Hello to everyone on this noble platform, I am very excited to write and submit my homework post for prof @reminiscence01. I have read his lesson and I can firmly say it was interesting and easy to comprehend as well. Before I begin I would use this opportunity to once again congratulates all the newly elected professors including prof @reminiscence01 for they really deserved it. I say congratulations to you all.

Now let's dive into today's business.

Below is the link to my reviewed work https://steemit.com/hive-108451/@salma78/crypto-academy-season-3-week-2-homework-post-for-professor-reminiscence01-or-or-introduction-to-charts-or-or-by-salma78

Explain the Japanese candlestick chart (chart screenshot required)

What is a Chart?

Chart refers to the pictorial representation of information that portrays data through the use of certain elements such as lines or emblems that shows the statistical information in a numerical and accurate manner. They are represented by graphs or in tabular format. This format helps to explain ambiguous data in a simple format.

What Charts are in the Crypto Market?

Crypto charts represent a form of interaction between the buyer and the seller shown in a graphical representation. They help traders to see the movement of the price of an asset in a clearer manner.

What is the Japanese Candlestick Chart?

Japanese candlesticks chart comprises candlesticks that allow traders to predict the price movement of an asset by analyzing the candlesticks. The Japanese candlesticks method was re-implemented when Japanese Rice merchants realized that the method was a good asset in evaluating and predicting the price of prices of cryptocurrencies.

Candlestick also plays an important role in predicting the closing and opening prices of assets for traders. This indicates that candlesticks help traders in identifying bullish trends and bearish trends on charts.

The Representations Under Japanese Candlestick Chart.

- Green Bar: The green bar candlestick represents an uptrend in the price movement of an asset. The top-end represents a close position whilst the bottom end represents an open position to buy. This is the period of a bullish trend.

- Red Bar: The red bar candlestick represents a downtrend in the price movement of an asset. Here the top end represents the opening position whilst the bottom end represents a close position.

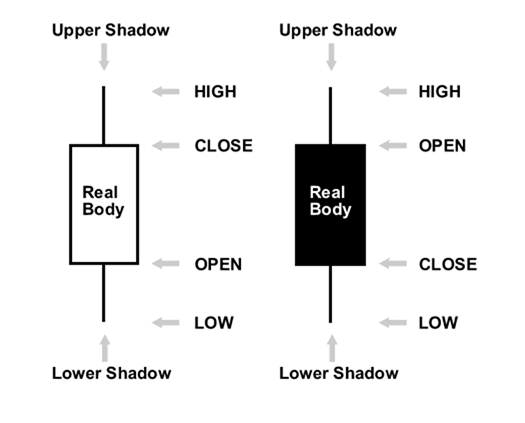

Similar just in the case of the green and red bar candlesticks, white and black also indicates the same as follows;

Black bar: this represents the downtrend in the price movement of an asset, similar to the red bar.

White bar: this represents the uptrend in the price movement of an asset and this is also similar to the green bar as indicated above.

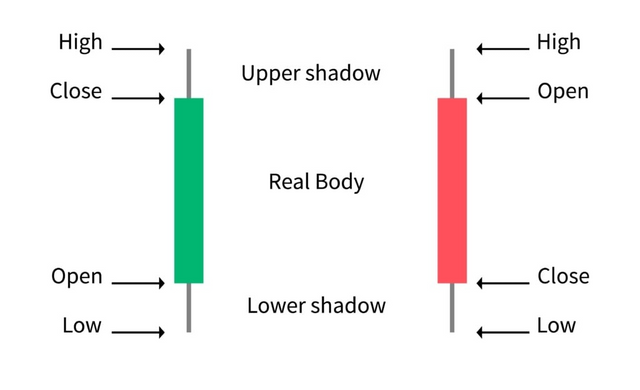

We can observe that the candlestick has body parts and what they represent, I would like to list the body parts below and explain what they mean or represents.

The parts or components include;

- High

- Close

- Open

- Low

- Shadow

- Real body

| Component | Feature or use |

|---|---|

| High | This represents the highest price level of an asset in a specific time |

| Close | This represents the closing price of an asset in a specific given time. |

| Open | This indicates the starting price of an asset for a specific time. |

| Low | This indicates or represents the lowest price or level of an asset for a specific time. |

| Shadow | This indicates the rate of prices that traders have traded within the day on an asset giving a high or low price. |

| Real Body | This represents the full details from the opening price range to the closing price range of an asset for a specific time. |

There are three types of patterns that are used for quicker analysis of charts and they include the following;

- Single Pattern

- Double Pattern

- Triple Pattern

I would like to briefly explain them one by one below;

Single Pattern

A single pattern is one of the easiest patterns available that deals with one trading period. The single pattern serves as the basic building unit to another pattern in the market analysis of charts. The following are found under a single pattern;

- Spinning top

- Hammer

- Shooting star

Double Pattern

As the name suggests, over here the pattern is geared towards two periods formed in the market signal and it can be found on the uptrend. The following are found under the double pattern;

- Harami

- Tweezers

- Homing pigeon

Triple Pattern

This too as the name implies, its period is focused on three periods in the market signal and it is taken to the strongest pattern among the available patterns. The following can also be found under the Triple pattern;

- Morning Star

- Three white soldier

- Evening Star

Describe any other two types of charts? (Screenshot required)

I would like to explain the following two types of charts with screenshots below in my article;

- Line Chart

- Bar Chart

Line Chart

The line chart to me is the simplest chart to read and understand by any trader regardless of your experience. It displays the information using a specific time frame but in the actual sense, it doesn't fully display many details of the chart. It is drawn by a line moving from a particular price point to another without any time frame.

With all it's simplicity, it is not really advisable to use in trading or looking for open and close points of prices of assets.

Bar Chart

The bar chart displays a chart with more details as compared to the line chart. The bar chart portrays the opening and closing prices of assets in the chart with respect to the highest or lowest rate available. With a bullish bar, the price is opened at the left bottom of the bar and closes at the right top part of the end. On the other hand, for a bearish bar, the price is opened at the left top of the bar and closed at the right bottom of the bar. This can be shown below from the diagram,

source

In your own words, explain why the Japanese candlestick chart is mostly used by traders?

Japanese candlestick charts are used by most traders due to the benefits they provide to traders and below are some of these benefits;

Japanese candlestick charts are readable: Due to the nature of its two-color pair appearance i.e. (red and green or white and black), it makes the charts easy to readable and understandable to traders hence making it easy for traders to predict the future price trend movement of assets.

The Japanese candlestick chart is easy in identifying changes in the market. When traders use this tool with the knowledge of indicators together, it makes it very easier to identify areas where there would be a change in the market trend. As a result, this help traders to make profits and avoid losses in trading.

The Japanese candlestick chart makes it easier in identifying the uptrends and downtrends of assets. The Japanese candlestick chart makes it easier for traders to decide when to go in for a buy option and when to go for a sell option as well.

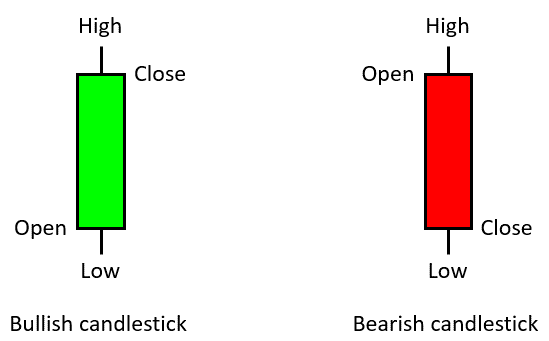

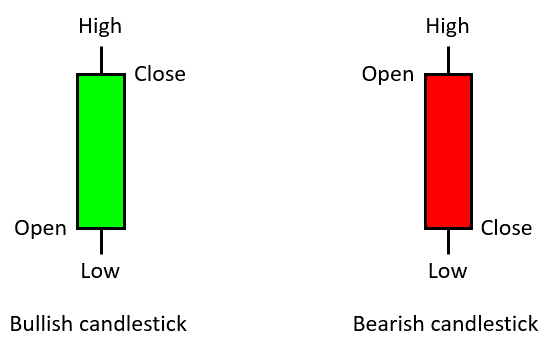

Describe a bullish candle and a bearish candle identifying its anatomy?

The Bullish Candle

When the price of an asset closes above the open price then a bullish candle is established. It is green in colour and in other cases are white in colour. It signals a buy option or an uptrend to traders so they can make profits during such periods.

The Anatomy of the Bullish Candle

The anatomy of the bullish candle is four components, i.e. open price, close price, highest price and lowest price.

Highest Price: This indicates the highest price that an asset is being sold at a specific given of time.

Lowest Price: This indicates the lowest price of an asset at a specific given time.

Open Price: This indicates the startup price of an asset at a specific given of time.

Close Price: This indicates the closing price or level of an asset for a specific period of time.

The Bearish Candle

When the price of an asset closes below the open price then a bearish candle is established. It is red in colour and in other cases are black in colour. This candle signals a sell option or a downtrend in the assets price thereby alerting traders of the downfall in the price of the asset. Traders sell their assets when they see this signal thereby avoiding loss.

The Anatomy of the Bearish Candle

The Anatomy of the bearish candle is the same as that of the bullish candle and hence a reference above is taken;

- Highest Price: This indicates the highest price that an asset is being sold at a specific given of time.

- Lowest Price: This indicates the lowest price of an asset at a specific given time.

- Open Price: This indicates the startup price of an asset at a specific given of time.

- Close Price: This indicates the closing price or level of an asset for a specific period of time.

source

Conclusion

In conclusion, I would like to summarize all that we talked about in my article. We looked at what charts and Japanese charts are and also looked at the representation of candlestick charts. Again, we looked at the various components of the Japanese candlestick and their meanings. We also looked at some of the benefits of the Japanese candlesticks and why most traders utilize them. Finally, we looked at how the Japanese candlestick can be used in identifying trends and the anatomy involved in each type of trend.

I would like to thank professor @reminiscence01 once again for such a wonderful lecture taught this week. Thank you all for reading and passing by my post.

@steemcurator02 below is repost review score

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit