Edited on Canva

Edited on Canva

Hello Steemians,

This week we have a very interesting lecture on Trading Liquidity Levels the Right Way by professor @cryptokraze. It’s simple and important to understand. Thanks to the professor for that fantastic class.

1 - What is your understanding of the Liquidity Level. Give Examples (Clear Charts Needed)

Liquidity is a trading term or in other words, it’s a finance term that can convert a price of an asset into cash flow without affecting the market price. By process of ordering buy and sell. There is a verity of ordering a buyer or a seller wait for the right trend of market their they can take profit and stop loss.

Liquidity level: Normally when any trader places an order according to their take profit and stop loss and they set some trigger price where they want to buy or sell. And it creates a Liquidity level. Basically, it’s the movement of price and usually, we can find in that as a candlestick graphical form. That belongs to the above or below segment of resistance and support level.

For Example, we can see the below chart of BTCUSDT it gives a real-time market liquidity level idea so that a trader can analyze the chart to some technical analysis to take strong decisions for their investment. This candlestick presents the price movement of BTCUSDT according to time and it help trader for trading.

2 - Explain the reasons why traders got trapped in Fakeouts. Provide at least 2 charts showing clear fakeout.

Understating the right liquidity level and Identifying is an important part. And it does not work as we assumed. When liquidity level does not move as assumed and that is fake outs create false shortfall breakout the liquidity level.

When traders place an order during breakout level and that moves in the opposite direction and it’s trapped so in that case, traders should wait for trends confirmation whether it’s up or downtrends.

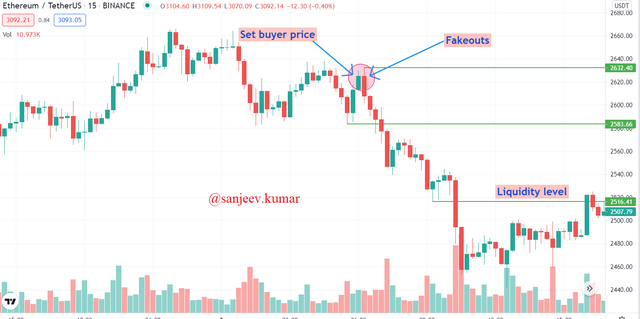

Let’s understand by a chart of ETHUSDT

In the above chart, we can see that a buyer set buying price at $2625 and it was not in confirmed trend and fall down that breakout $2600 so here traders tapped and lose their asset actually traders should wait for the confirmed trend and then make a decision. Even though it creates many resistance levels.

Chart BNBUSDT

In the BNBUSDT chart, we can see that the trader set the selling price at $325 and thought it’s in downwards and create a support level but after place the order, it bounces back and cross $327. And this was not in confirmed trends.

3 - How you can trade the Liquidity Levels the right way? Write the trade criteria for Liquidity Levels Trading (Clear Charts Needed)

The right way of trading Liquidity level is to learn from the reversal chart and analyze the crypto chart and then use trading strategies such as Market Structure Break (MSB) and, Break Retest Break (BRB). Take reference to the price indicator of (moving average) MA that helps use liquidity levels.

Let’s see these strategies.

MARKET STRUCTURE BREAK

BUYING Criteria :

- First, check liquidity level from the market and mart it properly. Wait for the right time to create a good structure Market structure break strategy situation.

- Cross-check price movement that should make a Higher Low after a series of Lower Lows.

- The candle's Liquidity level should be low, clearer and crystal.

- And the most important point is to keep remember the market trend must be in a downtrend. The time frame can be 15 minutes or 1hours for the proper structure.

- Now wait for a strong bullish candle that will breakouts the neckline. that called Market Structure Break.

- Now it’s the right time to buy a trade, and keep in mind your entry price should be just above the MSB point.

Selling Criteria:

- First, check liquidity level from the market and mart it properly. Wait for the right time to create a good structure of Market structure break strategy situation.

- Cross-check price movement that should make a Lower High after a series of Higher highs.

- The candle's Liquidity level should be high clearer and crystal.

- And the most important point is to keep remember the market trend must be in uptrends. The time frame can be 15 minutes or 1hours for the proper structure.

- Now wait for a strong bearish candle that will breakouts the neckline. that called Market Structure Break.

- Now it’s the right time to sell trade, and keep in mind your entry price should be just below the MSB point.

BREAK RETEST BREAK

Buying Strategy:

- Check liquidity level from the market and mart it properly. Wait for the right time to create a good structure of the break retest break strategy situation.

- The candle level of Liquidity level should be higher and clearer to trapped from fake outs.

- Now Wait for the price to break through the resistance level and it should make a swing high point.

- After swinging high check, the price should retest resistance level and bounce back in an uptrend.

- Now it's time for creating 2nd swing high from the previous swing.

- Now it’s the right time to buy entry, and keep in mind the just above the break of swing point.

Selling Strategy:

- Now check liquidity level from the market and mart it properly. Wait for the right time to create a good structure of the break retest break strategy situation.

- The candle level of Liquidity level should be lower and clearer to trapped from fake outs.

- Now Wait for the price to break through the support level and it should make a swing low point.

- After swinging low check, the price should retest support level and bounce back in a downtrend.

- Now it's time for creating 2nd swing low from the previous swing.

- Now it’s the right time to sell entry, and keep in mind the just below the break of swing point.

4 - Draw Liquidity levels trade setups on 4 Crypto Assets (Clear Charts Needed)

These are the Liquidity level trade setups of 4 crypto charts.

BTCUSDT: Buy using BRB strategy

XRPUSDT: Buy using BRB strategy

BNBUSDT: Sell using MSB strategy

ETHUSDT: Sell using MSB strategy

Conclusion

After going through this interesting topic of Trading Liquidity Levels the Right Way. It’s obvious that traders should not be trapped in fakeouts. To get more profit and good trade just follow the liquidity level with the help of MSB and BRB trading strategy to make sure profitable trading. Once again thanks to professor @cryptokraze for this amazing class.