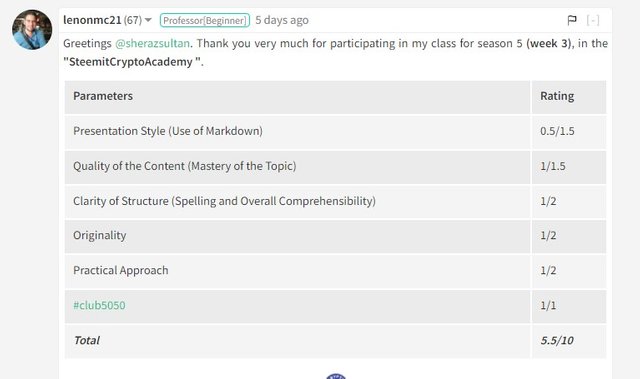

Link of original post = Homework for professor @lenonmc21

Respected @lenonmc21 @steemcurator02 . My post was not curated

Hello everyone. A warm welcome in another week of this amazing community. This week, professor @lenonmc21 has delivered the lecture about the Perfect Entry Strategy. It was amazing to learn about this strategy. This is my homework post.

.png)

Q.1) State in your own words what you understand about the Perfect Entry Strategy (Place at least 2 examples on crypto assets)?

The perfect entry strategy

There are a lot of indicators which are use to get the good entry or exit spots in the market. The traders use the indicators or strategies to analyze the market in order to determine what to do next. They make the buy or sell order by using the different strategies so that they can get maximum profit. To maximize the profit, multiple strategies are being use in the crypto market and the perfect entry strategy is one among them which the traders use to maximize their profit and to minimize the loss.

The perfect entry strategy can be said the combination of three conditions. When the three condition get fulfill, it is consider the best time to enter into the market. The first condition among them that market should be in trending phase. The trend can be bullish or bearish. But the market must be trending in a certain direction. first check whether the market is trending or not. If it is trending then first condition is meet. Focus on the direction where the market is trending. The market can be trending upward or downward. Get clear the direction of the market

The stochastic oscillator is an indicator which is being use in the market to determine the direction of the market. This indicator is highly useful and easy to understand. When the stochastic oscillator reading is below 20 bands, it show that market is in downward direction and an uptrend is expected because no trend is for permanent. If right now, the market is trending downward, next there are chances that the market will rise upward.

If the stochastic oscillator is trending up the 80 bands, it show that market is in overbought zone. The market right now is trending upward and there are probabilities that the next trend in market will be bearish. Next condition which need to get fulfill is 200 moving average. The price should be close to the 200 moving average.

.png) Bullish market structure where the perfect entry strategy can apply because market is in trending phase.

Bullish market structure where the perfect entry strategy can apply because market is in trending phase.

.png) Bearish market structure where the perfect entry strategy can apply because market is in trending phase

Bearish market structure where the perfect entry strategy can apply because market is in trending phase

All these three component together produce the signals by use of which the traders determine what to do next to maximize their profit. These three components are highly useful and help the traders together to trade in a successful way.

To use the perfect entry strategy, the first thing is getting clear about the direction of the market. Check where the market is trending. The market can be in bearish trend or bullish trend. The third one is the ranging market. The time when there is no clear trend in the market is known as ranging market. AT this time there are sideway moves shown in the chart. In the ranging market, the traders should avoid to take any trading decisions.

After getting clear about the trend of market, now check that 200 moving average should be close to the price of the asset. The market can be trending upward or downward. The 200 MA should be close to the price on the chart either in upward direction or downward direction. When there see a doji candle, it is expected that now the trend will reverse.

Then at last to make the perfect entry strategy, check the whether the market is in overbought region or oversold region. The stochastic oscillator reading show the region of market. If the reading of the indicator is between 80-100 bands, it show that market is in overbought region. The buying pressure is high at this point and selling pressure is low. At this region, the demand is high and supply is low because of which the price rise upward.

.png) The market is in oversold region

The market is in oversold region

.png) The market is in overbought region

The market is in overbought region

.png) The chart where the perfect the buy order can be place

The chart where the perfect the buy order can be place

.png) The chart where the perfect sell order can be place

The chart where the perfect sell order can be place

When the reading of the indicator is between 0-20, the market is said to be in oversold region. Here the demand is low and supply is high. The price of the coin decline and the market is in the oversold region.

Q.2) Explain in your own words what candlestick pattern we should expect to execute a market entry using the Perfect Entry Strategy.

This strategy is expected to execute in a market which is trending upward or downward. This strategy produce the signal of trend reversal and hence the traders become able to trade in successful way by taking the important trading decisions at that moment. That candle is also known as the doji candle. The doji candle is a candle on the candle stick chart which is shown in the trending market but when it appear on the chart, it is expected that trend is going to reverse.

The traders then make the important trading decisions when the doji candle is shown on the chart. The doji coin show that the trend is end and now market will move in opposite direction. If there is uptrend and doji candle is form, it indicate that the uptrend is end here and now market will move in downward direction. SO traders should sell the coins and should exit from the market

When the market is downtrend and the doji candle is form, the traders should know that the downtrend is going to reverse in uptrend and they should enter into the market by buying the coins. But there are some conditions when the market start ranging after the doji candle. This is the zone where the market do not follow a certain trend but show the sideway moves. Still we see that the market stopped trending in its previous direction after the doji candle.

Q.3) Explain the trading entry and exit criteria for buy and sell positions in any cryptocurrency of your choice (Share your own screenshots)

There are some points which we need to keep into consideration while making the buy or sell entry into the market.

- We must have a proper plan before entering into the market. To make a perfect entry into the market, we should have perfect preparation that all the condition which we mentioned above should meet. The market should be in trending zone. The 200 Moving average should be close to the price on the chart and last one is stochastic oscillator.

- All the condition should be fulfill before making the perfect entry into the market. But if the 1 condition among three which i have explained above fail to meet, we should make the entry into the market. We should wait for another opportunity in the market where all the conditions get fulfill and then make the perfect entry by selling or buying the coins.

- To place the buy or sell order, make sure that market isn't in the ranging zone. There should be sideway moves on the candlestick chart. There must be a clear trend. It can be downtrend or uptrend but in case of ranging market, the traders should buy or sell any asset. Sometime, we see that all the conditions get fulfill even in ranging zone but still we do not have idea where the price of the asset will move so we should wait unless and until the price start moving in a particular direction and then should make an entry into the market.

- While placing the order, we should be very careful about the stop lose and the take profit. The take profit should be above the 80 bands of the stochastic oscillator. The take profit is the maximum profit which the traders want from trading. The stop lose should be below the small candle. The ratio is usually set as 1:2 or 1:3. The profit is usually set greater than the stop lose

.png)

.png)

Q.4) Practice (Remember to use your own images and put your username). Trade 2 demo account trades using the “Perfect Entry” strategy for both a “Bullish” and “Bearish” scenarios. Please use a shorter period of time to execute your entries. Important you must run your entries in a demo account to be properly evaluated.

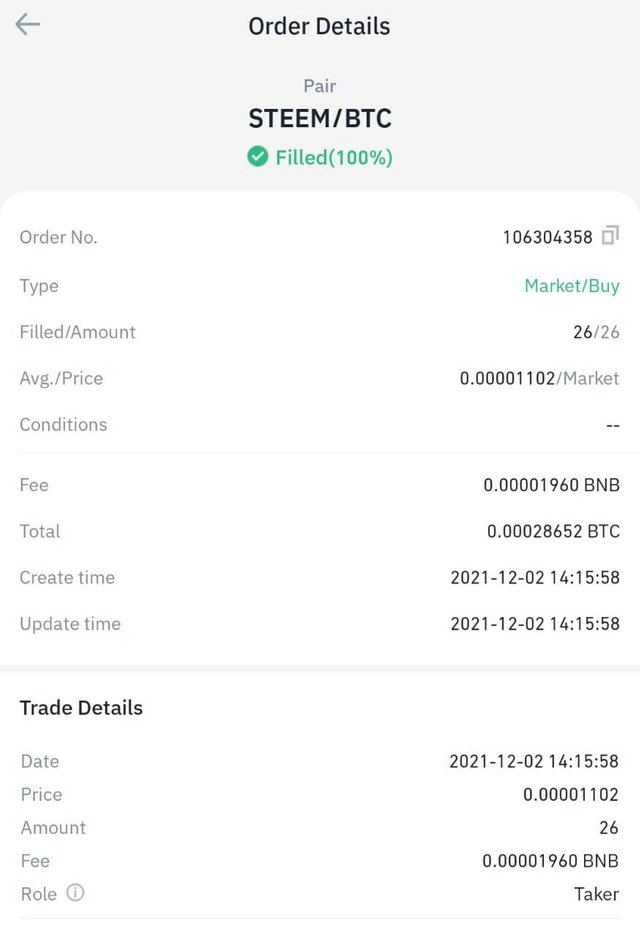

I use the binance to place the order for this question.

.png)

I analyze the STEEM/BTC market. The above is the chart where we can see that the market is trending downward. The market is below 30 on the stochastic oscillator which mean that market is in oversold region. There is bearish season in market. The stochastic oscillator showing that market is not in overbought region but oversold region. Then the small candle is close to the MA. Here i place the buy entry. I place the buy order of steem/BTC.

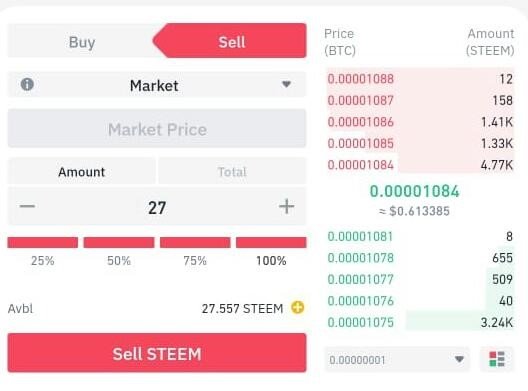

To place the sell order, focus on the below chart

To place the sell order, focus on the below chart

_LI.jpg) The market is in overbought region. The moving average is close to the small coin so i place the sell order here to maximize my profit. This is the best exit position. I exit from the market by selling the steems which i have bought.

The market is in overbought region. The moving average is close to the small coin so i place the sell order here to maximize my profit. This is the best exit position. I exit from the market by selling the steems which i have bought.

.jpeg)

Conclusion

The perfect entry strategy can be said the combination of three conditions. When the three condition get fulfill, it is consider the best time to enter into the market. The first condition among them that market should be in trending phase. Then the price should be close to 200 moving average. The stochastic oscillator also use here which determine whether market is in oversold region or overbought region. This help to find the best entry and exit spot. By using all three components, the traders get the perfect entry spots.

Thanks to professor @lenonmc21

.jpeg)

Respected @lenonmc21 @steemcurator02. Please curate my assignment. I have reposted it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings.

Ready, it has been sent to the curators.

Steemit Cryptography Professor.

@lenonmc21

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@lenonmc21 @steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit