Sourse

introduction

1. Define the Order Book and explain its components with Screenshots from Binance.

The order book is an important element to keep in mind when we start trading on an exchange, in this case Binance. The order book shows all the lists of buy and sell orders of an asset, which are organized by price, here works a system that achieves that the buy and sell orders can match, this system is called matching engine and this system determines the strength and efficiency when executing the exchange.

There is the decentralized exchange DEX, this is responsible for the exchanges algorithmically match the buy and sell orders through the so-called smart contracts, DEX also facilitates operations and prevents the funds are monitored by any centralized entity, of course it has its commitments and responsibilities in the performance and performance.

I also want to point out that there is an order book for each cryptoasset that exchanges support, and this allows traders and users to access the order book for each crypto. The advantage of using the order book is that it makes it easier and simpler for traders to perform technical analysis.

Components of the order book

The order book has several components or elements of which I will highlight the most important and they are:

Purchase orders or Bid : In this section is where they show us all the purchase orders that are made by traders, here we observe the price of the order provided by buyers, which are at limit prices and is organized from the most expensive price to reach the lowest price.

Ask or Sell Orders: Here in this section we will observe the sell orders that the traders have made, unlike the Bid section, the Ask section is organized starting from the lowest price until reaching a higher price.

Order History: Here we will observe all the references of the orders or buy and sell orders that we have already executed within any platform, in this case the Binance exchange.

Source

2. Who are Market Makers and Market Takers?

MARKET MAKERS

The market makers are organizations or entities which could be individuals or companies, these have the primary objective of guaranteeing, providing and providing liquidity in transactions or operations carried out in the market, and to continuously offer the prices of purchases and sales also comply with the relevant regulation of the financial market and it is through a contract with the governing body of the same.

The function of the market makers is to stabilize prices, they are also obliged to provide the counterpart for investors who want to make purchases, providing sales positions and vice versa.

MARKET TAKERS

In simple words, market takers are all those who take bids and subtract liquidity from the market and add volume to it, this concept applies in general to the trading world. We are simply takers when we place a market order on a crypto exchange, also when we place limit orders, we are a taker when we fill an order from others.

3. What is a Market Order and a Limit order?

MARKET ORDER

The market order is an order we use to buy or sell instantly at the current price available in the market. These orders depend on the liquidity of the market in order to be filled. Market orders execute immediately at the current market price. On the Binance exchange, trading fees are paid as a market taker.

There is a process called slippage, and this consists in the fact that when a market order is placed, it can be a market buy order, it will match with the best limit sell orders, but if the limit sell order, which is a low price that is available, is not enough to execute and thus complete the entire market order, what can happen is that it will automatically match with the limit sell orders that follow until the market order is completed.

The market order is used by users who are in a hurry and are willing and able to pay the higher fees and costs that are incurred by the slippage process, if these users want to buy and sell quickly regardless of the price.

LIMIT ORDER

The limit order is an order that we use to place in the order book in a specific way the limit price or higher, this limit price is defined by us, which means that when we place this limit order, the operation or transaction will be executed when the market price of the asset reaches the price that we provide in our limit price. This type of order is used to buy at a lower cost or to sell at a higher cost than the current market price.

It has the advantage that you save on commissions as a market maker, since this limit order is not executed immediately.

4. Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

The market makers provide liquidity to the order book so that it can be matched in the future. Then the market takers, some trader will take the order that is in the order book. This process or relationship that exists between them will allow the flow and increase liquidity in the market, this happens through the market makers that will be to match the limit order, then in the case of the market takers will place orders that will allow to match the market order, and as mentioned above this will generate liquidity and fluidity in the market.

The market makers provide the prices generating the liquidity through the limit order, and the market takers accept the prices placing the market order and thus take the liquidity that the market makers provided them.

5. Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

The process of switching from SBD to STEEM for the lowest price was instantaneous, because the steem offer was already available at the time of the transaction.

For this, we will first log into our wallet, and then we will select the current lowest price in the market, as we will observe in the following image.

Sourse

b) changing the lowest ask. Explain what happens.

In this process I placed the lowest price, so it took a little longer to complete the transaction, as we will see in the image below.

Sourse

6. Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market.

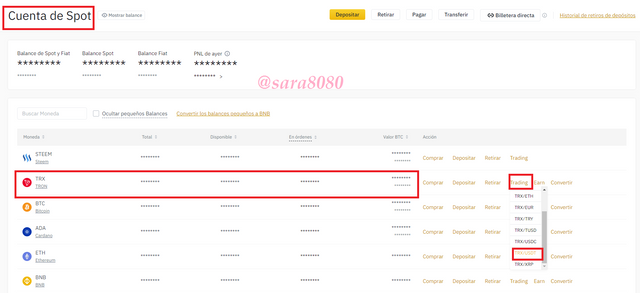

To perform this transaction we go to the spot account

Select TRX and we must have available 15$ in USDT or more.

Select trading

and choose the TRX/USDT pair.

Source

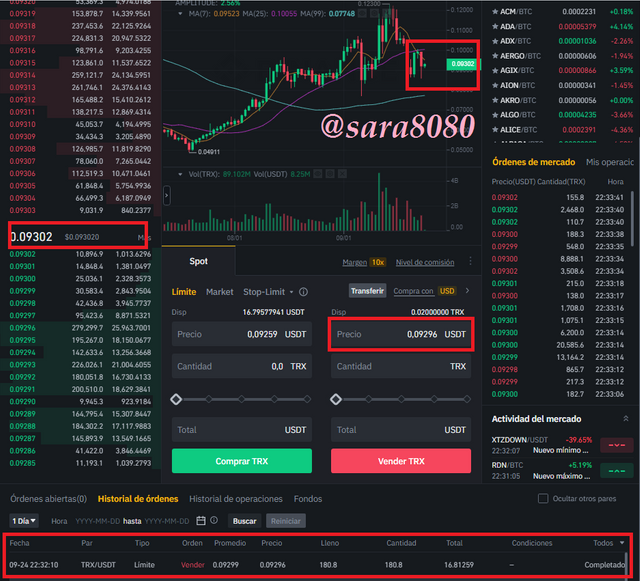

The following image shows the Limit order to sell for the TRX /USDT

180.8TRX = 16.812USDT

The impact on the market took only a couple of minutes to perform the operation and did not affect the economy of the TRX/USDT as we are talking about insignificant volumes compared to the large transactions that are made every second of quite significant volumes.

It was very fast and did not affect the price at all due to the high volumes with which the TRX network currently operates.

Source

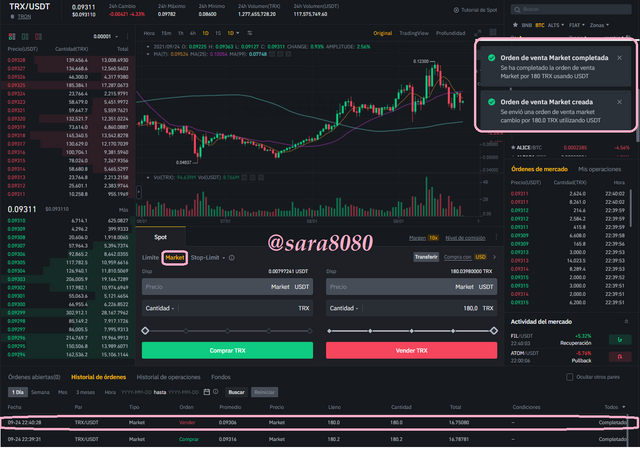

7. Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market.

To perform the following operation I just applied the Market order option and placed the amount of TRX I wanted to exchange to USDT.

The transaction was instantaneous as the market placed the order directly at the price of some TRX buyer.

The commissions were super low.

and changed 180.0TRX to 16.75USDT

The impact on the market lasted only a couple of minutes to perform the operation and did not affect the economy of TRX/USDT as we are talking about insignificant volumes compared to the large transactions that are made every second of quite significant volumes.

Source

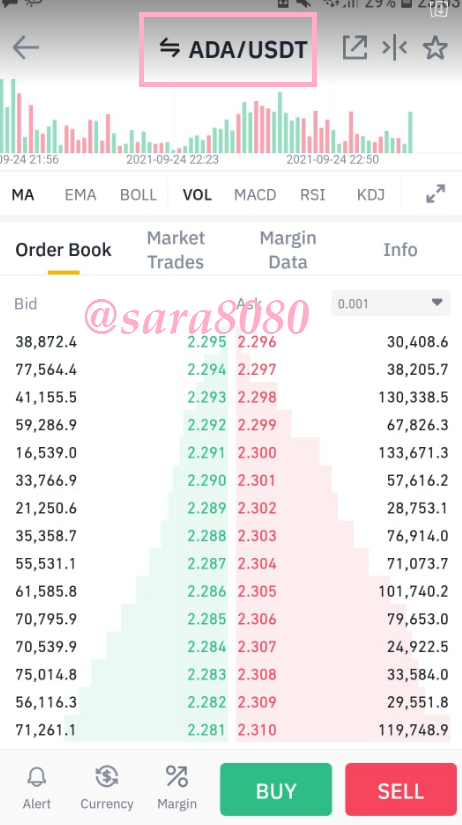

8. Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

Source

Looking at the above image, I will perform the Bid-Ask calculation and the calculation of the average market price of the Binance ADA / USDT pair order book, below:

a) Calculate the Bid-Ask.

Ask = 2.296

Bid = 2.295

Spread = Bid - Ask = 2.296 - 2.295

Spread = 0.001

b) Calculate the Mid-Market Price.

Average market price = (Bid + Ask) / 2

Average market price = (2,295 + 2,296) / 2

Average market price = 4.591 / 2 = 2.2955

Conclusión

Everything seen in class and done in this assignment, leads me to understand that the order book is very important and is a fundamental piece in the study and technical analysis as traders within the cryptocurrency platform. The proper use and handling of the order book will facilitate the decisions we will make to make buy and sell orders, its correct use is of utmost importance and vital to obtain and make the most of everything we do as traders. Understanding who are the market makers and market takers, what is a market order and a limit order, and how they relate to each other, all this is vital to improve our ability as traders.

I want to emphasize that order books help traders, traders, not only to observe but also to make measurements of the interests of buyers and sellers specifically at price levels, and this provides the data required to know the possibilities of support and resistance levels of assets in the market.

It is also very important to know how to place buy and sell orders within Steemit, Binance or within any platform of our interest.