This is Season 3 Week 3 of Steemit Crypto Academy and I'm writing Homework Task for Professor @allbert

1)

Select two Crypto, perform fundamental analysis, and based on your fundamental analysis explain why you chose them. Exclude BTC, ETH, RUNE. Develop and justify your answer. Be original.

For cryptocurrencies, there are many types of analysis. One of them is fundamental analysis. Fundamental analysis is the strategy mostly used by investors to know the intrinsic value of an asset. We can conduct fundamental analysis on an asset by three methods by

looking at the data available on the blockchain such as the active addresses, paid fees, transaction counts, and the amount staked.

On project information such as the white paper, team, tokenomics, and competitors.

Financial information such as the market cap, trading volume, liquidity and maximum supply.

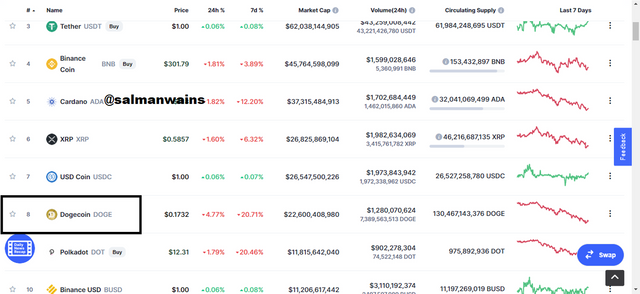

I am choosing DOGE and BNB which both are among two cryptocurrencies from the top 50 cryptocurrencies to perform a fundamental analysis

Dogecoin (DOGE) fundamental Analysis:

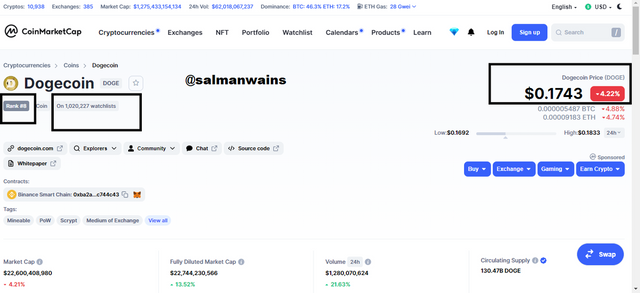

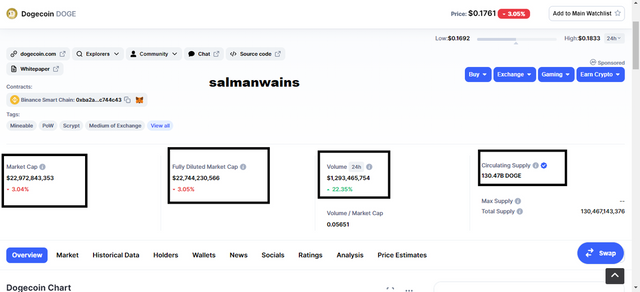

Dogecoin is a mem-based cryptocurrency and in my view it holds a great potential. I will further validate my assumption through fundamental analysis. There is a great future for meme-based cryptocurrencies. Due to its success, we see many meme-based currencies as it is inspired from it such as the shiba inu, Cat$, MONA, kishu Inu. It uses proof of work consensus similar to bitcoin to validate the transaction. I will base my analysis on the authentic information available on coinmarketcap.com.

The current price $0.1751 of It is ranked 8th in terms of market value. It is on the watch list of 1,020,230 people. Dogecoin began to be popular since Elon Musk started to talk about it in his tweets. It is an important detail that so many people are on the watch list.

It has a total market capitalization of around $22,861,175,694. Dogecoin trading volume is around $22,861,175,694. It is a sufficiently high volume keeping view of the bearish market season these days.

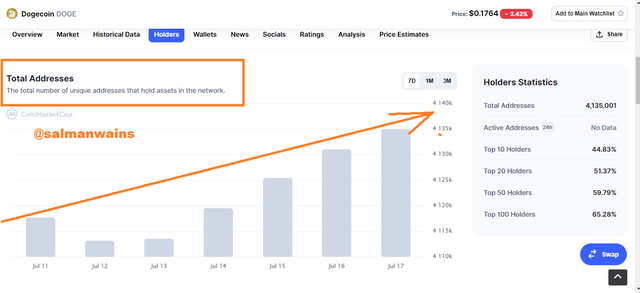

If we look at the addresses the addresses have been increasing,

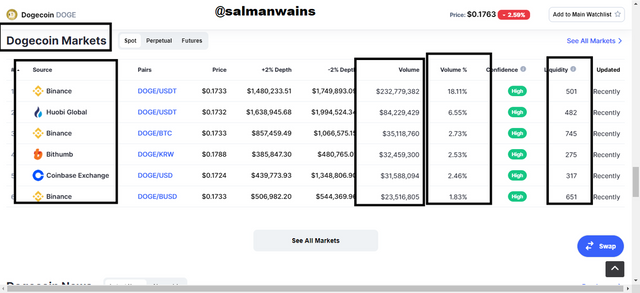

Dogecoin is listed on almost all major exchanges such as Binance, Coinbase, Huobi, Bithump, and many more. The listing of a cryptocurrency on such a large exchange shows that it has got potential and the market has confidence in it.

Reason of choice:

Dogecoin is a very competent cryptocurrency. The charts and data develop the notion that its market will conquer a lot in the coming future, understanding the coin and going for a long term investment into It can be very beneficial.

Moreover, Recent Tweets from Elon Musk and other Big whales shows that Doge coin can be used in future as payment purposes just like Tesla owner Elon Musk started accepting Bitcoin as Payment for Tesla couple of Months ago but later they stopped it due to some energy consumption issues. So, Many of us can still think that big whales like Elon Musk who showed their support for the DOGE can start accepting them as for payment in their own businesses any time.

BNB coin Fundamental Analysis

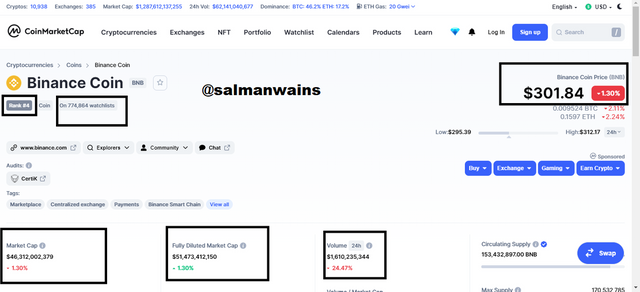

Binance exchange is a well known cryptocurrency exchange. The BNB coin is the intrinsic token of the exchange. It was founded 5 years ago in 2017. It has been performing remarkably well and providing its users with upto the mark services. Most investors use this exchange due to its very supportive team. To know more about it and the native coin you can search their official website.

Like above I will base my analysis on the information collected from coinmarketcap.com.

BNB coin is ranked among top 5 cryptocurrencies in terms of performance in the market. Around 774,869 people have added it into their watchlists. Its current price is $301.76. Its market cap is $46,264,814,027. It is very high although the market is in bearish season. It shows traders interest in it. Its trading volume is also very high and is around $1,607,591,264.

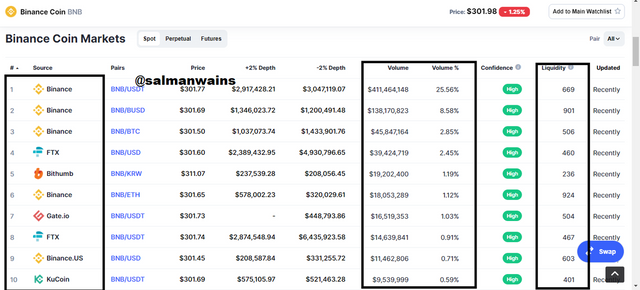

It is listed on the top exchanges including FTX, Gate.io, KuCoin, Bithumb and many more. If we look at the circulating supply which is around 153,432,897.00 BNB we see big numbers here too. This shows that it is well in use and trusted.

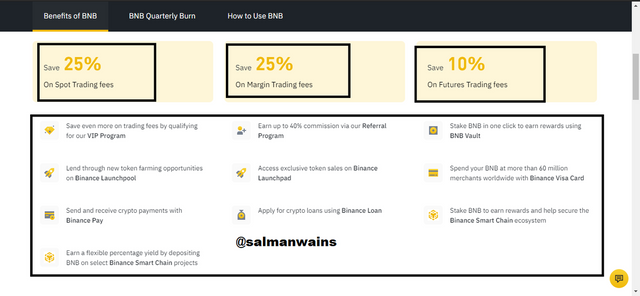

According to the Binance website BNB has a great potential for staking, buying, selling , exchange and as a storehouse of value.

Reason of choice:

BNB has got very much potential and is supported by many exchanges. I choose this coin because I get enough information on it to draw a substantial fundamental analysis. Moreover, if we use BNB on Binance exchange for trading crypto then it also costs us very less fee as compared to Bitcoin, ETH and USDT etc.

2)

Through your verified Exchange account (screenshot needed), make a real purchase of one of the cryptocurrencies selected in the first assignment and explain the process. The minimum investment must be 5USD (mandatory) and must present screenshots of the verified account and the whole operation.

From the above Two coins, I will be buying Doge Coins. Because I have already invested in this currency and I think it will surely give me profit in coming days.

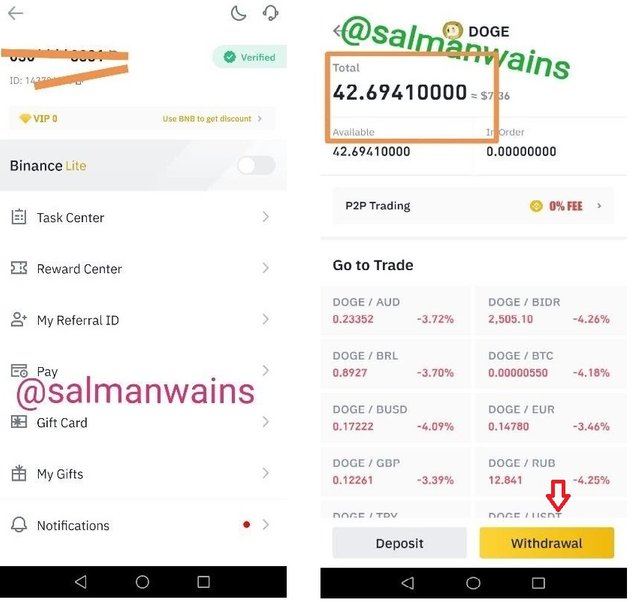

- First of all, I logged in to my account Binance account and it showed my verified profile as well as Doge coins in my wallet which I already bought them and the initial account balance was 42.6941 doge.

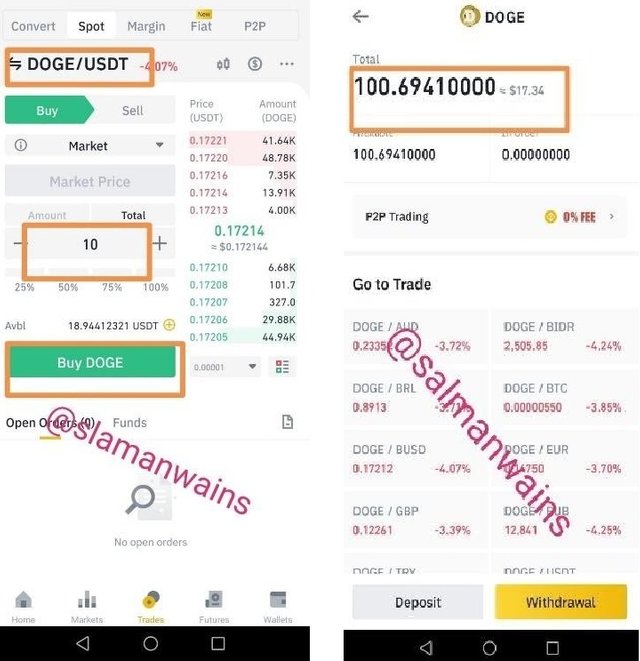

- Then I clicked on DOGE/USDT pair because I had only USDT in my wallet as stable currency and USDT is always my first choice to buy crypto assets.

- As the minimum requirement was to buy with at least $10, so I entered $10 as amount and bought Doge coins on market rates.

The above screenshot shows that I bought Doge Coins of $10 and my total Doge Coin balance is now more than 100 Doge.

3)

Finally, make a simulated exercise, using the DCA method to perform the purchase of two assets and present charts showing the data of days in which the operation was performed, price of purchases, average price, sell point, percentage of profit or loss. (Include screenshots)

DCA strategy is a very helpful strategy in minimizing losses. I am applying the DCA strategy on BNB. I divided the purchases into 5 small purchases

- Purchase date price: June 21, 2021 – 341.65 BNB

- Purchase date price: June,24 2021 – 316.24 BNB

- Purchase date price: July 4 2021- 312.17 BNB

- Purchase date price: July 7, 2021 – 336.12 BNB

- Purchase date price: July 15, 2021 - 321 BNB (typing error in the screenshot)

Let’s assume that all the purchases have been made on the same unit. And the unit of supposition is 1 BNB for every purchase.

Now let’s calculate the average for estimating the loss or profit. Sum of all prices: 1627.18

Average value: 1647.18/5= 319.436

The current price: 299.47

There is approximately 20% damage relative to the average price. The DCA strategy very much depends on the time you are buying. As we can see the average price is a bit higher than the original price. There is a 20% loss as compared to the current price.

Even then The DCA strategy saved us from a big loss here is how:

Consider if we had purchased all the coins at 336.12, we would have suffered a loss of 37% for each coin and since there were 5 coins so the loss would have been increased. But with the DCA strategy, we suffered only 20%.

So, what happens here is despite investing 3 coins at the same price I bought them at different times to divide the loss. If I had purchased all three coins at 336.12, I would have suffered a greater blow but here we suffered less due to DCA strategy.

But the DCA strategy should be applied in a way that the market should not be in bull and hence the price should be kept near to the average price.

Exit scenario:

By looking at the market trend I see that the price goes high mostly around the price of 320$ and therefore I will leave the market as soon as the market comes near to that price tag and it will save me from even 20% loss and maybe I will end up gaining 1% profit.

The next coin I am performing the DCA strategy is the Dogecoin

In this, I made three purchases

- Purchase date price: June 24, 2021 – 0.26241 DOGE

- Purchase date price: June,27 2021 – 0.2695 DOGE

- Purchase date price: June 29 2021- 0.26312 DOGE

Now if we calculate the average of all the prices

Sum of all the values: 0.26241+ 0.2695+ 0.26312 = 0.79503 Total

Average: 0.79503/3= 0.26501

Current price: 0.1742

Again, here the current price is lower than the average price and hence we are at loss again. It is because the purchases were made when the market was in a bull period. In the bull period it is common to have high prices. As the market is currently in bearish trend therefore the current price is low.

Now if we calculate the loss, it comes out to be 9% with the average price due to DCA strategy.

Now compare the single purchase with the current price. Which means if we have invested all the coins at the 2nd price.

The first purchase was made at 0.2695 the loss as compared to the current price would have been approximately 10% but with the average price the loss is approximately 9%. In DCA strategy the average price is the price for the single purchase. So, we suffered less loss due to the wrong time of buying.

So, what happens here is despite investing 3 coins at the same price I bought them at different times to divide the loss. If I had purchased all three coins at 0.2695 I would have suffered greater blow but here we suffered less due to DCA strategy.

Exit scenario:

By looking at the market trend I see that the price goes high mostly around the price of 0.27-0.30$, I made mistake while investing and I would had to look at the right time when to invest. Now, as I'm in loss so I will again wait and look at the market trend when to sell. As I stated above that the price of Doge usually stays between $0.27 to $0.30 so I will leave the market as soon as the market comes near to that price tag to minimize my loss or to gain some profit.

Conclusion

The lecture was very informative. We learned how to perform fundamental analysis as well as through real-time implementation of the DCA strategy it was made clear that the time of buying impacts the loss a lot.

Hello @salmanwains Thank you for participating in Steemit Crypto Academy season 3 week 3.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit