Hi to all my friends . I hope you will all well . It's me @shahzadprincejee and i am glad to participate in this class . I am also a student of your class . I am grateful to professor @asaj for this interesting lecture.

What is RANDOM INDEX

Random index is a technical indicator which is used to compare the security's movements to the random movements in the market . It can be use to generate the trade signals which is based on the strength of the fundamental price trend . Random index is also called the KDJ Indicator which is used to predict the market prices . It consists of three lines which are called K ,Dand J. It is said that it is also known as the practical indicator . KDJ indicator is can help to the traders and investors to determine the oversold and overbought . It is also used to determmine the signals of the buy and sell .

The random index was introduced by Michael Poulos in order to determine the security's instant price . It is usualy used to get the results of statistically significant trend , higher and lower . This technical indicator was published in Technical Analysis of Stocks in a1990's magazine article .

We can see the different trends in the above image .

How to calculate RANDOM INDEX

As we know that this indicator measures the uptrend and downtrend strength and has the requires separate calculations for both .

First of all , we will see the calculations of the high period or the RI high is :

RI high = High-Low /ATR x 100%

wher ; ATR=average true range

Now we will see low random index :

RI low = high - low / ATR x100%

As we have seen that the same method is available to approach the high and low random index . Every day the calculations are completed again .

Is the random index reliable? Explain

As we know , no human is perfect in this world . Each one has some flaws and some strengths . Just like that , every indicator has some flaws and some strength but no one is 100% perfect and reliable . As we have discussed in the above explanation that the KDJ indicator is used to determine the trend analysis and technical indicator . But we can make it reliable by combining some more indicators . But only KDJ indicator is not 100% reliable and perfect . It can generate the false signals of buy and sell for the traders . It can wrong guide to its user because it will not work when the market will unstable . I will advice to my friends who want to invest and trade , they should be use the more indicators and strategies to determine the original price of the market . Best of Luck to all traders and investors .

How is the random index added to a chart and what are the recommended parameters? (Screenshot required)

As the requirement of the question , we want to add the KDJ indicator onto the tradingview . First of all, we login the tradigview and click on the option of the "Chart" .

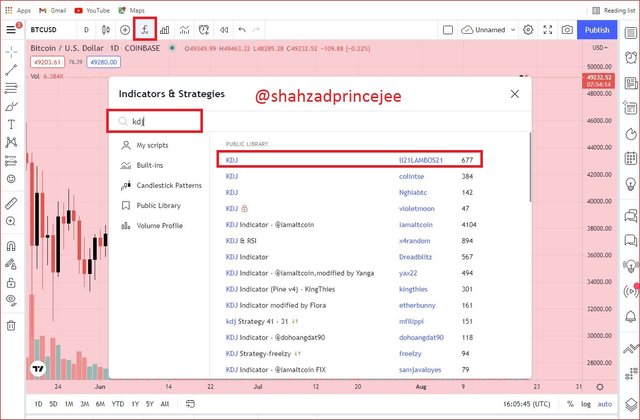

Now the chart is ready to determine the different asset's pair of price . I will choose the pair of BTC/USDT as you can also see in the window type box which i will show you in the below image .

Now we will click on the "fx" icon to add the new indicator which is shown in the above image . When we click on that icon a new pop up will be open and now we just put the KDJ on the search box . we have to choose KDJ By “ll21LAMBOS21” from the all of indicators due to its high ranking and reliability .

Now we can see the K, D and Jlines in below image after applying the KDJ indicator.

I have taken the 1 minute price changing of screenshot . Now we will see some signals of oversold and overbought .

Overbought signals:

Generally , overbought signals shows that the current short term movement in the price of the security . It reflects the positive expectations that now the market will correct price in future . Now we will talk about our chart , when the Jline will move above 80 in the price chart then it is called the overbought . Now the investors and traders will be ready to sell their assets .

Oversold:

The oversold means a situation where the value of assets are low and in future the price will expect to be good . Now we talk about our present chart . when the price goes down 20 , then it is called the oversold . Now the most of investors and traders will be ready to buy the assets that in future they will get the good profit from these assets .

Differences between KDJ, ADX, and ATR

KDJ

It consists of three lines . It is practical technical indicator which is used to determines the trend analysis of short term stock . It is known as the random index indicator . It can show the price pattern in a traded asset . It is derived from the stochastic oscilator indicator . Because it has an extra line which is called the J line . It can determine the asset's overbought and oversold . In this indicator the J line shows the divergence .

ATR

It consists of only one line . It can be used to determine the placement of the stop loss order . It is also known as the Average true range indicator (ATR). This random moving indicator shows that how much this asset moves during the specific time frame . It has been applied to all types of securities . It is also use in the technical analysis . ATR value can be calculated at any time or each hour . It does not indicate the direction of prices .

ADX

It is also a single line indicator . It also does not indicate the direction the price . It represents the strong trend decreases the risks and increases the profits . It is considered that it is ultimate trend indicator . It is used to determine the strong trending price . It is selected to quantify the trend strength . It is applied as a single line with value ranging low of zero to high of hundred .

Use the signals of the random index to buy and sell any two cryptocurrencies. (Screenshot required)

Now we will demonstrate the buy signals and the sell signals by using the KDJ indicator . I am still not a trader . I am only a student , my study is still continue so that i have not a good experience in trading till. So i will try my best to explain the sell order and buy order . Please ignore my small mistakes .

Sell Order:

I have choosen the TRX/USDT cryptocurrency pair for trading . Now we will see in the below image that how is the J line intersecting by applying the KDJ indicator . As you can also see that the yellow line come from the ups to downs . We can see clearly in the image below.

Buy Order:

I have choosen the DOGE/USDT cryptocurrency pair to demonstrate the buy signals . I estimated that it will give the profit to its user . We can see in the below image that i got buy signals.

As we can see in the above image the yellow line is moving from the bottom to up .

Conclusion

In the last words , i want to say that i really enjoyed very to complete this task . I have learnt a lot of thing which i did not know before this amazing lecture . Especially , i did not know about the KDJ indicator . It is such a unique indicator why i like it because it has an extra J line which help to the trader to determine the overbought and oversold . I taught that how to add the KDJ indicator and its unique properties . As we know that no the every indicator is perfect and 100% reliable . So just like that i do not prefer the KDJ indicator to the investors and traders . Today , i knew about the ATR, ADX and KDJ indicators . I had a good time to complete this task . Thank you so much professor @asaj for this nice topic .

Special Thanks

Best Regards

It contains close paraphrase and/or plagiarized content.

Original Source:- https://www.investopedia.com/terms/r/random-walk-index.asp

We would encourage you to publish original content, purely based on your own experience with a wallet/dApp(or as the task demands). Any act of spam/plagiarism diminishes the very idea of Proof-of-Brain, hence disregarded/discouraged by the community.

If you need any further help/clarification related to the task, please feel free to ask.

Thank you.

Cc: @endingplagiarism @endplagiarism04 @asaj

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good post brother

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @shahzadprincejee, thanks for performing the above task in the eighth week of Steemit Crypto Academy Season 3. Recent investigation have provided evidence that you submitted plagiarized content in the academy. Given that you've had multiple cases of plagiarism, you have been muted. Plagiarism is unlawful and is prohibited in the academy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much professor for review on my task . Next time , I will try my best .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit