Edited on Canva

Hello everyone,

We have yet another steem crypto academy lecture by professor @fredquantum about ZethyrFinance which is one of the core finance system protocols, I’m answering my understanding.

1. What is Zethyr Finance?

Finance is the pioneer section of any market where it’s a bank or crypto market. Basically, Zethyr Finance is a decentralized financial system for the TRON ecosystem. Which solves many problems for Tronians and makes a seamless transaction over the TRON ecosystem. Zethyr solves the most common problem which is lending, borrowing and, exchanging.

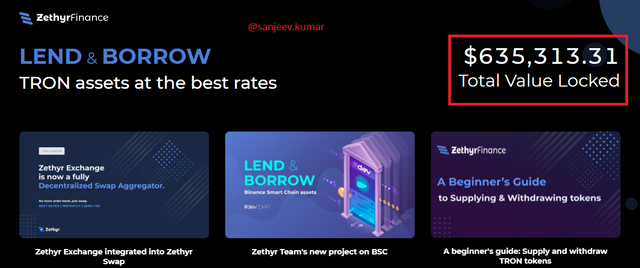

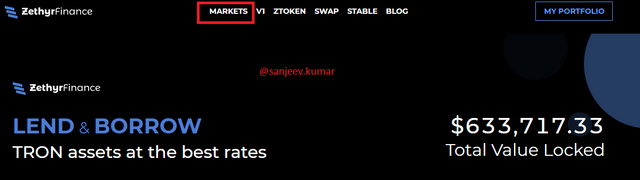

Zethyr finance provides best interest charges by supping their asset whereas a borrower can avail the minimum charges for taking assets. For exchanging the asset Zethyr finance protocol take a 0.1% fee for buy and sell. As we can see on the above screenshot lend and borrow total locked asset is $635,313.31.

Zethyr platform allows the user to take advantage of there for Crypto and earn APY.

- TRX

- USDT

- WIN

- BTT

2. What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

Zethyr has many features that make this platform unique and valuable. I’m going to highlight the following feature.

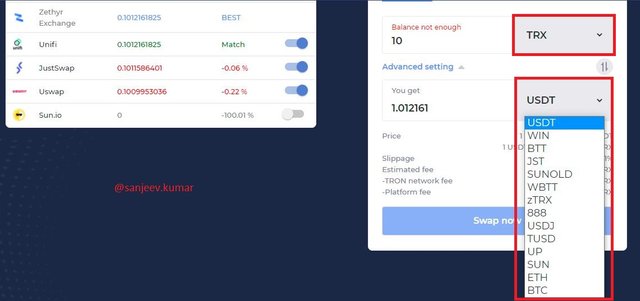

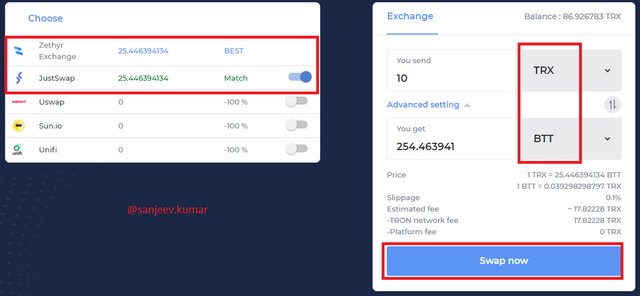

1. Exchange(Swap) feature:

Swap feature is one of the most important points when they do trading, but on this platform, traders can swap their assets without placing the order can save trading fees. On Zethyr platform users can take this advantage for their swapping asset which swaps fees at zero cost. Initially, it was Zethyr Exchange and Zethyr Swap but after Zethyr Exchange update V2 it is merged as Zethyr DEX Aggregator. So traders can swap by using dApp Justswap. There are 17 crypto pairs that can be seen easily. TRX, WIN, BTT, JST,SUNOLD,WBTT,888,USDJ,TUSD,UP,SUN,ETH, BTC, zTRX, zWIN, zBTT, and zUSDT.

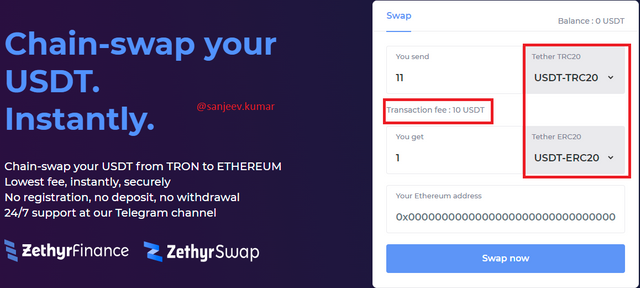

2. Stable Swap:

Stable swap is mainly for a stable coin which is most demand and sustainable that famous on another ecosystem too like USDT, On Tron network use TRC20 with USDT of Ethereum network uses ERC20. So traders can flawlessly swap but as the transaction fee is high, 10 USDT is the minimum transaction fee even for an $11 swap get $1.

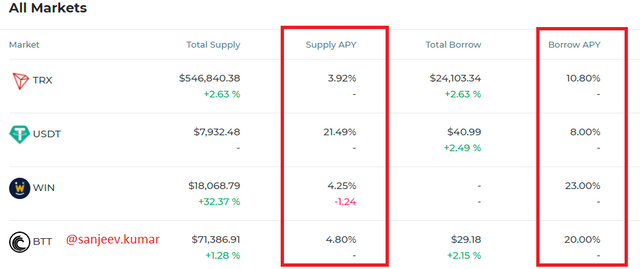

3. Lending and Borrowing:

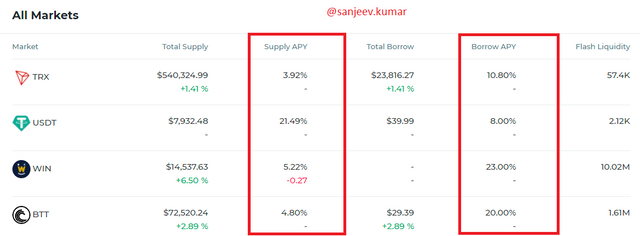

On Zethyr finance platform lend and borrow are the good feature their trader can use these features according to their need. Those who want to get some rewards on investing assets that maximum rewards can earn 21.49 % APY similarly for borrow can take at minimum 8.00 % APY. So supplier has to enable Collateral feature and based on that that they can take borrow by repaying minimal fee. On Zethyr finance users can supply/ borrow only these 4 cryptos, TRX, USDT, WIB and, BTT.

4. Staking zToken:

As we have seen 4 tokens for supply and borrow. So based on that user token deposit they will get the ratio of 1:1 zToken. For example, user supplies 100TRX then will get 100 zTRX that deposit in the user's wallet directly similarly it will burn when they redeem zToken.

Here is the table of tokens and respective zToken.

Zethyr DEX Aggregator

As previously explain after Zethyr update V2 it has been combined as Zethyr DEX aggregator exchange desterilized and centralized liquidity across crypto market best on the best match and suggested user exchange.

As in the below screenshot for TRX exchange, we can see the best matches on the left side.

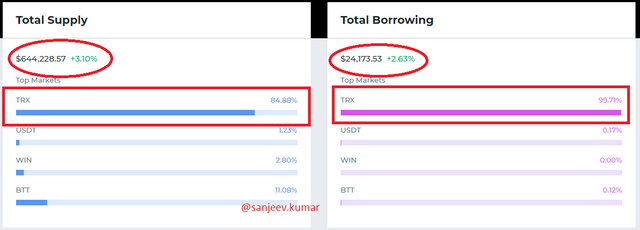

3.Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

In order to explain this question after landing on official click on the market navigation, markets and market token list observes as below.

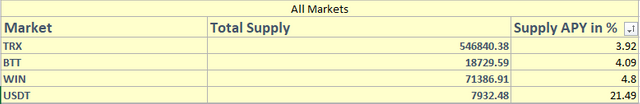

List of Supply All market token

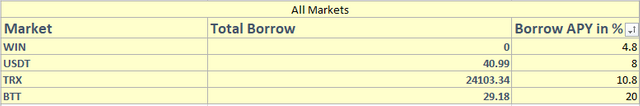

List of Borrow all market token

From the above two tables, we can see the maximum APY (21.49%) get on USDT with a total supply is 7932.48 whereas WIN has a minimum APY (4.8%) without borrowing. So USDT gets the best profit on Zethyr finance platform.

In terms of total supply is $644228.57 and total borrowing $24173.53 whereas TRX is on most demand for both cases.

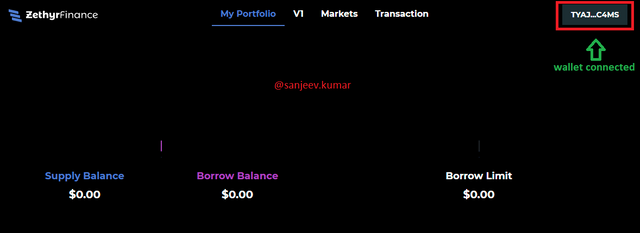

4. Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

TronLink wallet can be connected with a mobile app as well as desktop TronLink extensions. I’m using a desktop. First of all, make sure to install TronLink extension in your local browser. In this case, I have installed TronLink on the chrome browser.

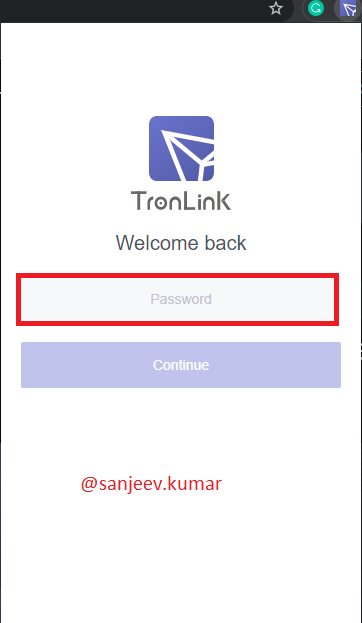

Once install create your Tron wallet or restore. And set your wallet password. After landing on site.

Following are the steps

1 log in to your Tron wallet. Now ready to connect.

2 Click on My Portfolio.

3 After connecting the Tron wallet we can see the Tron wallet address in the right corner.

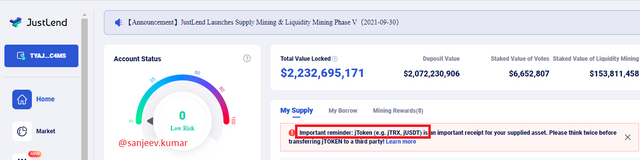

5. Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

As I have already explained Ztoken in question 2nd. In addition to that similar token is jToken where supplied get jTRX and jUSDT on JustLend platform. The purpose of jToken is to governance token on justLend. Similarly zToken governance on Zethyr finance platform.

6. Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

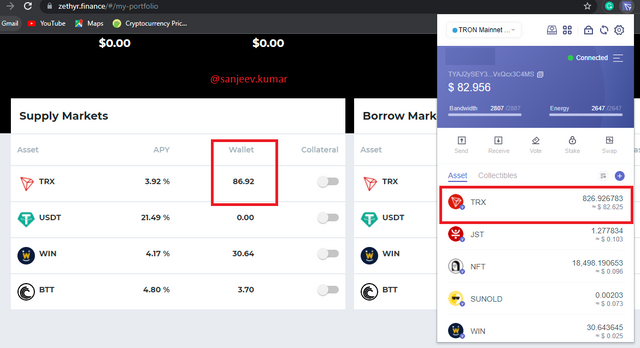

In order to perform real transactions, I’m following these steps.

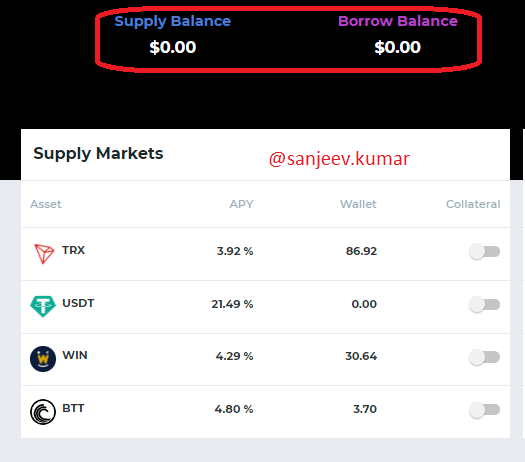

1 After connecting my wallet to Zethyr finance platform the connection step we have already seen in the post.

2 Before supply.

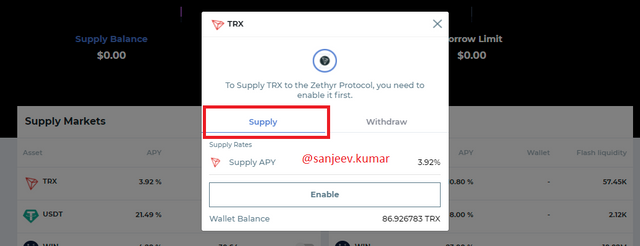

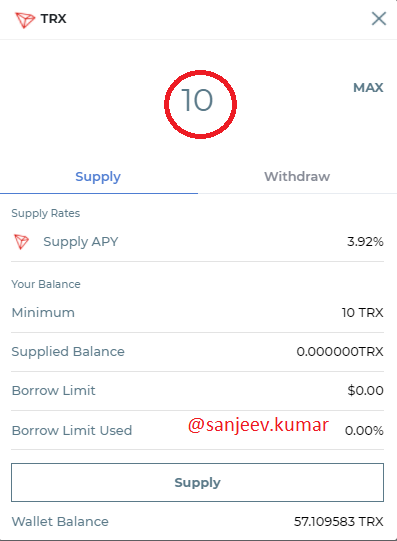

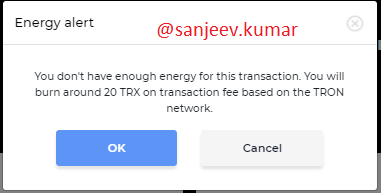

3 Click on asset list TRX and enable the protocol.

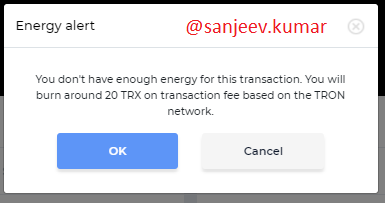

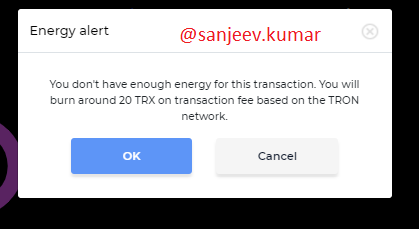

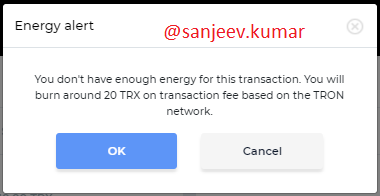

4 An energy pop-up will alert. In case of insufficient energy.

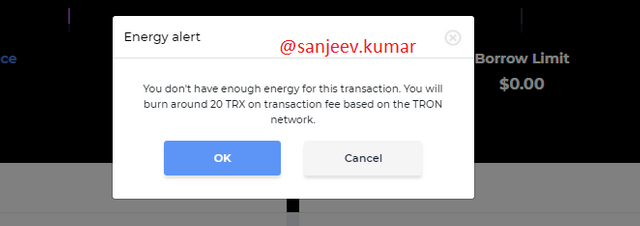

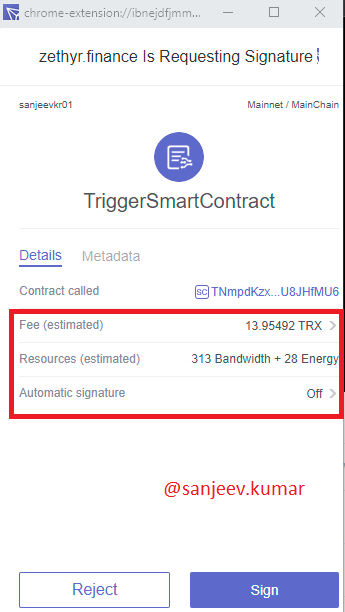

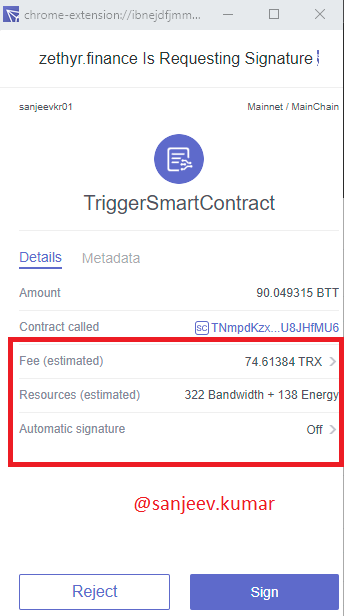

5 Now confirm the transaction.

as we can see the estimated real fee is 29.9TRX that is will burn for this transaction.

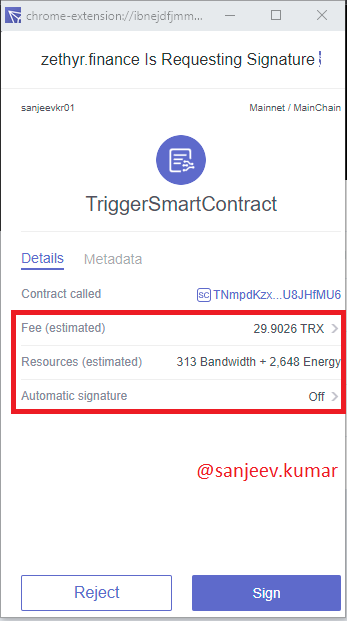

6 Enter the amount that wants to supply in my case I'm supplying 10TRX

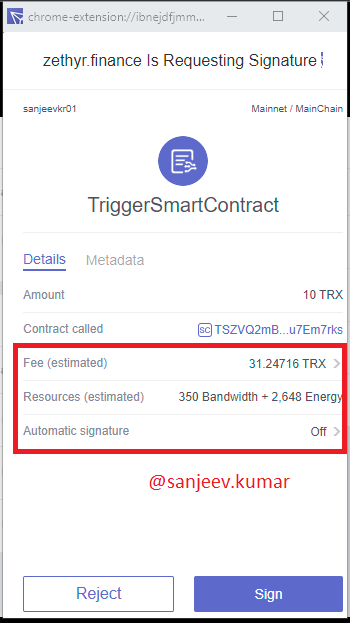

7 Now confirm the transaction.

the estimated real fee is 31.24TRX

transaction detail

Hashid 7832dfaf909d8651cc577c24972cc8ae0477d6a64304d498de215f90303749df

Supplied asset

src

7.Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

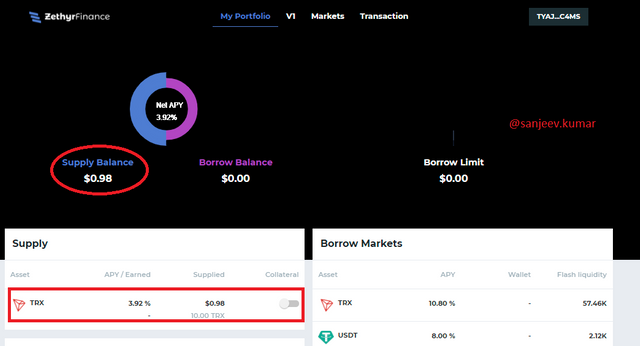

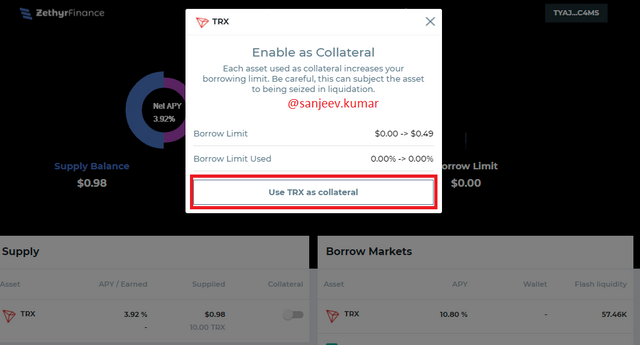

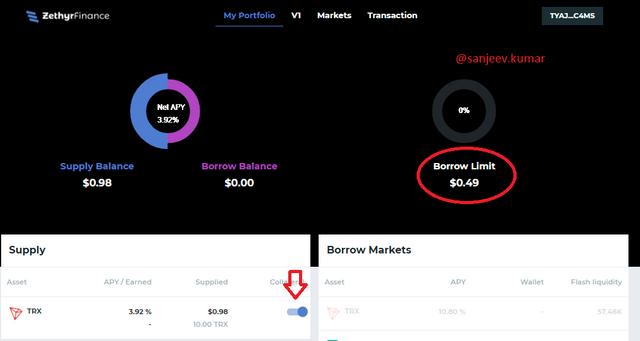

Before borrowing any token we have to enable collateral

Now confirm the transaction

src

the real fee is 13.9 TRX for this transaction

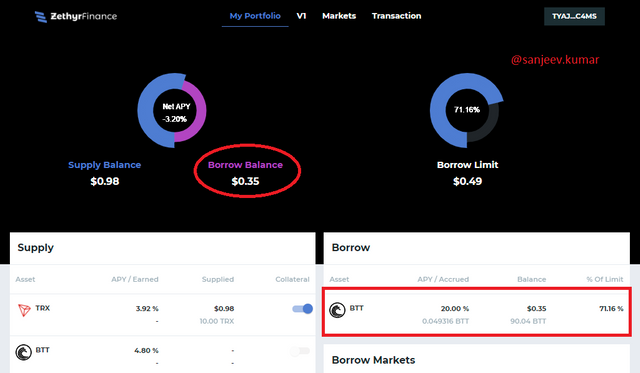

Based on supply got a $0.49 borrow limit.

These are the following steps for Borrow.

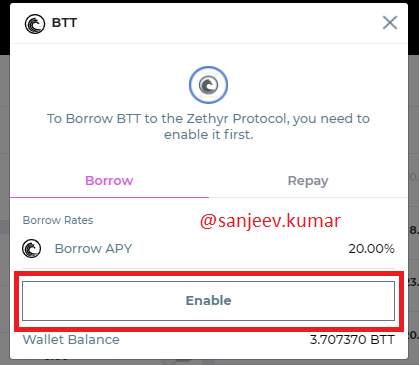

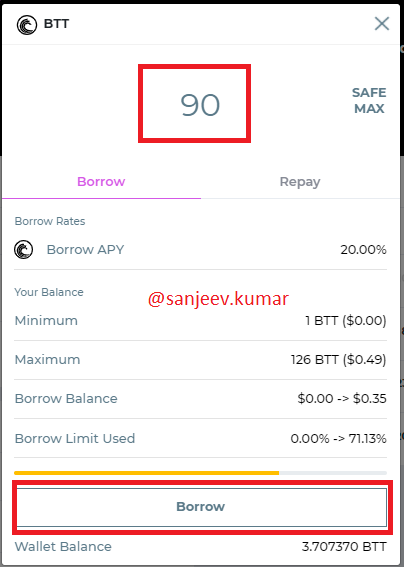

I’m borrowing some BTT to get real experience.

1 Enable the borrow option for BTT

src

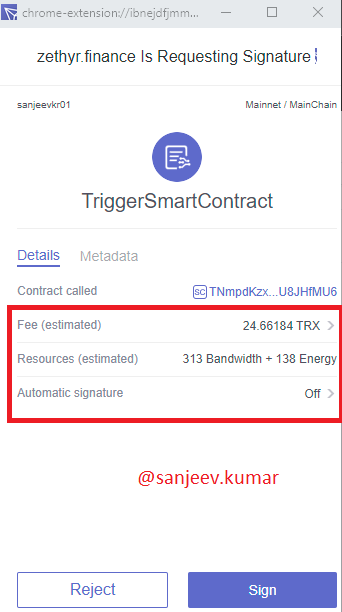

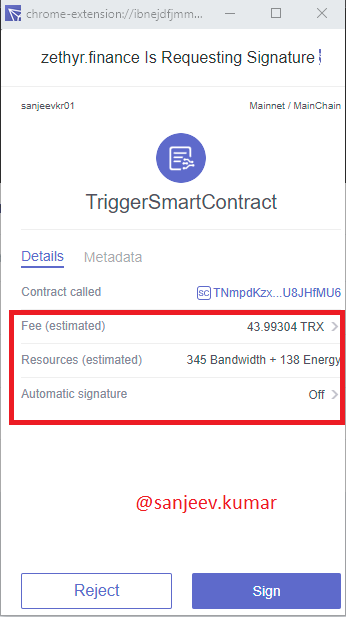

2 Now confimer the transaction

Real transaction fee is 24.66TRX

Now we are ready to borrow.

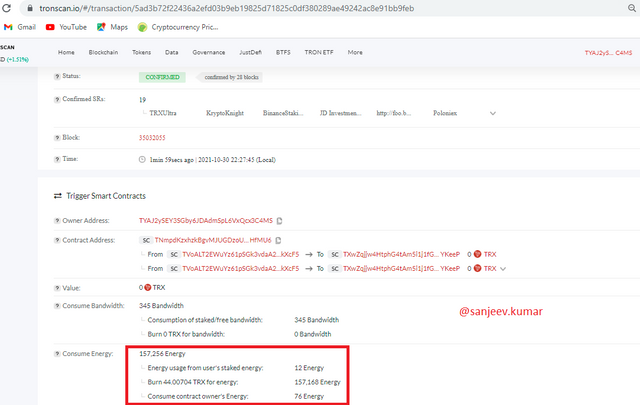

3 Enter borrow amount and Click on Borrow. With 20% APY

4 Now confirmer the transaction and burning fee which is 43.99TRX

Transaction detail 5ad3b72f22436a2efd03b9eb19825d71825c0df380289ae49242ac8e91bb9feb

Transaction detail

Now we can see the borrowed balance that is $0.35.

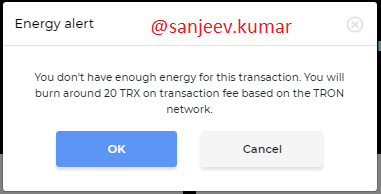

Similarly, we can repay and withdraw the token by burning TRX in case of insufficient energy.

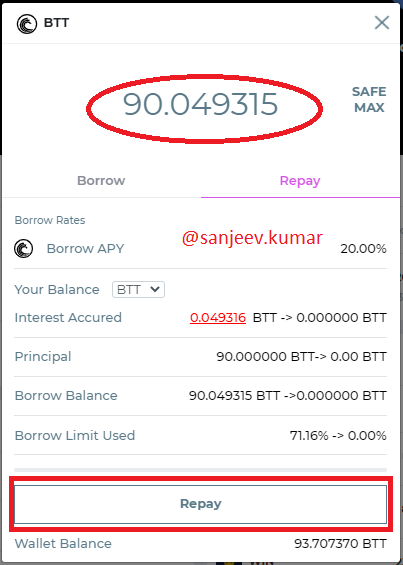

Repay

Now for repay, we have to pay including 20% APY interest change too.

Confirm the transaction

for this transaction, the real fee is74.5TRX.

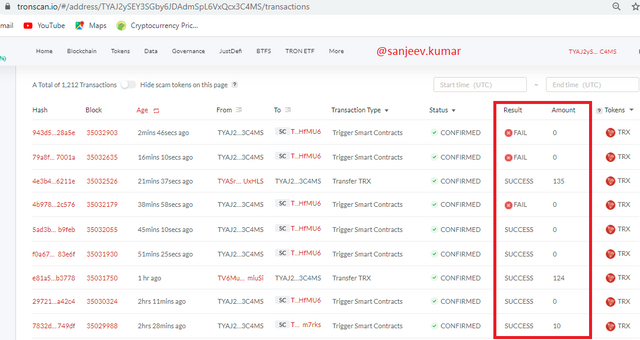

I’ve tried 3 times and unfortunately got the same result got an error. More than 150 TXR burns for this transaction even the TRX was sufficient because added TRX to complete this transaction.

These are three transaction detail.

4b97802a1b1bf7f75b30beef75eda7a77dfe1f0639c529d8d37ea8917de2c576

79a8f4d9676302c1086b6b18436e130854d3e3f400045a91efde384553e7001a

943d5d3c870d34369d35ffdebcf83f0bf0713af6a94cefc29d1691e42a628a5e

Wallet detail

src

8.What do you think of Zethyr Finance? Is it great or not? State your reasons.

I feel Zethyr is a great finance platform over the TRON ecosystem which has an amazing feature that makes it standalone.

As it's a decentralized finance platform that managed centralized market liquidity too.

The user has 4 different token options for lending and borrowing. TRX, USDT, WIN, and BTT

The supply ratio of zToken is 1:1. With loss transaction fee.

Users can take advantage of the supply and borrow feature according to their need by a collateral minimum amount.

User gets instant swap solution on zethyr finance platform that uses TRC20 protocol.

For the stable swap, the separate feature available like USDT for TRON U network TRC20 swap with Ethereum network using ERC20 USDT.

And after the update of V2 Zethyr finance merged the swap function as DEX aggregator which makes it better.

Conclusion

There is no doubt Zethyr has the most promising feature on the TRON ecosystem. As It is a decentralized finance protocol. Which allow the user to supply/borrow asset and make a profit. As TRON burns huge energy and bandwidth that really painful in case of the transaction went wrong. Once again thanks to professor @fredquantum for this lecture.

Do not use the #club5050 tag unless you have made power-ups in the last 7 days that are equal or greater than any amount you have cashed out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @steemcurator01,

As I'm following #club5050, and in the last 7 days have done 465 power up and cashed out 375. please correct me if calculating wrong.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit