This is Season 4 Week 1 of Steemit Crypto Academy and I'm writing Homework Task for Professor @sapwood

Question 1.1)

What is a HODL wave, how do you calculate the age of a coin(BTC, LTC) in a UTXO accounting structure?

HODL wave

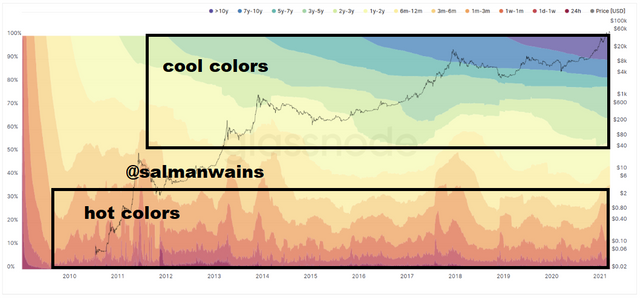

HODL wave is a type of on-chain metrics. It uses color scheme charts and gives an insight into the age distribution of the coin supply. It represents changes in this age distribution through a macroeconomic view of the asset indicating the holding and spending movements.

It also shows the unmoved assets through the unspent transaction outputs.

The above HODL wave is of Bitcoin.

So, on the whole HODL provides an insight to the age distribution of the existing supply and changes in this distribution as the coins are spent. The life span of the asset is categorized into different periods with range bands of 1 hour, 1 day, 1 week, 1-3 months, 3-6 months, 6-12 months, 1-2 years.... 10 years the 10 years range is only applicable to Bitcoin.

Calculation of the age of the coin in a UTXO accounting structure:

Calculating a coin's unspent transaction outputs (UTXO) accounting structure using the HODL wave is done with the help of the age band Color scheme. There are two color schemes in the HODL metrics; hot colors and cool colors.

To calculate the supply bands, we need to measure the number of transacted coins within the specified time period. The formula to find the Active Supply is given below.

Formula:

Active Supply= value (of all UTXOs where t−tcreated is in selected age band)

The hot colors:

The hot colors represent the activity of the recent unmoved coin within the age bands ranging from 24 hours, 1 day, 1 week, 1 month, 1-3 months, 3-6 months, 6-12 months.

Hot colors are seen at the bottom in the below chart.

The cool colors:

The cool colors represent the activity of the older unmoved coin within age bands ranging from 1-2 years, 2-3years, 3-5years, 5-7 years, 7-10years.

Cool colors are located at the top of the chart.

Question 1.2)

How do you interpret a HODL wave in Bull cycles?

HODL wave gives the ratio of spent and unspent coins in proportion to the supply and demand which then forms the spending or holding pattern.

the recent age bands of 24 hours, 1 day, 1 week, 1 month... 6-12 months are formed from recent unspent transaction outputs; these become old over time and form the older age bands of (1-2 years, 2-3 years... 10 years).

When the older age band expands, it indicates an increase in the percentage of unmoved coins stored in wallets which represent limited UTXO spending, and thus a decrease in supply of the coin is seen. The limited supply then increases the demand and the price of the coin is increased and we see a bullish phase of the asset.

The price line then gradually shifts to the older age band.

Question 2)

Consider the on-chain metrics—

Daily Active Addresses:

It indicates the number of active Bitcoin addresses in every movement of the price change. The metrics move accordingly with the price of the asset as depicted below

Short terms term (3 months)

From the above chart we can clearly see that first the rising trend in the number of active addresses correlated with the upward movement of price. Then later the dipping trend in the number of active addresses matched with the downward movement of price.

Long term chart (2 years)

The long-term chart too showed a direct relationship between the active addresses and the price movement.

Transaction Volume:

Shows the coin exchange activities within a network. The movement of the Transaction Volume metrics does not move directly with the price movement. The peaks and spikes of the Transaction Volume metrics indicate a rapid change in the supply or demand.

Short term (3 months)

In the chart above we can see that the price line and the trading volume metrics does not go hand in hand in the same direction. But the spikes do indicate a rapid rise or fall in the price.

Long term (2 years)

The long-term transaction Volume on-chain metrics also show a non-alignment movement between price and the on-chain metrics. But the spikes are formed before the price moves upward or downward.

Network Value to Transaction Ratio NVT:

Represents the value of an asset by dividing the market cap of the asset by the transaction volume of the asset. These on-chain metrics help in the evaluation of the actual worth of an underlying crypto asset.

It has two values:

a high bound and a lower bound. The high bound indicates an overvalued state of the asset and thus a downward movement can be anticipated anytime soon. The lower bound on the other hand is the undervalue state of the asset and hence an upward shift can be predicted.

Short term (3 months)

The HR or higher reading corresponds with dipping price movement and the Lower reading corresponds with the increasing price movement.

Long term (2 years)

In the long-term charts the NVT anticipated dips and rises in prices by the formation of higher and lower bounds respectively.

NVT is often used with other indicators to study price trends.

Exchange Flow Balance:

The total balance calculated from the total exchange inflow and outflow balances. An inflow is seen as downward price movement and the outflow is seen as an upward price movement. It is so because as the supply increases the price decreases and vice versa.

Short term (3 months)

In the short-term chart above we see the on-chain metrics to be very distorting and giving false signals.

Long term (2 years)

The chart below shows an increase in price after the exchange outflow

Supply on Exchanges as a percentage of Total Supply

The supply on an exchange as the percentage of Total supply on-chain metrics is inversely related to the price movement of an asset. The total supply of a coin is the measure of how much of it is flowed into exchange wallets. This affects the value of a coin. We already discussed above how the increased supply decreases the demand and hence the price of an asset. We shall explain it through the charts below.

Short term (3 months)

We can clearly see the inverse relation of the price and supply in the chart below

Here the exchange supply percentage was 13.23% and the price of BTC was $38k. when the exchange supply percentage was 13.15% the price of BTC was at $39k.

Long term (2 years)

The long term again shows a clear inverse relationship between price movement and the exchange supply as a percentage of total supply movement.

Question 3)

Are the on-chain metrics that you have chosen helpful for short-term or medium-term or long term(or all)? Are they explicit w.r.t price action? What are its limitations? Examples/Screenshot?

The on-chain metrics provided best signals when used for longer time frames of (1-2 years, 2-3 years .....etc.). The short-term and medium-term are often found giving unreliable or fluctuating signals. This notion can not be universally applied but more often the long-time frames giver better understanding of the price changes.

The best plan would be to use more than one indicator and fundamental analysis tool for the understanding of the price action of an underlying asset.

On-chain Metrics and Price Action

There is a close relationship between the price action and the on-chain metrics. Some on-chain metrics such as the supply on exchanges as a percentage of total supply is inversely related to the price movement while others such as the active addresses move parallel to the price movements.

The on-chain metrics are based on the principles of supply and demand which in turn determine the price changes of an asset. The price action on the other hand is an integration between the buyers and sellers which governs the supply and demand.

Limitations

The on-chain metrics have the following limitations

They can exhibit false signals mostly when used in medium-term and short-term frames. One example of false signals was displayed in exchange flow balance metrics, here the exchange outflow spike occurred but price continued to decrease

On-chain metrics can only provide limited information or full information of only Bitcoin since it is the only coin which is 10 years old.

They can easily be altered by sudden changes in supply and demand during the ICO and may show false signals.

Conclusion

The on-chain metrics are important fundamental tools that govern their values from the ongoing activities on the network. They are based on the principles of supply and demand and should be coupled with other indicators for better signals.

Thanks to professor sapwood for delivering a valuable lecture in Steemit Crypto Academy.