My Experience Investing in the Crypto Market

None of us could have predicted how rapidly things would alter when the first Bitcoin was introduced in 2009. Almost every day a brand-new phrase for cryptocurrency pops up since it has grown so popular in modern society. Millions of people are investing in digital assets and exchanging them on various online marketplaces, resulting in a market capitalization of cryptocurrencies that exceeds $200 billion.

The cryptocurrency industry has rapidly gained popularity for a number of excellent reasons. Due to the lack of a requirement for in-depth corporate expertise or risk-averse investors screaming for your shares, investing in cryptocurrencies is far simpler than in regular stock markets (trust me, I know from experience). Additionally, there are no minimal criteria to register a brokerage account and begin trading like everyone else, making it far more accessible than traditional assets. Everything you need to know about investing your hard-earned money in cryptocurrencies will be covered in this tutorial. Let's start now.

Discuss your first experience investing in the crypto market.

My first investment in the cryptocurrency market is something I still clearly recall. After researching different digital currencies, I made the decision to invest in a few of them. On a well-known exchange, I created my account and sent some funds there. I started buying and selling different coins after that, occasionally turning a small profit. But as time went on, I came to understand how volatile the cryptocurrency market is and how one must exercise extreme caution to avoid suffering significant losses. I also discovered that the market is full of fraud and scams, so investors need to be especially watchful. Overall, it was a positive experience because I gained a lot of market knowledge and made some money.

What is your first investment in the crypto market and what drives you to invest in the crypto market.

When Ethereum was introduced in 2015, that was where it all began for me. When blockchain was first proposed as a decentralized, trustless method of exchanging assets, I was a college student and found it to be quite intriguing. I wanted to be able to invest in Ethereum because I believed it may be the next big thing. I studied up on the topic fast and realized that investing is a journey, not a destination, so I started looking at other coins.

I then started reading about the development of ICOs (initial coin offerings), which made it possible for anybody to generate money through the sale of tokens.

I quickly learned that investing in tokens was far more approachable than investing in businesses, which is why it's so enticing to many people. Even ICOs with viable business concepts were risky investments at the time since they frequently didn't represent something that would actually materialize (the most well-known ICOs at the time were virtually always frauds).

I made my initial investment in the cryptocurrency market by purchasing 10 dollars' worth of ethereum. I didn't know what I was doing at the time, and since Ether is now over $1,000 a token, it was a pretty costly error.

Have you ever encountered any loss as a result of the instabilities in the crypto market? Discuss

Yes, I have suffered some losses as a result of the volatility in the cryptocurrency market, but the majority of my losses have been the result of poor investments and portfolio management errors.

I've known from the start that I needed to monitor my portfolio and rebalance it frequently, but I frequently neglected to do so. I also did a poor job of rebalancing my portfolio when I first started investing in the cryptocurrency market, which is how I ended up with a lot of coins with low market caps. Keeping track of your portfolio and regularly rebalancing your holdings is crucial if you're new to investing in the cryptocurrency market. By doing this, you'll be able to avoid many of the common mistakes that new investors make.

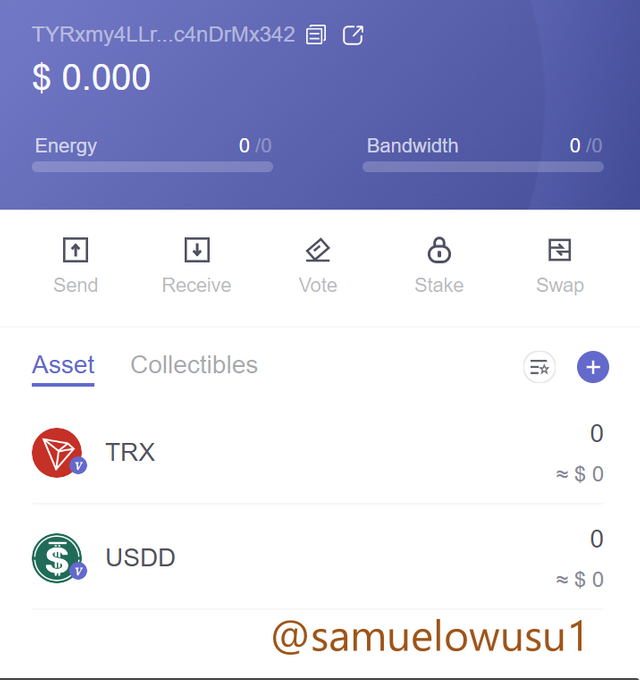

What crypto assets are you currently holding? Why did you invest in them? Please take a screenshot of your portfolio.

In my tronlink wallet, I have no crypto assets at the moment.

As an experienced cryptocurrency investor, Do you believe in Holding or Trading cryptocurrencies?

I used to trade, but as my investment grew, I started to believe that holding a large portion of my assets in safer assets like cryptocurrencies was a wise decision. Holding a small portion of your investment in safer assets can help shield your investment collection from sizable losses. However, cryptocurrency is a risky asset class, so it's important not to play it too aggressively. Many people believe that you should only invest in cryptocurrencies, but you are not required to do so. There are many different asset classes, some of which are worse than others. Trading cryptocurrencies is much riskier than trading stocks and bonds, so if you're going to invest in traditional assets, you're probably better off doing it through a licensed broker-dealer.

What's your advice to a newbie investing in the cryptocurrency market.

First and foremost, you must comprehend that this market is highly speculative. Cryptocurrency prices frequently fluctuate greatly, and if you don't understand the risks involved, you could lose everything. The best piece of advice I can give you as a novice investor is to keep your investments modest and approach them as a gamble; you don't have to put every last penny into them.

If you want to invest in cryptocurrencies, there are many different investment vehicles you can use. A cryptocurrency exchange, where you can buy and sell tokens, is the most popular way for people to invest in cryptocurrencies. The well-known exchanges Coinbase, Gemini, and Binance are just a few. You can also invest in stocks and bonds through a broker-dealer if you're looking to invest in a more conventional asset class.

Conclusion

Trying to trade cryptocurrencies the same way you would stocks and bonds is the worst thing you can do, you must first realize.In traditional markets, investing in businesses that have submitted publicly available financial reports and are subject to audits by unbiased accounting firms gives you some level of fraud protection. Contrarily, when it comes to cryptocurrencies, you typically work with a crowdfunded project that hasn't even begun to produce anything, much less submitted a public financial report. This indicates that no impartial third party is available to confirm the project's legitimacy. Additionally, you have no way of knowing the project's level of risk or the proportion of the crowdfunded tokens that are actually valuable.

Thank you

muy buen trabajo, cada día que pasa vas a ir ganando experiencia y podras ser un gran criptoinversor

exitos y feliz inicio de semana!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit