Greetings to the students and professors in the crypto academy.I wish to participate in this week's homework post for Professor @asaj

INTRODUCTION

Trading Psychology deals with how a trader controls his emotion as regards to buying and selling.It is always good to perform proper technical and fundamental analysis before making any move in the market.

A good trader does not act on how he feels or his mode rather acts on the trend in the market as to know the best time to buy,hold or sell.

•PART A(CASE STUDY)

QUESTION ONE

The case study about JANE in part one is simply a case of Trading Psychology which means the trading behavior of an investor.

Jane as a case study was an investor who made a couple of wrong decision because she did not perform proper technical analysis,rather she relied on peoples opinion and her emotional point of view to make such a poor decision that she definitely regretted.

When Jane learnt about the price of the asset was at $9, indecision and poor technical analysis made her not to buy,otherwise she would have made a profit of +66.6% when the price moved from $9 to $15.

Also when she finally bought at $15...the price later moved up to $20 but because she didn't consult charts like candlestick,line chart to understand the price movement,she continued to hold her asset thinking that the price will continue to go up(a bounding rationality bias).

Unfortunately,the $20 was the resistance price level and then the price started to go down.If she has sold it at $20....she would have still made a profit of +33.3%.

To cap it all,when the price went so low,she allowed her emotion to control her by setting a stop-loss at $5 which means that once the price gets to $5,the system will automatically sell her asset on her behalf.This is fear at its peak.

She was happy when the price continued to go down ,because she has sold off her asset at a stop of loss of $5,so she thought she had made a wonderful decision.

However,when when the price went up and then got up to $10....She regretted setting the stop loss at $5,she never knew that the price will later come up and so she sold an asset of $15 at $5.This is nothing but a loss of (-66.6%).

Jane's anger would definitely boil a kettle of water if she sits down to properly count her loss which was caused by Trading Psychology and lack of Technical Analysis.What do I mean?

Imagine she has bought at the initial $9 and then sold at the resistance level of $20....It would have been a profit of +122.2%....

BOTTOM LINE FROM JANE'S PREDICAMENT

It is always good for an investor to:

•Make proper market analysis before Investing.

•It is not good to rely on people's opinion about the market.

•It is not good to allow our emotions to guide how we INVEST,maybe buying or selling out of anger,fear and good a sound judgement.

QUESTION TWO

BIASES THAT INFLUENCED JANE'S TRADING BEHAVIOUR

From the lecture and from the case study of Jane.I believe the following biases influenced her trading behaviour.

•Emotional Bias

This is one of the bias that affected her judgement.She did not do technical analysis as to know the price movement and market trend.She only used my personal/emotional mood or how she feels to make decisions.Decision making should be based on the market sentiment and not personal sentiment.

She entered the market late due to indecision.Then when she finally bought at $15 ...she could have at $20 but because of GREED which is a type of Emotional bias,she held on thinking that the price will continue going up.

Fear as a type of emotion also made her to set a stop loss at $5....she never knew that the price will later come up again.

•Confirmation Bias

This is another form of bias which affects traders.This is a situation where a trader takes a decision and when it work in her favour,she thought that she has taken a wise decision.

When Jane sold at at a stop loss of $5...She was so happy because the price was even getting lower and so she thought she has made a great decision.However,when the price made a reversal and moved up to $10...She felt so bad.

•Herd Mentality Bias

It is a situation where a trader rely on the information from other investors or a group of investors without making proper research.

This approach could be suicidal because the investors in question may not have even done a proper technical analysis.

When Jane relied on the Telegram group for information and trade signals,she was actually having the Herd Mentality Bias.

•Disposition Bias

This bias arises when a trader is making more purchases more and more assets when the price is going down.This approach could be disastrous because the bearish season might continue for a much more longer time, causing the trader to lose more or even sell at a much more lower price.

Jane made some purchases when the prices where going down.Leading to further loss.Who knows how much she has invested in that process.

•Self Attribution-Bias

This is a common situation where a trader praised himself when his decision goes well but when the decision goes south(the wrong way),the trader will start blaming other factors for the problem.

In the case of Jane,she felt happy when the price went below $5 bit when the price went up to $10....she started blaming the stop-loss feature for her predicament.

QUESTION THREE

How Can Those Biases be Avoided??

•Emotional bias could be avoided when a trader makes sound and logical decision:making decisions based on the market trend instead of allowing how we feel and what we think to control our decision.

•Confimation bias could be avoided by having the knowledge that there is always a rise and fall in crypto market and a prize fall may not last long.

•Herd Mentality bias could be avoided by making our own proper analysis instead of relying on other people or a group to influence or control our trade decision.

•Disposition Bias could be avoided by having a specific on how much we budget for investment so that we won't be tempted to over buy when prices are low,because over buying when prices are getting lower may lead to further loses.

•Self Attribution-bias can be avoided by not being in haste to make decision when prices arent in our favour.For example, Setting the Stop-loss feature should be done only after a proper study of the price movement and market trend.

PART B(RESEARCH AND ANALYSIS)

QUESTION ONE

WHAT TYPE OF ANALYSIS COULD BE USED TO MONITOR MARKET PSYCHOLOGY AND TRADING PSYCHOLOGY AND WHY???

•Market Psychology

Market Psychology had been defined as the behaviour and emotional disposition of people or traders in the market at a given period of time.This behaviour and emotional of traders affect the rate of buying and selling.Although most times,market psychology is decietful because it is based on sentimental analysis.

•Trading Psychology

It is the behaviour of an investor.It colud be called Trading behaviour or an Investor's behaviour and it is affected by a lot of biases which are bored out of sentiment and emotional behaviour.

To monitor both Market Analysis and Trading Psychology,I suggest that Technical and Fundamental Analysis are very paramount.Why do I think so???

My reason is that Technical Analysis is an analysis of price using graphical representation to determine the market trend.Technical Analysis involves using charts like candlestick,bar chart etc to study price movement so as to know the right time to enter the market and when to exit the market.

Technical analysis will help to know whether there is Resistance or Support, Bear or Bull etc.

This is possible because the charts shows the price movement so that one can see when the graph is moving up and when it is moving down.

The Whales cycle would also help to make informed decision in the market,one can identify the Accumulation Phase, Uptrend, Distribution and Downtrend and so can make proper decision devoid of the aforementioned trading biases.

Infact one can even use Technical Analysis to check the market for as low as 1-hour basis as to know the opening price,highest price,lowest price and closing price for the selected time frame.With his knowledge,a trader can monitor the psychology or behaviour of the market traders.

On the other hand, Fundamental Analysis will help to know the price of the asset,its trading volume,dominance,market capitalization and supply.Proper knowledge of Fundamental Analysis will help monitor the market psychology and make proper trade decisions.

Differences Between Trading and Market Psychology

| TRADING PSYCHOLOGY | MARKET PSYCHOLOGY |

|---|---|

| It is the sentimental behavior of an investor | It is the sentiment of market actors or traders over a period of time |

| It is guided on personal emotion | It is built on the sentimental behaviour of the markets investors |

| Logical Reasoning without bias must be necessary | Proper Technical and Fundamental Analysis must be necessary |

QUESTION TWO

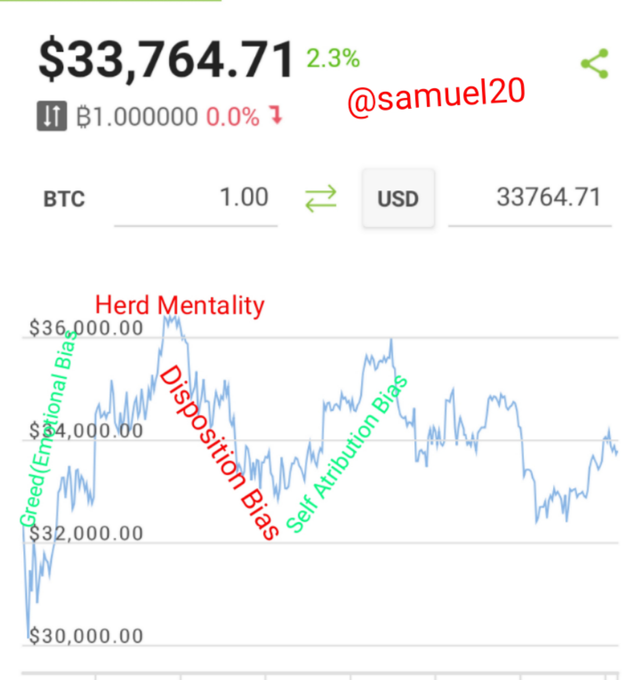

USING A CRYPTO CHART TO IDENTIFY AND EXPLAIN TRADING BIASES

I will try to use the chart above to explain some trading biases.

•From the chart,the price of BTC moved from $32,000 down to $30,000 and then got as high as $36,000.I believe Emotional Bias can set in here when trader continued to be greedy by not selling,instead continue waiting for the price to continue moving higher and higher.Unfortunately,the price never went beyond $36,000 again.The Uptrend period will lead to overbought as the price has moved from $32,000 to $36,000.

•At the price where the price got to $36,000...Herd Mentality Bias could set in,because a trader may follow the crowd to buy at this time without checking to know that the price has already got to Resistance level and so the trader is trapped because the price has started going down.

•Disposition Bias is sure to happen,this is because a trader might continue to buy thinking that he will lower the purchasing average.However,the price went down from $36,000 to almost $32,000.This period will cause oversold.

•Self Attribution-Bias is evident here.The trader is happy that the price has gone down below the price that he sold his asset.

Unfortunately,the price started moving up again,and the trader is now regretting and blaming the market as to how he sold on the low and now the price is going high.

QUESTION THREE

Efficient Market Hypothesis (EMH)

There is an adage in my place that says

You can cheat someone* all the time,you can cheat everybody sometimes but you can't cheat everybody at all times.

The Efficient Market Hypothesis is a theory that suggest that it is virtually impossible to win the market at all times.The theory suggests that although a trader can buy a stock that can give a short-term juicy profit,however,the juicy profit cannot continue forever because no one can beat the market at all times.

The Efficient Market Hypothesis suggests that one can not always use Technical and Fundamental Analysis to win the market rather taking risk is the key.

This is evident this year,I bought dogecoin after all the hype about dogecoin.I bought it late and since then the price has continued to go down, now I am experiencing the Disposition Bias.

The fact is that provided stocks trade at a fair market price,then it is almost impossible to buy undervalued stocks at a bargain or even to sell overvalued stock at a very high profit margin at all times.

Efficienct Market Hypothesis is divided into:

•Weak Form

•Semi-strong Form

•Strong Form

Advantages of Efficient Market Hypothesis

•It saves a trader the rigmarole of making Technical and Fundamental Analysis by studying candlestick,bar chart,line chart, volume chart etc.

•It saves time because the trader has known that no amount of market analysis can guarantee making profit at all times.

•One can make huge profit from it since the profit is always high when it happens.

Disadvantages of Efficient Market Hypothesis

•It can make a trader to always be at loss because the trader neglects or does not see the need to make Technical and fundamental analysis.

•It is like a gamble-full of uncertainty.

•It will make a trader to lose faith in the other stocks whenever he incurs a heavy loss in one stock.

CONCLUSION

Trading Psychology is an important skill to master because when it is done without proper logical thinking,it would be very disastrous.The trading psychology of many or all the traders is called market psychology.

It is important to use technical and fundamental analysis to analyze the market as to know the best time for entry and exit.

Efficient Market Hypothesis suggest that nobody wins at all times,so we have to invest with caution to avoid regrets.

.jpeg)

Hi @samuel20, thanks for performing the above task in the second week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 6 out of 10. Here are the details:

Remarks:

Brief but straight to the point. I enjoyed your straightforward approach of answering questions. However, your answer to Question 5 isn't particularly accurate. Overbought and Oversold zones can be discovered using technical indicators. The graph you uploaded does reflect such detail.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you prof @asaj

I will do better.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit