Hello gorgeous ladies and gentlemen

Today j am exciting to take part in another contest and always way of learning and motivation for me is increased to take part.

What is a bitcoin ETF and how does it differ from owning bitcoins directly?

- Bitcoin ETF is the combination of two things we can say the combination of two investment one is ETF and other one is cryptocurrency and we cover it into one package so that's called the Bitcoin ETF so the main purpose of bitcoin ETF is to track the price of Bitcoin and help the investors for Digital asset with out directly owning pyshical asset.

- So firstly I am going to elaborate on the term Bitcoin ETF this is also called a spot Bitcoin ETF. This is actually an investment vehicle that is used to track the price of Bitcoin and in simple words we can say this is a bitcoin exchange traded fund.

- This is regulated on specific security exchanges and this is not available on the as usual cryptocurrency exchanges this is the main difference. So there are two methods which the investors can get through spot Bitcoin ETF and another one is bitcoin futures ETFs.

So the first Bitcoin was approved in the US and Australia. In US 2017 sec approved is and let it down so then later on the Bitcoins strategy ETF which is also known as bito start trading and this happened in October 2021. After approval in US then Bitcoin ETF also launched in Australia and it is approved in Australia and this was launched basically to see to track the price of Bitcoin and Ethereum.

So after November 2021 Australian ETF provides are huge exposure to all the companies and investors to support ETF.

So there are certain advantages of Bitcoin ETF the invested scan directly get expourier to Bitcoin with out need to go on Crypto exchange to create any wallet or anything else another important thing is photo folio diversification and the most importantly the investors are being more secured protected and their investment is regulated but the disadvantage of this is that there are certain restrictions as well.

For example there are certain trading hours this is entirely different from Crypto exchanges that actually works 24/7 hours and but on the Bitcoin ETF they just provides certain hours for trading and the ETF management fees is also very much.*

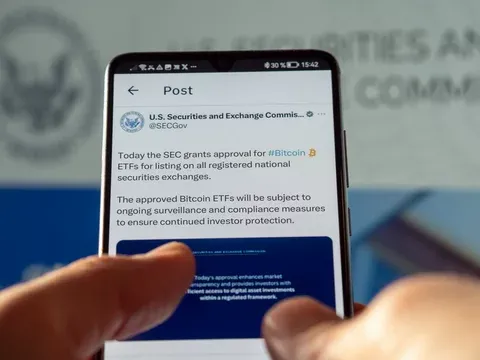

How can the approval of a bitcoin ETF by the commissioner of the american stock exchange sec influence the cryptocurrency market? and why did it fall just after this approval?

- When the US SEC approved the ETF they received 11 applications and their just ignored all the risk associated with this. So after approval now all the investors will automatically compromise the physical Bitcoin which the usually by from the Crypto exchanges so now they will just track the Bitcoin prices. Because they need to clearly understand that Bitcoin ETF is entirely different from what they already doing mean by Bitcoin directly or indirectly.

- So the Bitcoin ETF has actually saved the investors to all the complications and risk from directly by the Bitcoin so in simple words we can say the investors what security from the Crypto exchange.

- So it was a very positive change that Bitcoin ETF makes everything easy for the invested to get security and as well as enable them to directly by the Bitcoin and just and track the Bitcoin price. So this is the very large step taken by the SEC to explore the biggest crypto by market.

So this approval was a very influencer because after the approval of Bitcoin ETF the new investors were attracted and lead to higher amount of Liquidity and adoption increased.

So globally market impact over all in US Crypto to takes very positive vibes. But after the announcement there was not much increase in Bitcoin so the biggest Crypto asset was $46,000.It was one percent only while the oldest assest which rallied put was about 150 percent in one year.

- So there was already existence of Bitcoin ETF in other countries like Canada and Europe but after us approval now the new doors have been opened over all for biggest capital market in the world. So all the investers they were actually pouring all the funds into crypto after approval and expecting $100 billion at the end of 2024.

- The main reason why Bitcoin fall after approval is just because the investors become more greedy and they just don't want to give more funds and and they were thinking about more how to get more profit.

Another reason was tracking of Bitcoin price was not very accurate and was not well regulated there was between the market value and what we were tracking.

And there was very uncertainty and and dynamic was not well regulated and volatility of market fluctuations was very high due to which investors were not ready to pour their funds. And this these factor lead to fall just after approval.

How could the approval of a bitcoin ETF by a financial authority such as the sec contribute to the legitimacy and institutional recognition of cryptocurrencies?

So after the US approval when they seen that after one day of the trading being approval that trading was above dollar 4.6 billion this was just the first day trading after the approval so when they have seen this much anthusiasim so they become more happy also curious about the volatile nature of the cryptocurrency.

- How this approval to change actually after the approval many new investors many new choices engaging on cryptocurrency and this was a very innovative Crypto product because this is considered the second largest cryptocurrency.

- Initially it was thought because of ability of the Bitcoin ETF so there is uncertainty in the cryptocurrency but when the decision was made and it was approved so the US authorities were just working on its regulation and all the market and the investors concerned for example how to do trading and all the fees and over all impact on the market.

- So this approval has made a very positive change like high interest of the investors. And you can save in the long term the viability of all the Crypto assets.

Regulation

So Bitcoin ETF actually has attracted invested in a very positive way because the all the institutional investors who were actually hesitating how to invest directly into cryptocurrency just because of the volatility nature of the cryptocurrency and uncertainty so after the approval they have been attracted so much.

Transparency

SEC have regulated and them put on very strict rules and regulation which actually has bring so much transparency in the system that all the manipulations which were going on in the market and investors investing protection and security has been provided to institutional adoption.So there was very less chance of risk or loss of the Bitcoin.

Increase Institutional Interest

So there was high institutional interest in the trip to because of the viability nature of the investment and this was just due to the introduction of Bitcoin ETF.

So if I summarise all I would say that the approval of Bitcoin ETF has increased so much the institutional adoption of cryptocurrency just because of the features we have streat rules and regulation that transparency and another thing is investment is secured and viable and most important the liquidity has been increase so much.

There is no quality in the price or we can say the price is stable and due to stability of the price the investors are attracted so much and so it can lead to legitimacy of cryptocurrency for all the investors and their are also less risk associated with the loss of Bitcoin.

- So Bitcoin ETF has many advantages which I already mention that liquidity is increase and a diversification and we don't need to deal with any specific keys or don't need to sign up for wallet but at the same time there are risk as well because there are market volatility and the fee is also increase and sometime there maybe tracking error we can't track properly the Bitcoin price and sometime they are maybe me understanding our miss match between the ETF and words actual going on in the market.

How might the introduction of an sec-approved bitcoin etf interact with the decentralized governance of the steem blockchain, and how might these two approaches complement or diverge in investors' perspectives on asset management? digital assets?

- Now this thing is very easy and understand evil that when the ETF is approved so as I already mentioned it is a combination of two things so when I am saying that it is also containing the Bitcoin and when the Bitcoin will rise it means that it's demand and supply will increase and when we can't fulfill its demand so other cryptocurrency will rise and steem price will also increase.

- And enter the investors will develop more interest in other coins like a steem block chain and so we are expecting that there will be rise in the steem block chain as well.

And secondly there is diversification as well and the transaction fees is very less with the steem block chain.

As the steam is decentralized it means that there is specific decentralized system which is handling the steam and which is well regulating it and maintaining the daily rewards it's diversification as well as invested interest into it.

Conclusion

So this is all what I have able to write and search about it and about Bitcoin ETF and what it containing and then I talk about how it's approval in Australia Canada and US and then I talk about how it effects The other cryptocurrency as well and then I also talk about the advantages and disadvantages of the ETF.

All of picture I took from adobe.com none of this is my property or taken with my mobile.

Hello there Your comprehensive explanation of Bitcoin ETFs is fantastic The analogy with a financial gift basket makes it so relatable. Your insights into the advantages and disadvantages of Bitcoin ETFs provide a well rounded perspective. The detailed analysis of the impact on the cryptocurrency market post SEC approval is insightful. Your breakdown of the factors contributing to Bitcoins fall after approval shows a deep understanding. Wishing you the best in the contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TEAM BURN

Congratulations, your comment has been successfully curated by @inspiracion at 5%.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks you for reviewing my post and commenting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your comment and we can uplift each other

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post has been successfully curated by @inspiracion at 35%.

Thanks for setting your post to 25% for @null.

We invite you to continue publishing quality content. In this way you could have the option of being selected in the weekly Top of our curation team.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

I have to say, your explanation of Bitcoin ETFs is absolutely amazing. The way you compared it to a financial gift basket is such a relatable analogy. Your insights into the pros and cons of Bitcoin ETFs give such a well-rounded perspective. And your detailed analysis of the impact on the cryptocurrency market after SEC approval is truly insightful. I'm really impressed with how you broke down the factors contributing to Bitcoin's fall post-approval. You really have a deep understanding of this topic. Wishing you all the best in the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for visiting my post I wish you good luck for this contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you friend you always comment on positive way I will try to improve more inshallah

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Improved and you have much enthusiasm 😊😁😊 for learning keep doing great work ☺️☺️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes I am improving ❤️🩹❤️🩹❤️🩹

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yup sure

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings, @shanza1! Your fantastic analogy of Bitcoin ETFs as a financial gift basket is osm! 🌟 The way you delve into the impacts post SEC approval shows a deep understanding. All the best in the contest, success for you! 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for valuable comment.....wish u success too

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agree with you that whatever you have explain about the Bitcoin ETF and also about owning Bitcoin in a direct way as well as you have also shared your complete understanding about Bitcoin affects after the approval of Bitcoin ETF that what are the factors which were influenced especially in the overall market I wish you success.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for visiting and commenting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It was my joy and happiness 😊💕

Have a blessed evening 🌆

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks 😊😊😊😊👍👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Have a blessed Monday ☺️

Keep calm 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Estoy de acuerdo en considerar a los ETF como un paquete de dos componentes, una parte es un fondo de apuestas como los ETF y la otra es la criptomoneda Bitcoin como activo subyacente que los ETF representan. Sin duda será más fácil invertir en los ETF sin muchos conocimientos tecnológicos para operar en la bolsa.

Esto traerá cierta estabilidad al mercado crpto, gracias a la regulación, dará mayor transparencia y por ende mayor credibilidad, aumentará el interés institucional.

Gracias por compartir, saludos y mucha suerte.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for visiting and valuable commenting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

¡Saludos amiga, feliz día!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

💜💜

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Aapane Bitcoin ETF ke bare mein aur Bitcoin ki histry ke bare mein bahut acchi Tarah se baat ki hai ki yah kaun se area mein sabse pahle approve hua tha aur aapane iski future ke bare mein bhi hamen bahut acchi Tarah se guide Kiya aur har question mein acchi Tarah likhane ki Koshish ki hai main aapki koshishon per aapko good luck kahati hun.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bht Shukria Meri post review krny liay bht mehrabni apki

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit