This is Week 10 of Steemit Crypto Academy and I'm writing Homework Task for Professor @kouba01

Homework Task:

What is a cryptocurrency CFD?

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

Are CFDs risky financial products?

Do all brokers offer cryptocurrency CFDs?

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

The 21st century has seen many reforms globally, and one of the significant reforms in technology is shifting towards Cryptocurrency.

What is Cryptocurrency?

A Cryptocurrency is a type of payment that can be traded online for products and ventures. The main component of Cryptocurrency is that any focal power doesn’t constrain it: the decentralized idea of the blockchain makes Cryptocurrency hypothetically safe to the old methods of government control and obstruction.

WHAT IS A CRYPTOCURRENCY CFD?

A Contract for Difference trading, also called CFD trading, is a strategy that empowers people to Trade and put resources into a resource by participating in an agreement among themselves and a specialist, rather than opening a position straightforwardly on a specific market.

The trader and the broker concur between themselves to repeat economic situations and settle the distinction among themselves when the position closes. CFD Trading offers numerous benefits that don't exist with direct Trading, like admittance to abroad business sectors, utilized Trading, short (SELL) positions for resources which customarily don't offer that choice, and then some.

One of the critical ideas you need to comprehend before Trading Cryptocurrency money CFDs is influence, which is both a key advantage and detriment of this subordinate. To open a CFD Trade, you just need to store a trim level of the Trade's complete worth. This could be 20%, 5%, or even less of the absolute Trade and is known as the edge necessity. So in case you are opening a Trade worth $10,000, for instance, you may just have to pay a store of $500. Notwithstanding, you can, in any case, get 100% of gains if the value moves how you foresee

EXAMPLE:

If you are keen on trading cryptocurrency using CFDs, the accompanying models will help clarify how it functions. On the off chance that the selling cost is $11,500 and the purchasing cost is $11,550 for one bitcoin, and you accept that the bitcoin's cost will fall against the dollar, you may choose to sell ten bitcoin contracts at $11,500. For simplicity of reference, every one of our CFD contracts is identical to executing in 1 bitcoin.

Situation A: The bitcoin value falls, and our new cost is $11,300/$11,350. You choose to take your benefit by purchasing at $11,350. $11,500 – $11,350= $150 move or 150 focuses. Your gross benefit is 10 agreements x $150 = $1,500.

Situation B: The bitcoin value rises and our new cost is $11650/$11700. You choose to close your situation by purchasing at $11,700 to restrict your misfortunes. $11,700 – $11,500= $200 move or 200 focuses. Your gross misfortune is 10 agreements x $200 = $2,000.

ARE CRYPTOCURRENCY CFDs SUITABLE FOR TRADING STRATEGY?

The cryptocurrency CFDs are a good trading strategy, but they depend on CFDs lying it to your interest. Crypto CFDs are much more helpful as they permit traders to exchange various resources, all from a solo record.

Additionally, with no fixed agreement size, dealers can pick their position size in light of their danger hunger, level of influence, and exchanging objectives. Guaranteeing robust risk management is additionally helpful with CFDs. Without much of a stretch, brokers can spot their stop misfortune and take benefit orders before going into an agreement.

ARE CFDs RISKY FINANCIAL PRODUCTS?

CFDs can be very unsafe because of low industry guidelines, likely absence of liquidity, and the need to keep a satisfactory edge because of utilized misfortunes. If you exchange a crypto CFD for a security token, you will not have the option to influence the market in any capacity whatsoever. Moreover, you don't have the chance to enhance on the spot. You'll need to pull out the supports first and contribute elsewhere if the stage you are utilizing isn't; however, you would prefer any longer.

Also, The CFD financiers need to consider their benefits well. They can't just permit simple brokers that ensure significant yields currently, can they? To monitor this, they disregard to give more than a couple of crypto CFD choices.

DO ALL BROKERS OFFER CRYPTOCURRENCY CFDs?

CFD Brokers don't offer you to purchase real cryptocurrency. You exchange contracts on the cost of certain cryptographic forms of money - yet you never actually own the cash, nor would you be able to pull it out ( there are a few exemptions). Trading on CFD brokers is fundamentally wagering on the cost of cryptocurrency without claiming it.

STEPS FOR TRADING CRYPTOCURRENCY CFDS WITH A DEMO ACCOUNT:

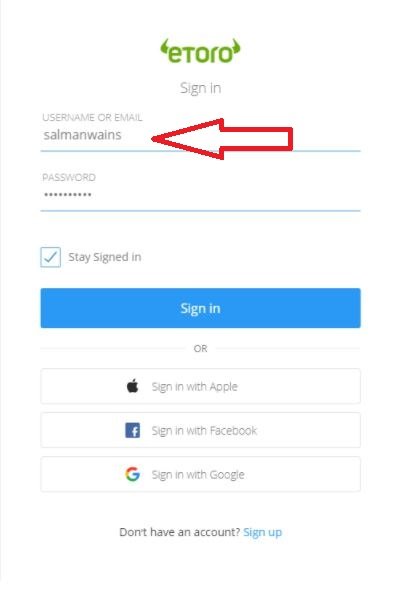

- Sign in with your credentials

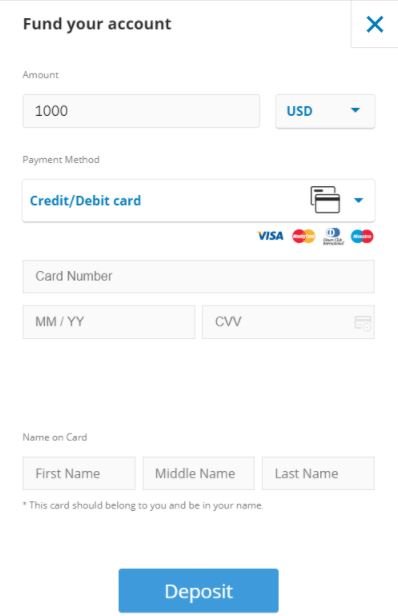

2. Enter your card details and get started with the CFD trading

3. After entering credit card details, we can start the CFD Trading.

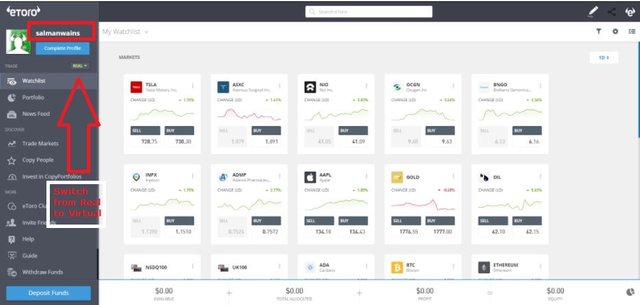

Now, If we want to do DEMO trading, then we should select the option of virtual trading from Real as mentioned in below screenshot.

After that,

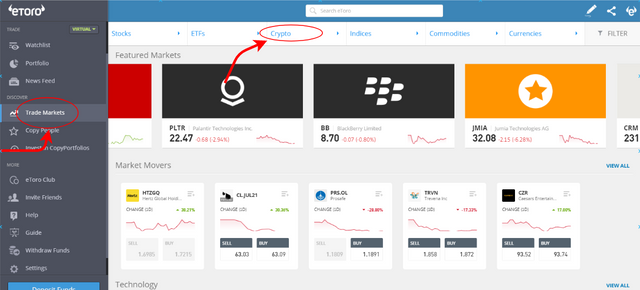

- Click on Trade markets

- Choose the crypto asset

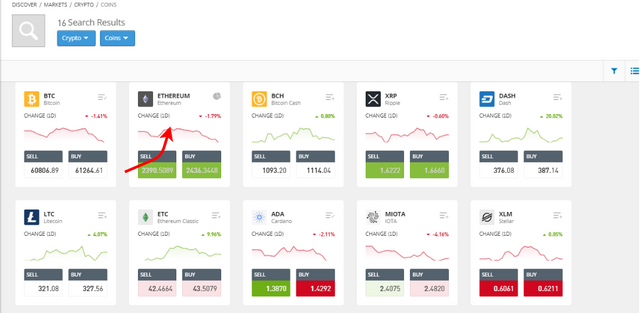

- Select as cryptocurrency Ethereum

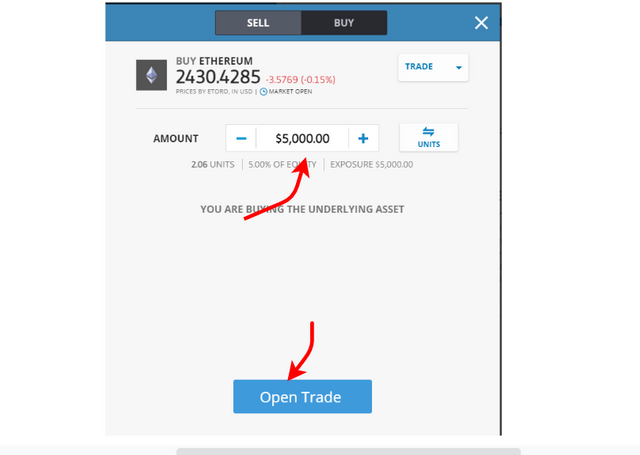

- Click on Trade

- Enter the desired amount and click on Open Trade

After switching to virtual portfolio, I was having an issue on Etoro. So, that's why I'm attaching screenshots of Professor's lecture.

CONCLUSION:

Cryptocurrency CFDs permit crypto-traders to make momentary benefits by adapting the bullish and bearish Cryptocurrency without claiming them. Plus, CFDs offer more apparent openness to the cryptocurrency market through edge exchanging and influence. To become a fruitful crypto trader, you don't have to have the best exchanging system. It is just important to embrace a methodology adjusted to your character, your exchanging destinations, your accessibility, your exchanging capital, lastly, your danger resistance.

Hello @salmanwains,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 7/10 rating, according to the following scale:

My review :

The content of the article is good, with a clear understanding of the questions and an accurate answer. You could have used another CFD broker platform so that we could share several experiences and benefit everyone.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit