Contest Link 👇

SEC S18-W6 || Mastering the Break Retest Break (BRB) Strategy . I invite some of the skilled users I know to participate in this contest. "Honorable Mentions:

@rashid001 @radjasalman @ripon0630

The Break Retest Break (BRB) strategy, also known as the Break Hook and Go technique, is a very efficient method utilized by traders working in break and retest markets. Let's delve into the details:Let's delve into the details:

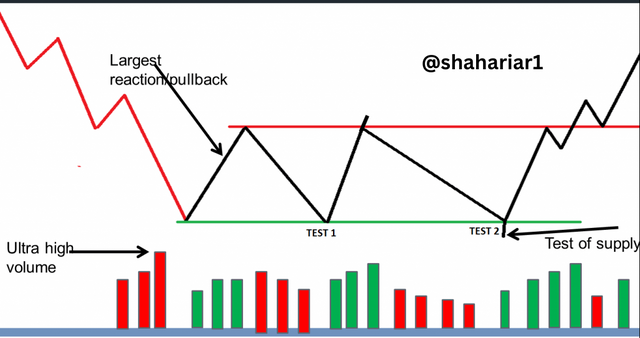

The Break (Breakout):The Break is a very significant level where price action enters a vital level referred to as the breakout and do so with good volume. This is because unlike breakouts, which can be rather iffy, traders wait for the first breakout to occur and then focus on the test.

The Retest :Price, after crossing the upper or lower band, tends to pullback in order to test the violated band. This pullback is known as the Hook or Retest which indicates that buyers are coming back into the market. The retest usually happens at lower and decaying traffic. There is an effort to confirm that the level has changed its role from Support to Resistance among traders. An ideal time to enter the trade is when the price is near the retested level, preferably once it has closed below it.

The Bounce :After the retest make sure of its stability and keep an eye on that level. When the level holds during the retest, and the price start rising it indicates the bounce. Access points are defined at this stage; that is, points that are secure from the aspect of view. Optimize the number of stops regarding the position price movements to increase the amount of earned money.

Now, applying this to Steem token trading: Determine significant points of support and resistance in a chart of Steem. Thus, one should wait for a breakout (high volume) above a resistance level or below support level. Following the breakout, focus on the retracement of that level. If the retest validates the level’s change, it is advisable to open a trade. Watch the bounce , if price stays above this level, then entry here is fairly safe.

|

|---|

Now it is time to discuss more about the BRB strategy and its implementation on the Steem’s side. The use of available funds strategy where an organization buys assets, reinvests its earnings, and borrows money forms the basis of the BRB strategy. Here's how it can be applied to Steem:Here's how it can be applied to Steem:

Buy: To invest in to Steem, begin with the purchase of Steem tokens. This can be done on the platforms that deal in the trading of Steem cryptocurrency. The second aspect is to search for the points of entry according to the technical analysis, such as support levels, moving averages, the chart pattern and the like.

Reinvest: Anything you do on Steemit to earn steem (for example: posting, curating, or delegating) you can at times use some of the earned rewards to buy more Steem. This can be done by powering up your Steem Power Other features include: SP is your standing on this site and measures the weight of your vote.

Borrow: Even though borrowing is not a written member of the BRB acronym, it can add to your situation. Using your Steem as security, you can get stablecoins cash loans. Employ these borrowed funds to buy other forms of stocks or other possibilities.

Technical Indicators and Market Conditions:

Relative Strength Index (RSI): It will therefore be relevant to track the position of the RSI so as to reveal when the market is overbought or oversold. A value below thirty is considered oversold area, which may imply that it is a good time to purchase stocks.

Moving Averages: Look at the simple rates (for example 50- or 200-day) to evaluate the tendencies. Crossover could be a buy signal for example when the short-term moving average is above the long-term moving average a bullish crossover.

Volume: Closely track trading volume in both its relation to prices. Volume during the price up and down movements can be useful.

Fundamental Analysis: About Steem’s environment, changes, and people. The findings also indicated that new development could affect price.

|

|---|

Let's discuss the exit criteria for a position based on the BRB strategy:Let's discuss the exit criteria for a position based on the BRB strategy:

Profit Exit Criteria:

Price Target: Fix price level that you want to achieve for Steem. If the price gets to this target or even slightly above it, think about booking profit. This target can be either based on technical analysis or fundamental ones.

Relative Strength Index (RSI): Thus, when the RSI? reading is above 70 in the daily chart it may be an indication that Steem is overbought and a correction is needed. Consider taking profits.

Divergence: The second condition to look for in the chart should be bearish divergence of price and momentum indicators. When price making higher highs while the indicator making lower highs, it’s a warning.

Fundamental Changes: Steem is a valuable asset if there is any negative occurrence in the ecosystem reconsider the stand.

Loss Exit Criteria:

Stop Loss: It is always appropriate to place a stop loss order so that there are not heavy loses made. It’s equally important to decide at which level you will close your position, for instance in the basis of the supporting level or of the technical indicators if the price reduces.

Risk Tolerance: Defining your risk tolerance is also vital to an investment decision. If Steem’s price falls to the levels that you don’t like, it may be appropriate to exit the position.

Market Conditions: It is recommended that in overall bearish market situations, get ready to cut your losses by selling Steem.

Adverse News: Make response to Stteem or any negative news in the crypto markets. As for the prices, negative events can affect them to a greater extent.

Now, let’s go through a theoretical BRB trade with the token, Steem (STEEM). To illustrate, I shall give entry and exit points for an investment decision, and the embedding of the rationale behind each of the decisions.

Technical Analysis: In the last couple of days, the price of STEEM has risen after touching a good support area of $0. With the suggestion of bullish sentiment implied by the above figures totaling 10150 or 45, it also gives the probability of a bullish run.

RSI: The RSI is below 70, therefore the market is oversold.

Fundamentals: Any changes which are good in the context of Steem platform like new protocols, or more usage.

As already mentioned, this is only a hypothetical situation and actual market conditions might be different. Do not forget about careful research, risk control, and employing changes in the strategy based on the presently received data.

Risk and capital management are deemed critical when working under the BRB strategy. Let's dive into some effective techniques for risk management specifically related to Steem token trades:Let's dive into some effective techniques for risk management specifically related to Steem token trades:

Position Sizing:As a general Rule of thumb, decide on the proportion of the steem position to your portfolio. Do not invest a large amount of your money in one single property. The common conventional wisdom that should not be exceeded is 1-2% of the total capital invested in a particular instrument.

Stop Loss Orders:Make sure to install a stop loss price rank that you will use to exit your Steem position to minimize your losses. For instance, if you purchased Steem at $0. 30, may then order a stop loss at $0. 25. If the price goes that low, the order sells your Steem automatically in order to get that price.

Trailing Stop Loss:Originally known as an original stop loss that as price changes the position. If Steem increases, the trailing stop is set at a percentage below the highest price that was achieved. In turn when the price renews the opposite direction, stop loss is activated.

Take Profit Orders Decide at what price you want the order to close and make sure you have made the required profit you are aiming for. For instance, if you purchased Steem when its price was $0. 20, it is advised to put a take profit order at $0. 30. The order is triggered if the price goes that high.

Risk-Reward Ratio:Consider how much can be gained assessing the risk from taking the particular kick to how much can be lost. Ensure that you have a healthy risk-reward ratio, that is for every $ 100 that you risk, ensure you target $ 200 in profit.

Diversification:Remember, don’t invest all the capital into Steem only. Spread risk across the different assets to ensure that the return on each of the assets is different. Originality show, stocks or other hard assets, or non-correlated cryptocurrencies.

Stay Informed:Watch for the new and changes regarding Steem along with the market opinions. Any events scheduled should be observed in a bid to see how they affect the price of Steem.

Emotional Discipline:Do not make decisions under pressure of being frightened or extremity greedy. Remember to abide to the risk management laid down before commencement of the project.

I have presented the little knowledge before you. Remember trading is always a risky affair.

You need to acquire sufficient knowledge about then trading. Hope you like my content. Ending here with my voice wishing everyone good health.

I invite you to support @pennsif.witness for growth across the whole platform through robust communication at all levels and targeted high-yield developments with the resources available.

Click Here

Click Here Thanks for reading the Post

29/06/2024

The End |

|---|

I really agree with emotional discipline. This will give us a lot of influence that can make us richer or bankrupt.

Looking at the support and resistance lines can also make our trading better.

Of course this means a lot, friends, we can even minimize losses with Stoploss when the market suddenly reverses.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for your valuable comments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TEAM 6 : Congratulations!

This comment has been curated using steemcurator08. We appreciate your efforts on making useful comments. Thank You! 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

💯⚜2️⃣0️⃣2️⃣4️⃣ This is a manual curation from the @tipu Curation Project.

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 5/6) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice to see you here I wish you success very well analyzed and presented BRB strategy is really very important for traders to use and analyze to find out their anti point and support resistance and exit point and it is very effective good luck to you Regards and greetings

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings my friend @shahariar1,

Its awesome how you broke down the Break Retest Break (BRB) strategy! The detail about the importance of emotional discipline really stood out. Staying calm and sticking to the plan is crucial for success in trading.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Emotional discipline is must needed while trading. The risk management you explained can helpfull to avoid losses in trading.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buen post amigo. A veces tanta gráfica pareciera enredar las cosas pero realmente cada cosa tiene un fin y es una herramienta esencial en el trading para evitar las falsas rupturas y prevenir los riesgos.

Gracias por compartir, saludos y éxitos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit