Edited on Canva

Hello Everyone,

We have yet another crypto academy lecture Bitcoin's Trajectory by @imagen. As we all know that it is a very trending topic nowadays. As professor elaborated on each point in detail. Now I’m doing my homework task.

1.) How many times has Bitcoin been "halved"? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have been "halving".

Bitcoin Halving

In the last decade, we have seen the Bitcoin has dominated the crypto market. So before understanding the Bitcoin Halving process. Let’s understand How Bitcoin work. Like another currency, Bitcoin is a decentralized digital currency. Which work on technology and innovation. So basically, Bitcoin consists set of many computers or in other nodes, that execute thought computer program and track all the transactions on the Bitcoin network. As each node has the entire history of full transaction. And node verifies the valid or invalid transaction based on the complex hash function and computer algorithm. And the process of validating transactions is called mining. As it’s very complex and though mathematical logic applied that need huge power, CPU, and computers, so miners come into this picture which basically ends users. Once the users will solve the complex logic of the block, will get rewards as new Bitcoin.

Bitcoin halving is the mechanism that dived the rewards into two parts Bitcoin inflation rate and new Bitcoin created in circulation. Normally Bitcoin produces every 10 minutes per block. So, rewards started at 50 BTC/block after every 21000 blocks that mean every 4 years, rewards are divided into two parts. So, November 2012 was the first halving and rewards divided 50BTC to 25 BTC per block. Similarly, in July 2016 rewards were divided 25 to 12.5 BTC per block. And recently in May 2020 rewards were divided 12.5 to 6.25 BCT per block.

And next Bitcoin halving is projected in February 2024 and rewards will be 3.125 BTC per block mined. And this Bitcoin halving will continue until the year 2140.

Litecoin Halving

Likely Bitcoin the Litecoin produce every 2.5 minutes a new block. And Litecoin rewards started at 50 LTC/block, in August 2015 after 840,000 blocks mined. 2nd it was 2019 rewards reduced to 25 to 12.5 LCT/block and next will be in August 2023 and rewards will be divided t 12.5 to 6.25LTC/ block. This process will continue until the year 2142.

Bitcoin SV Halving

Similarly, Bitcoin SV occurs every 4 years after 210,000 blocks, it just completed the first halving 12.5 to 6.25 BSV/ block and the next halving event will happen in August 2023 6.25 to 3.125 BSV/block. And block height is 840,000.

2.) What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

Consensus Mechanisms

The consensus mechanism is the process of validating the blockchain in the network. It’s a computing-based algorithm and cryptographic technique that help to validate the blocks. Mainly these are different consensus mechanisms. Poor of Work (PoW), Proof-of History (PoH), Proof of Stake (PoS), and Proof of Brain (PoB).

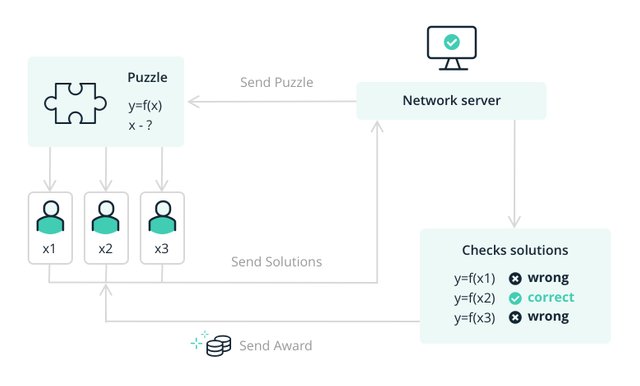

Proof of Work (PoW)

Proof of work (PoW) is work based on a consensus mechanism for confirming the transaction and create the new block and added to the on-chain. In this process, the minors (a set of people) compete against each other to validate the transaction and add to the block. This validating computation happens based on complect mathematical puzzle and takes a lot of energy. And once minor successfully solve the puzzle and create a valid block. They get rewards. Like Bitcoin, Ethereum and Litecoin.

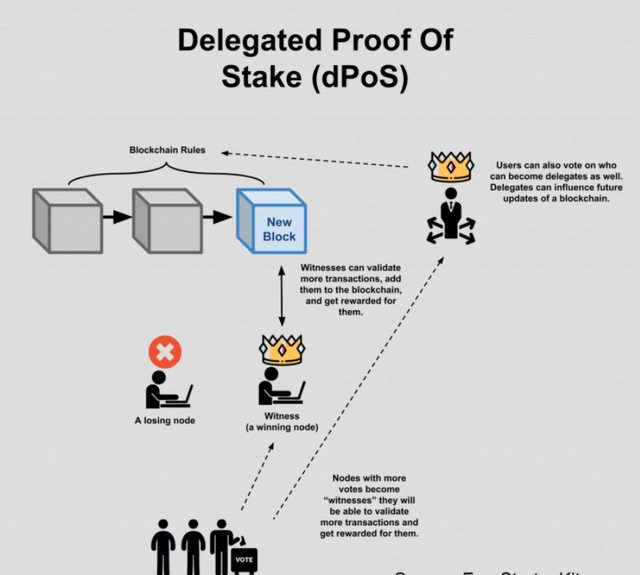

Proof of Stake

Proof of Stake is also work based on a consensus mechanism. This consensus mechanism work based on staking the asset or power by minors(users). For any blockchain transaction validation, it required that block should be validated before adding into the on-chain. For example, Ethereum moving to PoW consensus mechanism to proof of stake PoS. On the Ethereum blockchain user need a minimum of 32ETH to become a validator. So, these validators will be chosen randomly for validation of the block and confirmation. And users must own 51% of cryptocurrency on the network. There is no reward for creating a block, but the creator takes the transaction fee.

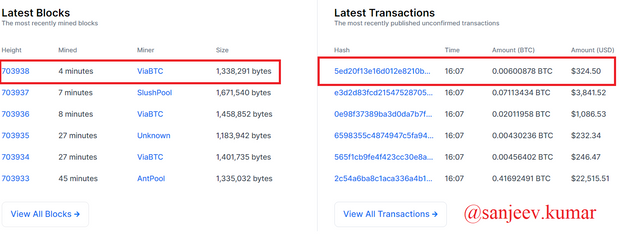

3.) Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot.

To answer this question, I chose Blockchain bitcoin explorer

After landing on how the page of the official site

We can see in the below screenshot the latest transactions detail and blocks height.

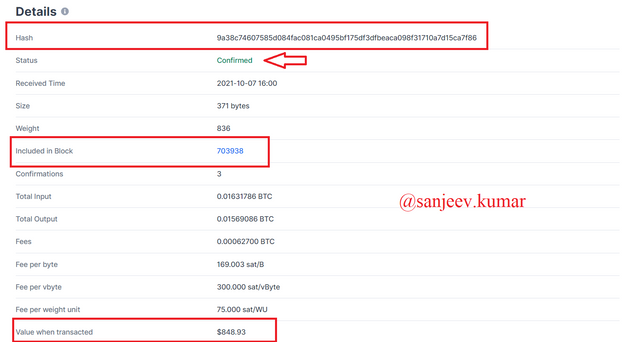

And corresponding that hash id is:

9a38c74607585d084fac081ca0495bf175df3dfbeaca098f31710a7d15ca7f86

As we can clearly check that the #703938 block has been included in the on-chain. Where total input is 0.01631786 BTC total out is 0.01569086 BTC and mining fee is 0.00062700 BTC and total transacted was 0.01631786 BTC ($848.93).

4.) What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

What is meant by Altcoin Season?

Altcoin season means the Alternate coin or Altcoin dominates in a time of period the in crypto market. As Bitcoin has more dominant 40% to 50% over the other Altcoin. So technically if Bitcoin dominancy decrease and Altcoin dominates increase the ratio of 75:25 % in the last 90 days. That is called the Altcoin season.

Current season

To know this I have used the Blockchiancenter platform

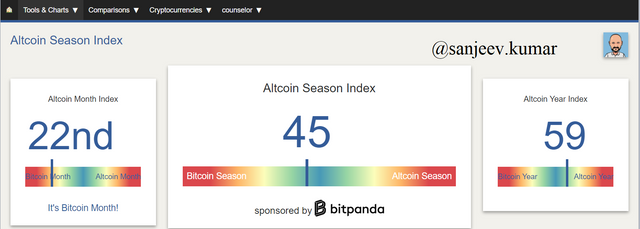

After landing on the home page got the Altcoin Season Index and we can see the below screenshot.

As currently, the Altcoin season index value is 45 that means the Bitcoin dominant 55%, and the Altcoin year index value is 59. That means is not Altcoin year. It should be 75% dominant over Bitcoin.

Last AltCoin season

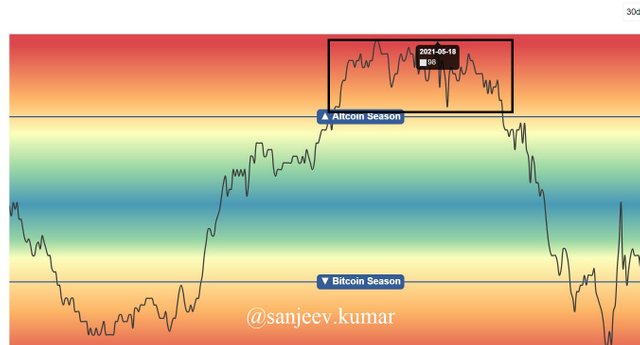

From the below graph, we can understand that from March 25th, 2021 to June 20th, 2021 was the Altcoin season and on May 18th, 2021 It increase to 98%.

Last Altcoin season performance graph

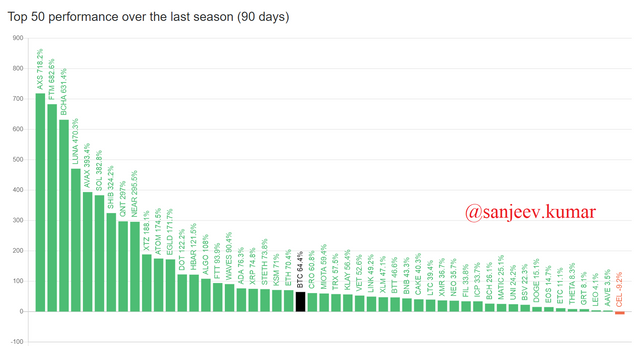

Let's see the top two-coin ASX and FTM

AXS

Axie Infinity (AXS) token mainly introduce by fun and education way in the crypto world. As there are many games and crypto kitties. As in march 2021, it was just $3.77 market price and it got 718% as per Altcoin season and touch the $135 all-time max.

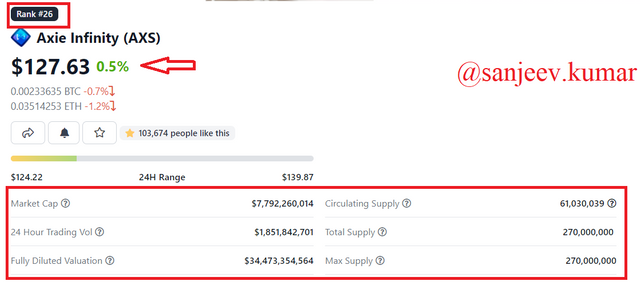

Current rank 26 with price of $127.61 where total market cap is $7,792,260,014 and circulation supply is 61,030,039 and last 24 hours total volume is $1,851,842,701.

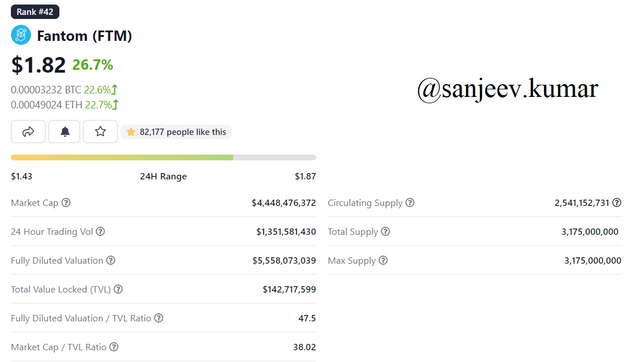

FTM

Fantom (FTM) is a smart contract-based platform for asset and dApp. Its main purpose is to provide fast, scalability, and secure service to end-user. Over the consensus mechanism. In the month of March 2021, it was just $0.33, and it got a huge pump and reaches the $1.81 of 682 % increment.

Per crypto market current rank is 42 with $1.82 market price where total market cap $4,448,476,372, last 24 hours volume is $1,351,581,430 and circulating supply is 2,541,152,731.

5.) Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, tron or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders / developers? Indicate the currency's ATH and its current price. Give reasons for your answers. Show Screenshots.

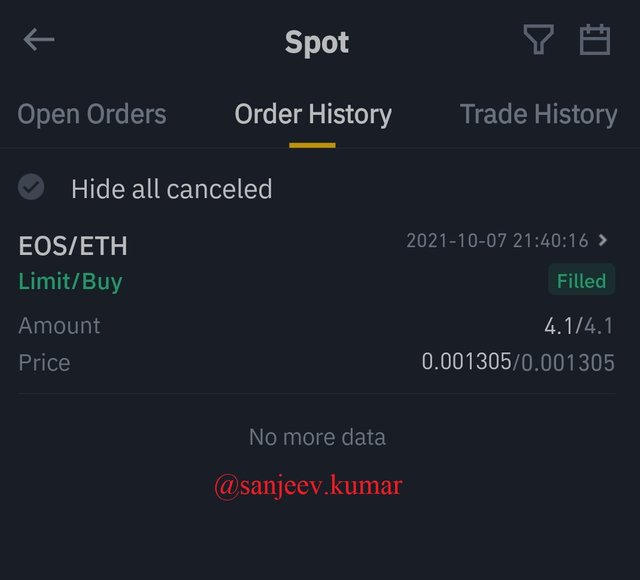

Buying EOS/ETH

To complete this activity I chose the Binance exchange platform. So I checked the market current price and pair list of EOS on the Binance platform. I used a mobile device to place an order. After login, I set my custom price at $0.001305 ETH which is approximately $4.7 /EOS and it’s excited finally. And got 4.1 EOS the value of $19.2.

Below is the transaction detail.

Why did you choose this coin?

EOS is an open-source project based on new technology. That leads to industry transactions and provides fast speed and flexible usages. This platform was created for enterprise utilities and then make for public and private blockchain. It supports large-scale business and gives role-based permission to perform transactions. As this is a decentralized platform. That works on a smart contract mechanism. As it’s an open-source project and uses c++ for implementation. It has a core protocol. Transaction protocol, consensus protocol peer to peer protocol, and accounts and permissions.

EOS established by Daniel Larimer and Brendan Blumer. EOS first released in January 2018, the main purpose was to eliminate the transaction fee and provide quick speed for transactions. And the latest release in May 2021.

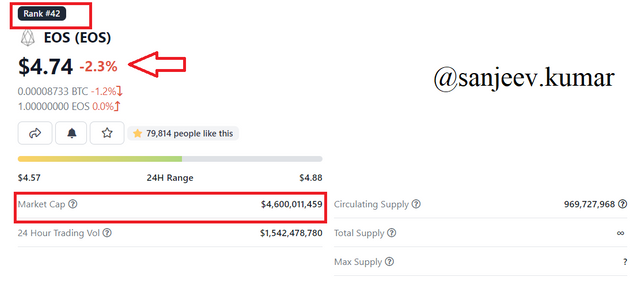

EOS market price

EOS blockchain is one of the leading cryptocurrencies and Its current rank is 42 and market price is $4.74, whereas the total market cap is $4,599,893,404, Circulating Supply 969,727,968 and last 24 hours volume $1,542,439,194 with a total supply ∞.

As its all-time high price is $21.17

src

I chose it because it’s good for long-term investment and the price is perfect for the small buyer. I’ll keep this coin for the long term to hit the previous highest price.

Conclusion

For any investment, analysis is very important, and understand the main reason behind the project introduced. And Bitcoin halving is the mechanism to know the rewards of mining and consensus mechanism help to validate the valid block and adding before into the blockchain, that makes Blockchain sealable. Once again, I would like to thank professor @imagen for an informative lecture.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor for your valuable feedback.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit