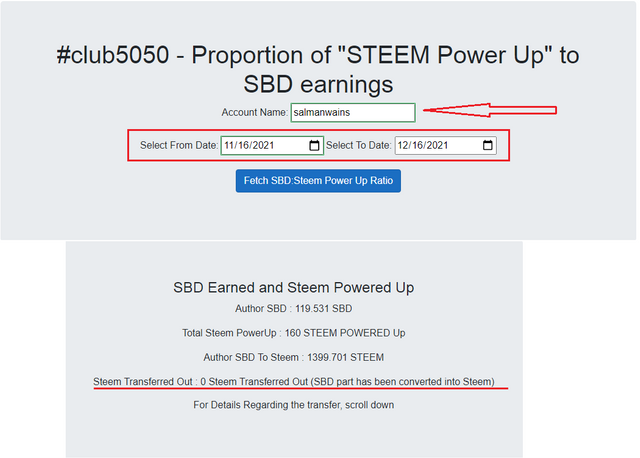

This is Season 5 Week 5 of Steemit Crypto Academy and I'm writing homework task about "Onchain Metrics" and this is Part 3 of this Course which is assigned by Professor @sapwood.

.png)

Question# 1

What do you mean by Global In/Out of the Money? How is a cluster formed? Explain ITM, ATM OTM, etc. with examples?

The term itself clears its definition that it is concerned with the global buying and selling of assets. As we know that every minute or even second there are different traders who are buying and selling different assets. The buying and selling pressure then determine the trends and the price of the asset the price then helps predict their next move and this loop continues.

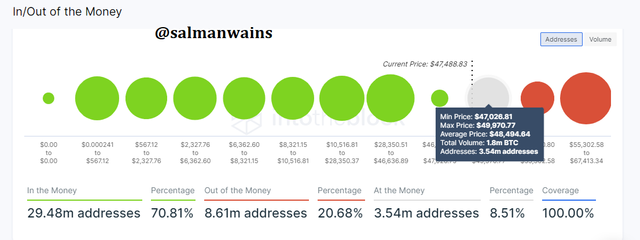

The changes in the price leads to the formation of different chart patterns and these then form the basis of different trading strategies. The Global In/Out also known as the GIOM records the on-chain data of when the asset was sold and bought and at which prices. Visually we see spheres of different diameters. The diameters show the number of buyers or sellers that made their activity. The greater the number of traders who made their activity of at a particular price the larger the sphere.

These spheres more accurately represent price ranges in which the trade was done. These then are used to analyze the profit that a trader is making by trading in a particular range.

The clusters are formed when the asset is held for longer.

Above we see a clusters of the GIOM which makes up its chart the last green sphere is a cluster formed by a trading volume of around 34.59k BTC. The max price, minimum price, and average price of the cluster which represent the extremes and mean of the price range are indicated in the screenshot below. The total address in this cluster are around 126.58k addresses.

The cluster Is formed when the traders buy particularly in the indicated minimum and maximum prices.

ITM:

It stands for in the money. It is used when the current price surpasses the current maximum limit of the cluster. The cluster is thus referred to be as in the ITM. In the screenshot above the maximum price of the range is 47,026.75 which is lesser than the current price 47,488.83 thus the cluster can be said to be in the ITM. As we can see the green clusters are all in the ITM.

ATM:

The clusters are said to be in the ATM or At the Money when the current price of an assets falls within the range of the cluster.

In the chart above we can see that the price ranges from the 47,026 to 49, 970 and thus it is in ATM. This is in turn effects the size of the cluster the currently has 3.54 million addresses with the percentage of 8.51%.

OTM:

Out of the money is when the cluster’s minimum price is greater than the current price of the asset. In other words, the current price is lesser then the range of the cluster and does not fall into the range. From the above chart we can see that the range oof cluster is 55,302 to 67,413. Thus, It is in the OTM with 8.61 M addresses and 20.68% volume.

Question# 2

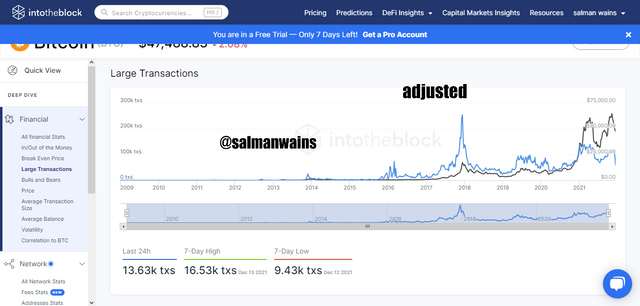

Explain about Large Transaction Volume indicator with examples? What is the difference between Total and Adjusted Large Transaction Volume? Examples?

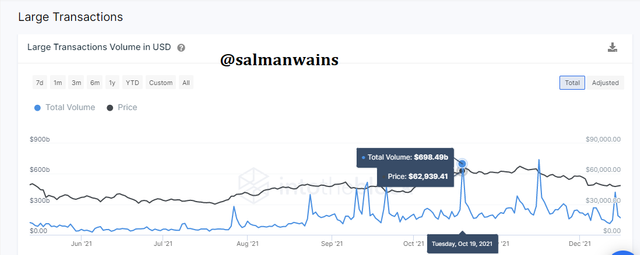

One of the commonly used on-chain indictor is that is used by traders is the large transaction volume which is used to indicate larger transactions such as that of greater than 100k$. As we know that transactions this large are always made by some greater investor a whale, a panel using a single platform or institutions. So, this indictor indirectly indicates that a bigger investor or institution has entered the market.

What larger transaction indicator does it that collects linear data of when transactions larger happen on an asset and plots it in the form of a graph as a total continuous or adjusted.

In the chart below we can see a spike at 698 billion BTC at a $62,939 price.

Difference between total and adjusted:

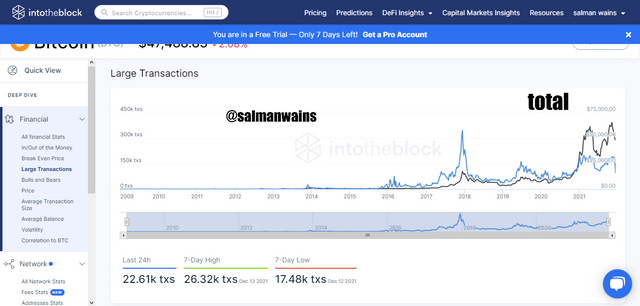

The large transaction volume total records every transaction that is recorded over the 100K$ mark. When we use the adjusted filter, it filters the transactions from similar addresses and thus filters repeated returns. By adding it in the chart we get more accurate results. To understand see the following examples.

When we use the total chart the total recorded transactions in last 24h are 22.61k txs but in case of the adjusted chart these are only 13.63k txs. Which means the extra transactions were repeated and the adjusted filter help us filter them.

Question# 3

Analyze a crypto asset (other than BTC) using on-chain metric: GIOM, and Adjusted Large Transaction Volume? Ascertain whether it supports a Bullish or Bearish bias or Neutral? How do you find the support and resistance using GIOM? How do you ascertain the upside/downside momentum using GIOM? Use InTotheBlock app or any suitable app? (Examples/Screenshots)?

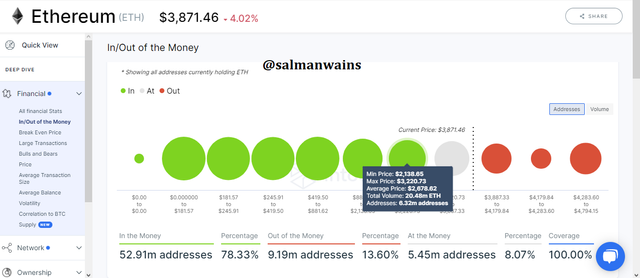

I will be using the Intotheblock.com as I used for the other questions and the asset that I am analyzing is ETH.

From the chart we have the following details on Ethereum:

Total volume of: $20.48M ETH.

Address: 6.32 million addresses

Maximum price of $3,220.73

Minimum price of $2,138.65

Average price of $2,678.62

In addition to that

In The Money (ITM): 52.91M addresses with a Percentage 78.33%

At The Money (ATM): 5.54M addresses with a Percentage 8.07%

Out of the Money (OTM): 9.19M addresses with a Percentage 13.60%

Analyzing the Bias

These values can be used for the determination of the market Bias. In case OTM is greater than the ITM we say that the asst is a bearish bias and in case the ITM is greater than the OTM we say that the asset is in a bullish bias. In case the OTM and ITM are equal we can see a neutral Bias. In case of ETH we can see that the ITM is greater than the OTM thus we can expect ETH to move bullish.

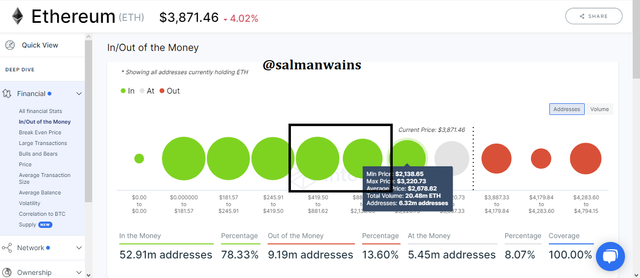

Analyzing the Support and Resistance Levels

As explained by the professor in the lecture we can analyze the support and resistance levels of the market using the GIOM. By looking each cluster and its size. The cluster size and color changes with the changes in the trading pressure of the underlying volume. Simply in case of ETH its cluster size will change when the ETH moves from one address to the other.

A cluster can be called support if it is ITM and can be called resistance if it is in the OTM. The price ranges of ach cluster help in ascertaining the levels of support and resistance. large-sized clusters hold more importance in identifying support and resistance levels than the smaller ones.

For example, if we take two ETH clusters from the above chart with average prices 2,678.62 and 1,503.04.

Both act as a support since they are in ITM.

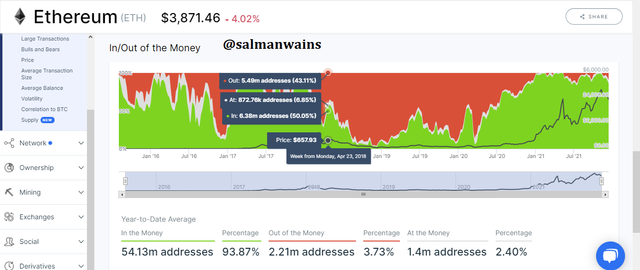

Analyzing Momentum Using GIOM

We can analyze the momentum using the GIOM by looking at the relative difference between ITM and OTM for a cluster with number of addresses for a specific price range in a selected period of time. If this difference comes out to be positive than the momentum is favoring the buyers and if this difference is negative than the market is favoring the sellers on case of momentum.

At a price of about $657.93 we can see the OTM is 5.49M addresses and a percentage of 43.115 on the other hand ITM was 6.38M addresses with 50.05% in this case we see ITM greater then OTM and thus the momentum is favoring buyers.

Conclusion:

There are several on-chain metrics that help us analyze the assets in different aspects. By using the GIOM we can analyze the support resistance levels, describe which side is the momentum is on and in addition to it helps in identification of the density of the assets held and the pressure of the buyers. These metrics often prove valuable for long term traders and whales. The large transaction volume helps in pinpointing large activities on the network. We know these large transactions greatly affect the price.

Note :

All the Screenshots have been taken from the intotheblock.com .

CC:

@sapwood

Club5050 Eligible