This is Season 5 Week 7 of Steemit Crypto Academy and I'm writing homework task about "Risk Management and Trade Criteria" assigned by Professor @reminiscence01.

Question# 1

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading ?

As we all know cryptocurrency and its trading is associated with a lot of risk. Any who trades wants to end it in profit. There are many ways traders can design their trade setups to be profitable but all can go in vain if the strategy is not coupled with a good risk management strategy.

Risk management means to take actions to maximize profit and minimize loss before the trade is done. As is it is understandable that losses cannot be avoided in any type of trading but they surely can be reduced to minimum using the risk management strategy.

These tactics prove ideal when trades do not go the way as predicted. To summarize it all by risk management we mean all the precautionary steps taken to ensure minimized losses if the trade does not proceed as predicted.

Importance of Risk Management

Risk Management is important for the following reasons.

1. Limit loses

One of the most prominent reasons that a trader should use risk management strategy is to minimize losses by placing right stop losses preliminary to the trade ensures the loss does not go beyond that can be tolerated.

2. Prevents over estimation and greed

The traders that have the habit of placing take profits and stop loss levels before the trade do not fall prey to emotional turbulences that in future can turn a profitable trade in loss. Otherwise in case a trader can easily get trapped into the trailing market.

3. Makes trading peaceful

Trading can be very tiring using a tight risk management strategy helps a trader to be at peace knowing that everything is done by calculations and using market experience.

4. Helps in making calculated moves

One of the many mistakes that new traders do these days they place trades haphazardly and then experience losses proper education of risk management allow traders to take calculated steps and thus improve market experience and confidence in trading.

5. To choose trades wisely

Risk management also trains a trader to choose a trading pair wisely it helps a trader evaluate trading conditions based on the viable conditions that the trade will go in profit.

Question# 2

Explain the following Risk Management tools and give an illustrative example of each of them ?

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

Following are some of the most popular risk management strategies.

a) 1% Rule.

It is a type of risk management strategy that sets a specific percentage for investment. This simply means that you need to risk not more than1% of your total capital. Experienced traders follow this rule and often risk not more than 3% of their total investment.

For example: if any trader has 100$ in his investment account so if he uses the 1% tool, he will risk not more than 1$ with 200$ he will risk not more than 2$ if the trade does not go as predicted and so on.

Similarly with a capital for 200$ a trader opens 4 trades thus the maximum he can risk will be 8$ and even if all the trades go in loss, he will still have a maximum left to open further trades. On the other hand, with larger percentage such as 10% at risk he will lose a total of 80$

b) Risk-Reward Ratio

Risk reward ratio is another important risk management strategy that prevents getting trapped into emotions as well as prevent heavy losses. A trader sets a risk reward ratio based on the market structure and indicator readings. Beginners are recommended to use 1:1 ratio otherwise 1:2 is also acceptable.

A 1:2 ratio means that if a trader is risking 10$ he should set a reward to around 20$. Though many traders do not consider a 1:1 ratio worth taking it is quite safe for beginners especially who are learning and understanding the market.

c) Stoploss and Take Profit

one of the other or more commonly used risk management strategy is the stop loss and take profit. Many experienced traders these days use this strategy.

The trade stops automatically when it reaches the stop loss level or take profit level. Stop loss helps to limit loss as when the trade goes against our will. This is an ideal strategy as it protects against both conditions if the trade goes in favor or if it does not.

Traders used different indications to place accurate stop loss and take profit levels such as the MAs, Market structure, breakouts, last peaks and falls etc. But simply a stop loss is set at the price level that a trader can tolerate to lose. Take profit and stop loss when placed along with using risk reward ratio provide an ideal risk management setup.

Question# 3

Open a demo account with $100 and place two demo trades on the following ?

1. Trend Reversal using Market Structure.

2. Trend Continuation using Market Structure?

(Original Screenshots on Crypto pair required)

a) Trend Reversal using Market Structure

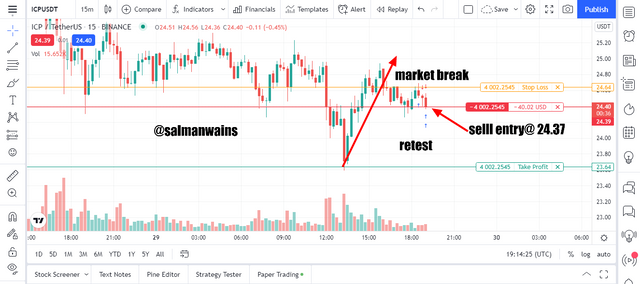

Below we have a ICP/USDT 15 min chart.

In the screenshot below we can see a bullish market trend. The price was making higher highs and higher lows. A dynamic support can be drawn connecting the higher lows. The market after a while broke the dynamic support indicating a trend reversal.

At this moment it is ideal to wait for another bearish candle to start forming to see the trend becoming stable. Once another bearish candle could be seen forming a sell entry was taken. The stop loss and take profit was set near the previous high and previous low respectively which was around 1:1.

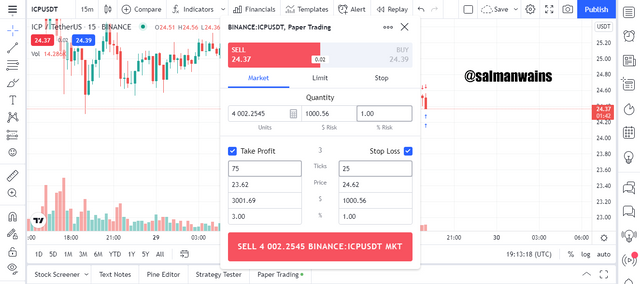

Here you can see the stop loss and take profit levels and the risk level.

My accounts total accounting was around 100056$ and using the 1% rule I was risking around 1000.56$ on this trade.

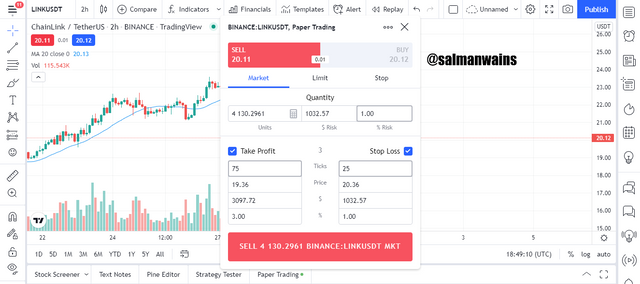

b) Trend Continuation using Market Structure

in the LINK/USDT the current trend was bearish and the next low was lower than the previous low the market thus showed a continuation of the bearish trend. I risked 1% of my total investment here too and placed stop loss and take profit levels using the support and resistance levels in order to make sure that I do not lose more than I can afford. The trade initially did not look to go in favor but I was confidence since I had placed risk and reward ratio.

The following screenshot show the stop loss and take profit levels.

Conclusion:

In this assignment we understood what is risk management and why it is important. To which we described risk management as steps taken before the trade in order minimize losses and it gives the traders the confidence and helps to avoid losses. We also discussed various types of risk management strategies and in the end we tried to use practical examples for illustrations.

Note :

All the Screenshots have been taken from the tradingview.com .

CC:

@reminiscence01

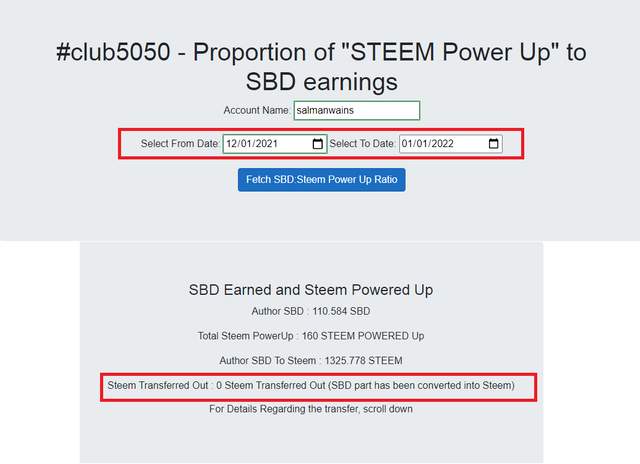

Club5050 Eligible

Hello @salmanwains, I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

Using 1:1 is not advisable. Always aim to gain at least 1:2 of your risk, that way you can maintain positive RR in your account.

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit