|

|---|

Hope you all are doing well and good and enjoying the best days of your life. This is me @shahid2030 from Pakistan and you are here reading my post. You all are welcome here from the core of my heart.

This is my participation in a contest AI and Machine Learning in Cryptocurrency Trading: A Steem/USDT Perspective organized in SteemitCryptoAcademy by @crypto-academy.

Question 1: Exploring AI and ML in Cryptocurrency Trading.Explain how Artificial Intelligence and Machine Learning are applied in cryptocurrency trading. Highlight their advantages over traditional methods and provide examples of their effectiveness in analyzing and predicting market trends. |

|---|

Artificial Intelligence (AI) and Machine Learning (ML) have given new dimension to cryptocurrency analysis trading by providing advanced tools. These tools are used to analyze market data, predict trends, and optimize trading strategies. These technologies basically works on past data available at the market, by uncovering past patterns, market behavior, trends, bull run that traditional methods might overlook.

Applications of AI and ML in Cryptocurrency Trading.

Let's have a look of how we can we use AI and ML to do better analysis and predict future market prices.

Market Sentiment Analysis A famous

AI-powered natural language processing (NLP), which helps to read and analyzes news articles, social media, and forums to assess market sentiment. Example, Tools like TheTIE or CryptoMood help in tracking sentiment from the public to predict future price movement .

Price Prediction Models ML algorithms, such as neural networks and regression models, go through historical patterns by identifying past data to predict future price movements. Example Recurrent neural network (RNN) is said to be the best tool to forecast Bitcoin's future price. It actually works on analysing the bitcoin past trends.

Algorithmic Trading AI systems can be used to execute trades automatically based on pre-set parameters or predictive models. It enables a rapid, and very high-frequency trading. Example Trading bots like 3Commas or HaasOnline using AI technology for market analysis.

AI and ML Advantages Over Traditional Methods

Risk Management ML models often access the market data, will always tell you to avoid trading in volatile market.

Finding irregularities AI helps in finding out an irregularities in the market, such as a manipulative behaviors and pre planned pump and dump. Many exchanges use AI to prevent fraud or huge market manipulation.

Speed and Accuracy AI processes and analyzes massive datasets in real-time, that's why their signals works quite better and faster.

Advanced features ML identifies hidden patterns and correlations, which are very hard to find it out through traditional means (statistics and Data).

Adaptability ML models can adapt to evolving market conditions, unlike traditional methods which stick to it's old methodologies.

AI and ML past works and their effectiveness examples in the market

1). A study shows that in 2022, ML algorithms like XGBoost achieved higher accuracy in predicting Bitcoin's short-term price movements.

2). Firms like Alpaca and QuantConnect in frequency trading environments have always shown significant profits using AI-driven strategies.

3). The AI system especially used by hedge funds (Two Sigma, AQR) work too good in volatile market. It effectively construct a strategy that helps minimize losses.

Question 2: Building a Predictive Trading Model. Create a simple predictive trading model using historical Steem/USDT price data. Use any AI or ML tool (such as Python’s Scikit-learn or TensorFlow) to predict price direction for the next 24 hours. Provide a step-by-step explanation of the process, including data preparation, algorithm selection, and interpretation of the model’s output. |

|---|

To create a predictive trading model for the Steem/USDT pair, using Python Scikit-learn or TensorFlow is something out of my range, because I am a simple trader not a programmer. I use simple strategies for and models for my trading, so I will implement my traditional way of making a best 24 hours model for STEEM/USDT where we can find best entry and exit points.

Best 24 hours model for STEEM/USDT.

Gather historical price data of Steem from the reliable sources, such as coinmarket Cap, CoinGecko and some top exchanges like Binance, Bybit, OKX, KuCoin, etc. Find the opening price, high and low of the day. Also find out it's volume, how it varies with time, and the orders booked. Use 15 or 5 minutes time frames as you trade as day trader or a scalper.

Now you can put this traditional data in AI tools (using Python Scikit-learn or TensorFlow) to make a productive trading strategy for you. It will signal you when to buy and when to sell, will also signals you market is now going in upside or downward.

One thing additional if we use technical tools such as RSI, EMA, Fibonacci, and many others with it we may get more accuracy. Along with it if we follow drawing important levels such as support and resistance, trend lines and yeah follow important patterns I think we will double our accuracy.

Question 3: Implementing Sentiment Analysis for Trading Decisions. Perform sentiment analysis on recent Twitter posts or Steemit articles mentioning "Steem." Use an AI-based sentiment analysis tool (e.g., NLTK, VADER, or Hugging Face) to classify posts as positive, neutral, or negative. Explain how the sentiment trends can be used to adjust a Steem/USDT trading strategy, providing a clear example based on your findings. |

|---|

If it comes to sentiment analysis we can do it using some best tools on trading view too. According to me the best and easiest too is Sentiment histogram. It's too much simple and give accurate data too.

Ofcourse here we have to find out using AI app to collect data from famous social media platform such Twitter, Facebook, Instagram and YouTube, ect. Their is probability that this data will be more accurate compared to any tools data as it seems more practical.

On Binance we have an option too where we can find out people reviews regarding certain project. Ofcourse being one of the top crypto exchanges we can get best analysis data from there.

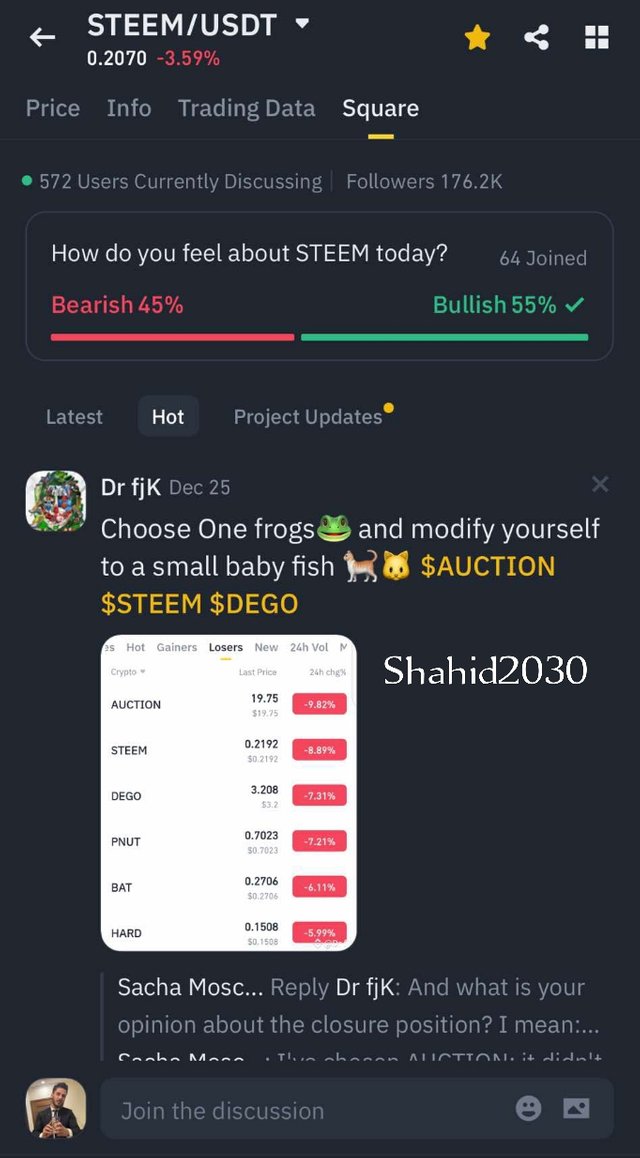

This is what I am talking about. Click on Steem coin in Binance, then click on square option. Here you may see a question on the top How do you feel about STEEM today? and below are bullish and bearish options. 55% people believe it's bullish and 45% believe it will be bearish for today. You may see it's followers list too showing there which is almost 176.2k, which is a huge amount. Currently 572 people are discussing it, it's also a mediocre amount of people. Below if you scroll down you make read people's reviews are post regarding steem coin.

So in short I believe, we can get sentiment analysis from this option of Binance too using square option. It might not be 100% accurate as AI tools prediction, because it's just the sentiment of single trading platform, not the entire world trader, but being the largest crypto exchange we can somehow trust it's data provided.

Question 4: Designing an Automated Trading Strategy. Describe how an automated trading system can be designed using AI tools. Include the logic for triggering trades, setting stop-loss levels, and taking profits. Use examples to illustrate how the system can respond to live market data in a Steem/USDT trading scenario. |

|---|

We can make an automated trading strategy for STEEM, but we have to go through a long process. Let's talk about how can we acquire a goal of making a best automated trading strategy for STEEM coin.

Market Data Collection and Analysis

Data Collection

The first and far most important thing for an automated trading strategy we need is the ability to collect real-time market data. We can do it throughAPI Integration and Data Analysis Tools. Use cryptocurrency exchange API (e.g., Binance or Bittrex), to get STEEM/USDT data from it (price, volume, order book). For data analysis we can use Python libraries like pandas and NumPy.

Price prediction using AI

The AI learning model machine, I:e Long Short-Term Memory (LSTM) can be used to predict short-term price movements. Natural Language Processing (NLP) tools such as Hugging Face Transformers can be used to analyze social media or news sentiment around Steem.

Trade Triggering Logic

Use technical tools such as RSI, MA and many other and set them accordingly, if it hit that level it will automatically trigger your trade. For example, for MA trigger a buy when the 50-period MA crosses above the 200-period MA (golden cross). For RSI Buy when RSI < 30 (oversold) and sell when RSI > 70 (overbought).

How these things in combination can be used practically?

I will give an example for a long trade or buy signal. You saw 2% increase in price over the next hour, RSI is below 30 and positive sentiment score from social media is more than 0.7. You can manage your Take profit (TP) and Stop loss (SL) with a 1:1 or 1:2, which suits you perfectly. Put these setting in the AI tool you are using and it will automatically trigger your trade.

Question 5: Addressing Challenges and Improving Reliability. Analyze the challenges of using AI/ML in cryptocurrency trading, such as overfitting, data limitations, and execution speed. Propose solutions to mitigate these challenges and improve the reliability and performance of AI-driven trading strategies. Include practical examples where applicable. |

|---|

AI and ML provide significant advantages in trading to traders, and especially these days where AI is at peak. But it's true that their are certain challenges using AI and ML tools, which we consider their flaws or draw backs. Let's talk about those challenges and their solutions, how we come up with these challenges.

Overfitting

Challenge

In AI models, particularly in machine learning the greatest drawback is that, it catches and capture noise instead of meaningful patterns. It overfit the training data, which reduces the model's ability to generalize to unseen market conditions.

Solution

Other things like trading volume, order book depth, and social sentiment, can give us more authentic data. We can collect pure data from there. We can filter out data from anomalies using statistical methods. Synthetic Data Generation (GANs) could also be used to create synthetic market data for training.

Practical example

If their is limited data available for Steem/USDT, watch parallely correlated assets like BTC/USDT or ETH/USDT for better context.

Data Limitations

Challenge

We may be provided with limited data, because if we go through historical depth cryptocurrency data could be limited. The flash crashes or manipulation may subject market data to anomalies. Also Some of the exchanges may not provide sufficient data for effective training.

Solution

Other things like trading volume, order book depth, and social sentiment, can give us more authentic data. We can collect pure data from there. We can filter out data from anomalies using statistical methods. Synthetic Data Generation (GANs) could also be used to create synthetic market data for training.

Practical example

If their is limited data available for Steem/USDT, watch parallely correlated assets like BTC/USDT or ETH/USDT for better context.

Execution Speed and Latency

Challenge

To enter into a trade at a favourable price it requires a strategies with extremely low latency. Slow execution can lead to slippage and missing out the perfect entery zone.

Solution

To minimize latency use co- location service. Host the trading system close to exchange servers for speed up functioning. We can Use efficient programming languages (e.g., C++). It will help minimize this issue. It can also be reduce, if you execute trade instantly after getting signal from your set up. Don't wait for the set to execute it for you.

Practical example

If you are trading Steem/USDT and you get a buy signal, try to execute the trade instantly using pre-set parameters.

Using AI or ML trading strategies we may come up with some other major issues such as, Market Volatility, Regulatory and Ethical Concerns, Black-Box Nature of AI Models, and Model Drift etc.

Improving Reliability and Performance

Hybrid Strategies Use a combination of AI strategy with that of traditional one (technical analysis and fundamental analysis) for better reliability.

Backtesting Test the strategies you have made on multiple datasets and under various market conditions. It should be tasted at volatile conditions and simulated flash crashes for better results.

Risk Management The most important thing in crypto trading. Minimize the risk by diversification, position sizing, and strict stop-loss policies.

This is all about my blog for today, hope you guys have enjoyed reading it. See you soon with a new amazing and interesting topic, till take care.

| I would like to invite: @alejos7ven, @janemorane, @rme, @stef1, @goodybest, @ripon0630, @beemengine, to participate in this Contest |

|---|

Your presence here means alot

Thanks for being here

Regard shahid2030