DIFFERENT CRYPTOCURRENCY INVESTMENT

It is well known that to hold cryptocurrencies, a storage is needed which is known as a wallet. Basically there are different types of wallets ranging from cold, wallets, hot wallets, etc. This wallets differs and is used by different people for different purposes. Individuals have their own personal interest and chooses the one which benefits them.

WHY I PREFER HOT WALLET

Personally, I love Hot wallets, because it is quite easy to use and operate. Although there are cases where the wallet can be hacked if one isnt very careful. The hot wallet is further categorized into 3 which are the Exchange wallet, mobile or desktop wallet and the web wallet.

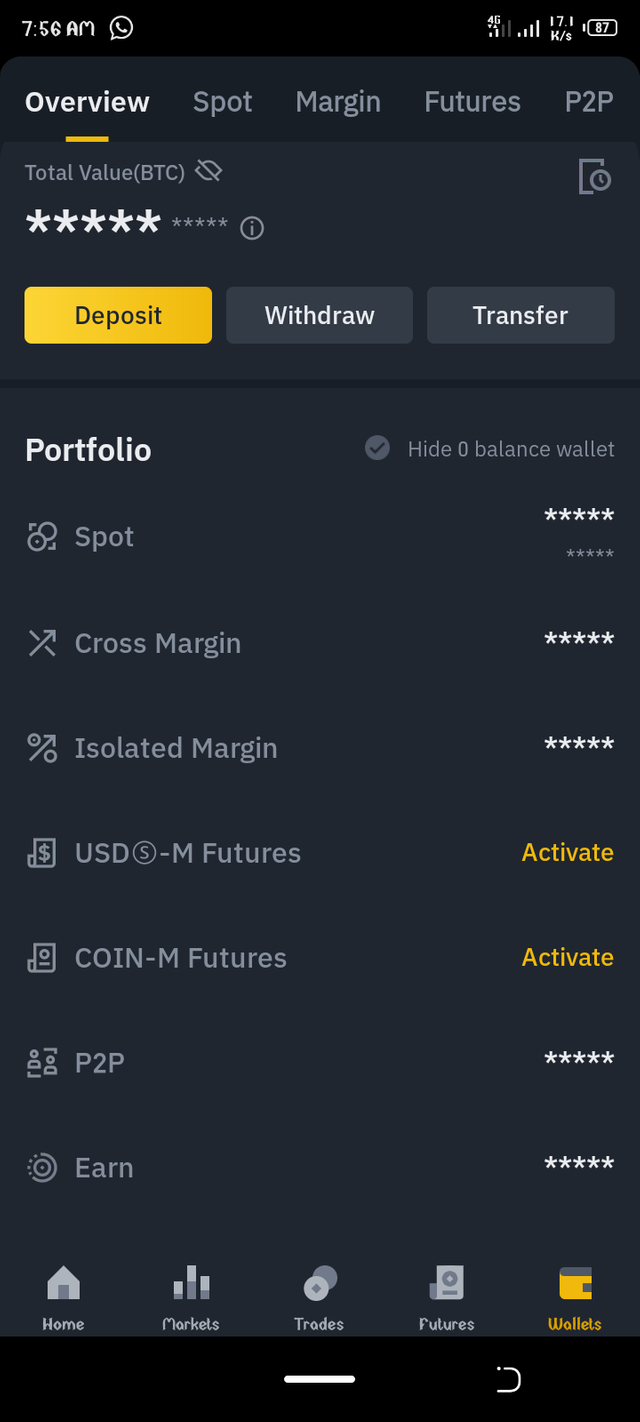

All token I plan to hold or I am holding are been kept in the hot wallets. I am able to do trading with binance and at the same time keep my coin on it.

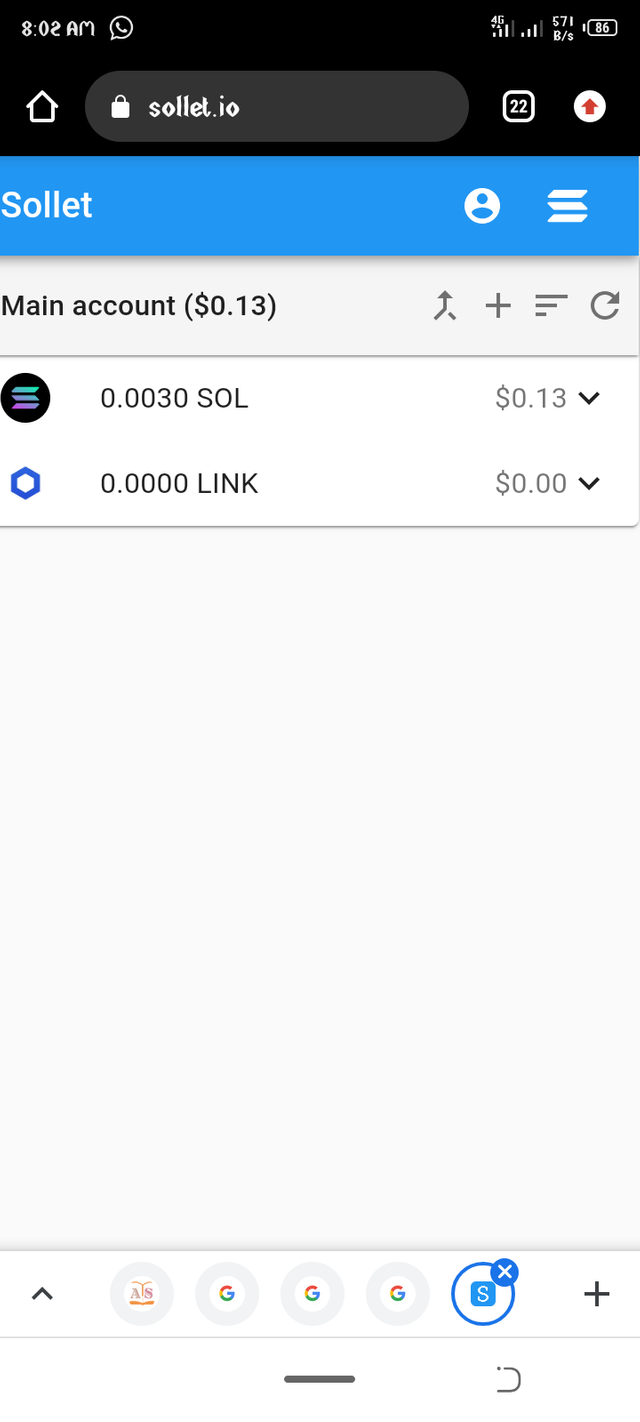

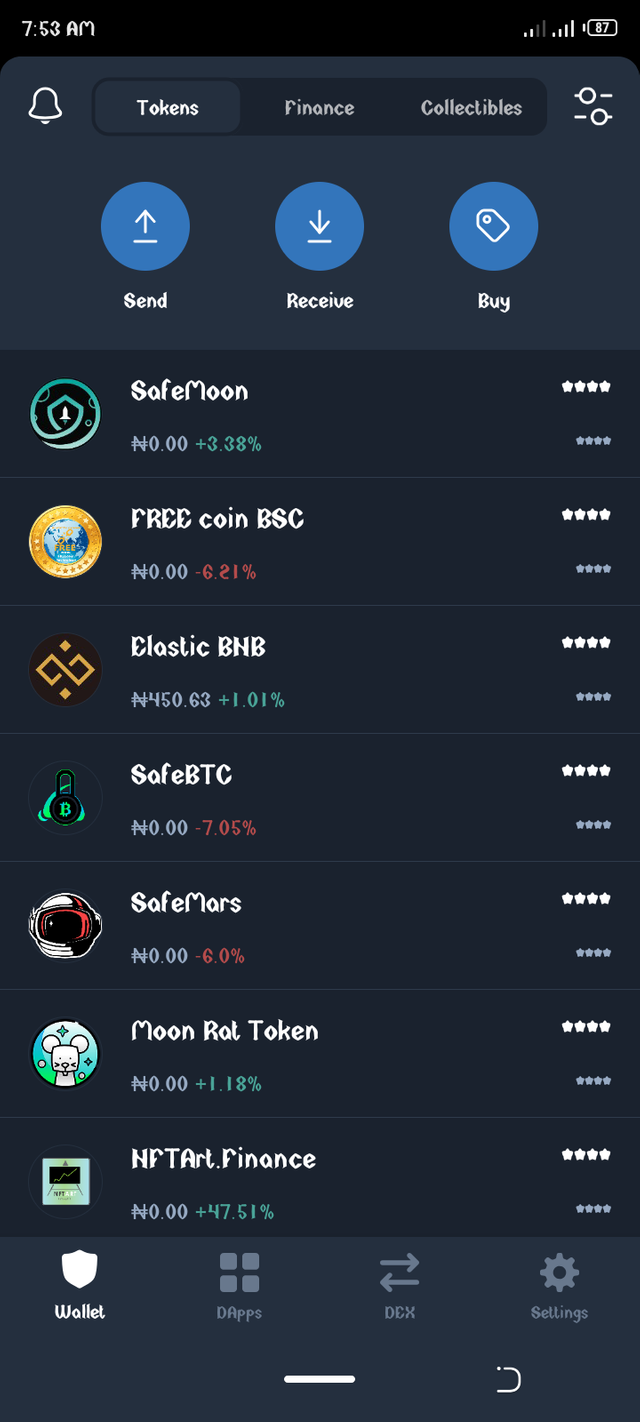

Screenshots of hot wallets

HOW TO SPOT TRADE ON BINANCE

Spot trading in a nut shell is a kind of trading that is done in cryptocurrency to take profits either through coin and Fiat or coin for coin. To trade spot one needs a wallet and I will be making use of binance for this tutorial.

Under spot trading we have 4 features

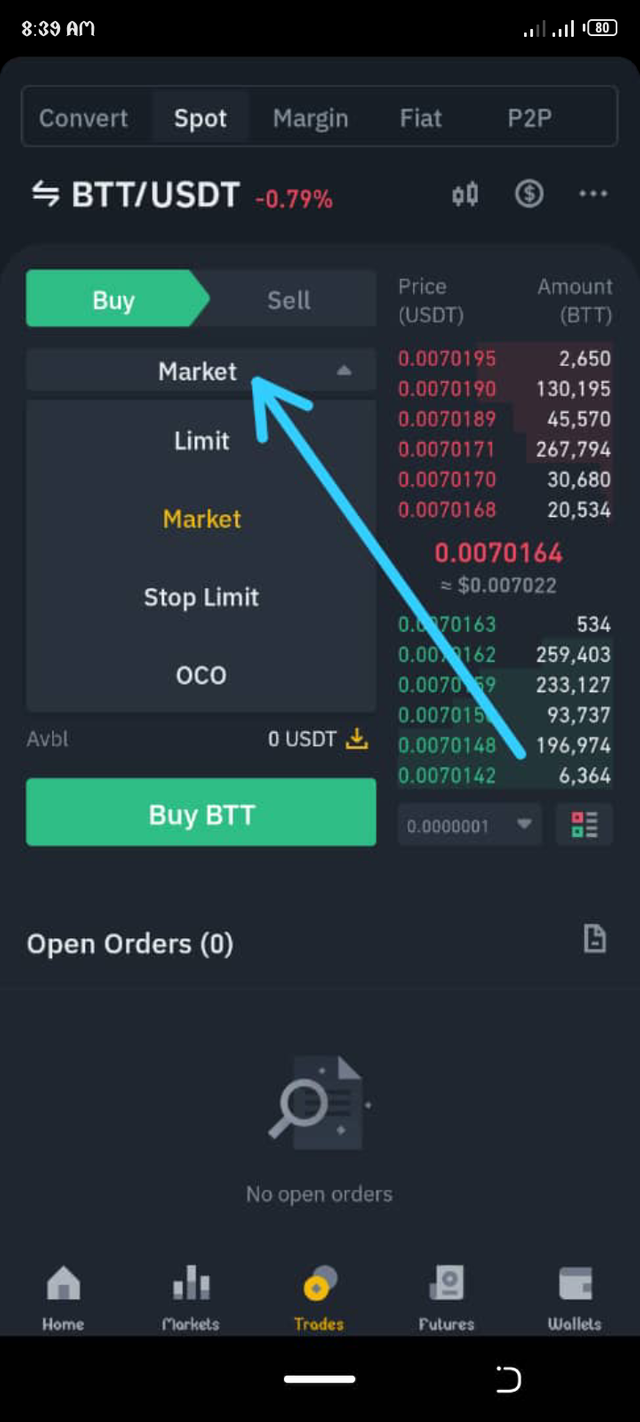

which are MARKET, LIMIT, STOP LIMIT and ONE CANCEL ONE(OCO).

MARKET

This trading doesn't have any technicality in it. it's just to buy/ sell a coin at the current price.

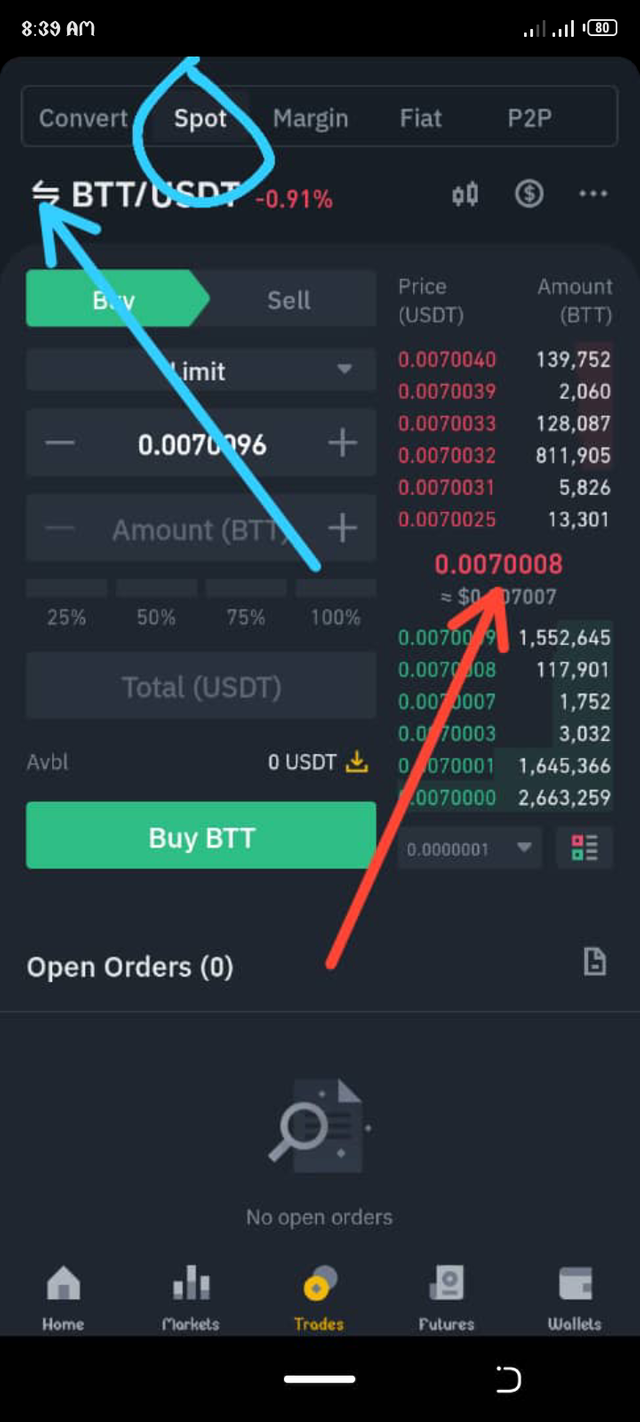

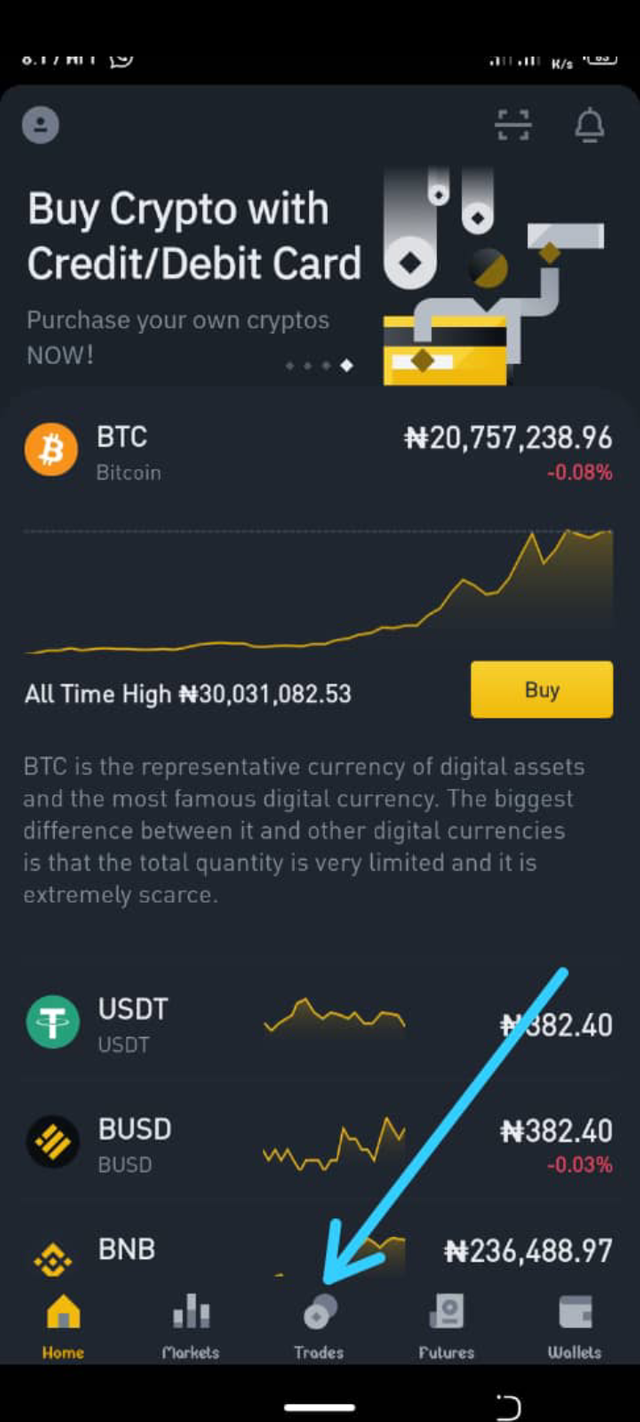

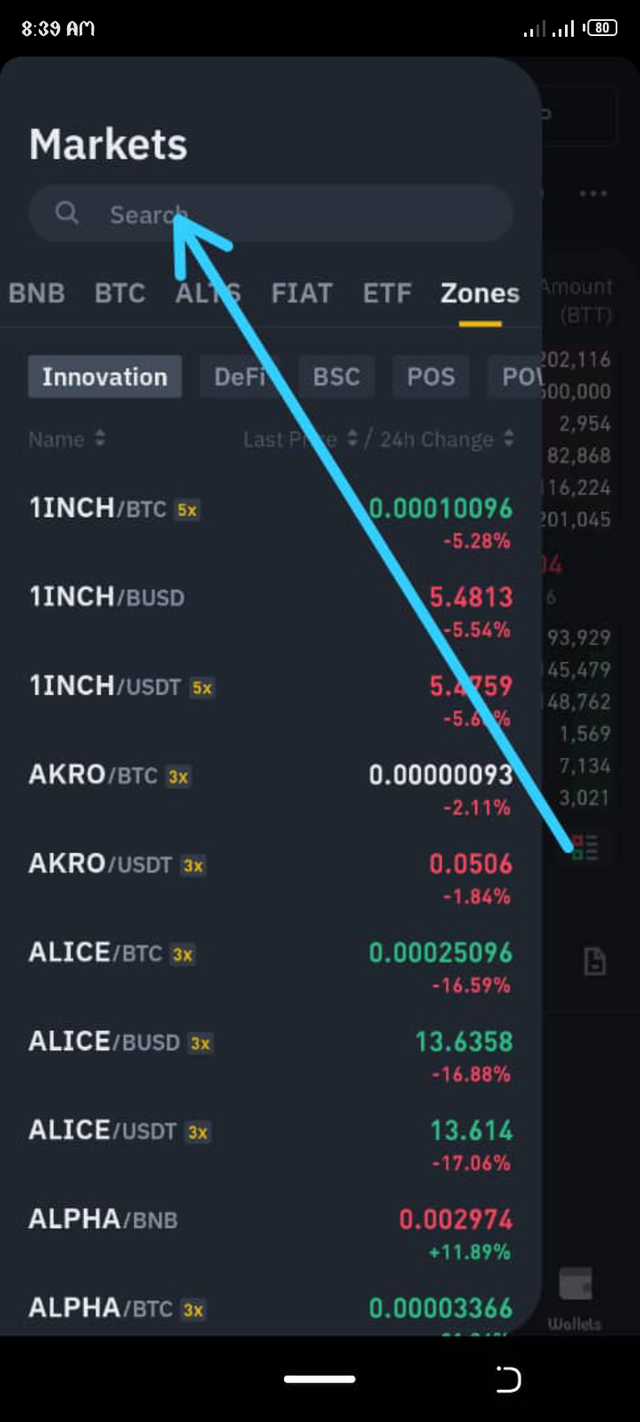

When you open the binance app. Click on the trade icon, it will take you to the interface and put you on spot trading as circled. Then click ok the icon the blue arrow is pointing at to select the pair you want

to trade, I selected BTT/USDT. The red arrow is showing you the current price.

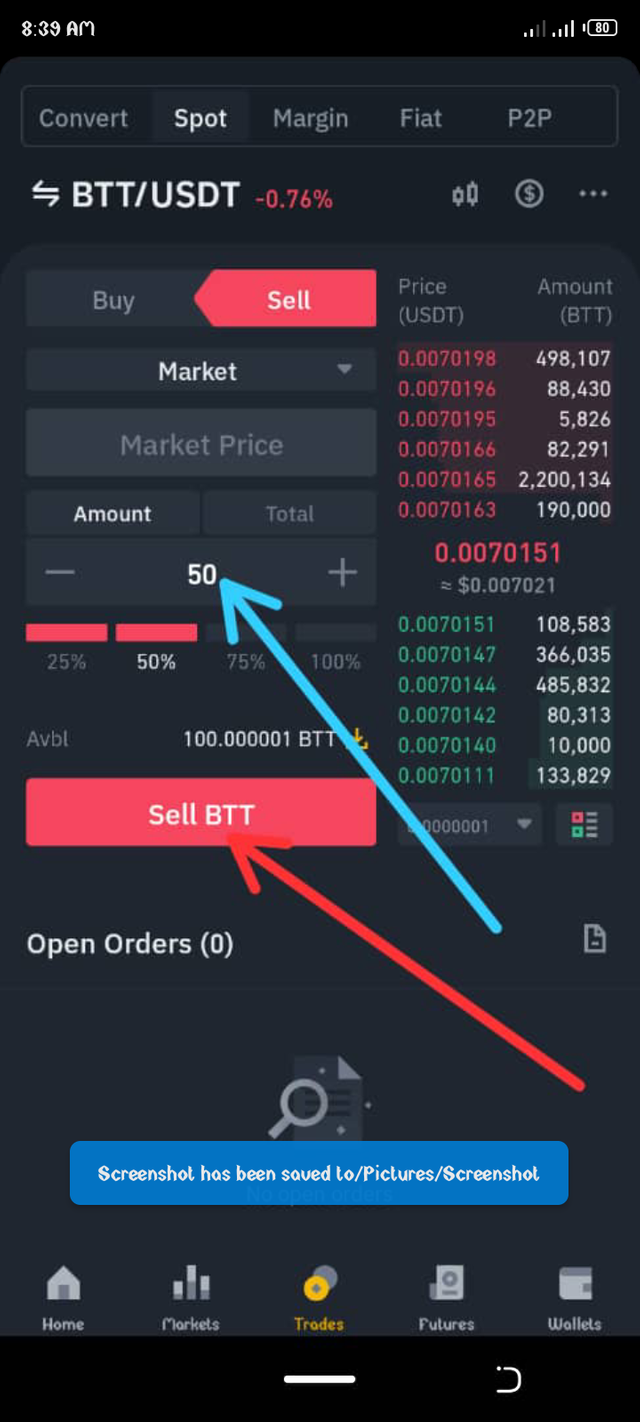

After selecting a pair you then click on the market icon it all show you a drop down of all features because we are using market we click ok market. I want to sell my BTT for USDT so i will click on sell and input my amount where the blue arrow is pointed, then I click sell. The transaction bwikk write successful.

LIMIT

This is a kind of order that allows you to set the price of whatever coin you want to buy or sell my yourself. You can say you want it to help you buy a coin which is at $40 at $35...so whenever the coin gets to that amount it buys for you.

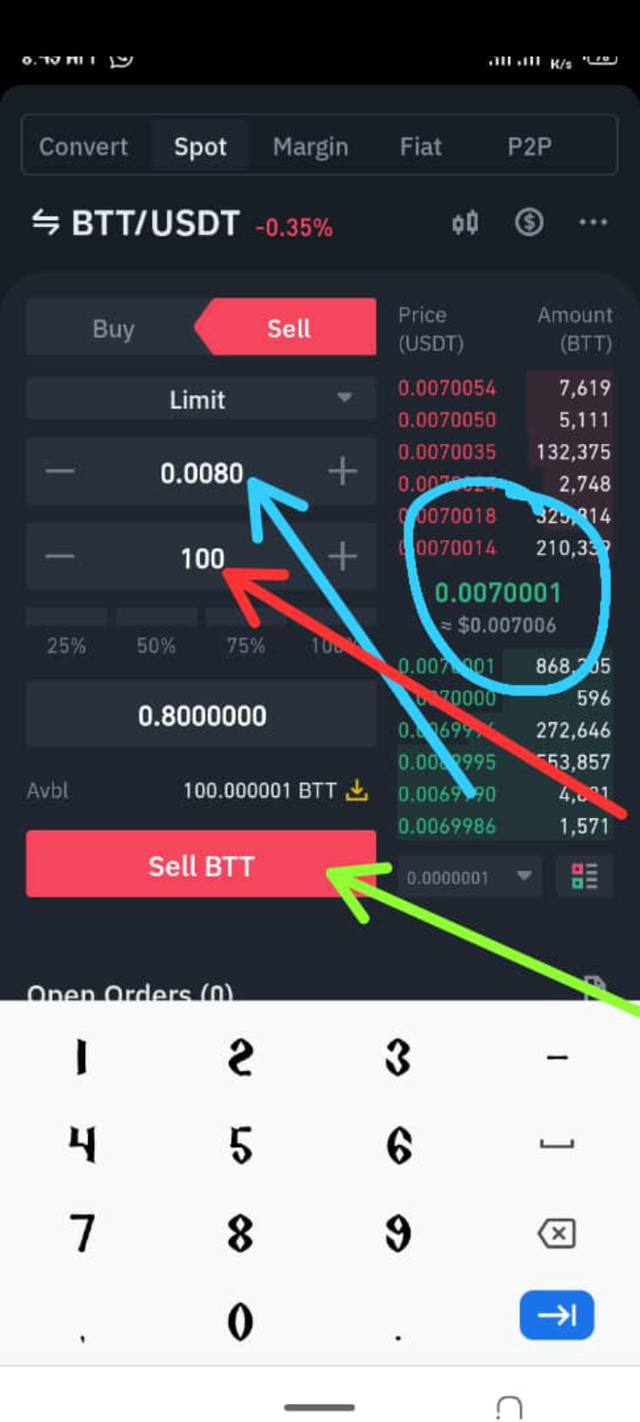

Every other steps will follow then you click on the market icon and select LIMIT.

The blue arrow is where you set the amount you want to buy or sell. The current price is at $0.007 but I want it to sell my coin at $0.008 so I can have profits. The red arrow is the amount of coin I want to sell, and the Green arrow is the sell button.

STOP LIMIT

This kind of order does 2 things for you in a platform,

- It stops your trade when a desirable price has been reached

- It creates a limit order to buy or sell a crypto at a certain price.

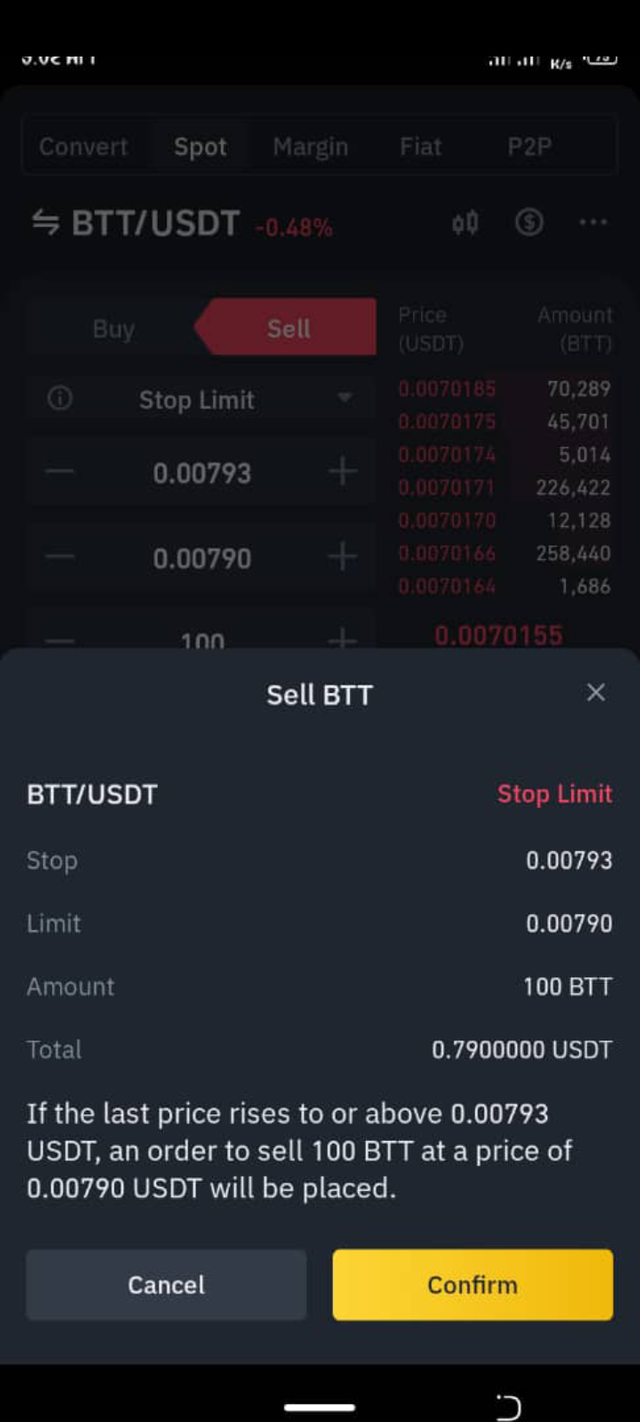

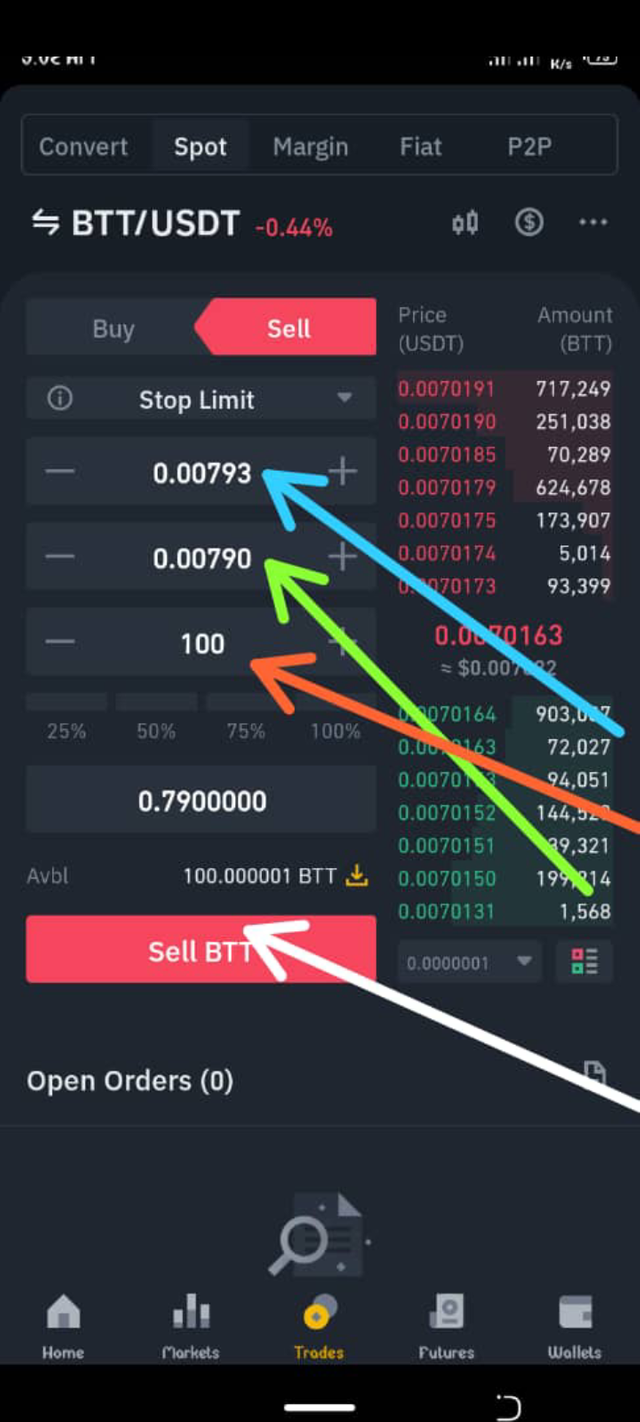

Follow previous procedure and click on stop limit.

On stop limit you have the right to place a stop limit value, a sell value and amount. The blue arrow is pointing to where you input the stop limit, the Green arrow is the price you wish to sell your coin and the orange arrow is where you input the amount you want to sell.

in this case I set my stop limit at 0.00793, the current price is at 0.0070163 but once the price reaches 0.00793 I have told the platform to help me create and order so that when the price comes down to 0.00790 it can sell my coin for me. After clicking sell it brings the order for you again so you can confirm.

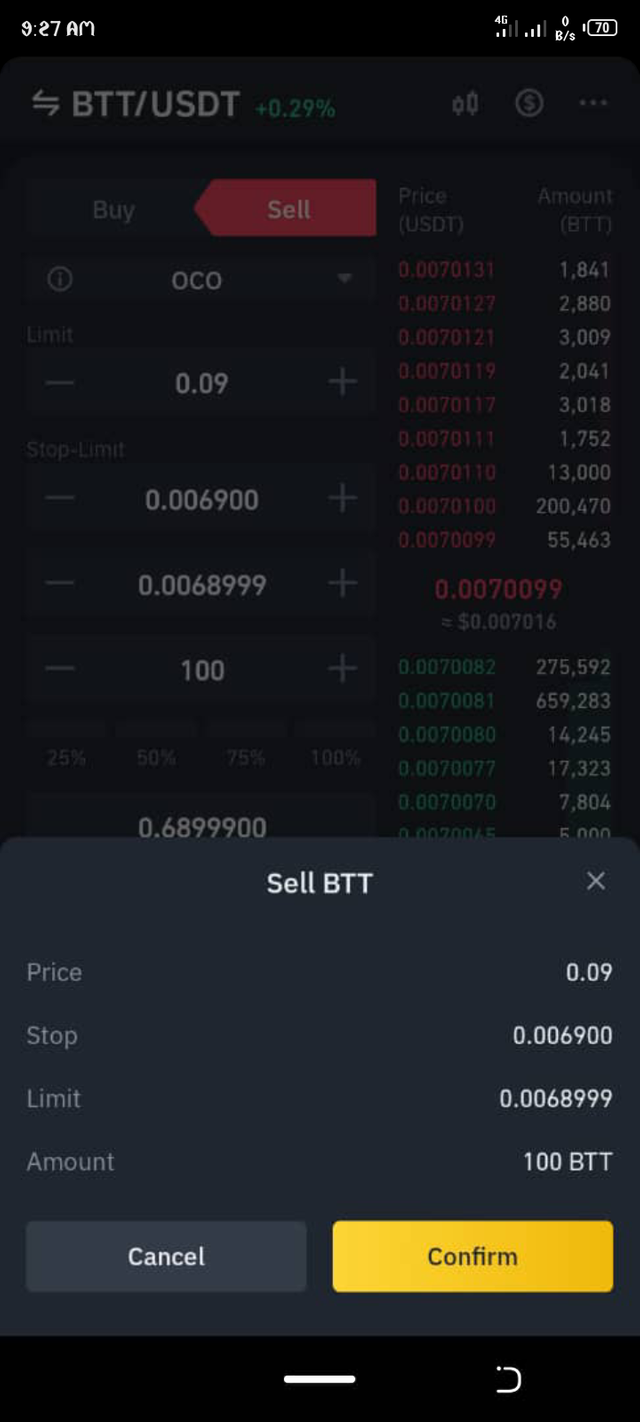

ONE CANCEL ONE(OCO)

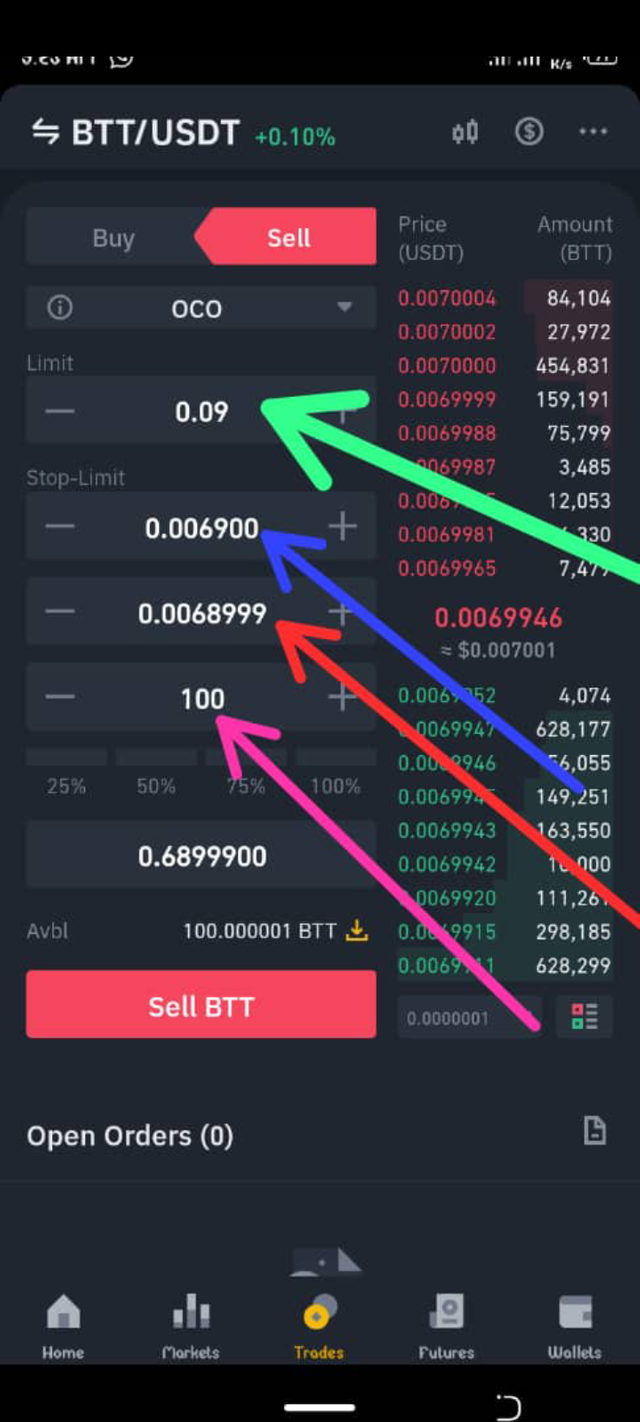

This kind of order is used to place 2 orders which when one is executed the other one is cancelled. What do I mean, if you got a signal to buy a coin at a certain price because the price will drop but then you don't want to miss out also if the coin end up going up, what you will do is to use the OCO to create a buying point and a selling point. Beautiful right

For this order there is a limit and stop limit. The limit is the price for it to take profit when it rises while the stop limit is the price for it to sell when the price falls down.

The current price for the coin is at 0.0069946, so I set a price that it should sell the token for me whenever the price reaches 0.09, at the same time I set a stop limit that...incase the coin is going down and I don't want to loose much I set my stop limit at 0.006900 so once the price gets to that it will trigger my sell order, if the price eventually gets to 0.0068999 it will execute the order on my behalf. But note the first order to be executed will cancel the other.. if the price goes up to the limit it will take profit and cancel the other order and vice versa.

HODLING AND TRADING

Why I prefer Holding

HODLING can be defined as the act of holding a coin or token for a long time until it meets your desired target while trading is not a long investment for an instant way of making money via cryptocurrency.

Trading is more technical and it might take sometime for a newbie to learn how to trade well unlike hodling which is just to buy a coin and keep.

Holding is still one of the best way to invest for both newbies and experts. This is the one I prefer most,it is easier to understand but also requires patience because the journey might be long and there will be hurdles to cross.

Scoring

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit