Edited on Canva

Hello Steemians,

We are in week 3rd of the Crypto Academy task series. I’m glad that participating in such a great learning platform. So as professor @allbert explains in simple and easy-to-understand about Trading with Contractile Diagonals. And here is my homework task submission.

1-Define in your own words what a contractile diagonal is and why it is important to study it. Explain what happens in the market for this chart pattern to occur. (screenshot required / Bitcoin not allowed)

Contractile Diagonals is one of the technical analysis aspects for verifying market trends with the help of converging diagonal lines that give price trend reversals. It forms a chart by converging wave pattern using max and min price value in the forms of mathematical numbers as 1,2,3,4, and 5 the boundary of diagonal. It represents rising wadge (a signal of bearish reversal) and falling wadge (a signal of bullish reversal), Which is form based on market price movement.

The main reason for creating Contractile Diagonals is short of trade volume and due to that it reduces the price movement and shrinks the price chart which sign of trends reversal.

As in the above screenshot, we can see ETHUSD of 1-hour time frame chat that the market trend is in uptrends, but market volume is getting reduce and shrinking the pattern and its breakout the market trends which is a clear sign of reversal trends and a trader can take this opportunity for their investment.

2-Give an example of a Contractile Diagonal that meets the criteria of operability and an example of a Contractile Diagonal that does NOT meet the criteria. (screenshot required / Bitcoin not allowed)

Contractile Diagonal Criteria

These are the basic criteria for Contractile diagonal.

- First criteria are that wave 1st should the greater than wave 3.

- The second condition is the wave 3 must be more prominent than wave 5.

- 2nd wave shoulder greater than wave 4.

- The boundary line on waves 1, 3, and 5 must be traced with the diagonal line but in few cases, it can be excused.

- Similarly, the bottom diagonal line wave 2,4 must be aligned.

- Now both the diagonals line must be converging and at some nearby point should intersect.

If all the above criteria are met that means the It forms the rising wadge patterns by the breakout of the diagonal line, a sign of reversal trend. We can understand this by the BNBUSDT chart.

In the below screenshot we can clearly see that wave 1 is shorter than 3 and 1,3 and 5 are diagonally aligned and does not meet the Contractile Diagonal Criteria.

3-Through your Verified exchange account, perform one REAL buy operation (15 USD minimum), through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Your purchase data must match your analysis data: such as cryptocurrency and entry price.

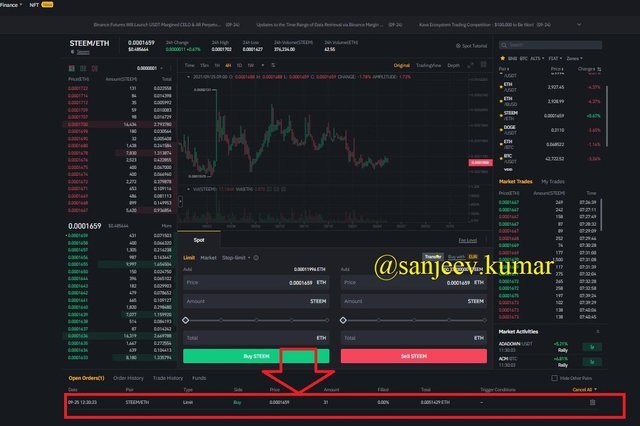

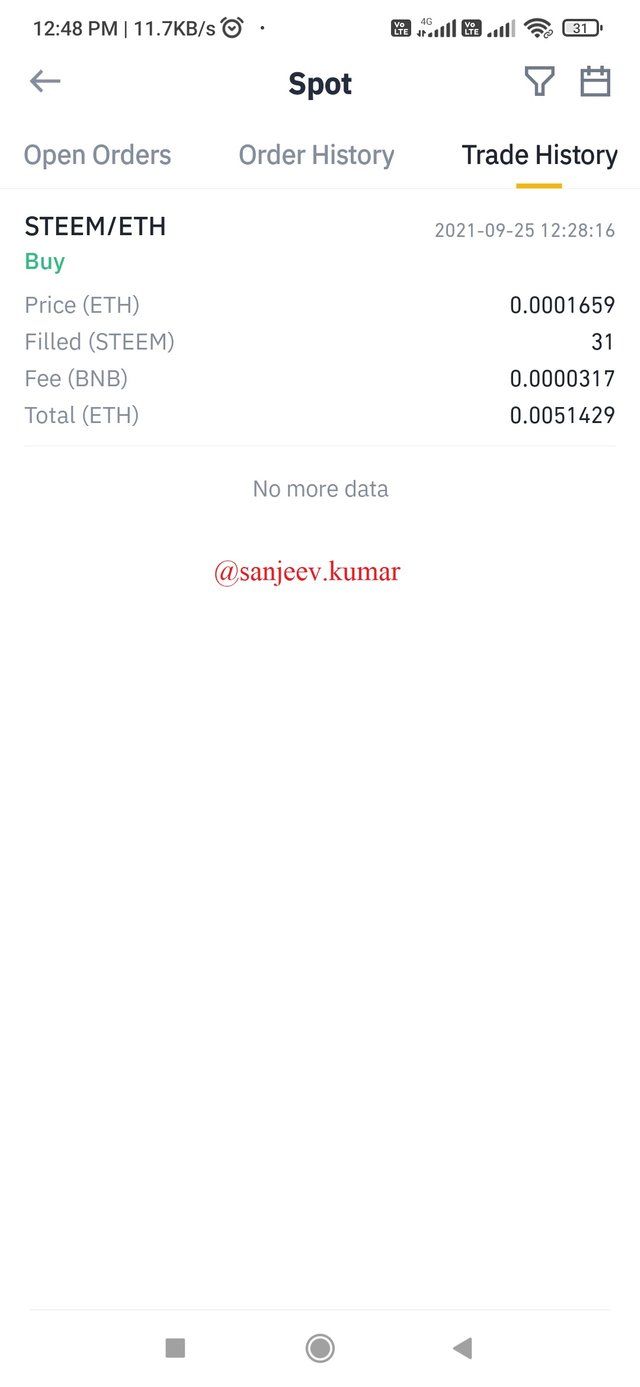

Buy Order STEEMETH

After waiting so long the market trend fall in Contractile Diagonal criteria. As after doing technical analysis I place a buy order.

In the above screenshot, we can see the STEEMETH chart which forms a contractile diagonal. It also verifies the buy criteria and wave 1,3,5 form a diagonal line and likewise wave 2,4 in a diagonal line. And both the lines converge, able to cross the nearby point. The buying order candle breakout the lines, So I got 31 STEEM which is worth 15.05USD.

Order placed at 25/09/2021 12:20 pm IST time on the Binance platform.

Order executed at 25/09/2021 12:28 pm IST time

4-Through a DEMO account, perform one sell operation, through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Bitcoin is not allowed.

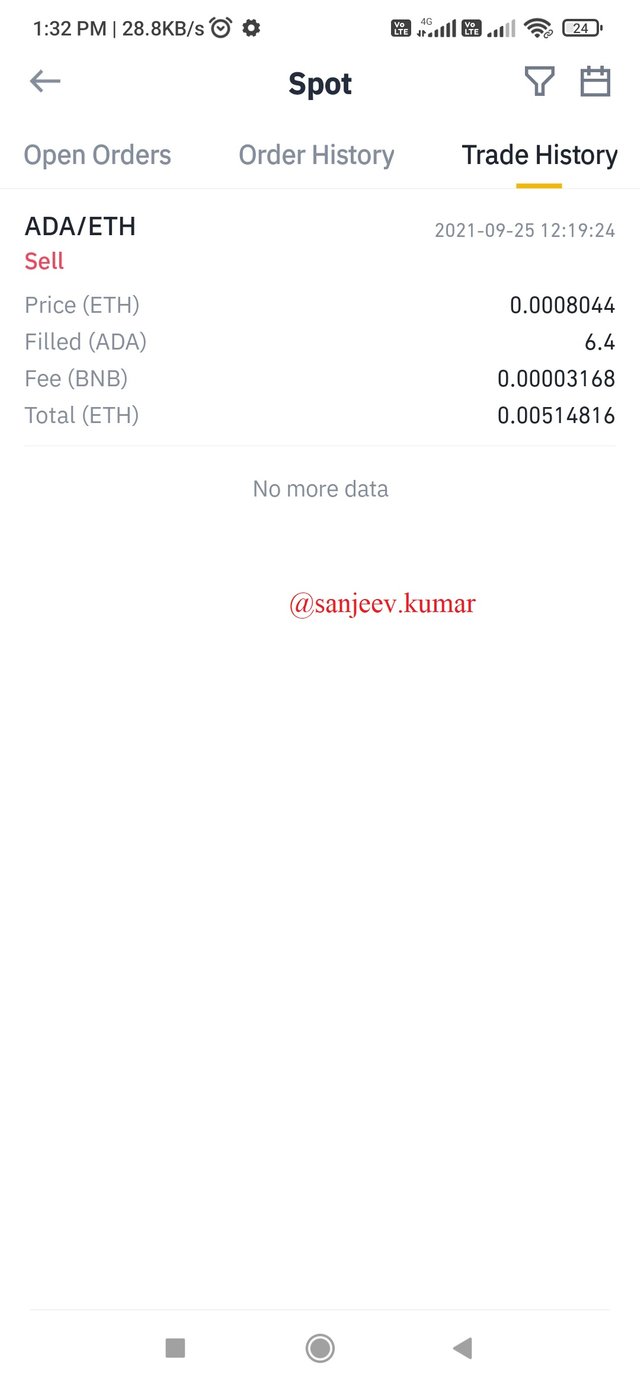

As we have already understood all the Contractile Diagonal criteria and based on technical analysis. I have placed a sell order. Let’s ADAETH chart.

As in the above screenshot, we can see the ADAETH graphical chart which follows the Contractile Diagonal and all the waves point 1,3 and 5 forms a diagonal line similarly 2,4 waves form a diagonal line and the diagonal line near to cross the line and break out the candle and sing of change in reversal trends. So, I’ve placed the sell order at $0.0080125 and it’s executed after few minutes. And I kept the stop-loss and risk-reward ratio 1:3.

5-Explain and develop why not all contractile diagonals are operative from a practical point of view. (screenshot required / Bitcoin not allowed)

We have already understood the basic criteria of contractile diagonals so we came to know that there are two possible cases 1st is it can be bearish or uptrends trends or bullish or downtrend. Let see both cases.

Case 1 DOGEUSD contractile diagonals

In the above screenshot, it’s clearly visible that all waves 1,2,3,4, and 5 follow the contractile diagonals in bullish trends. Wave 1,3, and 5 forms diagonal lines similarly wave 2 and, 4 form a diagonal line and near to cross the diagonal line and sign of reversal trends. So, a trader can take a prominent decision for their asset.

Case 2 ADAUSD contractile diagonals

In the above image, it can be seen that the market trend is a bullish trend but all waves 1,2,3,4, and 5 are not met the contractile diagonals. As the upper diagonal forms 1,3 and, 5 are not formed a proper diagonal line, and waves 2 and, 4 seem are not going to cross the diagonal line. So, this chart is not operative and traders can take dissection wisely. So it’s not sure that the chart gives 100% accurate so be aware of that.

Conclusion

Contractile Diagonal which is also known for wadge is the one technical tool for helping traders to take proper benefit of this tool while doing analysis. As we know that the Contractile Diagonal forms line with the help of waves 1,2,3,4 and, 5. As every trading tool has its own pros and cons so do your own technical analysis and take the right decision. Once again thank you so much professor @allbert for this amazing lecture.

Note:All the image taken from Tradingview

You have been upvoted by @sapwood, a Country Representative from INDIA. We are voting with the Steemit Community Curator @steemcurator07 account to support the newcomers coming into Steemit.

Engagement is essential to foster a sense of community. Therefore we would request our members to visit each other's post and make insightful comments.

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit