This is Season 4 Week 5 of Steemit Crypto Academy and I'm writing a homework task about Onchain Metrics(Part-3) by Professor @sapwood

.jpg)

How do you calculate Relative Unrealized Profit/Loss & SOPR? Examples? How are they different from MVRV Ratio?

We already discussed in the previous lectures that the Market cap and the realized cap are based on the actual worth of the asset calculated from the UTXO balance based on the time that the transaction was last moved. The market cap on the other hand is calculated based on the current value. Their difference thus gives the value of the unrealized profit/loss.

Calculations:

As discussed earlier;

Unrealized Profit/loss= Current price- realized price

Or Unrealized Profit/loss= market cap –realized cap

If the difference is a positive value estimates the unrealized profit whereas if the difference value is negative it estimates the unrealized loss.

On the other hand

Relative unrealized profit/loss = (Market cap - realized cap) / Marketcap.

Example

Any asset X has a market cap of $35,000,000 and a realized cap of $25,000,000. The unrealized profit/loss and relative unrealized profit/loss will be

Unrealized profit/loss = $35,000,000 - $25,000,000

Unrealized profit = $10,000,000

Here the difference is positive thus the unrealized profit in this case is $10,000,000

Relative unrealized profit/loss=($35,000,000-$25,000,000)/ 35,000,000

Relative unrealized profit/loss =10,000,000/35,000,000= 0.2857

The market is still below the 0.56 mark and below the greed zone

Spent Output Price Ratio (SOPR)

The SOPR is the ratio between spent UTXO price and the price of its creation. This is widely used by traders or investor’s to locate or predict upcoming swing points. If the ratio is above 1 it predicts an upcoming high swing whereas below 1 it indicates an upcoming low swing.

It is calculated as

SOPR = Spent output price / Initial created price

If this answer is greater than 1 then indicates a high swing

If this answer is less than 1 than a low swing in the market

For example

The initial price of a UTXO=254$

Spent output price of UTXO=765$

SOPR= 254/765= 0.332

As the answer is less than 1 then a low swing in the market can be anticipated.

Difference between the unrealized profit/ loss, SOPR and MVRV ratio

The value of unrealized profit or loss determines the actual profit or loss of an asset w.r.t to its circulating supply. The SOPR on the other hand determines the profit or loss ratio of spent UTXO balance in correspondence to the current market price. It is used to indicate swing points in the market.

MVRV ratio highlights the actual worth of the asset based on the relationship between market cap and Realized cap. It highlights the overvalued and undervalued regions and in turn giving hints for the accurate market trading signals.

Consider the on-chain metrics-- Relative Unrealized Profit/Loss & SOPR, from any reliable source(Santiment, Glassnode, LookintoBitcoin, Coinmetrics, etc), and create a fundamental analysis model for any UTXO based crypto, e.g. BTC, LTC [create a model to identify the cycle top & bottom and/or local top & bottom] and determine the price trend/predict the market (or correlate the data with the price trend)w.r.t. the on-chain metrics? Examples/Analysis/Screenshot?

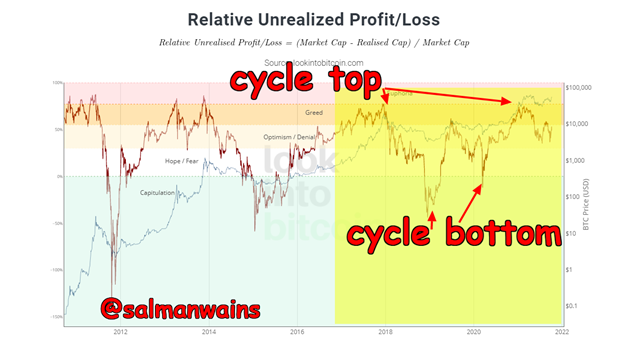

RUPL 5 year’s chart

Here to illustrate the chart we will set parameters that are when the RUPL is above 75% it indicates a historical top when it’s below 0% it indicates a cycle bottom between these extremes is the cycle which can show interim tops and bottoms.

At the end of 2017 in December, we saw a cycle top the RUPL was moving around 78% which indicated the formation of swing high and the BTC price reached $16.2k. The price then dropped to a cycle top and the price reached $13K and the RUPL reached 61% which was below the 78% mark.

The swing lows indicating eh accumulation zone indicate the price reversals as the price reaches the strong support levels during this time and then finally a bullish reversal. The next historical top was seen at the end of 2021 when the price of BTC peaked at $55k and the RUPL again was trading close to 78% level.

SOPR

There are some important parameters to understand the SOPR chart. That is the when the SOPR value is above 1 the price is approaching local highs and when it is below reading 1 the price is approaching swing low.

In 2020 in the first week of May on 6th, we saw that the SOPR was around 1.03 and the price of BTC was around $10K approximately. Here in the chart above, we as the SOPR was significantly above the reading 1 the market formed a higher swing the price approached a bearish resistance level, and soon there was a bearish reversal. The pinnacle of the bearish reversal was indicated by the SOPR dipping up to 0.9.

Then again in the start of 2021 on Feb 6th theSOPR reached 1.04 the price raced to $55k the price dropped to a lower swing point of $46k and this was too indicated by the dipping movement of the SOPR around 0.95.

The second swing indicated by the SOPR level of 0.925 was the resulting from the pullback after the price had peaked at $56K the price reached around 31K while the SOPR was moving around 0.925.

Write down the specific use of Relative Unrealized Profit/Loss(RUPL), SOPR, and MVRV in the context of identifying top & bottom?

The on-chain metrics discussed above have wide range of uses. They help in studying the market drawing analysis.

Uses of RUPL

The calculation of RUPL is important for market stricture study as it indicates approaching cycle tops and bottoms in relation to the market cap and time. When the value of the RUPL is appreciably above 0.75 it indicates that the investors can be approaching a zone of taking profit and the market can anytime hit a cycle top close to the level or zone of bearish resistance.

On the other hand, if the value of RUPL is below 0.25 it indicates that the gradual lowering of the price of an asset is hinting at an accumulation zone and the price of the asset is approaching a significant cycle bottom.

The RUPL levels are tagged with psychological zones as the price changes affect the trader accordingly such as Greed, Denial, Hope, Euphoria or fear.

Uses of SOPR

The SOPR value as discussed earlier is used to hint at tops and bottoms or swing highs and lows in the market. We can also say the values of SOPR hints at local tops and bottoms in comparison to RUPL which marks cycle highs and bottoms by calculating a ratio of spent coins value at the time of creation/bought value.

A SOPR value SOPR reading significantly above 1 indicates the price is approaching a swing high while a SOPR reading below 1 indicates that the price is approaching a swing low.

Uses of MBRV

It also identifies historical highs and lows based on the ratio between market Cap and unrealized cap of the given asset. The market is regarded as being overpriced or underpriced in terms of the ratio. In the last lecture, we studies that a value above 300% indicates an overpriced market whereas a value below 100% indicates an underpriced market situation.

Conclusion

The three on-chain metrics namely RUPL, SOPR, and MVRV help us understand the price movement over a longer period of time. These are ideally deployed by long-term investors in drawing both the fundamental and technical analysis. They increase the accuracy of trading signals since they overlap raw signals.

Regard

@salmanwains