SWING TRADING

Swing trading is defined as a form of trading that sets its initiatives on earning to diversify profits over a short time interval. Traders in swing trend tends to view and capture uptrends and downtrends in the stock markets. Traders in this swing trend tends uses various hi-tech gauge to seek chances to recognize various forms.

In swing trading, traders are not required to spend much time than viewing the trends in the stock market constantly because the trades might exceed days or week

Source

In the above sourced diagram,

STRATEGIES INVOLVED IN SWING TRADE

The major aim of swing trading is to utilize methods that will enable you encapsulate a single move.

In stock markets, several strategies are used to achieve this most especially in swing trading. I will be explaining some strategies involved in swing trading.

Some of this strategies includes:

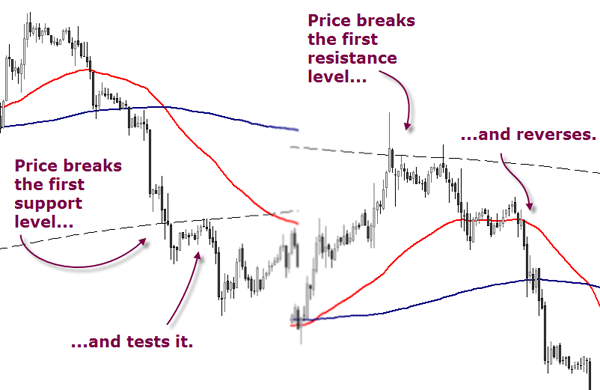

Support and Resistance

This method is being implemented by users to know about price range on stock charts that acts as a stumbling block, and avoids the price of trading profits to being shifted from a certain point of view.

Hi-tech analysis takes advantage of support and resistance measures to locate price position on a stock chart where the likelihood benefits a stagnation or backtracking of a winning trend in stock trade. Support do happen literally when a downtrend in stock market is required to undergo stagnation because of inflation in demand from traders.

While resistance occurs when an uptrend is required to also undergo stagnation for a situated time Fibonacci Retracement

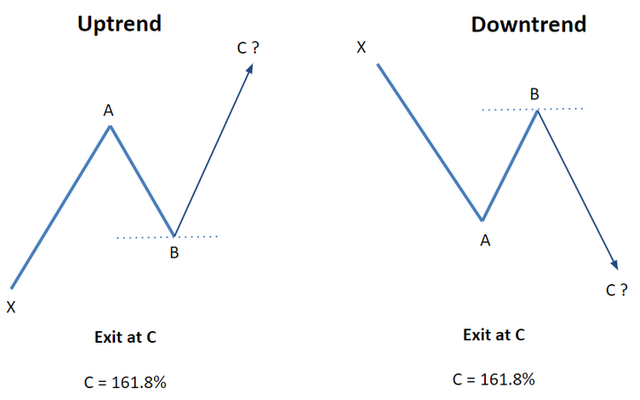

This plays a vital role in aiding traders to know the range of support and resistance and the realizable backtracking range on trading stock charts. A swing trader might engage in a short term out trader point if the downward trend goes down a speculation position.

Fibonacci retracement position initiate forms possible to aid make available ranges of support and resistance in a condition where a turnaround in management might occur and be implemented to inaugurate positions of entrance or approach.

From the image source, it simple narrates what happens in an uptrend and downtrend.

Uptrend encourages traders to attempt entrance at position B and then know the level of the previous conjecture from A to B, to know the extent the swing will make before it moves to position C. – i.e. 161.8% level.

While in downtrend, stock traders, will ensure to access the emendation at point B and then know the level of the initial speculation from position A to position B and know how the swing would emanate before reaching the position C. i.e. level 161.8%.

CRYPTO ASSET PAIR

A crypto trading pair can be said to be a task or an activity where you have various currencies (crypto-currencies or paper-currencies) to merchandise between each other. When crypto-currencies are being traded, it is being traded between local currency that is accepted to carry out normal buying and selling activities in your location. For instance: If you are trying to buy a Tron Coin with Nigerian naira, the trading asset pair will be TRX to NGN. This form of trading can also be carried out in other crypto-currency coins like: LITCOIN, BITCOIN, SHIBA, and ETHERIUM AND MAN OTHERS.

Crypto asset pairs also entails trading a particular crypto coin for another not necessarily using local currencies

The understanding of Crypto assets pair is vital to traders because some crypto currencies can only be traded with other cryptocurrencies. Understanding the working principles of crypto-pairs is vital to broaden the traders mind on how to trade, when to trade and more.

ENTRY AND EXIT STRATEGY

The entry and exit strategy is a tactical strategy that is required of traders to imbibe on a made plan to gain knowledge on when it is best for them to know when to enter the trading market and at what time it is best for them to exit the market.

Traders should also device an alternative plan incase this don’t works out. By entering the market at a wrong time and exiting at a wrong time. This is necessary to avoid huge loss.

Although, there seems to be no visible entry and exit strategy that will benefit every crypto-trader in the market.

In entry and exit strategy there are so many factors to consider such as:

At what time intervals would you like to make profits, what percentage of profit do you e=intend earning and how long will it take you to make such profit desired.

It is very necessary to keep all entry and exit strategy easy and not complex.

It involves more time for one to participate in the market.

MULTIPLE AND TIME FRAME ANALYSS

This requires viewing equivalent currency asset pair across different platforms, without requiring intervals at which various reoccurrences could be followed and also to know the successful one to choose. This can be achieved by using various time intervals to monitor the market. Example can be: 10 minutes, 20 minutes or an hour. It can also take weeks. Months or so. It is just dependent of the trader.

CANDLESTICK ANALYSIS AND USE OF OTHER RELEVANT SUPPORTING INDICATORS FOR YOU TO TRADE

DECISION

Candlesticks analysis pattern are used to forecast the management of price flow in trading market. Candlestick charts seems to be one of the most used piece of hi-tech analysis, to ensure that traders are able to explain price details more quickly and efficient.

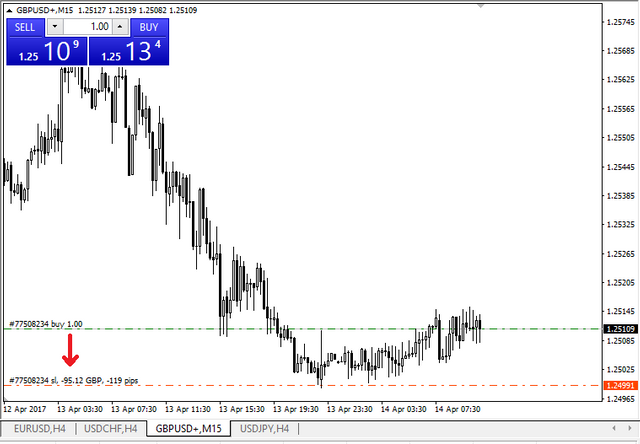

TRADE MANAGEMENT (SETTINGS, STOP LOSS, TRADING STOP AND TAKE PROFIT)

One of the best method for initializing this process is by trading instantly when requesting for new orders in the market.

To achieve this, you are expected to enter a desired cost in the stop loss entry field, after initializing this, it i=will be Implemented automatically when the trade hires your desired position.

Trailing stop are costless to use and they safe guard your trading account to avoid adverse market moves.

Thank you Prof @yohan2on for this master piece thanks so much

Hi @samuelj

Thanks for participating in the Steemit Crypto Academy

Feedback

This was more of a practical homework task. You mostly shared about the various aspects required for Swing trading but you did not clearly demonstrate that knowledge on the charts.

Homework task

1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I skipped your article because you used a wrong tag @yohan2on-2sweek7 instead of @yohan2on-s2week7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much prof i appreciate your input hope to do better next time

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit