on the top search tab with wrapped. One click on it will show us the wrapped bitcoin, wrapped bittorrent, wrapped ethereum and many other cryptocurrencies of different blockchains.

Source: tronscan.org

Question 5

What is to mint a Wrapped token? What is burning a Wrapped token? What is your function? Create an example explaining the process.

Source: exhibit.tech

So far we have discussed about token standard of ethereum, tron and their wrapped token that are compatible with them. If we dive more into the issuaance of wrapped token, we will get to decipher the science working behind wrapped tokens. Whenever a user of the Defi wants to take a swift advantage of trading opportunity or lending it for greater returns, they do so by requesting wrapped token from the custodial service.

The custodial service is an authority that holds for example bitcoin or any cryptocurrency that are needed to wrapped, and in return they gives wrapped token to end user.This task is achieved through a process called minting where a trustable custodial service receive a original token and upon certain number of verification, an equivalent amount of wrapped token is issued.This process of issuing a Wrapped tokens is called minting of wrapped token.

Now if the user wants to get back their original token and are desiring to unwrapped their token, they can again request the custodial service which has previously issued the wrapped tokens. For this, they are required to send the wrapped token to custodial authority wrapped token address.

Upon certain confirmation the custodial authority will return their original token in exchange of a wrapped token. The authority will later proceed to remove the wrapped token from the smart contract permanently.This permanent removal is commonly known as burning of a wrapped token. All this process of a minting and burning of a token can be verified through a block explorer of the custodial authority.

The main idea to publish this data through a block explorer publicly is to bring transparency throughout the whole procedure that every minted wrapped token is being backed by original token in a 1:1 and there is never any access wrapped token in circulation than the original token holding of the custodial authority.

Conclusion

As we witness the rise of the Defi on ethereum, tron and other similar blockchains whether it is lending, staking or borrowing, we have covered a great stride in this landscape to achieve financial decentralisation and this could not have been possible without intervention of wrapped tokens of ethereum and tron blockchain. They have removed redundancy, improve efficiency of transaction and has increased interoperability between two assets of different blockchains which was previously impossible.

In my opinion, that with the passage of time, more inclusion of wrapped tokens in different blockchains will let Defi users take more advantage of fetching revenue seamlessly with low transaction fees creating a parallel financial system that tends to compete with the traditional financial system.

@pelon53