Spot Trading

Let me start off by saying, I believe anyone who has made any crypto investment has made a spot trade. Why do I say so?. It is the most common way for people to trade.

Spot Trading is when you buy particular assets in hopes that they will rise in value. Simply put, you wage your money on a particular asset, let's take for example you purchase Solana in hopes that it will rise in value much more than you have purchased it. In other to sell it in the Spot market when the price increases and make profit.

The current market price of an asset is what we call the Spot Price. Depending on your decision to sell or buy the price at which you make such a transaction is the spot price.It is important to note that when trading in the spot market you can only use asset you own there is no leverage. The word leverage is one word we would capitalize on going forward.

For Beginner's such as myself. It is a good way to manage risk. Since this market is dependent on demand and supply we can say that the Prices are transparent.

You can enter and exit a trade as you like and also not have to worry about been liquidated.

With spot Trading you don't have to constantly check on your asset, you can invest and decide to hold your coins for as long as you so desire.

Potential gains are much less on spot Trading. You can't really take a chance on good trading opportunities.

Margin Trading

As I had mentioned earlier we would capitalize on the word leverage. To understand Margin Trading let's understand leverage.Leverage is using a borrowed money for investment in hopes that your profit will be much bigger than the amount you are to pay back, in this case so you can make profit too.

In Margin Trading, you trade using money borrowed from a third party. Giving you access to a much bigger capital allowing you to leverage your position. This makes it possible for traders to realize huge profit on successful trades.

Of course, would be making high profit. Also, this opens position for traders to trade regardless of their low capital. Traders can open several positions without having to move large sum of money into their accounts.

We are looking at the possibility of loss that might exceed traders initial capital. This is why it is considered a high risk trading method .The slightest drop in market price can cause losses for traders.

Future Trading

This is using the power of leverage to trade. In future trading, traders speculate the price of an asset. As we have discussed earlier on leveraging , in future trading it gives you power to buy with little capital.Future trading allows traders to create leveraged positions. The ratio of position would mean multiplication in profit than their trading account balance.

In future trading, the market price is constantly changing in response to buying and selling forces. The market is very liquid and due to the high risk associated with this trading high profit are made.

They are highly leveraged. Which imposes high risk of loss and also very high profit. Example: If i am trading with 1000$ and using a x10 leverage,what i would have as profit now is 10000$ instead of 1000$. Also, money can be made fast.

In extreme price movement assets can be liquidated.There is no control over future prices fluctuations.

Different types of Orders in trading

Market Order

This is an order to buy or sell at the current market price. This orders are executed by people known as Market Takers. This group of people do not haggle or try to specify they get paired with the limit orders on the order book.They are carried out instantly.

Pending Orders

Limit Order: This is an order that is executed at a specific price. The people who place this orders are called Market Makers. They place the specific price to buy or sell, when this price is matched the order is filled

Stop Limit Order: To make this easier to understand. Let's look at stop price and limit price. Although this two can be the same, we can look at in this way

Stop price is the price that sets off the limit order and the limit price is the price of the limit order that is set-off. This simply means that once your stop price has been reached your limit order will be placed on the order book.

In other to increase your chances of getting your limit order filled after stop price ,one could set the stop price a bit higher or lower than the limit price.

OCO order: This order is helpful for traders who open two different orders at the same time.These orders are the limit order, with a stop-limit order, only one of the two can be executed. This brings the name One Cancels the Other Order. As soon as one of the orders is fulfilled the other is automatically cancelled.

Also it's important to note that if you cancel one order the other gets cancelled too. This order is advantageous in taking profit and minimizing potential looses.

Exit Orders

Take Profit Order: Just as the name it's an order that helps to exit a trade and take Profit.It helps to give you an edge, when the necessary profit has been made in a position, it helps you take your profit and exit your trade.

Stop Loss Order: In every trade, there is a possibility of loss. This an order that helps limit such losses. It helps you exit a trade and avoid loosing all of your money.

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed

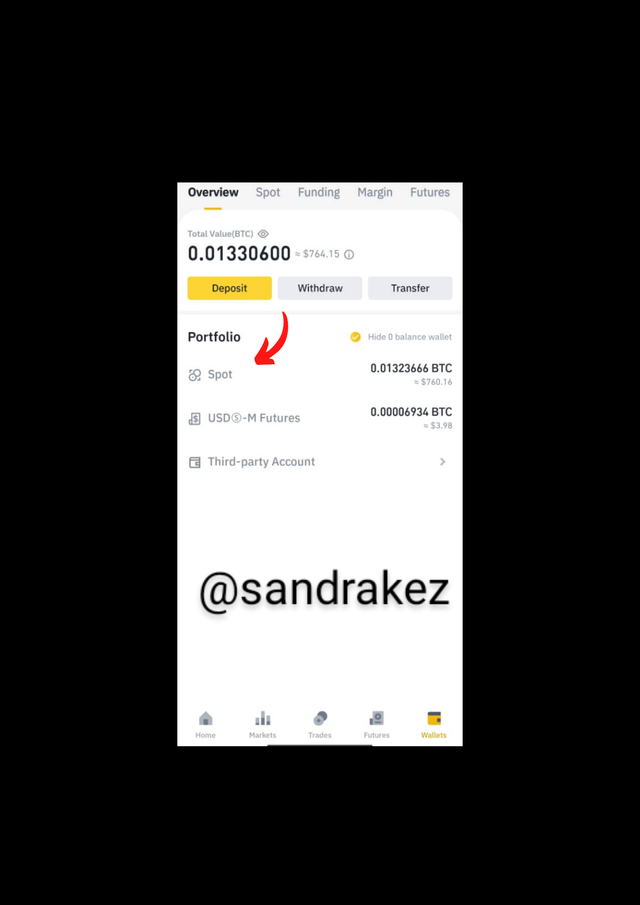

- Open your Binance

- Click on wallets

- Click on Spot

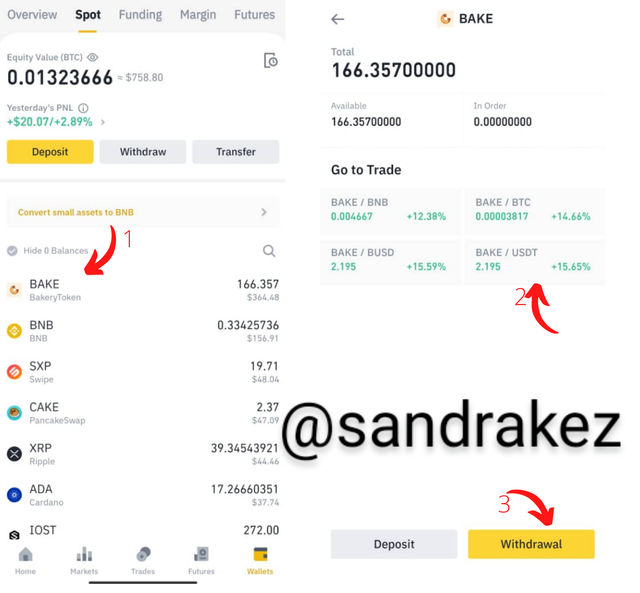

- Click on the desired crypto asset(BAKE)

- Next click on the pair

- Click on withdrawal

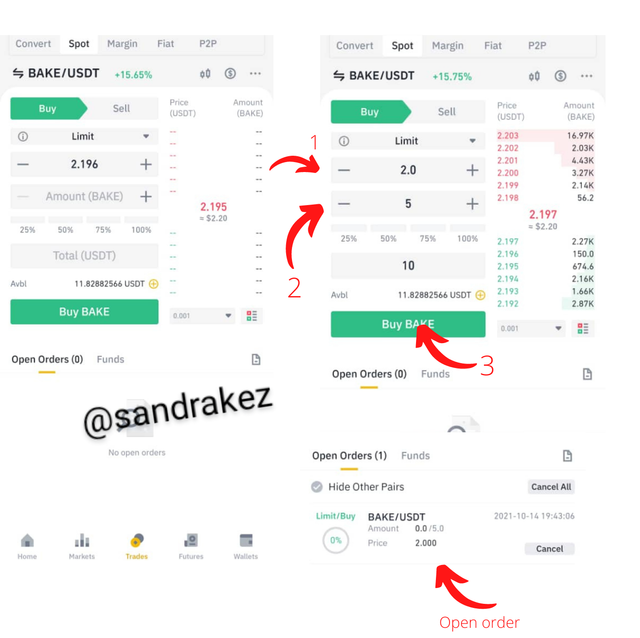

- Change the order type to limit order

- Input the price you wish the limit order to be filled

- Also, Input amount you wish to execute it with.

- Click on "Buy"

- And you've opened a limit order

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset.

I)Why you chose the crypto asset

I was looking to buy and the crypto pair BTC/USDT was one that had a recent EMA crossing

ii) Why you chose the indicator and how it suits your trading style

I needed an indicator that clearly indicates the price movement and recent price data and I'm comfortable using the EMA for that.

iii) Indicate the exit orders

Conclusion

We can see how some trading methods can increases losses and also maximize profit. How leveraging can play to an advantage and also a disadvantage in this trading methods.

Also, the OCO which a new type of order to me and how it works with a combination of limit order and stop limit order.

I will like to thank Prof @reminiscence01 for enlightening on new ways to trade Cryptocurrencies

Hello @sandrakez , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

Your explanation here is too shallow. You could have elaborated more on why you chose the crypto pair.

Also, you didn't show any proof of your trade execution.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit