AI and Machine Learning Applications on the Cryptocurrency Trading

Cryptocurrency has brought significant changes in financial industries and has developed new horizons for using Artificial Intelligence (AI) and Machine Learning (ML) in trading. Such sophisticated methods are being used to unearth trends, to make predictions that the conventional approaches can leave out. Using AI and ML in cryptocurrency trading has been so widespread due to its precision and efficiency and better decision making.

As for the way for cryptocurrencies to make use of AI and ML, it can be on how past and current data sets are used and how it seeks out complex relations in these sets. Let’s take an example, say ML algorithms can take millions of data points and search for price movement synchronized with volume, news or social media activity. While conventional technical analysis relies heavily on charts and graphs, interpreted through human brain power, these algorithms rely on history to make more accurate future estimations regarding price changes.

The other benefit of AI and ML is they help trade by pr* cessing information and making decisions without any human inter* vent*on. This real-time analysis gives traders a chance to exploit market opportunities long before other traders, guided by their human instincts, can do so. Moreover, ML models are well capable of being trained in a way that ensures that they continually cover the market changes and the possibility of human error is almost completely eradicated.

One area where artificial intelligence and machine learning found success in cryptocurrency trading is sentiment analysis. Media articles and social media are full of information that can change the situation on the market. As an example, while social media is rich in unstructured data, it can be processed by NLP techniques determining market sentiment of AI algorithms. This in turn can be useful for traders to better decide whether to buy or to sell their cryptocurrency.

Trading Model and Implementation

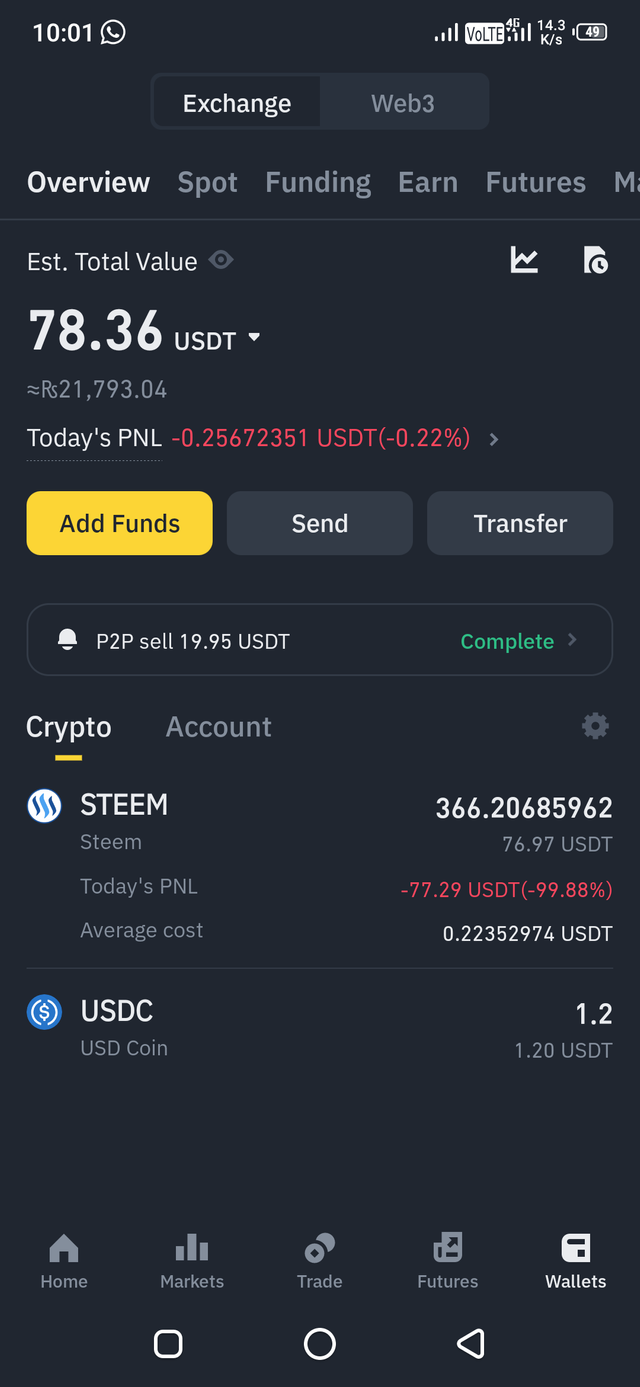

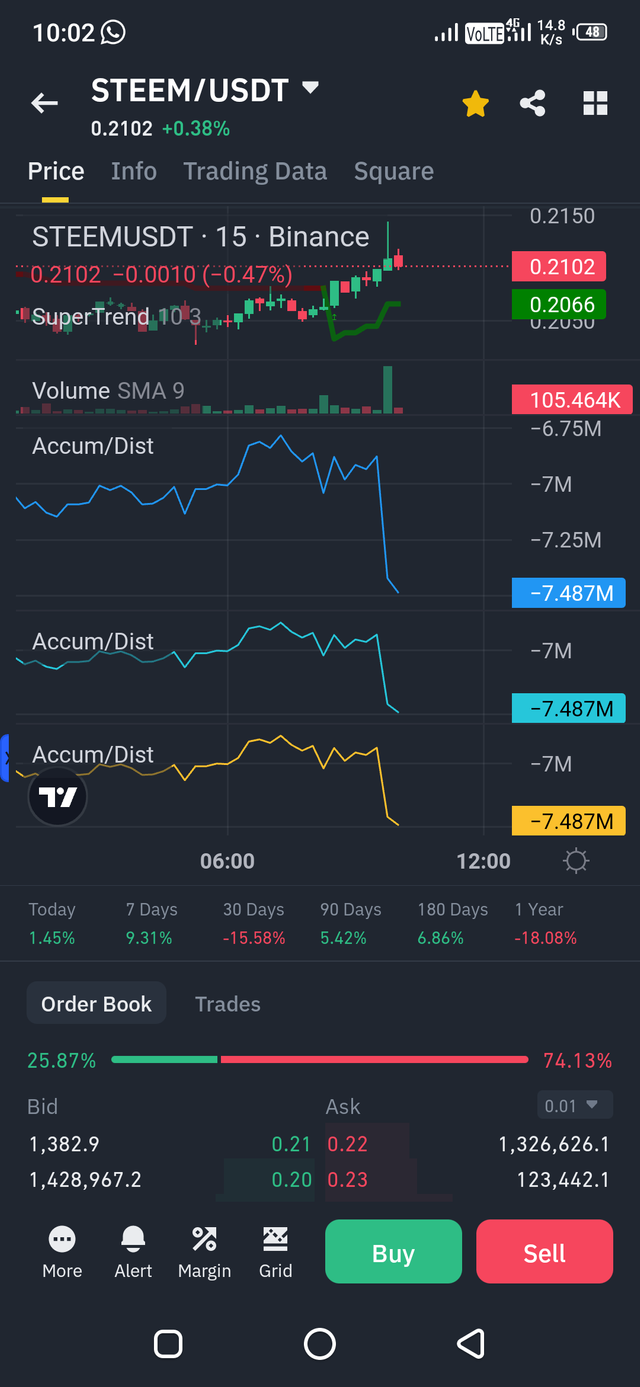

For the creation of this basic forecast model for trading signal, we will employ the historical data involving Steem/USDT price in Python with the help of the Scikit-learn library. Several aspects are also involved in the process, these are data preprocessing, method choice and model understanding. Let's delve into each step in detail:

Step 1: Data Preparation

The first of course to creating a predictive trading model is to assemble and prepare the data required. For this example, let’s focus on historical Steem/USDT price data which is available on the web and can be extracted from a credible source of crypto market data. For any other necessary parameters, you just need to include timestamps and prices.

We then required to clean the data Once data has been collected. This involves:

- Cleaning the data: Sometimes it is necessary to drop any extreme values which may mitigate the accuracy of the proposed model.

- Splitting the data: Split our data into training and testing set. Model learning, how our model predicts the answers, is evaluated using testing set and we call it evaluation dataset, while we called training set as the datasets to build the model.

- Feature scaling: Create all features in the same range so that there is no one feature that seriously impacts the model in making it’s prediction.

Step 2: Algorithm Selection

After that, we will proceed to choose an adequate algorithm to use as the basis for constructing the predictive model. In this instance, we will be using one of the most widely used algorithms known as Linear Regression. It is quite easy to implement and can be used for predictions of continuous values This algorithm is best suited for a situation where you need predictions for a value with close values in a range, for instance price.

Step 3: Model Training

Now it’s time to prepare the data and chose the algorithm and train the model. The algorithm is trained using training data so that the algorithm knows how to map some kind of inputs, say, price and volume, to some kind of output, price direction.

In case of Linear Regression the algorithm will determine the line which best fit with the features of the input and the output variable. After that, the model can approach the future prediction of unseen data.

Step 4: Model Evaluation

After we are finished training the model we will have to test our model on the test data that we have. It’s very important as it enables us to understand whether the model will be able to predict well for new data, and not to overfit.

There are several metrics we can use to evaluate the model's performance, including:

- Mean Absolute Error (MAE): Known as Mean Absolute Deviation it is a method that calculates the average of the absolute differences between a set of forecasts and actual values with no respect to the direction.

- Root Mean Squared Error (RMSE): Equations the proportionate root of the sum of the squares of the error between the forecasted and realized values.

- R-squared: A statistical measure of the squared difference of the difference between the predicted and actual values of the dependent variable split by the squared differences of the values of the independent variable(s).

Step 5: Model Interpretation

Finally we will elucidate what the special points in the model are so as to trade in the market.When it comes to Linear Regression model the output will be the probable price after the next 24 hours.If the model expects the price of the security to rise in the future or is not less than the current pricenthen the signal at this stage is a buy signal If the model expects the price of the security to drop or is below the current price then the signal is a ‘sell’ signal.

However, is important to understand that trading models no matter how sophisticated they are or that are developed from past data are not perfect. It’s not perfect pricing because prices can get volatile in the markets and outside forces which cannot explain by the model. Hence, it must be noted that the prediction model must be effectively blended with other forms of trading analysis and diversification is important for trading.

Therefore, it is crucial to consider the use of AI and ML since they are beneficial to any cryptocurrencies trader as they help in making correct predictions on how the trader can engage in the cryptocurrency trade market which is very volatile. Due to the growing technique of predictive trading models, traders are more likely to be able to generate better outcomes by improving their models.

Moving toward the constructing of a Simple Predictive Trading Model of Steem/USDT pair

Just like with any other asset, the ability to predict the future prices of a cryptocurrency asset can enable traders to have a competitive advantage over other operators in the market. Employing ML and AI we are able to develop models that allow for the prediction of price changes and thus be useful for trading. In this article, we will explore how to construct the basic trading predictive model on the Steem/ USDT through trading history data and tools of python Scikit-learn.

Step 1: Data Preparation

To build the model we have to have a clean and structured dataset first. Steem/USDT historic prices are often found on historical exchange sites or on other historical data vendors. For this example,let’s identify the fields as date,open,high,low,close prices and volume majorly for the Steem/USDT trading pair in CSV format.

Firstly, we will involve using the Python language to read data, and pre-process it for with intended utilization in data analysis. We can use the pandas library for efficient data manipulation:

import pandas as pd

Now, before we proceed with the analysis, let’s read the data from the CSV file for analysis.

We first read the CSV with a header using pickle and parse_dates parameter, as we don’t have header information.

.datasources = datasources.dropna() # This command cleans the data by eliminating records containing missing values.

df.dropna(inplace=True)

># Take the data and resample it to one hour intervals

df = df.resample('1H').mean()

Now that we have prepared the data it is ready to be fed to a machine learning model.

Step 2: Feature engineering is the critical aspect of developing an ML model, as is the right selection of the algorithm the model should use.

However, to do this, we need to know which features can help to predict the direction of the price movement. There is one more rather popular strategy used in financial markets – lagged features, which are essentially previous prices and volumes of the asset. We can generate these lagged features using Python's data manipulation functions:

# Generate lagged features

Next, we made a new feature that was equal to the previous ‘open’ value to use in an equation later on in the process: df['open_t-1'] = df['open'].shift(1)

df = df.assign(close_t1 = df.close.shift(1))

df['high_t-1’] = df[‘high’].shift(1)

df.set_index(‘date’, inplace = True) df ‘low_t-1’ = df ‘low’.shift ()

df = df.set_index(‘date’).df[‘volume’] = df[‘volume’].shift(1)

In this case, let us therefore employ a Linear Regression model while is quite easy to implement and provides a fairly acceptable foundation from which to evaluate the efficiency from the predictive model. However for the real world data on complex models such as Random Forest, Gradient Boost or even Deep learning like Long Short Term Memory can be used.

Here's how to implement the Linear Regression model using Scikit-learn:

import sklearn.linear_model as linear_model

### Disclaimer:

This is not a comprehensive list.If you require more topics, please visit website at http://www.lessing.me.

For this we will be using function from sklearn.model_selection,train_test_split in order to split data into training and testing sets.

# Select the features

To create this matrix we take the features as columns in the dataframe df and select the relevant columns X = df[['open_t-1’, ‘close_t-1’, ‘high_t-1’, ‘low_t-1’, ‘volume_t-1']]

# Forecast the next day of closing

y = df['close'].shift(-1)

># Divide the data into training and testing dataset

X_train, X_test, y_train, y_test = Xtrain, Xtest, ytrain, ytest = train_test_split(X, y, test_size= 0.2, random_state = 42)

# Initialize the model

model = LinearRegression()

# Train the model

model.fit(X_train, y_train)

Step 3: It is thus possible to clearly interpret the model as well as make predictions.

When the model is developed, we are in a position to predict, utilizing the test data set: But these models should be checked and their efficacy is gauged by accuracy measures such as Mean Absolute Error (MAE), Mean Squared Error (MSE), or R Squared. Here's how to calculate the predictions and evaluate the model:

import sklearn as sk

### Options:

import sklearn.metrics as sk_m

### Location:

aimaaltech.com

### Reference:

geekeester , 8 years ago

They used the created models to generate predictions on the test data.

For the final calculation, the following was used in order to get the vector of predictions predictions = model.predict(X_test)

### interpret the results of the model

mae = mean_absolute_deviation (y_test, predictions)

np.mean((y_test-float(predictions))**2)

r2 = r2_score(y_test, predictions)

print("Mean Absolute Error: ", mae)

print("Mean Squared Error: ", mse)

print("R-squared: ", r2)

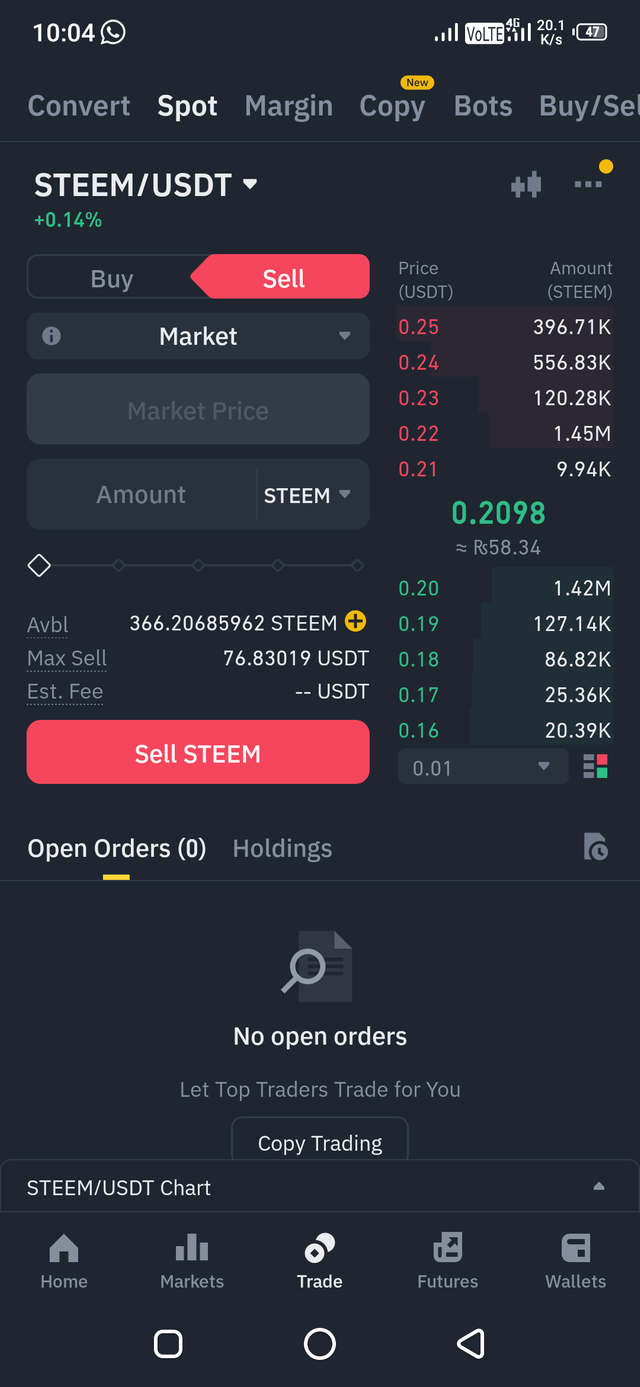

Step 4: The trading signal’s and the trading or analysis.

Finally, after having made a predicted price for the next 24 hours, we have to convert it into a trading signal. A simple threshold-based approach is to decide whether to go long or short based on the predicted price:

# Generate trading signal

if predictions[0] > y_test[0]:

signal = 'Buy'

elif predictions[0] < y_test[0]:

signal = 'Sell'

else:

signal = 'Hold'

print("Trading Signal: ", signal)

We can, therefore, try other models where the inputs are lagged features, analyze other algorithms and refine the parameters of the model if necessary. On a similar note, it becomes possible to come up with a wider array of features including the technical indicators, and augment the sentiment feature by sentiment data, news data, and many others.

In other words, when constructing the model for Steem/USDT trading, there are mandatory steps such as data preparation and feature selection, choosing a right algorithm, assessment of the result and generation of trading signals. The model and signals should become dynamic to incorporate or reflect the current market conditions if at all they change. Finally, always do not think of any model as ideal and risk management should be an integral part of trading. Happy trading!

The Power of Sentiment Analysis: Secrets to Enhance Your Steem and USDT Trading Plans

Picture this: When you are busy looking at your Twitter timeline, or you are reading through the articles on Steemit and you find different posts about “Steem.” By now you may ask yourself, how can I transform this quite informal reading into an advantage for my Steem/USDT trading approach? Arise sentiment analysis – a tool that is capable of turning these often insignificant remarks into usable information for your trading strategies.

How Sentiment Analysis works

Before that let’s check the tone of more recent post on Twitter and the Steemit articles which include the word ‘Steem.’ For analyzing the sentiment of the text we will use one of the most frequently employed AI-based tool known as VADER an acronym for Valence Aware Dictionary and sEntiment Reasoner. This is a Python library that is specifically used to work with text from social media, which exactly what is needed to measure the amount of positive or negative emotion that is conveyed in these texts.

To begin, one only needs to load VADER and employ it to categorize the posts according to given sentiments. VADER will classify each post as positive, neutral or negative depending on the type of words used in the post, use of punctuation marks and the structure of the sentence formed.

Sentiment Trends: The Key to Trading Success

Finally, this phase once you have oriented the sentiment trends in the posts, it is time for some wise trading strategies. Here's an example of how you might use the findings to adjust your strategy:

Scenario 1: Positive Sentiment

Suppose a lot of messages on Twitter and Steemit are positive about future prospects of Steem. There is always an expectation from users to enhance the platform in one way or the other as seen in the recent addition of a new feature, or integration with other block chain projects. In this case you might want to purchase more of Steem or hold your position in Steem. If the tone of your positive thing is that your asset might be appreciated soon then that’s positive.

Scenario 2: Negative Sentiment

On the other hand, there are so many posts that are down about Steem and the possibility of its weaknesses or poor performance. For instance there might be cases where users are commenting on a site’s recent decline, security breaches, or regulatory problems. In this case it may be advisable to sell some of your Steem or decrease the risk from exposure to it. The negative feeling may mean that the price of Steem will likely fall over the short-run.

Scenario 3: Neutral Sentiment

At other times, the posts will consist of opinion polarities which may be positive and at other times negative. And that's the most safe strategy here – to do nothing and watch over everything. Further decision can be made out of how sentiment trends change overtime.

Final Thoughts

When trading using sentiment analysis, you can ensure that you have the latest information about market sentiment and how people are talking about the Steem. However, it very important to understand that sentiment analysis is typically complement not a replacement to fundamental research and analysis of the actual asset. It should be only one factor while making trading decisions.

If sentiment analysis is to be regularly incorporated into your trading model, you’ll get a better feel of which sentiment translates to which price. And so as you interact more with the candidate, especially through different levels of the organization, you can refine your approach as you modify your strategy. The more one assesses the emotions involved in trading the easier it is to find ways of dealing with changing market conditions and increase one’s profitability.

The World of Automated Trading: A Steem/USDT Saga

It is a dynamic world out there and given that most financial markets are global, one gets caught up in sharp swings in market conditions and numerous factors that influence the prices of assets and numerous trading options. In the middle of all this, traders remain continually on the search for a tool that would help them to optimize their work and make better decisions. Come in Automated Trading Systems – an abode as it can be to new inexperienced traders as well as experienced professional traders who are always on the hunt of efficiency, speed and most importantly an opportunity to make more money.

Automated trading system design is not a purely technical activity, but a creative one. With the help of AI traders are now able to create personal trading techniques that are able to flex in the ever-shifting global marketplace. For instance, I will take you through a step by step process of building an automated trading strategy for the Steem/USDT couple.

The Elements of our Automated Trading System

Before we delve into the specifics of the strategy, it's essential to understand the main components of our automated trading system:

- Data Collection:Gathering market data from the actual market including the historical prices, volumes, etc.

- AI Tools: Employing the AI technology including ML to filter and analyze trading opportunities on the basis of the data.

- Trade Execution: Entrusting the actual trading with the portfolio based on the AIs signals to a human trader.

- Risk Management: Using various…such as stop order, take profit order to minimize risks in stocks trading.

With all these components on the ground let me proceed and explain how the strategy would be implemented.

The Strategy: A Step-by-Step Guide

Step 1: Collect Market Data

The first part of the creation of an automated trading concern is to gather real time market information. In the case of the Steem/USDT pair, the signals would be collected from the exchanges both, historical and live. This data could include:

- Steem/USDT price movements

- Volume

- Trading patterns and trends

Regarding Steem and other related crypto currency markets, it would suffice to say that the news and social media sentiment is trending as follows:

Step 2: Data Interpretation and analysis.

In this case, the data collected is analyzed and interpreted through AI tools in the subsequent process. Through the use of machine learning, the system can easily pick out given variables, or associations that may be fundamental in the determination of the market. To give an example, neural networks can then (on our case study) be used to predict future prices on the basis of the available data or try to measure social media or news sentiment on the Steem/USDT market using natural language processing.

Step 3: Logic for Triggering Trades

The trade execution logic that exists in the center of our automated trading system. In the subject case, this is where the analytical skills of the AI come into play. The system would also scrutinize the market data to establish potentials for trading. for example if the AI has trained the model on a bullish signal of Steem/USDT, it would generate a buy signal.

However, the system wouldn’t depend on only one particular signal. In order to validate the signal further and have high likelihood of being successful, it would accompany them with technical indicators like moving average, RSI, MACD etc.

Step 4: Setting Stop-Loss Levels

Like any trading activity, risk management is a crucial element of our BOT system and using automated trading makes no exception. It would also provide certainty of the fact that its trading activities will be under this one condition in which its stop loss conditions for each trade entered in the system will be predetermined. Such levels would be predetermined based on the analyzed volatility of the market as well as its previous trend and other factors. For instance, if the system infers that Steem/USDT had high volatility, it would set a stop loss level in the event of a bear market instance.

Step 5: Taking Profits

As important as it is to manage risks it is equally important to determine when it is time to take profit. The automated trading system would include take-profit announcements that interact would be set at predetermined values depending on the market conditions that the AI would determine as favorable for certain profits. In our Steem/USDT model, if it finds signs that the price has risen to the extent that the trader will want to cut his profit, the AI will sell the asset to the trader.

Conclusion

This paper demonstrated how AI could be used to transform the way traders analyze the market by explaining the formulation of an automated trading strategy for the Steem/USDT pair. Through ML and other AI instruments, one can develop the highly effective trading model that will not only point at attractive opportunities but also assess risks and make a correct decision about buy/sell.

Overall, the most important thing you have to learn when learning to develop an automation trading system is that its technical and creative sides should be learned in a comprehensive manner. It will take more time for the field to develop, but the traders who followed such approach will have the opportunity of being involved in the future of financial trading system.

@artist1111

@ashkhan

@sahmie

Greetings friend, first of all I would like to thank you for the invitation, bringing this contest to my notice... I may not have the chance to participate as I'm out of the town for the festive period and being caught up for family and work load.

However, I must commend you for your hard work as this post is very informative, making it an excellent way to learn about trading with Artificial Intelligence. Basically, this technology came into existence to help us make better decisions and do things more easily and same is applied when it comes to trading, to help us analyze data and market trends faster and more accurately than doing it all ourselves.

But then, as much as AI takes a lot of the hard work out of trading in making it simpler for everyone, not everyone can also understand and participate in it as it requires certain level of knowledge not common to everyone such as machine language and it's commands. So this serves as a tune down point for some of us.

Good luck in the contest, all the best and Merry Christmas 🎄 even though I think you may celebrate it being a Muslim. Have a lovely day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @sahmie

As this is honour for me that you replied to my post and appreciate me.

I have tried my best to do well and working hard people like you and other successful steemians.

I hope you will support all those steemians who are working hard to get success.

Again thank you 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One thing I've come to learn in my Steemit journey so far in all these years is that we grow by supporting each other...

There's a common saying around here that says "We grow by lifting others up" and I think this apply to Steemit as well so yes if I see a good work, I do my bit in supporting it with the little I can.

I know how hard it could be to make a quality post for this community and challenge, so I can't demoralized anyone after putting in such hard work... All the best mate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for your compliments

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

informative post, it is great way to learn Trading With Artificial Intelligence, AI makes human life easy and full of knowledge...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

🚩 Downvoted for entering an engagement challenge with AI generated content 🚩

I can see from your timeline that you've decided to only post AI content now. I can even see the exact date that you decided to start this.

So, you will understand why I will be downvoting you until you return to your old, non-AI style of posting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit