Helloo Steemians

People who live in the world of crypto-currency know that there are fluctuations in the world of crypto-currency, sometimes up, sometimes down, sometimes on a certain stage. So different tools are used to determine the value of a bit we know that most of the altcoins are estimated on them which are the best things in the market and in the trade if you look at it. It follows the trend of the market, which means that the trend of things increases, the market predictions become higher and a new insight emerges that people increase their profits. will lead to higher and higher profit trends.

image editing on Canva

Explain in your own worlds the stock to flow model what is the its function.?

The stock-to-flow model is a tool used by bitcoin analysts to determine what bitcoin shortfalls are and to estimate their specific determination that bitcoin is short before what it means. It is used to determine the scarcity of Bitcoin and will be able to determine its prices in the near future and it is rapidly being worked on to estimate the prices, which means that this tool A large scale has been carried that will be able to estimate future prices and track pricing.

We know that a tool that a person can He was an unknown person, he was hidden and played a hidden role, meaning that his secret was not revealed to anyone, as we know that time passes and he As time goes by, the supply of the bat is determined and the bat is estimated to be short of them.

There is no doubt that after obtaining these figures and calculating the annual income, how much can be delivered annually and over time, the investor will be By estimating the price, the users will be able to make their own decisions and the S will be able to make successful decisions in which they can trade with the bitcoins.

How does it works.?

S2FCalculating the ratio of the current circulating total annual new supply of bitcoin is estimated to estimate the circulating supply of bitcoin and know that there is no doubt that the result obtained According to us, we don't provide insight, which means that as time goes by, the bitcoin that exists is becoming rarer.

As we know that its supply is being reduced, there is no doubt that when a product disappears from the market or its quantity in the market is very low, it means that You can figure it out like this: the price goes up and up. We know that this determines what Bitcoin is and its supply.

Yes, it leads to declines, the stock will have a higher volatility ratio. Its power will increase and its rate will fluctuate because the more something decreases, the more its value increases.

Stock-to-flow represents the decline and price determination we know that bitcoin declines must do. There are many other factors that are involved, and there are also many projects that are in the works. The stock-to-flow ratio can be affected by market demand for tokens, adoption of tokens and awareness campaigns, the impact of regulatory structures on tokens, the effects of market attention, prevailing market sentiment, the level of technological development surrounding the token, and general economic factors. If we talk about it, apart from that we have some other external factors including security breaches and banking and geopolitical activities which are also included in all these factors.

What would be the advantages and disadvantages of the stock to flow model.?

** The advantages are...

There is no doubt that it is very easy to use, so to speak, to know and track most of the circulating supply and new issuance in the crypto space. All this means that all of them can be easily accounted for and that it can be estimated and accounted for, which can be an intrinsic help to Bitcoin.

That it can help him we don't see anyone who can successfully determine BTC and so to speak it is not used in production and one of the most important is that S to F stock. Flow ratio which plays an important role in determining the value of gold for its ease with the price of gold, it attracts very large investors which means that it allows investors and traders to Gives an insight means it tells all the people when to invest and the right timing of investment that can make them earn huge profits and more profit in their life and theirs.

Investments can be further enhanced if we talk about the other price of Bitcoin which along with other factors controls its price meaning that it helps to know the current sentiments in the market and the sentiments of the marketers. can see what their emotions are saying, whether it's going up or down, but has the ability to know their emotions in every way.

Disadvantages

Most importantly, it does not fully control the impact of demand on the BTC token, meaning that it cannot keep track of it, and it has annual fluctuations. Based on the rate of supply and new tokens that appear and contribute to them and use the rate of issuance of new tokens, S2F does not provide any other conditions generator that BT provides.

There are unexpected circumstances and one of the big ones is that we know that it can lead to a decrease in the price of BTC and it is the most important factor to bring down its price. Even things like the DDoS attack and BTC regulatory shutdowns can affect shutdowns. They intend to sell things immediately and when the market goes up, they try to sell whatever they have and hence the volatility of the market.

It happens sometimes the market goes up and sometimes the market goes down, that means the less things are available in the market, the price will go up and the more things are available in the market, the lower the price will be, we know. are that S2F's forecasts cannot be validated because it does not include factors that may determine the market's underpricing.

Make an analyse of the stock to flow graph.

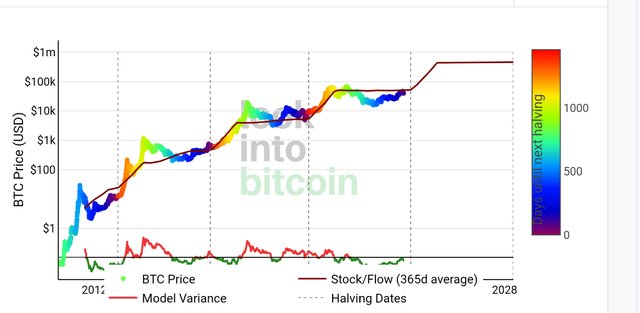

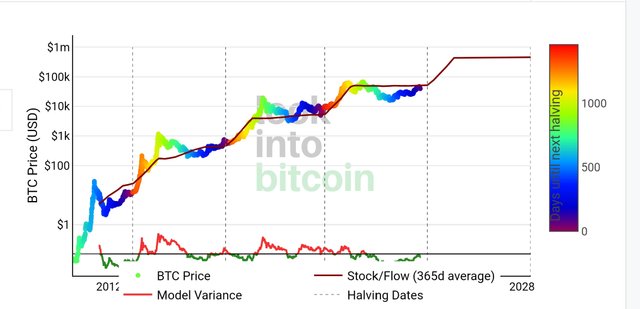

A stock to flow chart is an example of a bitcoin stock to ratio flow brown color is a single single line a single single line shows us while the price of bitcoin is the dots that we see that we see Above or below the stock-to-flow ratio line, we can clearly see them and we can see them.

What is the pricing of what is its predictions, we clearly see that on this account all fluctuations and on this account all its things that are are carried out and all the action of all that is on this account. is moving under and its ratio line which is moving forward means that it is increasing its speed is moving forward rapidly which clearly gives us an example of this.

is giving and arguing that all of this is due to the scarcity of Bitcoin because the scarcity refers to the halving of what we have seen and we will see the work on that in April. Because any buyer never points down the line, meaning that a buyer can buy it from anywhere, it is an indication that if the market moves from above to above, that buyer If you can talk about it, if bitcoin is halved, its price will go very fast.

It's running but if you talk about what it's worth, it can reach a hundred thousand dollars. The number to halve is represented by colored dots. First its vertical signs are showing as S2F is against its colored dot, we can clearly see that we are well ahead of the BTC halving.

A new tool to show the difference between the price of S2F and its actual price is shown in it and a new tool is shown in the middle of the bottom of the chart below it. It is seen that any time the S-to-F value is higher than the actual value, the dotted line is above the S-to-F line ratio and we see the tool clearly red, meaning that it is a danger sign.

goes on and after that he also shows us green later on meaning he's out of it so now we can see him between the price and the factors and quickly lose through the dot. The line that is in and this line will move upwards and increase in speed especially when BTC is going to halve knowing and experimenting that the price drop may be the last one. Is

Can this model be applied to STEEM give reasons why this stock to flow graph model can or cannot be applied.

There is no doubt that every human being has his own personal experience and speaks based on his own experience.If I speak, there is no truth in what I say and its application to Steam. It will be because there are several reasons why I am talking about this, which I will tell you.

The consensus mechanism used by BTC is different that from SteemBTC uses proof of work consensus algorithm Steam uses Delegate while it uses Proof of Stake and their reward systems are different which means they are very different from each other and we know that their prayers are also run differently from each other.

The production rate of blockchain in both coins is also different from both. If we talk, Bitcoin is seen from the point of view of digital gold. Also because it is traded differently in each region. In some regions it is called blue chip. This process works many times differently than the mining rate and the STEEM token and they have their own.

We have our own calculations, our own methods, and the level of BTC is much higher than Steem, and at the same time, we know that there are different models. This means that this does not happen in Steem Coin. We know that the amount of BTC being reduced can be brought up by the constant decrease in its number, because the lower it is.

The lower the number of coins it has means the more investment and rupee money its value can be stabilized and thus its value will go further. Much more difficult work but in BTC it can be detected and we can find out that the ratio is used by investors as the S to F equal trade meaning that the trade will be exactly equal. Know that the number of Steem is difficult to estimate but the number of BTC can be estimated.

Conclusion

The S-to-F ratio is used by investors and traders alike, meaning that as we know it, we have determined the current status of BTC, providing the best time to invest in them. It can be helpful to mean that timing your investment gives you that because we know that BTC drags most of the altcoins with it and the market cap. We can use it to understand the meaning of its market volume or extent and we can get support from it.

i would like to invite [ professor @kouba01 ][ professor @pelon53 ](@patjewell @josepha @suboohi @chant @malikusman1 @beautiful12 to take part in this contest

Best Regard

@shabbir86

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://twitter.com/shabbir_saghar/status/1750577897759293453?t=PPaid0z3KVahPCdTroXeRQ&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@shabbir86 Your post about the Stock-to Flow model is incredibly insightful. I appreciate how you broke down the complex concepts in a way thats easy to understand. Your analysis of advantages and disadvantages adds a thoughtful touch. Best of luck in the contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@hamzayousafzai

Thank you very much for reading this post and giving a great comment on it.Actually stock to flow model is a tool used for shorting bitcoin and others if you talk about it here is a compliment. What is Able Comment We know it's the world of crypto, the ups and downs in the world of crypto usually go up, sometimes down, that's the world of crypto, and it always fluctuates like this. We know that bitcoin price will halve in mid April which will benefit the up market and also benefit us. Thanks a lot for the great comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Saludos cordiales gran amigo shabbir86, un gusto para mi saludarte y leer tu participación.

Un modelo predictivo que tiene poco margen de error para predecir la valoración del BTC año por año, este modelo es muy específico para el BTC, pienso que no se puede aplicar al steem.

Te deseo muchos éxitos, que tengas un feliz y bbendecido día.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@yancar Thankyou so much for your excellent comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

Your post on the Stock-to-Flow model is really impressive. I love how you explained the complex ideas in a way that's easy to understand. Your analysis of the pros and cons is a great addition. Good luck in the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thankyou so much dear your feedback

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings, my friend @shabbir86! Your insightful analysis of the Stock-to-Flow model showcases a deep understanding of its complexities. The breakdown of advantages and disadvantages adds depth. All the best in the contest, success for you! 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@artist1111 My dear brother Thankyou so much for your valuable comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There's something important that I have learned from this your post based on the topic, which what I have learned is how to predict the future of cryptocurrencies and not just Bitcoin. I like your explanation. Success to you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jasminemary Thankyou so much your valuable comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

From your at article dear friend it proves that you are a man of high knowledge and experience to wisdom because the formers in which he is to explain Stock flow model is really entitled and amazing thank you for share search callusing contents on this platform.

Please engage on my entry too https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s15w2-stock-to-flow-model-or-or-modelo-stock-to-flow, remember starrchris cares

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Existen diferencias sustanciales entre STEEM y BTC que dificultan la aplicación del modelo como el algoritmo de consenso, la participación y creación de contenidos de sus usuarios para producir los tokens, dicha producción es dinámica o variable, usa la quema como medio de reducción, etc.

Has abordado las pautas de concurso con gran conocimiento aportando conocimientos.

Gracias por compartir ¡saludos y bendiciones!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit