Happy new week to all my friend on Steemit Crypto Academy and to the professor @yousafharoonkhan. Thank you for such a wonderful lecture.

Considering the Lectures we are looking at Death and Golden cross in cryptocurrency and more.

Introduction

Cryptocurrency trading is being made easier by the provision of certain analysis. This analysis could be considered historical or can be seen as trends which can be replicated in future trades. Such analysis also helps to eliminate and manage risk that could occur during trading, though may not necessarily be the same but it can be life saving at times.

There are different kinds of trading strategies of which Death and Golden cross can be classified under the Trend trading strategies. Usually some positions in trading are held for a long period of time say two, three months or even more, other are for a short time, trends traders therefore take advantage of this possible outcomes to follow the price trends. This price trends may not always be the same but sometimes very closes to the previous historical trends. In its real case Death and Golden crosses form part of the fundamental analysis during trading. To better analysis there is also need to look at what Moving Averages are.

Moving averages are usually incorporated by investors to determine trends in stock, it is defined as the sum of averages taken at certain points over a specific period of time. This moving average can be in two forms;

Simple moving Average (SMA)

This is derived by adding up recent data points in a given data and then you divide by the number of time period. It actually rely on backward datas to choose the best possible market entry points. Assuming the closing prices of BNB in USD within a 5 day period are 295, 302, 300, 301,305 respectively.

- SMA=sum of prices/no. of days consider

SMA = 295+302+300+301+305/5 =300.60

Exponential Moving Average (EMA)

This gives more weight to the recent price and can be considered to be more accurate than the Simple Moving Avreage (SMA). It usually involves about three steps which I may not discuss here. Further research can be seen here source

Death Cross

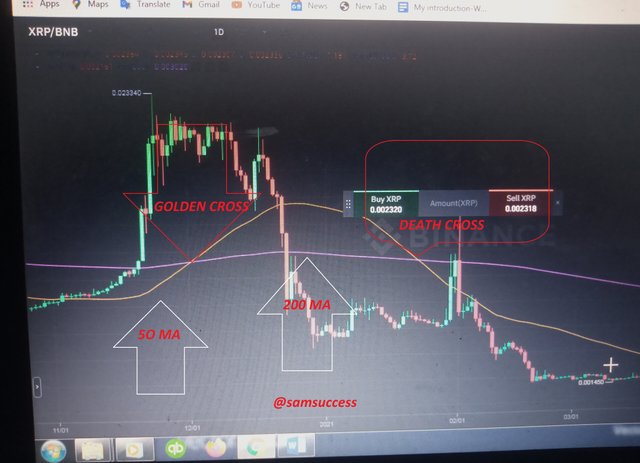

Haven understood what Moving Averages are, we can then discuss what a death cross is. A death cross is the opposite of the golden Cross. Usually and as stated earlier a moving average can be considered both in a long or short term, a short term usually considered is 50 days moving average and a long term usually is also set at 200days moving averages respectively. A death cross can therefore be determined when a long term moving average which in this case is 200days crosses the short term moving average which is the 50days moving averages and then moves downward forming something like a X shape or sign. The death cross usually represents a bear market, an indicator for major sell-off of stocks and has proven to be very reliable. There has been series of death, but the last Bitcoin death cross occurred on March 30 2018 when it dropped considerably.

Significant in trade

A death cross having more moving averages meeting together shows massive sell-off, however if the volumes after the death cross increase, then the downward trend is likely to gain considerable strength. Also if the price trades above the moving averages then a high volume is required to determine a turnaround. As prices start moving upwards selling pressure reduces.

Effect on the cryptocurrency market

A death crosses is followed by a movement downwards representing a bear market. This is a very important aspect of the market as investors see as an accumulation period usually called "Buy the dip". Usually there is panic as most investor sell off, the panic might be due to decisions from big time investors, social media, etc. This is not a happy moments in the market as many loss their investment because of fear of a crash, for those who are patience, the market may profit them. Finally, this does not indicate that the market will be followed by a bull run as there could be a further movement downwards.

Golden Cross

Similarly the Golden cross is also the opposite of the death cross as it indicates a bullish season in the market. In this case a short term moving average crosses a long term moving average, forming an X sign. As discussed earlier, the short term moving average usually is considered as 50 and the long term considered to be 200 respectively. The Golden cross require 3 stages to complete its trend, the first is a downward trend where the selling pressure gets weaker and weaker and eventually overpowered, followed by a shorter moving average which confirms a breakout and prices reversals towards the uptrend and the final stage is the continuous upward movement towards higher prices.

Significant in trades and Market

During the Golden cross, we experience a bullish season and market experience a shift upwards, high prices followed by high trading volumes and we experience a more buying pressure than selling pressure. Traders can therefore determine when to enter and leave the market as bear market is over.

Task 2

How many days moving average is taken to see Death cross and Golden cross in market for better result and why?

The most commonly used average moving averages are 50 and 200. 50 as the short term moving average and 200 as the long term moving averages, day traders use 15 and 50 respectively. Considering a long time or period will give room for formation of a long lasting breakout. The averages however shows specific time increments. The more or larger the period the more possibility for stronger signals, also the larger the chart time, the better and stronger the Golden cross that is determined. This is why a larger moving average is considered in technical analysis.

How to see death cross and golden cross on the chart.

A death cross can be seen when a long term moving average cross the short term moving average. In the same same vain the Golden cross can be seen when the short term moving average crosses the long term moving average forming a king of X shape.

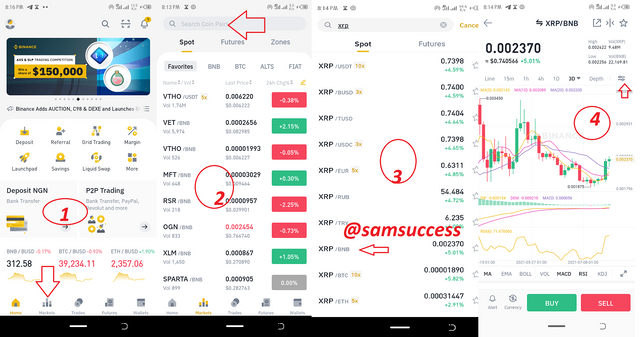

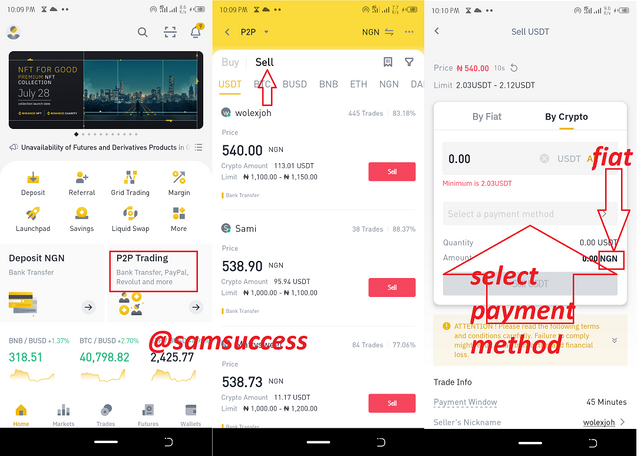

In other to show the death and golden cross on he chart, am viewing it from my Binance centralized wallet. we can view similarly by following the simple steps;

- Log in to your binance account

- go to trade

- choose the currency you want to trade

- A trading view would be displayed

- set your moving averages (MA) as required

What are the things to keep in mind during P2P trade and describe its four advantages and disadvantages?

Care must be taken when using the peer to peer trading feature to buy or sell your cryptocurrency. After you have entered the amount you want to see, it is expected that the buyer will send the value to your account, this will be communicated to you by the buyer through the chat provided in the platform. It is important to first make sure you receive payments,that is the money drops in your account before confirming any transactions to avoid loss of funds.

TASK 3

What is Binance P2P and how to use it ?

Binanace P2P like others is a Peer 2Peer payment system which allow customers buy and sell token with each other, in their own terms and in their own country currency. negotiations are done between the two users , money is then transferred after necessary negotiations and agreements, tokens are also released as well.

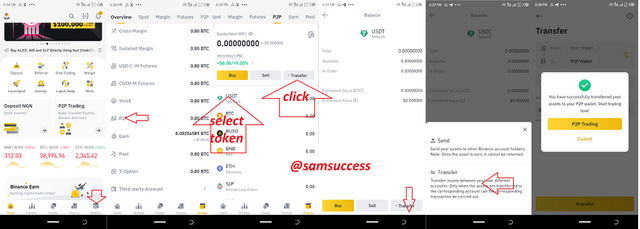

- How to transfer crypto currency to p2p wallet?

- First log ino your account

- the crypto can be transferred to your spot wallet where it can be transferred to the P2P wallet.

- select the token to transfer

- click transfer botton

How to sell cryptocurrency in local currency via p2p (any country or coin)(screen shot neccessary to verify account)

- Once the token is in P2P wallet, it easy to sell by clicking the sell botton

- Log on to your binance account and click P2P

- select your payment account

Advantages of P2P

Zero trading fees: Peer to Peer guarantees a zero trading fees means anybody can use it. This allows users to receive 100% gains and having no fear of paying any charge

Multiples choice and Fiat currencies: Peer to Peer service especially on Binance exchange provides us with multiple currency choice to choose, you can sell even using your prevailing country currency. Fiat currencies provides also makes it a wonderful place for exchange.

It's Local and global market place: It present itself as a local and global market place. In a Peer to Peer system the user chooses who he sees his cryptocurrency to, viewing and accepting the price. He is also free to determine his price, he also choose how he wants to receive his payment and finally confirms transactions when payment drops in his account.

Provision of an Escrow service for safety reasons: Binance provides an escrow services to guarantee users safety. An escrow service is usually an arrangement where a trusted third party is allowed to foresee transactions between two parties. Once a buyer places an order, and upon receiving the funds and confirmation, funds are transferred directly to buyers wallet. All these and many more makes Peer and Peer a secure market place.

Disadvantages of Peer to Peer

Reliability: A Peer 2 Peer system is always powered by a centralized exchanges which is also powered by a software, should this software fails, then a serious problem can be encountered. Most importantly also, they are powered by networks which may or may not be available at all times. Unavailability in network pose a barrier to P2P usage.

Lack of Regulation: Since there is no lack to entry, scammers might be admitted into the system. These scammers may be sellers or even buyers, for this reason payments must be confirmed before confirming transactions.Security: Security on P2P trading not totally be guaranteed, even n with measures put in place. An example can be considered to be cyberattack which could cause a state of unrest for investors and traders using the platform.

Decentralization: Though P2P trading networks are powered by centralized exchanges, it is itself a decentralized system and involves two persons connecting each other through the platform. There could be traces of theft and losses.

Conclusion

Death and Golden cross form a very important aspect in determining trading points in stocks and cryptocurrency. Cryptocurrency is really very uncertain sometimes and these are fundamental analysis/trends needed to inform the entry and selling points in the market.

P2P inclusion in Centralized exchanges have really made trading more possible and easy, especially trading in our local fiat currencies though poses some risks which have been mentioned and care must be considered to avoid them.

Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week 5

thank you very much for taking interest in this class

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you most respected Prof. @yousafharoonkhan.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit