How are you? I'm fine and I hope you all are fine too enjoying life's riches this is the best show I've ever been to and week five of season 22 is underway

canva editing

Question 1: Understanding News-Based Trading

Explain the concept of trading the news and its significance in the cryptocurrency market. Highlight its advantages and risks with examples related to Steem/USDT.

News-Based Trading in Cryptocurrency Market

News trading is a form of technical analysis wherein traders who are involved in trading do make a decision depending on an event or announcement that has happened. This approach is widely used in high risk categories, such as cryptocurrencies which price can be significantly influenced by new information within minutes. The news used includes regulation, partnership, technology, or any sentiment that can cause a price impact to enable traders to invest in the cryptocurrency.

Cryptocurrencies are an around the clock market which makes them especially sensitive to realtime news. To some extent, the orientation of news directly affects the trading prognosis for Steem/USDT since Steem is a blockchain-based sharing economy platform that deals with content creation and monetary incentives while USDT is a stable coin linked with USD.

Why Trading the News is Possible in Cryptocurrency Markets

News based trading is a fascinating concept of analyzing some factors that are going on in the external environment in order to be in a position to make right trades in the market. To fluctuate abruptly the nature of news is quite different from that in the traditional financial markets, the market of cryptocurrencies is relatively new, it is decentralized and its movements highly depend on the community.

Key types of news impacting cryptocurrency markets include:

Regulatory Updates

Issuing governments or institutions are the main decision makers of a market. For instance, for a county to ban cryptocurrency, this might lead to the sell-off as compared to when there is legislation that fosters the use of cryptocurrency this leads to the buying.Directions: Project Specific Announcements

Cryptocurrency news which outline upgrade, partnership, or any significant event in a specific cryptocurrency can influence price. For instance, the appearance of the news that Steem is joining the partnership with the leading content platform, traders will predict that people will use this coin more frequently and buy it.Market emotions of buyers and tendencies in social media

Cryptocurrencies are inclined to volatilities prompted by social media influencers and groups into the cryptocurrency markets. For instance, if a celebrity endorses Steem in the Tweeter, then the prices of Steem may rise as many investors purchase to hold for higher gains.Macro Events

Micro events include changes in interest rates, inflation rates and any geopolitical events that may affect the market indirectly by affecting the market sentiment of investors.

Role of News-Based Trading in Trade Cryptocurrencies

1. Benefitting from Fluctuations

For a particular medium of exchange, few assets are as unstable as cryptocurrency markets, and news are the key drivers of these changes. Therefore, their basic principle is taking advantage of fast reactions to breaking news, such as enormous volatility, mainly in the Steem/USDT trading pair.

2. Market Efficiency

With the news-based trading, there is order brought in the market as prices reflect the new information whether true or not. That way, when a big event occurs, traders keep adjusting, making sure that the market actually is indicative of today’s conditions.

3. Opportunity to Outperform

For those people who read and analyze news, trading with the actual data indeed could provide a better chance than mere technical and/or fundamental analysis traders.

Benefits of News Trading

1. One–time highly lucratively returns

Depending on the news sent, such change might happen quickly and to a large extent to affect cryptocurrencies prices. A positive buzz about Steem can be generated by an announcement of a new feature for the platform or integration with other platforms, to name a few… Businessmen are quick to make good money within a short period of time.

2. Information Penny Search

Cryptocurrencies are traded internationally and they are largely driven by users of the Internet platform. Doing away with factories and managing the system online also eliminates the need for external and uncontrolled information, yet many sources are available, including social media, forums, and crypto news outlets.

3. Combined with Other Attitudes

News-based trading can in fact harmonize with various other styles of trading such as technical analysis ones. For instance, should Steem be close to a key resistance level and positive news is out at the same instance, the traders shall expect a breakout and organize their trades appropriately.

4. Improved Decision-Making

Such reaction time empowers traders to work under the current market conditions rather than relying on the archived data. By adopting this sort of work approach it helps in addressing the overall trading performance.

News-Based Trading Risks

1. High Volatility Resulting in Higher Slippage

However, volatility like any other thing has its advantages and disadvantage as far as investing is concerned. Following a major announcement, the price of the Steem/USDT pair may get highly volatile, and trading at the required rate might be done at less optimal price points due to a problem called slippage.

2. Fake News

Currently, the cryptocurrency market is replete with scams and fake news, as well as pump and dump schemes. Some of the traders may base their decisions on any Hear say about Steem, and end up losing their money due to fake news.

3. Delayed Reaction

In the world of cryptocurrencies, news spread like wildfire, and institutional traders usually have an edge over sticking to the news and acting quickly. Retail trader could be slow in either getting to the news or in responding to it thus being unprofitable.

4. Emotional Trading

It can be quite difficult to avoid this kind of thinking since acquiring news can generate some stable reactions that are fairly typical of traders who make decisions based on their passions. For instance, loss selling Steem during temporary negative news is not very productive.

5. Fluctuations, Promotions and Sales

Again, not every news tends to result in the change that will persist in the prices. For example, a minor improvement on the Steem’s platform could cause an increase in the price of the coin but this could be short lived, and thus anyone looking to trade on the Steem could be at a disadvantage.

.sources of news-based trading with Steem/USDT

1. Positive News Example

If for instance, Steem sensitises a new collaboration with a content sharing site, this makes it more useful and attracts more users. This news could, therefore, result in an increased number of clients holding Steem tokens. Consequently, long traders waiting to realize their profits after the price has shot up might engage in Steem/USDT trade.

2. Negative News Example

On the other hand, if there is the news that the organization behind Steem is having legal problems or experiences some technical problems its price is expected to be low. Opportunities to enter negative positions could be seized through going onto sell Steem/USDT.

3. Neutral News Example

Sometimes, Steem may announce a regular software update which, for one reason or another, does not provoke any heightened interest. But even the expert traders may continue to observe market sentiment in trends with a view of discovering slightest trading patterns.

News Trading Strategies

News Trading Rules

Verify Information

One should act based on news only after confirming the reliability of the source out of which the news was received. Spending more time is better than wasting time on fake news and rumors instead of hearing it from reputable sources.Use Risk Management

While employed in trading, use stop orders and don’t use excess leverage to cover risks in situation commodity price swings in the opposite direction.Combine with Analysis

Combine news-based trading with technical and fundamental analysis to make well developed decisions.Stay Informed

Constantly, update yourself by following several news outlets such as cryptocurrency only sites, social networking platforms, and blockchain discussion boards.

Crypto news trading is a thrilling and, by all means, profitable approach to the cryptocurrency trading pairs such as Steem/USDT due to their volatility. Although it gives the possibility to make money as a result of fast price fluctuations, this strategy is also a high-risk one mainly due to mis-information and emotion causes. This means that news-based trading is a good opportunity in trading, but with numerous challenges that keep traders from taking full benefit from it, including the availability of fake news, the constant flow of new information, and a lack of proper risk management strategies at first glance.

Question 2: Analyzing the Impact of News Events

Choose a past event (e.g., a major exchange listing, regulatory update, or macroeconomic announcement) and analyze its impact on the Steem/USDT market. Discuss the price action and market sentiment surrounding the event.

Analyzing the Impact of News Events on the Steem/USDT Market: The effect of Binance Delisting announcement

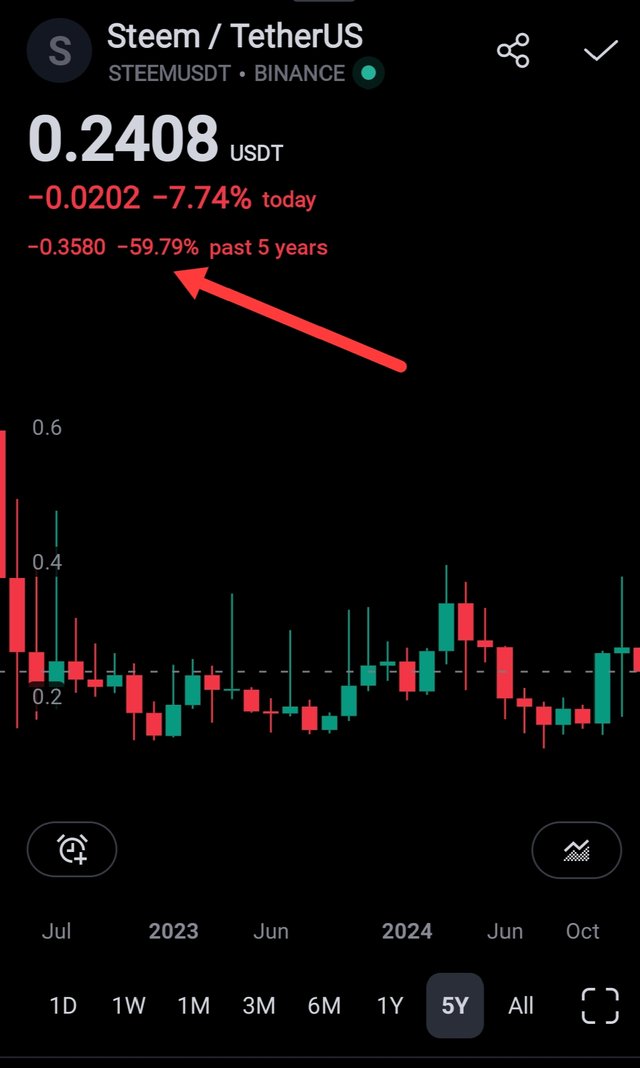

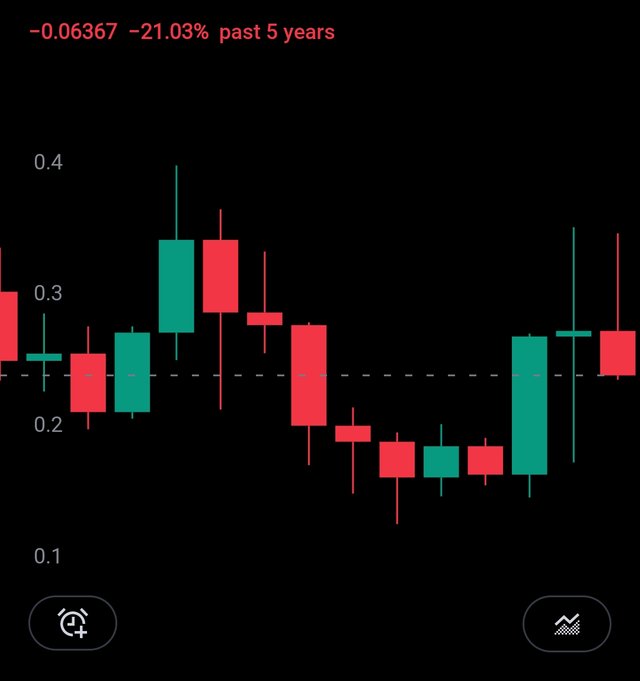

This is because news and events are among the key drivers of the cryptocurrency market where most tokens and coins their values fluctuate depending on announcements, market outlooks and other factors. There was one major event, namely Binance Steem/USDT market which was delisted on 25th December 2019. Binance, a leading cryptocurrency exchange, gathering millions of users from worldwide, became one of the first exchanges to delist Steem (STEEM) among other tokens. These changes generated significant price fluctuations and changes in market sentiment, which are very interesting and informative examples, before and after this event.

Background of the Event

Steem is an open-source social media protocol with distributed ledger technology that projects itself as aorce for creation of [content]. The digital currency of STEEM drives the ecosystem by being a currency which is used to reward users for their content. However unlike more generalwendung use case, seen in Steem, it had problems related to face competition, instabilities in regulation, low trading volumes.

Consequently, to give an account for its action, Binance, on December 25, 2019, released a statement detailing STEEM and other coins’ delisting. As for why it was delisted, Steem was not living up to a lot of standards anymore with regard to Binance: innovation, community, and trading volume, among others. It announced a deadline beyond which users would have to cease storing their funds on the exchange as STEEM trading pairs were to be deleted.

made by canva

Market Reaction: Price Action

The announcement of delisting by Binance shook the Steem/USDT market in the shortest possible time by size. Even after the announcement, the price of STEEM plummeted within hours, unfortunately given that it is typical of people to panic sell. Below is a detailed timeline of the price action:

- Pre-Announcement Trading Activity (December 24, 2019):

Earlier before the delisting announcement, STEEM was trading at $0.3580 USDT on Binance.

Overall the volume trades were moderate but with a growing concern of the amount of liquidity in the market.

- Immediate Impact (December 25, 2019):

The effect of this announcement caused the price of STEEM to decline by 25% in one trading session, to about $ 0.063 against USDT.

The sudden drop was followed by the increase in the turnover as people followed the crowd just trying to unload their products.

Several market characteristics were observed to portray lower liquidity including reduced depth of the market and higher bid ask spreads.

- Post-Announcement Recovery Attempts (December 26–28, 2019):

After the first wave of selling, STEEM had some volatility attempts, and in the subsequent days, the price ranged near $0.14 USDT.

However, efforts were done in this area but later on they were curt short due to negativity and lesser demand of STEEM.

screenshot taken on coin market

- Long-Term Consequences:

For the next couple of months STEEM dropped with its price, which has now established at a lower position.

The Binance delisting forced STEEM into a new category with a much lower exposure and trading activity in the cryptocurrency space.

**Event and Market Sentiment Analysis **

The major realizing of delisting news influenced the participants’ sentiment setting up a wave of negativity in sentiments of the investors and the Steem community. Below are the key factors influencing sentiment during this period:

Fear and Panic Selling:

Some users saw STEEM outcome as negative because of Binance’s decision which was considered decision as lack of confidence in future work.

They thought that this would decrease the chances of getting easy access and liquid STEEM and in effect, its value.Loss of Trust in Steem’s Development Team:

The delisting raised questions on how well the Steem development team can work on the issues raised by major exchanges and the communities as well.

There has been criticism in the fact that the project has a clear roadmap, innovation and relevance to market needs.Community Division:

The members of the Steem community were split in their opinion over the move to delist it. While some of the members complained regarding decision of Binance to cease sponsoring the project, others blamed the leadership of the project for being too passive to avoid such and outcome.Speculative Interest:

However, there were a few participants who sought to take advantages of the oscillations and engage in high-frequency manipulation strategies.

These traders helped provide short lived ‘pop’ to the nosediving stock prices but were not able to stabilize the situation.

Other Consequences for the Steem Ecosystem

However, the Binance delisting was not limited to the STEEM’s price as it had ramifications to its trading. These include:

Reduced Liquidity and Accessibility:

Binance is one of the market excluding where STEEM was actively traded. Its delisting harmed the accessibility by decreasing the volume of picks to buy or sell the cryptocoin in the market place.Loss of Credibility:

The slashing of a partnership with Binance lowered Steem’s credibility among Cryptocurrency enthusiasts because it made the project look doubtful and unsustainable.Impact on Partnerships:

Perhaps due to the negative media attention, no one wants to associate with the Steem ecosystem after the delisting.Shift in Trading Activity:

After the delisting, STEEM users engaged in trading in comparatively smaller exchange platforms with low trading volume and comparatively lower security standards. This migration continued to make the coin even less known and favorable amongst institutional investors.

The market of Steem/USDT was significantly affected by the Binance decision to delist XRP on December 25, 2019. The event culminated in sharp price drop due to selling pressure occasioned by negative sentiment from the investors. It also pointed to the more general issues affecting the Steem project, such as low liquidity, loss of believability, and fragmentation in the crowd.

For cryptocurrency projects, there is the need to regularly interact with some of the major exchanges and assuage the concerns of the community in order to sustain the confidence of the market. That is why the Steem/USDT case should become an illustrative example, teaching that cryptostocks should not only actively communicate with investors and the public, introduce progressive solutions, and be prepared for market shifts in the highly instable and competitive environment of the crypocurrency niche.

Question 3: Designing a News-Based Trading Strategy

Propose a strategy for trading the news in the Steem/USDT market. Include:

Criteria for selecting impactful news.

Tools for monitoring and analyzing news events.

Entry, exit, and risk management rules tailored to news-driven volatility.

Trading strategy based on news for Steem/USDT market

Investing in cryptocurrency markets including Steem/USDT news involves a large profit since the market is relatively sensitive to news information. But it also has its own peculiarities because the market is rather unstable and often exhibits unexpected fluctuations. It defines how relevant news is identified, the tools used in monitoring and analysis and entry, exit and risk management rules that facilitate the best trading result.

**1. Reporting Factors Used in Choosing News with Impact

Assuming that the future trading strategy will be news-based, it is vital to determine which news most seriously affect the Steem/USDT pair. Some key criteria include:

a. Relevance in the Steem Ecosystem

Information that relates to Steem and its related community will likely shift the price of Steem/USDT. Examples include:

Regarding real life changes of importance: changes to Steem blockchain such as the hard forks, upgrades or security vulnerabilities.

This includes, but is not limited to, press releases, articles, blogs, and posts on social media platforms, new features and product/service integrations, big name platform endorsements.

Technological Adjustments that may change the operation, management and or control of the Steem platform; Shift in leadership or dispute.

**b. Perceived General Market Outlook of Broader Cryptocurrency Market

Introducing a whole new asset class to the pan: The cryptocurrency market is a very interlinked market. Everyone is aware that factors affecting the entire crypto space including regulatory updates and changing institutional trends impacts the overall market including Steem/USDT. For example:

This may; include, announcements of detailed specific friendly polices towards or against cryptocurrency.

Steem could be moderately influenced by major price swings in Bit coin or Ethereum market.

- Information regarding the other competitors in a same sector to which Steem belongs to.

c. Social relation and trends of the communities

Steem is an organization whose main focus is social media and content creation, the fluctuations in online communities can affect price. Such posts, influencer opinions, and sharp upswings in activity on such sites as Twitter or Reddit can be warning signs.

made by canva

d. Volume and Liquidity Changes

The fluctuations in trading volume or liquidity of the Steem/USDT are most of the times associated with news-related events with more odd volume surges. Such opportunities can be determined by on-chain or market specific metrics before they make headlines.

**2. News Event Monitoring and Analysis Tools

Reporting to track the trading signal, and analyzing the results is crucial to the implementation of news-based trading strategy. Here are the key tools to use:

a. News Aggregators

News aggregators help to get updated information from different sources at certain period of time. Examples include:

Crypto-specific news outlet includes, but not limited to, Cointelegraph, CoinDesk, and CryptoSlate.

General financial news sources as they will help identify possible impoundment with greater certainty.

*b. Social Media Monitoring Tools

It is necessary to monitor such websites as Twitter, Reddit, and Telegram to focus on hot news and people’s attitude to the market. Tools such as:

- LunarCrush: A system for monitoring social platforms related to cryptocurrencies.

- TweetDeck: Enables constant tracking using the selected hashtag or key words such as #Steem or #USDT.

c. On-Chain Analytics Tools

On-chain analysis of this aspect might be useful to determine trends in the market with regard to Steem. Tools like:

- Glassnode: Records different on-chain parameters including the wallet and transaction frequency.

- Santiment: Conducts market analysis and trends within the social networks.

**d. Optimal Technical Analysis Platforms

Live signals of price charts, volume indicators and Trading view as well as technical analysis tools for Binance platform are also useful when making news-based decisions.

**3. The Rules on Entry, Exit and Risk Management

For trading based on the news, it is viable to have an effective trading plan in issue for effecting the price fluctuations. This comprises of admission control rules, ventilation rules and management of risks specific to the Steem/USDT fluctuations.

a. Entry Rules

Some individuals demonstrated an immediate reaction that values positive news by for example, congratulating the owner.

Use a long position at a time Steem is celebrating good news that will enhance its operation for example; the integration with an existing big platform or even Steem improvements and updates.- Actively verify the genuineness of the news by relying on other sources.

For bullish indications perform short-term technical tools such as Relative Strength Index or Moving Averages.

- Actively verify the genuineness of the news by relying on other sources.

Market Expectations

- Late entries are discouraged unless there is evidence that a news release is on the way (primarily identified by ancillary indicators such as social media presence or rising trading volume).

– Use stop-limit orders in an effort to avoid entering on thin air.

- Late entries are discouraged unless there is evidence that a news release is on the way (primarily identified by ancillary indicators such as social media presence or rising trading volume).

Firms in short positions for negative news

Employ bull put spread if worse-case-scenario materializes, for instance, when a company is receiving regulatory attention or security lapses.

Be with technical analysis to help one determine the keen resistances levels for timing the short entry.

b. Exit Rules

Profit Targets

These are Fibonacci retracement levels or historical resistance points since some profits should be taken at these levels.

– It means using existing advantageous positions with the aim to obtain a profit, at the same time still maintaining potential for further increase.Trailing Stop-Loss

- Place a trailing stop-loss which enables you to secure profits as the price progresses towards your direction.

Move stop loss higher/ lower depending on whether Steem/USDT market dominant trend is volatile or not.

- Place a trailing stop-loss which enables you to secure profits as the price progresses towards your direction.

Time-Based Exits

When trading for the short-term, get out of a trade as soon as possible; typically within a 24 hour period to avoid the possibility of reverse in prices.

For long term positions simply review if it is going in the right direction and on the appearance of contrary news.

c. Risk Management Rules

Position Sizing

In bearish markets for instance, traders should not invest large amounts of capital on any single trade, that is, position size should be at most 1-2% of trader’s portfolio.Stop-Loss Orders

For the long positions, it is appropriate to set the stop-loss orders below important support levels, and for the short positions, it is set above important resistance levels.

– Try to move stop losses to the new level depending on market situation.Diversification

– Steem/USDT market does not need constant attention and focus so it is important to check other cryptocurrencies or other classes of financial assets.Volatility Controls

Trade-only during the conditions of high stock liquidity in order to minimize the negative impact of slippage.

Trading decisions should not be made during volatile conditions (such as flash crash or Pump-and-Dump manipulation).

**4. Backtesting and continuous improvement Denne eksakte tilgang er vist for at vurdere den porteføljens ydelse løsning på et tidspunkt .saxreference 1.3 {.sourcedata}} Backtesting and continuous improvement, this accurate approach has been demonstrated to assess the effectiveness of this portfolio solution at a particular time.

This is good, before its deployment, conduct back test and this will test the strengths and weaknesses of the strategy when data is available. It is recommended that trades should be simulated as per past news events to fine tune the entry and exit rules. Assure that the effectiveness of the strategy of real time markets is incessantly measured and adjusted if needed.

There is usually potential for a very high profit in the Steem/USDT market if the trading strategy is news-based and is correctly implemented. Leading on these key points, traders can be able to benefit from the market while at the same time avoiding the risk areas through monitoring, encouraging an important news trading focus while at the same time maintaining a stronger trading rule compliance. Volume 2 – Current Situation Analysis; PESTLE Analysis; SWOT Analysis; Recommendations Promising sustained growth and development, commitment to learning and change will become a key factor in achieving long-term success within this ever-evolving market.

Question 4: Managing Risks in News Trading

Discuss the risks associated with trading the news, such as slippage, overreaction, or misinformation. Suggest practical measures to mitigate these risks and improve decision-making during volatile periods.

News Trading Risk Management

News trading strategies are among of the most attractive methods of trading, since the announcements lead to increased fluctuation in the prices. But it is equally dangerous, as market responses can be unpredictable that is why each trader can lose a lot. In this article, the author outlined the main risks that traders face when participating in news trading: slippage, over-act, and mis-information; and how to successfully eliminate these risks and control decisions during the period of outbreaks.

1. Risks in News Trading

a) Slippage

There are 2 main types of slippage; quoted and unquoted slippage: Quoted slippage refers to the situation where a trader is forced to take a price different from the one they wanted by fast fluctuating prices during the release of economic news. For instance, when an economic report is produced, the market may respond in a few millisecond resulting to a big difference between the limit price and the actual execution price. This can lead to a number of problems that can include, increased costs of production leading to low profits than expected.

b) Overreaction

One finds that market participants tend to overswamp on news which causes prices to be at their extremes contrary to the effect likely to result from the news. For example, an earnings release might be negative for a given company and should send its stock deep into a bear market well below fundamental value. Likewise, over-boasting after positive news is often followed by exaggerated prices, which cannot be sustained in the market.

c) Misinformation

Market movements can be greatly affected by false or misleading information whether posted accidentally or on purpose. Adopting wrong information from rumor or unverified news sources exposes traders to costly choices at the market.

d) Liquidity Risk

Overall, bottom line, during some significant events in the market spreads may increase and trading turnover decreases severely. This lack of liquidity may imply that getting into or out of positions at desired levels is costly due to the large risks of slippage and consequently losses.

e) Emotion based Decision Method:

In news releases, where markets are fast, there is pressure which leads to adoption of policies which are often uninformed by fear or by greed. Traders start to exhibit creative inclinations and will tend to buy more of stocks when the prices are going through the roof and will start to sell on the downside.

f) Broker Limitations

Some brokers have restrictions in high volatility period, which may include: rising the margin level, or/and halting all trading operations on some instruments. These limitations deny a trader chances to make more out of opportunities or shield themselves from threats.

2. Preventive Measures for MinimizingRisk

For trade news to be effective, it becomes important that some measures be taken in order to avoid real risks and increase the likelihood of the right decision. Below are practical measures for mitigating the risks associated with news trading:

a) Pre Preparation and Research

- Identify Key Events: Always maintain an economic calendar so that you can know the time, at which certain new values that may affect the economy will be released for instance; new central bank policy statements or economic indicators.

- Understand Market Impact: Use similar news events analysis to forecast the possible changes and volatility level in the markets, where you operate.

- Use Reliable Sources: It is also important to use correctly filtered data of reliable news provides and official channels in order to avoid becoming a victim of fake news. Watch and check before you jump into a decision.

b) Risk Management

- Set Stop-Loss Orders: Employ use stop-orders to limit potential loss in the event the market turns against you during news alerts.

- Position Sizing: By so doing, minimize the number of trades and the sizes entered into the market in volatile periods in an effort to reduce giant losses.

- Avoid Over-Leverage: Leverage in trading means that small changes in the value of an asset will greatly affect its value; a concept that automatically makes the value of an asset unpredictable if high leverage is used. It is equally important that we use conservative leverage ratios for the purpose of safeguarding your capital.

c) Trading Mechanisms

- Avoid Immediate Reactions: Only get into a trade position after the first few minutes to at least give the market some time of establishing its first norm. This lowers the chances of getting trapped in what analysts refer to as overblown responses or fake actions.

- Use Limit Orders: By using limit orders you are able to set a maximum price you want to buy a security or a minimum price at which you want to sell it avoiding undesirable slippage this time.

- Predefine Entry and Exit Points: Always be in a position to know where to trade-in and trade-out of positions, to avoid being carried away by emotions during a bang.

d) Implementation of Technology and Tools

- Trading Algorithms: A number of trading decisions can also be made and completed by automatic trading differently and much more effectively than complete manual trading due to slippage and emotions.

- Real-Time Alerts: When it is not possible to avoid news events, or to remain constantly up to date of market prices, use platforms that offer real time notification.

- Simulators: One should introduce the notion of trading the news in the demo account before starting trading in real account with an intention of risking actual money.

e) Diversification

- Avoid Concentration: During news releases, do not keep all your trades in a single asset or market. The market risks, particularly negative price fluctuations can be minimised by investing in instruments in different categories of the portfolio.

- Hedge Positions: Look at employing safeguard measures which are options or futures to minimize for example futures in cases of high volatility.

f) Emotional Tame

- Follow Your Plan: Continually follow the trading plan as you planned even when there is noise or emotions taking place.

- Take Breaks: Do not overtrade, this is by exiting the market after placing the trades. Excessive monitoring can also cause the tendency of taking hasty measures.

- Review Performance: Always look into your trades beyond the event in order to establish where you went wrongly and how you can adjust for similar news trading in the future.

News trading involves possible advantages and disadvantages as the markets are always very unpredictable especially during the news release. Lek closing encountered various risks that include slippage, overreaction, misinformation and last but not the least; emotional decision making does affect the trading performance. These risks can be minimized and the trader can be extremely effective during such shifts if thorough preparation is done, risk is well managed, technology is used, and emotional discipline is observed. Overall, trading in news entails the formulation of strategies based on fundamental analysis, flexibility to alter a strategy and learn continually.

Question 5: Leveraging Technology for News Trading

Explore how tools like sentiment analysis algorithms, trading bots, or real-time news aggregators can enhance the effectiveness of news-based trading strategies. Provide examples of tools or platforms relevant to the cryptocurrency market.

Leveraging Technology for News Trading in the Cryptocurrency Market

In the fast-paced world of cryptocurrency trading, news-based strategies play a vital role in influencing market movements. However, the sheer volume and speed of information in the digital age make it nearly impossible for traders to manually process and act on every news event. Advanced technological tools, such as sentiment analysis algorithms, trading bots, and real-time news aggregators, provide traders with an edge by automating the process of gathering, analyzing, and responding to news. This article explores how these tools enhance news-based trading strategies and examines some platforms relevant to the cryptocurrency market.

Sentiment Analysis Algorithms: Understanding Market Psychology

Sentiment analysis algorithms are designed to extract emotions, opinions, and sentiments from news articles, social media posts, and other textual content. In cryptocurrency trading, where market sentiment can drive drastic price changes, these tools are indispensable.

How Sentiment Analysis Works:

Sentiment analysis tools use natural language processing (NLP) and machine learning (ML) to classify news and social media content as positive, negative, or neutral. By identifying trends in sentiment, traders can gauge market mood and anticipate potential price movements.

For example, if a cryptocurrency like Bitcoin is receiving overwhelmingly positive coverage due to a regulatory approval, sentiment analysis tools can flag this trend in real-time. Traders can then capitalize on the positive momentum before the price peaks. Conversely, negative sentiment—such as news about regulatory crackdowns or exchange hacks—can help traders prepare for potential sell-offs.

Examples of Tools:

- The TIE: A leading cryptocurrency sentiment analysis platform that provides data-driven insights by analyzing millions of tweets, news articles, and on-chain data.

- LunarCrush: This platform aggregates social sentiment and influencer activity, helping traders understand market sentiment.

- CryptoMood: Combines social media sentiment with news analysis to offer a holistic view of market trends.

Trading Bots: Automating the Execution of Strategies

Trading bots are automated software programs that execute trades based on predefined algorithms and strategies. When combined with sentiment analysis or news alerts, these bots can quickly capitalize on market opportunities, eliminating human delay and emotional decision-making.

How Trading Bots Work with News-Based Strategies:

Trading bots can be programmed to act on specific triggers, such as sentiment scores or keyword detection in news. For instance, if a news aggregator detects a positive development about Ethereum (e.g., a major partnership or technological upgrade), the bot can instantly execute buy orders.

Bots can also manage risk by setting stop-loss orders or diversifying trades across multiple assets. Additionally, they operate 24/7—critical in the cryptocurrency market, which never closes.

Examples of Tools:

- 3Commas: A popular platform offering customizable trading bots with integration to sentiment analysis tools.

- Cryptohopper: This cloud-based bot allows traders to set up automated strategies based on news triggers and market sentiment.

- HaasOnline: Provides advanced features for integrating news-based triggers into trading strategies.

Real-Time News Aggregators: Staying Ahead of Market Trends

Real-time news aggregators are platforms that collect and organize news from various sources, providing traders with a centralized dashboard for monitoring market developments. These tools enable traders to stay informed without manually searching through multiple websites, social media platforms, and news outlets.

How News Aggregators Enhance Trading Strategies:

News aggregators ensure traders are always up-to-date with critical information. By filtering and prioritizing news based on relevance and urgency, these tools allow traders to focus on actionable events. Some aggregators even include advanced features like sentiment scoring, keyword alerts, and push notifications, ensuring traders never miss significant developments.

For example, when a tweet from Elon Musk about Dogecoin goes viral, a real-time news aggregator can instantly alert traders. Those equipped with trading bots can automate their response, buying into the hype before prices surge.

Examples of Tools:

- CryptoPanic: A popular cryptocurrency news aggregator that also integrates with social media feeds and sentiment analysis.

- NewsCrypto: Offers real-time news, market alerts, and educational tools for cryptocurrency traders.

- CoinGecko and CoinMarketCap: While primarily price tracking platforms, they also provide news feeds tailored to individual cryptocurrencies.

Integrating Tools for Maximum Efficiency

The true power of these technologies lies in their integration. For example, a trader could use a real-time news aggregator like CryptoPanic to monitor the latest developments, feed this data into a sentiment analysis platform like LunarCrush for insights, and program a trading bot like Cryptohopper to execute trades based on sentiment triggers. This seamless integration enables traders to act faster and more accurately than manual methods.

Challenges and Considerations

While these tools provide significant advantages, they are not without challenges. Sentiment analysis algorithms may struggle with sarcasm or context, leading to misinterpretations. Trading bots require fine-tuning to avoid executing trades on false positives. Additionally, relying heavily on automation can expose traders to unexpected risks during system failures or highly volatile markets.

To mitigate these risks, traders should complement automated tools with manual oversight and robust risk management strategies.

Conclusion

The integration of technology into news-based trading has transformed the cryptocurrency market. Tools like sentiment analysis algorithms, trading bots, and real-time news aggregators empower traders to process vast amounts of data quickly and act on actionable insights. Platforms such as The TIE, Cryptohopper, and CryptoPanic exemplify how these tools can be leveraged to gain a competitive edge. However, while technology enhances efficiency, human judgment and risk management remain essential for long-term success. By combining the best of both worlds, traders can navigate the volatile cryptocurrency market more effectively.

i would like to invite @patjewell @wilmer1988 @pelon53 to take part in this contest

Regard for me @shabbir86

💦💥2️⃣0️⃣2️⃣5️⃣ This is a manual curation from the @tipu Curation Project

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit