Hello everyone !! How are you all . As you May have fetched from the heading , i am here to make a homework post about the task given by @asaj . I have read the whole post thoroughly and it was interesting and informative . So let's begin our task 😇 ...!!

Part A ;

• The case study given is an example of what type of psychology? Explain the reason for your answer.

After reading the whole article and research , i am sure that this case study is an example of trading psychology . And i have proper reason for that :

" In the given case study the mentality of single individual named as jane is discussed . And all the actions she perform like selling and buying and thinking over the things and all that, it all include her personal preferences and thinking so it comes in the catagory of trading psychology because market psychology includes the mentality and thinking of the whole market not a single individual . In the case study all the actions like decision of buying , then assuming the market condition and then regretting on selling , all these actions are purely belong the herself as a single individual .

• Using the case study above, list and explain at least 5 biases that influenced Jane's trading behaviour with examples of how it affected her behaviour?

After studying the whole case study and then reading and understanding of different biases that were discussed by professor and also that were suggested to study , i can easily enlist the 5 biases that influenced Jane's behaviour ;

1) Emotional Bias :

This is the Bias that influenced the Jane's trading most . Emotional bias is actually all about how your all feelings and emotions effect your trade and your decisions .

First of all , Jane just thought it appropriate to buy more when the tokens prices were falling . She prioritize her preference instead of focusing on any indicators or taking advices . Her mind was unable to tackle that what if prices never flourish again .

If we talk about regrets that were first about not buying and cheaper price and then for not selling at higher price . This also comes in the catagory of emotional bias .

2) Trend chasing Bias :

In the start of case study we read that she invested after knowing about it on telegram channels . So it is obvious that she was just chasing a trend of buying . If she didn't had chased a trend and instead made a research on it the results could have been different . So we can say that trading bias also effected her trading .

3) Self-attribution Bias :-

From the case study i noticed that Self-attribution bias also effected Jane . Let me explain you how ;

Her wrong decisions were the reason behind the loss but instead she blamed Stop loss for this .

Instead of admitting her mistakes and improper research , she blamed the cryptocurrencies and their holders .

4) Bounded rationality Bias :

Bounded rationality actually causes to think about the temporary condition and it is for satisfaction not for a prolonged profitable strategy . Jane also got effected by it because

- Instead of investing somewhere safe she decided to invest in the coins whose prise were fluctuating constantly . She just thought that the price just went higher but she didn't considered that they could fall as well beyond the limits .

5) Anchoring Bias :

Anchoring bias is actually when someone relays too much on existing information and patterns. In crypto world it is very easy to get effected by Anchoring bias because the future is never related or cohesive to the past . And probably this was the factor behind Jane's behaviour towards choosing coin for investment and for averaging down and then getting effected by it . So she got effected by this bias .

So these were the five biases that effected Jane's trading behaviour .

• List and explain how each bias you have mentioned can be avoided?

According to me they can be avoided , So, let me explain you,how ?

Emotional bias :

This bias can be simply avoided by a single phrase that __ " Put your emotions aside while making a decision "__ . We make wrong decisions because we prioritize our feelings and not the work. Sometimes hard decisions are required that could be against our emotions but they are necessary .Trend chasing Bias :

We get effected by this bias not only while trading but also while in daily life . Because now a days people often pretend about their living . People fake everything and we make decisions just by looking at trends . So i suggest you to think about your life and make a proper research on anything you going to follow or engage.

Self-attribution Bias :

Keep in mind You are not always right this bias effect us only when we are barred minded . Barred minded means someone who don't want to accept anything new and can't admit his mistakes . If you start learning and taking advices from people instead of prioritizing your idea , you can easily avoid this bias .Bounded rationality Bias :

This bias effects when we just care about present or the next coming days but not about future . You should realize that your today will decide your tomorrow . So if you don't plan it and just think about immediate results then you will end up as a failed person . So plan for everything .

- Anchoring Bias :

As i told above this bias effects someone when they rely too much on existing information . The reality is that everything is getting Revolutionised day by day and of course they of doing this is also. So you can avoid this bias when you do a proper research and keep yourself updated with modern techniques and trying something new .

Part B ;

What type of analysis can be used to monitor market psychology and trading psychology, and why? Identify the differences between trading psychology and market psychology.

Both technical and diagnostic analysis can be used to monitor market and trading psychology.

Technical analysis can help you to get through all the minor details of Market where you can identify the factors that effected the trade and how the combinely effected the market . The indication or anticipation in any market also includes technical analysis . So they help you to anticipate coming curves in the graphs of exchange markets .

Diagnostic analysis can help you to diagnose the reason. For example if the Market just faced a bearish trend then you can use diagnostic analysis to identify what caused this trend. And of course when you will know about all the reasons it can help you to monitor the psychology of both trade and market .

Trading psychology deals with the psychology of an individual. So in this psychology only the decision, feelings and behaviour of a single individual is observed . All the decision making , reasoning , and all the factor behind trade for that specific individual are discussed .

Market psychology is kind a sum up of trading psychologies because in this type we consider all the individuals in market and hence what trend or effect is created due to the behaviour of all individuals is observed in this psychology . It also predicts and explains the trends of market. It also tells how people is market get influenced and effected by each other .

How can you measure market psychology using a crypto chart? Select 5 trading biases and explain with screenshots of any cryptocurrency chart how the biases can cause a coin to be oversold and overbought. (Add watermark of your username)

Yes we can obviously measure market psychology by looking at charts ;

Above i attached the Steem/btc trading chart of one month and now i will explain you how can i tell about market psychology .

In the Graphs you can see that the curve is continuously moving downward which means that market psychology is negative. So it is quite possible that people in haste sold all coins when a bearish trend came. So it is obvious that just like i did you can tell about market psychology just by looking at charts . Now it has again turning red which means the market psychology is again becoming positive .

Trading biases effects on crypto markets :-

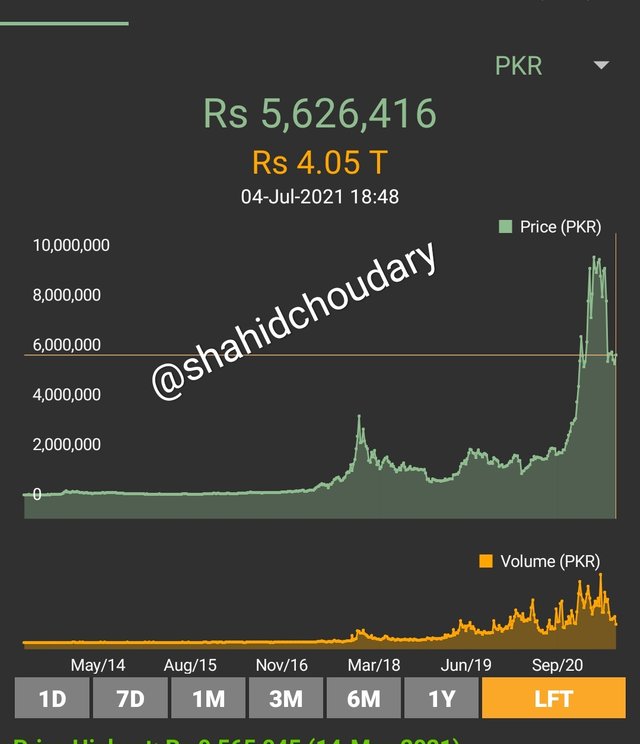

Effect of trend chasing bias on bitcoin ;

Bitcoin has suffered many times form this bias in its history .

In the above graph you can see that the market of binance suddenly went so up and hence positive from 2017. Actually if you study about it you can observe that actually it was due to a fame and trendy buying of bitcoin . It was almost stable for 2 year and then it again started a downward trend . Because it got some infamous and this trend made its downfall.

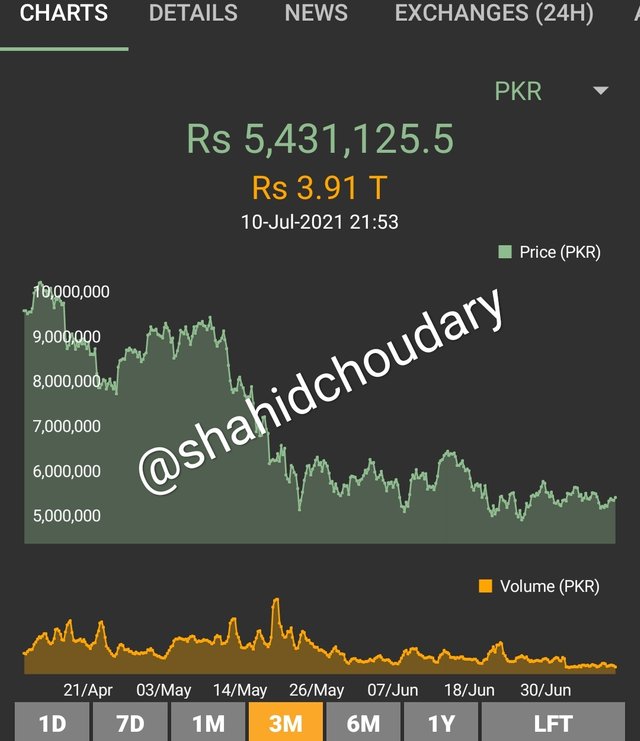

Effect of emotional bias on bitcoin :

In previous Month bitcoin got defamed because of Some negative news like it is again ecosystem due to inefficiency of energy . It made people feel bad about it and hence it faced a downward trend .

Effect of anchoring bias on all cryptocurrencies :

Now in past few months the trend of cryptocurrencies are totally different from the previous ones but people are still investing keeping previous information in mind so it often costs them a lot .

Herd mentality and confirmation biases also effects market psychology a lot because these biases effects individuals and market is a sum up of all individual psychologies .

So when the market psychology becomes positive it causes that specific currency to be overbought and similarly when due to effect of some biases sometimes the market psychology becomes negative and it creates a panic in market and causes the currency to be oversold .

In your own words, define the term efficient market hypothesis (emh). List and explain the advantages and disadvantages of efficient market hypothesis (emh) .

- Efficient market hypothesis states that if you select a currency randomly it would be much more profitable then selecting a specific after a proper research and study . So if you select a currency randomly from the market its more likely to get you profit .

Advantage :

It's just a hypothesis so we can't tell its advantages for surely . But according to hypothesis and graphically it shows that selecting it randomly generates more profits .

Disadvantage :

We aren't sure about profit so it's a high risk . Cryptos are alway Risky but in this case the the risk of loss is more because we have chosen the currency randomly .

This was all about my homework post. I tried my best to answer all the questions in a better way . I hope i get good grades 😇😇 ..

Submitted by ;

Hi @shahidchoudary, thanks for performing the above task in the second week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 5.5 out of 10. Here are the details:

Remarks:

While you did fine answering the Part A questions, your answers to Part B could use more depth. Again, thanks for the time and effort you put into this work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit