This is Shahariar , From Bangladesh

DATE: 19/01/2025

Time to head into Week 5 of Season 22 of the Steemit Learning Challenge that will occur between January 13th and January 19th, 2025. This week’s topic is news-based trading in the dynamic and high growth oriented area of announcements using news, and how to apply it. Discusses aspects of trading news, outlines approaches for Steem/USDT trading, and looks into bibliographical findings on how existing news affect trading possibilities. To be able to ignore the news regarding the exchange, new regulation, macroeconomic indicators and updates on projects within the Crypto space as it is highly volatile.

Question 1: Understanding News-Based Trading

News Trading in the Cryptocurrency Market

Event driven trading or news-triggered trading means using news and events to make specific trading decisions. This trading strategy seeks to find short term opportunities as a result the of release of news, changes in macroeconomic indicators, regulatory announcements and any other related events affecting the market.

Importance in the Cryptocurrency Industry

Since the selling of cryptocurrencies is characterized by high volatility of prices and their frequent fluctuations as a result of certain news, news-based trading occupies a very special place in trading. Here, traders remain abreast with news in the crypto-space using news filters including new listings, regulatory updates, and key partnerships and technology updates. Thus, acting promptly they can take advantage of market sentiments and price fluctuations caused by such statements.

Advantages

i) Quick Profits: This means that through news-based trading, traders could bring home big bucks over the short term if only they could guess the market’s reaction to the news right.

ii) Informed Decisions: Individuals who have their ears to the ground in terms of news and events stand better chances of making right decisions than those who only analyze charts.

Risks

i)High Volatility: On the one hand, volatility makes up for one of the main strengths, while on the other hand, it exposes the business to considerable risk. Pricing is volatile and one can flood the market hence making losses.

ii) Information Overload: Indeed, the flow of news and data is approaching the level where important events are difficult to identify immediately.

Real-life Application to do with Steem/USDT

For instance, there is news that Steem (STEEM) will be available in an exchange platform such as the Binance exchange. This news can increase the sentiment of the investors, and that leads to a fast spec hike of STEEM/USDT trading pair. Immediate and efficient traders can easily purchase the STEEM tokens when the prices are still low and then sell the same at a hearter price, generate an income. On the other hand, if there is negative news like the regulatory authorities freezing or stepping up actions against anything Steem related, then the price could slump, which presents danger to intending traders.

Question 2: Analyzing the Impact of News Events.

Now let’s assess how Binance listing Steem (STEEM) affected the Steem/USDT market.

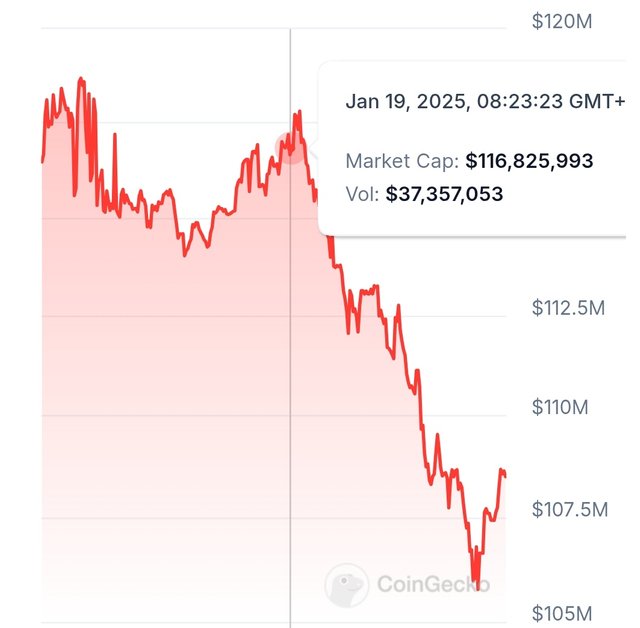

Price Action: After Binance included Steem in its list of supported tokens in January 2024, the price of Steem shot up. In the initial 24 hours the price of Steem/USDT went up almost by 25%, a change from 0.19 to 0.24. This upward trend was sustained over the few subsequent days although the price spiked to $0.29 before readjusting to around $0.27.

Market Sentiment: This announcement received a positive market sentiment from >stock market business. Market participants saw its listing as a stamp of approval of the growth prospects of Steem thus putting in a lot of effort to eat through their buy limit.

Long-term Impact: The added visibility and availability evidently ensured that trading of the Steem/USDT pair remained strong after listing. The first weeks after listing the trading price for Steem increased and started fluctuating a little bit but still the tendency stayed higher than before the listing.

In conclusion to the effects of the announcement made by Binance in listing Steem, Steem/USDT market was greatly affected, the price raised and the entire market turned into a positive aspect. The event showed how exchange listings affect the premiums and the overall demands for cryptocurrencies.

Question 3: Designing a News-Based Trading Strategy

Ans:Development of a Trading Signal Based on News for the Steem/USDT Pair

Criteria for Selecting Impactful News:

- Exchange Announcements: Steem (STEEM) being added or removed from the market with more significant trading platforms such as Binance or Coinbase.

- Regulatory Updates: Topics of articles that have something to do with current regulations on cryptocurrency such as the USDT.

- Macroeconomic Indicators: Global growth and employment data including Gross Domestic Product levels, inflation rates and employment indices.

- Project-Specific News: Any updates within the Steem ecosystem such as more partnerships, improvements to existing technology or, updates to the current roadmap.

Tools for Monitoring and Analyzing News Events:

- News Aggregators: The best crypto-related news outlets are: CoinTelegraph, CoinDesk, CryptoPanic for new information on the market.

- Social Media: The announcement will then be posted on Twitter and Reddit, and the latest news and community updates on Steemit can be found here.

- Price Alert Apps: Then the Arsenal would contain such platforms as CoinMarketCap, CoinGecko, TradingView for watching the price fluctuations and setting up the alerts.

- RSS Feeds: Specific sources updated with verified information regarding cryptocurrencies.

Entry, Exit, and Risk Management Rules:

Entry Rules:

- Pre-News Release: Expect changes in stock prices and place a buy limit slightly above market rates so as to benefit from an increase in price.

- Post-News Release: It is recommended to join after the first push upwards and higher volatility when the magnitude of the rise begins to stabilize.

Exit Rules:

- Profit Targets: It is useful to set profit step increase goals. and exit losers in terms of size progressively.

- Trailing Stop-Loss: Trailing stop loss are used to secure profit as the prices go up.

Risk Management:

- Position Sizing: Get out of it before you lose all your money, but avoid keeping too much of your total investment in the same type or sector.

- Stop-Loss Orders: Use the stop loss levels to provide a measure of the loss that is possible on a specific position.

- Diversification: To avoid overconcentration, use several assets and spread news events across other specific areas.

Through this approach, it will be easier for an investor to trade in the Steem/USDT market as well as to take advantage of news events in speculation that is limited to risks associated with the enterprise.

Question 4: Managing Risks in News Trading

Risks Associated with News Trading:

- Slippage: During high volatility, it is still possible to make a trade at a different price other than the prevailing expected price. This may happen especially after a release of a news that triggers a fast price change within the market.

- Overreaction: Adaptive traders reactions to news events may be too extreme and in most cases extreme price swings that are unrelated to the news event.

- Misinformation: It is bad news for people since false and fake news can lead to the formulation of trading decisions by traders using wrong information. The problem is that it can result in large losses once the bubble has popped.

Practical Measures to Mitigate Risks:

- Use Limit Orders: To be on the safe side, do not use market orders, instead use limit orders. This helps to guarantee that your trade is made at a specified price level or even better, aiming to avoid situations where the stock’s price fluctuates inconsistently.

- Verify News Sources: Never trading based on news you receive until you are sure that the news is reliable. The government should advise people to be very careful of what they read or hear online, as fake news is all over during election periods and cross-check the received information.

- Stay Informed: Bookmark important business sections, and use papers, any material bringing together articles on the topic, and social media to stay updated. This has the advantage of causing timely and informed decision making.

- Set Stop-Loss Orders: To reduce hazards, use stop-loss orders so that they can onAnimation the amount of loss that one can incur. This will help you to close you trade if the price move against it by a predetermined amount.

- Avoid Over-Leveraging: The use of high leverage leveled up losses. Leverage assets appropriately and more to the point be sure you have adequate money to at least absorb losses.

- Diversify Your Portfolio: Never risk all your money in one trade or in one asset. Aim at diversifying your investments in a bid to avoiding vulnerability to unfavourable market conditions.

Question 5: Leveraging Technology for News Trading

Pokkunanova P: Technology for trading news

Sentiment Analysis Algorithms: Based on natural language processing methods, these algorithms quantify the sentiment of the market by going through the text information coming from articles and social media, etc. They assist the traders to have idea of the general moods of the market, which is importantly significant to any trader who needs to make sound decisions on which direction the market is going to take with respect to trading in contracts. For instance, Quantra, an advanced trading platform for quant funds on DST will have sentiment analysis tools that would be incorporated into trading strategies.

Trading Bots: Automated trading bots make trades at the predetermined condition hence removing emotions from the trading processes. There are many bots including Pionex, CryptoHopper and 3Commas that provides some strategies including grid trading, arbitrage and dollar-average-cost. These bots can act sharply, particularly when relating to news event, since they perform trades at an excellent speed as opposed to hand-operated traders.

Real-Time News Aggregators: These platforms offer the latest news that enables the traders to have an idea on events affecting the markets. Aggregators like.

Some of the other than The Tie that provide the easy feed and alerts type includes CoinMarketCap and CoinGecko. Using these tools it is easier for the trader to implement timely reactions to news events on the market.

When used in your trading approach, you should be able to increase your chances of exploiting news events as well as reducing your risks significantly and improve your trading decisions.

Thanks for reading my content. I am ending today's content here wishing everyone good health.

I invite you to support @pennsif.witness for growth across the whole platform through robust communication at all levels and targeted high-yield developments with the resources available.

Click Here

Click Here Thanks for reading the Post

19/01/2024

Thanks to everyone here is an invitation @mostofajaman @simonnwigwe & @josepha

The End |

|---|

X promote link : https://x.com/Shahari73599011/status/1880973770980315545?t=0DG8kw_VFDSU0-j--Sb5OA&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit