![Screenshot_20210924-154030~2[1].png](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmPKN4pENaV8ShvFU5vAFhdUJAV2nrNcBWehzRaWDkjGEx/Screenshot_20210924-154030~2[1].png)

It is another week, and I am glad to join this class lectured by @aweononso. The lecture was quite an interesting one and I hope that I am able to answer the questions to the best of my ability.

Let's Begin...

Define the Order Book and explain its components with Screenshots from Binance.

On every asset pair there are lots of incoming orders waiting to be filled. Where these orders are displayed according to the number of buy or Sell is called the ORDER BOOK .

This book is arranged according to price from highest to lowest, simply distinguishing the Ask side(made up of Sell orders) and Bid side(made up of the buy orders). The Highest of the Bid price is always at the top while the lowest of the Ask Price is always at the top .

Bid Price- The highest price a buyer is willing to pay, irrespective of the fixed price

Ask Price- The Lowest price a seller is willing to sell, irrespective of the price ask by the buyer

Let's take a look at some of the components of the said order book

We would be using a screenshot of BTC/USDT from Binance

Screenshot from Binance

Just as discussed previously, we can see the Bid side which is the green side with its columns for the Bid prices, the amount and the total cost. As I earlier stated, the highest bid price is always at the top.

The Ask side which is the red side with its columns for the bid prices, the amount and the total cost. The Lowest ask price always at the top.

Market Makers and Market Takers

Who are the Market Makers?

The term Maker is simply anyone who can make something. For a Market Maker it is Prices.

Now, Market Makers are people who make their own market price, they create the price for their asset. Simply put, the dictate how they wish to run their transaction. They are not weary of the current market price and do not have their orders filled at the current market price but their own specified price. Such orders are referred to as Limit Orders on the orderbook and are placed by Market Makers.

Who are the Market Takers?

They are the complete opposite of the Market Makers. They are comfortable with the current market price and wish not to change anything so they take the price as it comes.

Market Takers do not dictate, neither do they haggle, they simply take the market as it comes. Such orders are referred to as Market Order and are filled instantly as they are the current market price they are placed by The Market Takers.

Market Order and a Limit order

As I have pointed out earlier, The order book is filled with orders that are awaiting confirmation.

Market Order is an order placed at the current Market Price for an asset to be bought or sold . They are always initiated instantly, people who initiate such order in the market are known as Market Takers.

While,

Limit Order is an order placed at a specified price for an asset to be bought or sold, that are not of the current market price. Such orders at different prices on the orderbook waiting to be filled up are initiated by the Market Makers.

Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

Liquidity simply means how readily an asset can be traded. Sufficient amount of buyers and sellers. The Buyers are willing to buy what the sellers are selling

Now in a market, where the Market Makers have fixed their prices Limit Orders. This would mean a lot of different prices open on the orderbook, this would mean that there are prices and a ready market for the Market Takers and the Market orders can be matched to available limit orders and filled out instantly.

Market Takers been known as people who do not haggle just go with the prices of the market makers and orders are filled out successfully . In this case, the Market Takers (buyers)are willing to buy what the Market Makers(sellers) are selling there by creating a liquid market. The Limit orders by the Market Makers Provide liquidity for an asset in the market

Place an order of at least 1 SBD for Steem on the Steemit Market place

a) accepting the Lowest ask. Was it instant? Why?

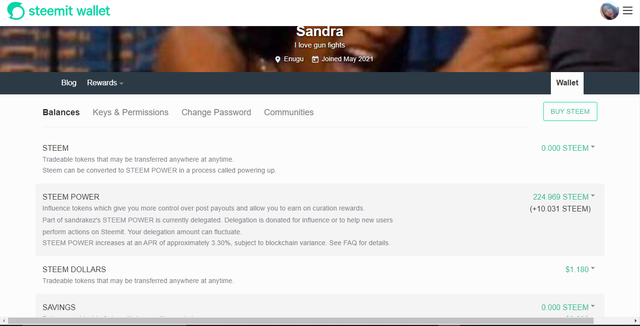

Step 1-Log into your wallet address

.png)

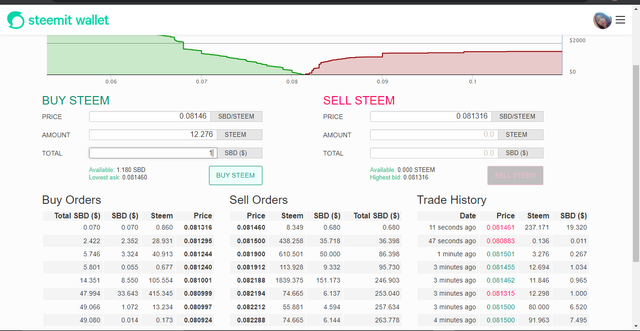

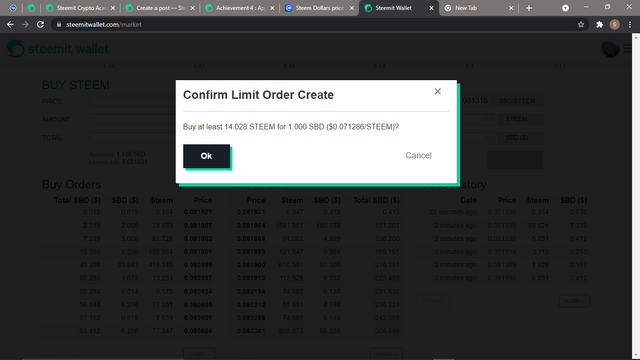

Step 2- Place an order by accepting the lowest ask

.png)

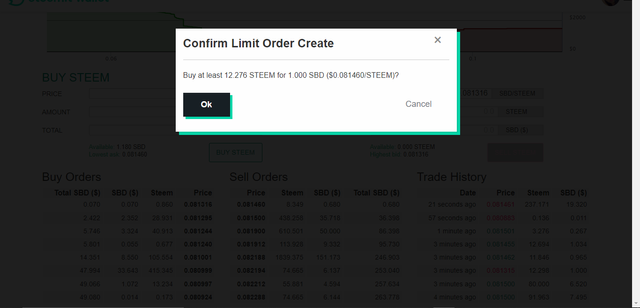

Step 3- Confirm and place

.png)

At the time I placed the order it was instantly filled. This is because I accepted the current Market Price, in this Order I was a Market Taker.

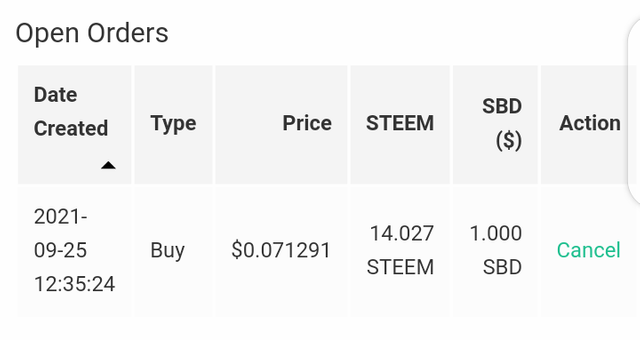

b) changing the lowest ask. Explain what happens.

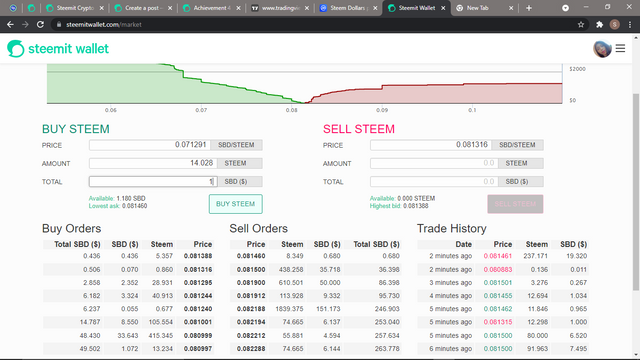

I placed an order and made changes to the lowest Ask

Instead of the current market price which was 0.081460, I changed it to 0.071291

.png)

.png)

I noticed a slight change as I was about to place the order

Then I placed the order

It took more time for my order to get filled, it wasn't instant unlike accepting the current market price. This was because I was a market maker in this order. So I had to wait to see if my Limit order got filled at my own specified price.

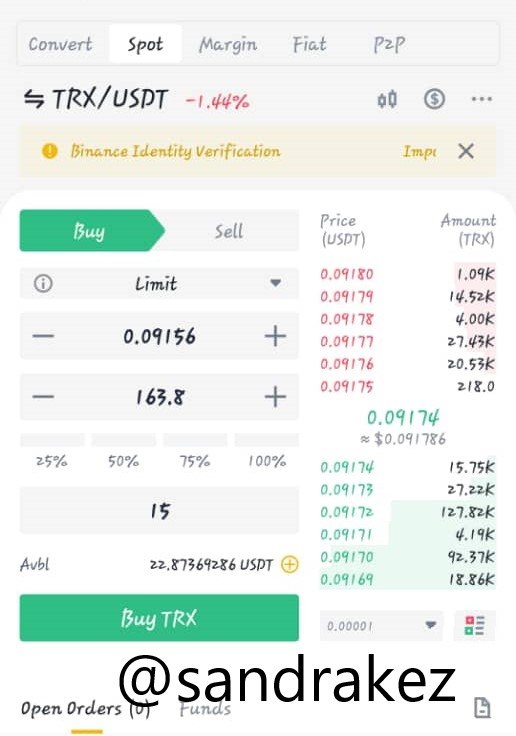

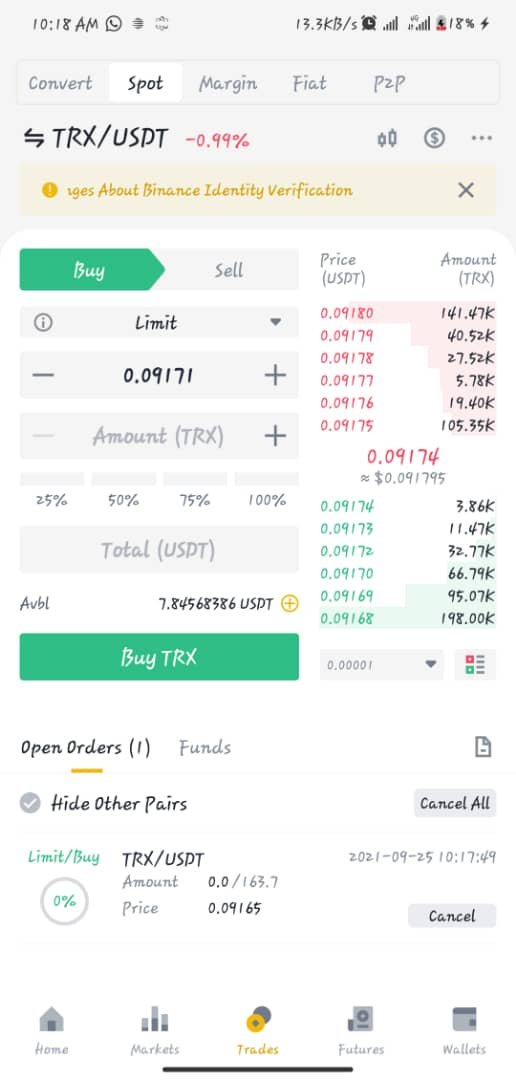

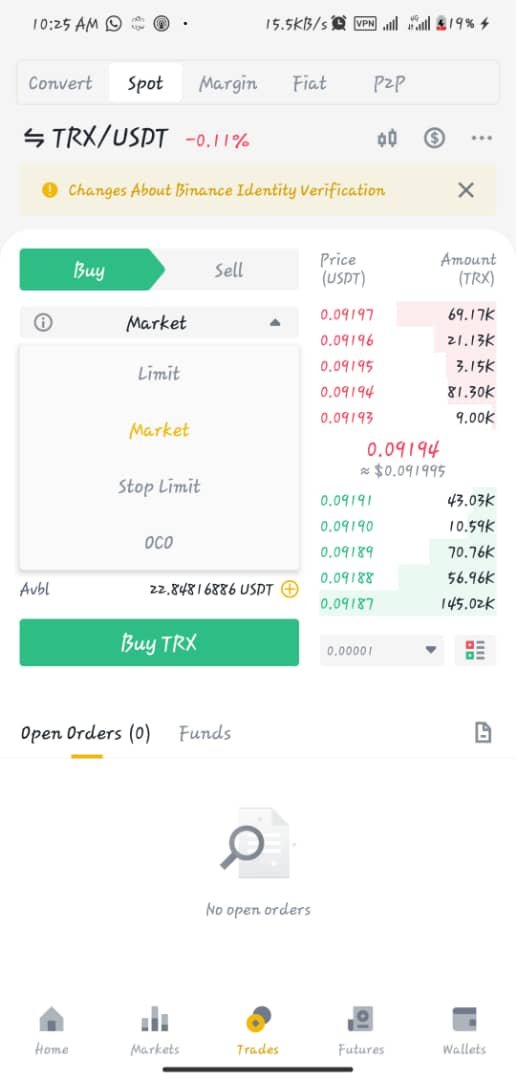

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

Step 1

- Open the Binance app

- Click on Market

- Search for TRX

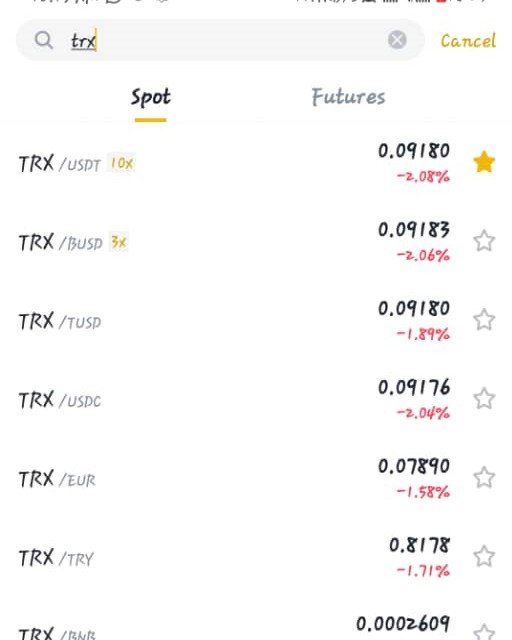

Step 2

- Select the TRX/USDT

- Click on The Buy Option

Step 3

- On the drop down arrow change to Limit

- Set your desired limit

Step 4

- You click on the "Buy" Option and place your order

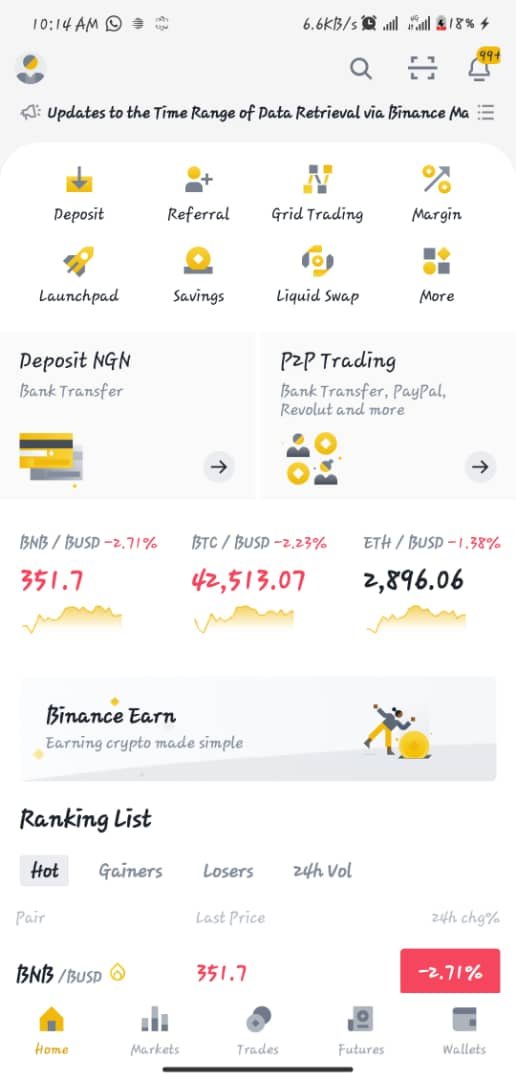

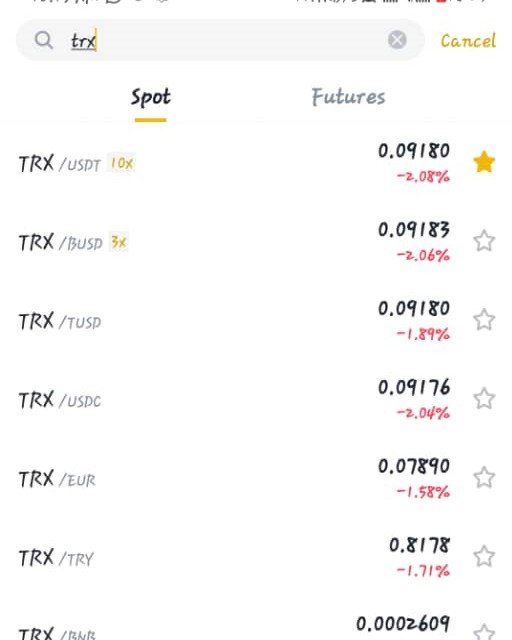

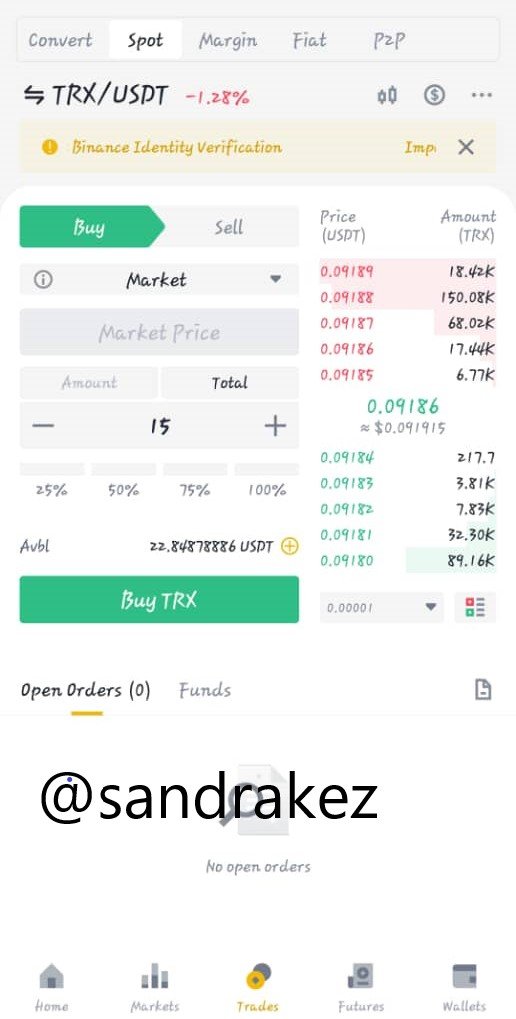

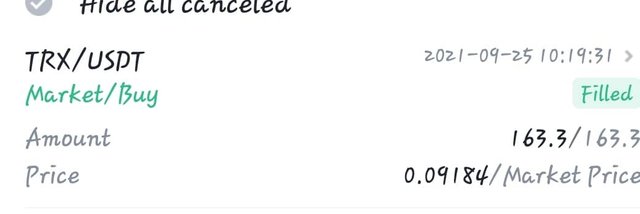

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

Step 1

Open the Binance app

Click on market

Search for TRX

Step 2

- Select the TRX/USDT

Step 3

- Select Market

Step 4

-Fill in the amount and Click on Buy

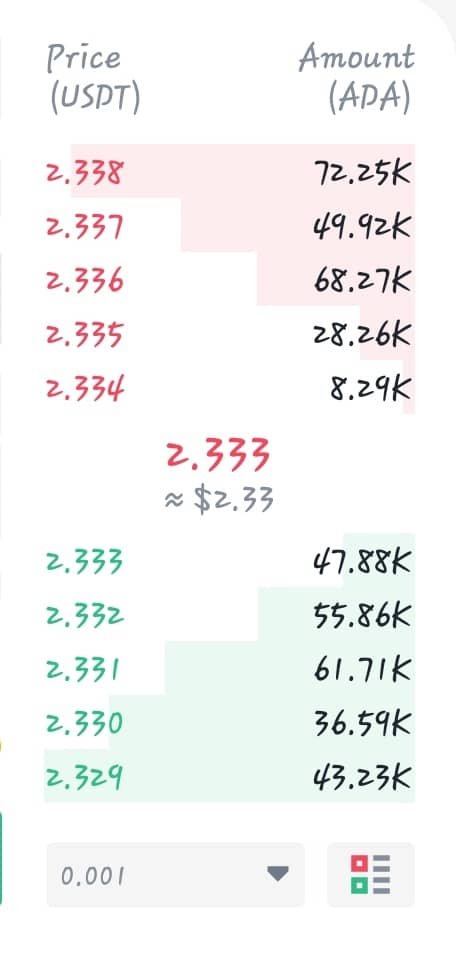

Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

The highest bid Price ADA/USDT is 2.333USDT and the lowest Ask is 2.3334USDT

a) Calculate the Bid-Ask.

Bid Price =2.333

Ask Price=2.334

BID-ASK=0.001

b) Calculate the Mid-Market Price.

MID-MARKET PRICE=2.334

Conclusion

Market Makers make the market liquid, making it easier for Market orders by Market Takers to get filled out instantly. Also, I have learnt that the Bid-Ask spread is measure of the liquidity in crypto transactions and this can be seen through and calculated with the use of the order book . You do not always have to be a Market Taker, place a Limit Order and see what happens. Be a Market Maker also, I have always been a Market Taker. This lecture has opened my eyes to new knowledge. Thank you @awesononso

</di