.jpg)

I am writing this post in response to the assignment task given by the professor @yohan2on , I really enjoyed it and i really appreciate and thankful to you for your lecture, help and support to the community.

.jpg)

Scalping Trading

Scalping is a Trading style and it means quick trades for quick profits. It involves short duration of quick trades in smaller time frames like 1, 5 , 10, 15 and 30 minutes etc . Scalping Trading is different from long term or day trades. Here traders take their position and exit from the trades taking their profit quickly and don't hold any trades or positions for long time. Price momentum and trend is mainly focused in scalp Trading.

.jpg)

There are lots of Trading Style or strategies available according to different kinds of Traders, But here i am going to talk about the Finger Trap Trading Strategy. Let's understand what basically it is :

Finger Trap Trading Strategy

Finger Trap Strategy can be defined as the trend following strategy. In this strategy we focus on strong market trend . It is focused on Market Trend but trade is taken in short time frame like 1 minute , 5 minute, 15 minute etc. following the trend.

It involves following things which is determined while taking trades:

- Identification and trading in direction of trend

- Multiple time frame analysis looking at higher time frames and lower time frames

- Trading with stop loss

How to setup and use Finger Trap Scalp Trading Strategy

- You will need to customize or add 2 Exponential Moving Averages ( 8 and 34 period of EMA) on the candle chart. To add EMA on chart goto indicator section and choose Exponential Moving Averages (EMA). After choosing you can change the default EMA setting and set one to 8 period and another to 34 period.

- You have to find the trend of the market in different higher time frame like 1 hour or 2 hour but trades will be opened on low time frame candle chart i.e: 5 minute candle chart.

I have chosen 1 hour candle chart and setup 2 EMAs(8 and 34 ) to identify the clear trend of BTCUSD pair and you can see the long term strong trends on the chart. This is how we have to look into the trend and now need to check smaller time frames and execute trades on correct time.

After finding the trend focus on candles touch or close to 8 period EMA line and wait for the correct entry time. When candle is holding or moving close to the the EMA line on higher time frame , then confirm or identify the trend and candle chart in smaller time frame (5 min candle chart). Always trade with stop loss to avoid higher loss if market trend is changed. When our trades moves in favor and got profit from it, now have to take profit and exit from the trade and look for another opportunity.

After analyzing the trend on 1 hour candle chart, look for short time frame candle chart and look for perfect entry. Trend is your friend, you must have to follow the trend. Take the trades on trend direction with proper stop loss and take profit.

You can see i have used 5 min candle chart and showing buy , stop loss and take profit on the chart. I trade on 1:1 risk to reward ratio. You can also take help of other most used and popular indicator like RSI and MACD along with EMA to identify the price momentum. Support and Reisistance is also very important in trading you also have to look at support and resistance areas.

.jpg)

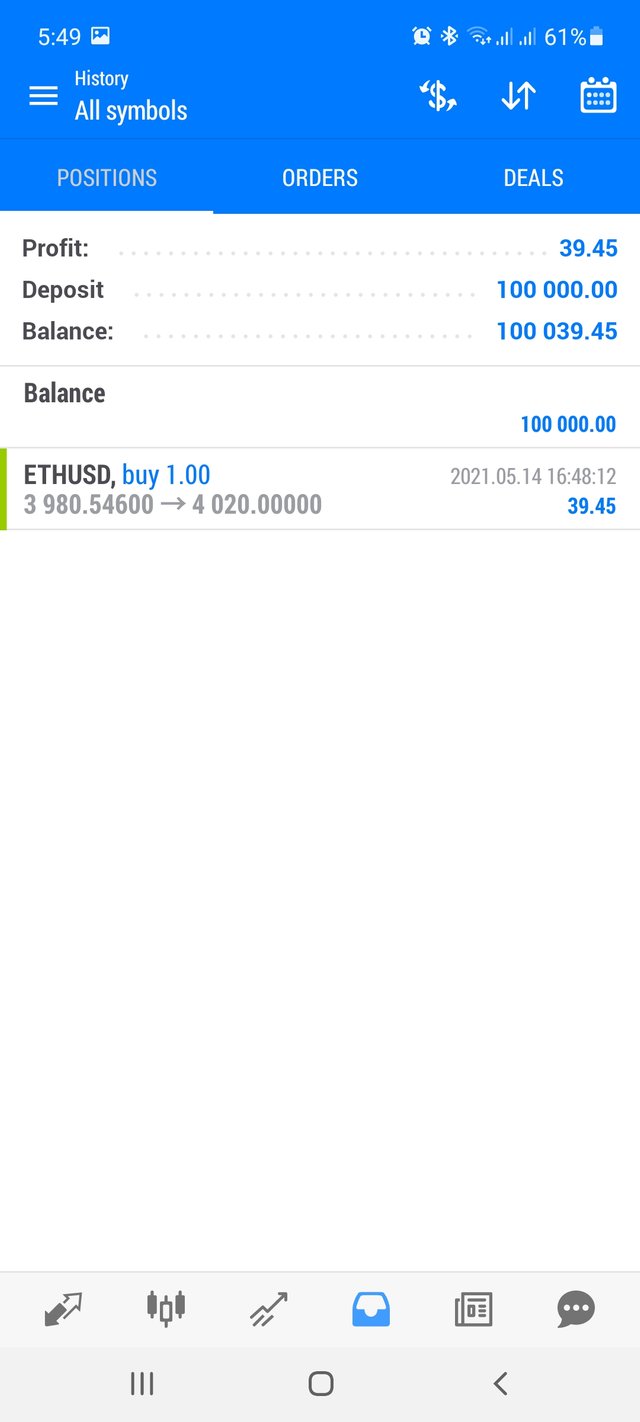

Now i am going to show my trade demonstration on meta5 web trading terminnal choosing 2 cryptocurrencies : Ethereum (ETH) and Litecoin (LTC) :

1. Ethereum (ETH) : In the chart you can see that the trend is uptrend in 1 hour .

On MOBILE :

You can see on above images that the ETHUSD pair is moving in upward trend. After identifying the trend i will look for 30 minutes, 15 mutes and 5 minutes candle chart. I am sharing meta5 Mobile application screenshots as most of the users use mobile for trading now a days and it will be easier for you to understand.

You can see in the screenshot that the trend is upside in 5 minute candle chart. i took a trade on ETHUSD pair in META5 mobile app with stop loss and take profit.

I opened a buy trade following the trend and EMA lines at price of $3980. I set stop loss at $3929 and take profit set at $4020. Stop loss and take profit can be adjusted as per the current price levels. Money management is very much important . Don't forget to set stop loss and take profit is also you must have to set . Risk to reward management depends upon you , i prefer and recommend 1:1 or 1:2 in finger trap strategy.

You can see ,my take profit was hit and price hit $4030+ . My trade closed automatically as i set TP on my trade . My Take profit was hit so it is showing green indication close to my trade details. In below image you can see i got $39 of profit from my Finger Trap Trading strategy in very short period of time.

.jpg)

2. Litecoin (LTC): In the below screenshot/image you can see LTCUSD pair is in downtrend in 1 hour candle chart.

Now i will check the pair in small time frame like 30 minute, 15 minute and 5 minute candle chart to identifty or confirm the trend and to find perfect entry in short time period for quick profits. . You can see in 5 minute candle chart also LTCUSD pair is in down trend.

After identifing the trend now i will take a trade of sell because the market trend is downside. ( Today saturday, the forex market is closed and meta5 mobile and web app showing as market closed and not let watch live chart and trade). SO, i am really very sorry that i can't show my live trade however i have tried to show it well on the Tradingview chart:

I opened a sell postion at $315 because the trend downtrend . I set my stop loss at $320 and take profit set at $312. After few minutes later you can see my take profit was hit and gave me quick profit.

.jpg)

Advantages and Disadvantages of Finger Trap Strategy:

| Advantages | Disadvantages |

|---|---|

| Quick profit can be made quickly | High volatile movement in short time frame trades, high risk of hitting stop loss again and again. |

| No pending or open trades overnight | High number of trades but low profit |

| Very easy to use and time saving | Need to pay fees for each trades we open everytime. Because of Spread depending on different platforms,we get lower profit |

| We can setup trading Robots (bot) with this strategy | Difficult to identify fake breakouts and reversal |

.jpg)

- Conclusion

Scalp trading is a profitable trading strategy if we follow all the steps properly and take trades seriously with tight stop loss and take profit to lower down the risk and to get maximum benefit from it. All financial market are very risky. In this strategy also there is high risk associated. I would like to recommend everyone that always start from very small amount untill you properly learn the things. You can take the help of some other popular trading tools and indicators along with this strategy for more better result. Always trade with proper money management(proper allocation of money in terms of risk) for low risk and higher profits.

.jpg)

Thanks Professor @yohan2on for all your beautiful and interesting lecture. I'm looking forward to your next lecture.

Thank you all steemians for reading !

Hi @sexualhealing

Thanks for participating in the Steemit Crypto Academy

Feedback

This is very good work. Well done with your research and the practical demonstration of the scalp trading style using the finger trap strategy.

Suggestions

I suggest that after identifying the trend in the 1-hour time frame, you move down to the 5-minute chart and look for good entries based on the candlestick formations. Always trade with the trend. Markets don't move in the straight line, you will therefore have to exercise some patience by waiting for the market to reload and get back in the trend which you are following.

Homework task

9

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot for your support and suggestions ! i will definately follow it !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit