With at any rate nine applications for Bitcoins ETFs gathering dust in the Securities and Exchange Commission's in-box and customers baying to purchase crypto reserves, US guarantors in the $6.4 trillion industry are cobbling together a developing number of workarounds.

A record of organizations are delivering or arranging "Bitcoin adjoining" items that skirt US controllers' refusal to permit the biggest digital money to be placed in a trade exchanged asset covering. Invesco turned into the most recent on Wednesday, reporting a couple of assets loaded with crypto-connected values.

It's the solitary way US firms can take advantage of the persistent clatter for advanced coins, and it might remain as such for some time. The SEC has effectively deferred its choice to endorse or deny a Bitcoin ETF once this year and is relied upon to punt again at its next cutoff time on June 17.

A record of organizations are delivering or arranging "Bitcoin adjoining" items that skirt US controllers' refusal to permit the biggest digital money to be placed in a trade exchanged asset covering. Invesco turned into the most recent on Wednesday, reporting a couple of assets loaded with crypto-connected values.

.webp)

It's the solitary way US firms can take advantage of the unwavering clatter for computerized coins, and it might remain as such for some time. The SEC has effectively deferred its choice to endorse or deny a Bitcoin ETF once this year and is relied upon to punt again at its next cutoff time on June 17.

"There's unmistakably solid interest from financial backers for openness to the cost of Bitcoin, and ETF guarantors are just hoping to fulfill that need," said Nate Geraci, leader of the ETF Store, a warning firm. "The SEC is basically driving ETF guarantors into the research facility to make these Frankenstein items."

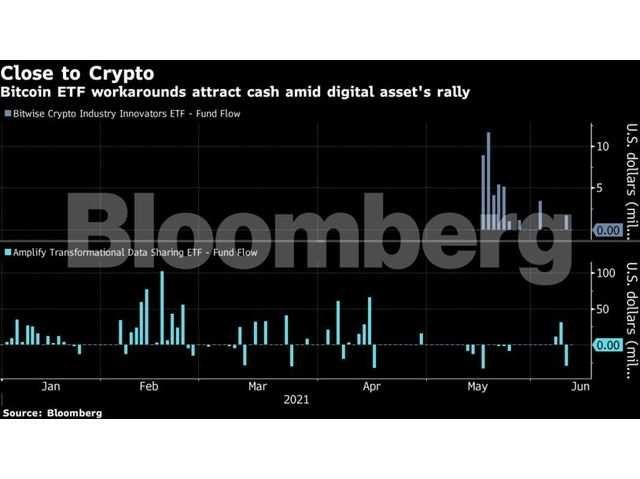

The Frankenfunds' makers are being compensated for their endeavors. For example, the Bitwise Crypto Industry Innovators ETF (ticker BITQ) has effectively drawn about $45 million in resources not exactly a month after its dispatch. That asset holds crypto-substantial organizations like MicroStrategy Inc., Coinbase Global Inc., and Galaxy Digital Holdings Ltd.

Then, at that point there's a record of more established items discovering new life in the midst of the coin fever. The Amplify Transformational Data Sharing ETF (BLOK), an effectively overseen store with stocks like MicroStrategy and PayPal Holdings Inc., pulled in more than $711 million this year as of now, as its cost has risen 30%. A friend store called the First Trust Indxx Innovative Transaction and Process ETF (LEGR), which puts resources into organizations utilizing or creating blockchain innovation, is on pace for its greatest year of inflows yet.

"There is a popularity for a Bitcoin item that has every one of the highlights that individuals love about ETFs - that they exchange on a trade, that they're fluid," said Ross Mayfield, venture system investigator at Robert W. Baird and Co.

Greatest Player Yet

Invesco is the biggest asset director yet to attempt the workaround strategy, with its Invesco Galaxy Blockchain Economy ETF and Invesco Galaxy Crypto Economy ETF, each holding around 85% of their resources in crypto-connected values and the rest in trusts and finances that hold digital currencies.

Two days before the Invesco recording, there was an application for the Volt Bitcoin Revolution ETF, which would incorporate organizations with Bitcoin openness. At any rate 80% of its resources will be in firms that either have Bitcoin on their accounting report or are creating or utilizing items inside the crypto environment, just as choices on those organizations and ETFs that have openness to them.

More finances following the crypto business - rather than real Bitcoin - may make a big appearance in the coming months, as the SEC keeps on voicing worries about the market. As of late, SEC Chairman Gary Gensler said the crypto area could profit with more noteworthy financial backer security and has encouraged Congress to give the administrative office authority over exchanging settings.

"My good faith on Bitcoin ETF endorsement has wound down as of late," ETF Store's Geraci said. "It's difficult to see Gensler's remarks on the present status of the Bitcoin and crypto biological system and feel hopeful about the possibilities of a Bitcoin ETF at any point in the near future."

Even after a genuine Bitcoin ETF at last dispatches in US advertises, these crypto-seasoned assets could in any case have advance, particularly in a world fixated on all things including blockchain and computerized tokens.

"These Bitcoin-contiguous vehicles bode well for individuals who would prefer not to manage all the unpredictability of Bitcoin however need openness," said Amrita Nandakumar, leader of Vident Investment Advisory. "It's an answer that has sprung up because of the repressed interest."

@santhosh03, Please do not post irrelevant content in Crypto Academy. This community is an exclusive niche for crypto-academy-related publications.

Any repeated attempt will be considered an act of spamming and will mute you in this community.

Cc- @sapwood

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit