As momentum increased, Bitcoin (BTC) bounced off short-term support at $44,000.

The cryptocurrency has gained 5% in the last week, but the resistance above $48,000 and $50,996 might stymie the surge, as it did in September of last year.

Pullbacks may be brief this time, as long as buyers hold support above $43,000-$45,000. Furthermore, the MACD indicator's dramatic lack of downside momentum over the last three weeks may stimulate additional purchasing on price drops.

After an overbought reading on March 28, the relative strength index (RSI) on the daily chart is approaching the neutral zone. This points to a stop in the current price surge, which is common at the start of the month.

For the time being, BTC is attempting to find support near its previous breakthrough milestone of $45,000. According to the DeMARK indicators, upside exhaustion signs presented a timely countertrend reversal set-up earlier this week, however, the sell signal has not been confirmed. That suggests the market is currently in a state of neutrality, awaiting a clear break above or below the five-day price range.

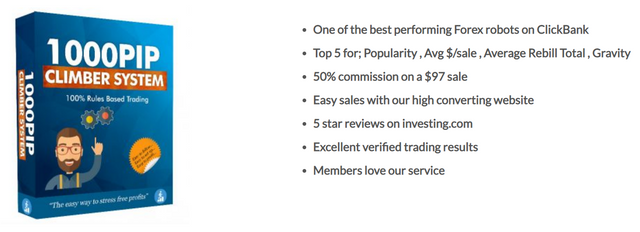

High Conversion Forex Robot:- https://bit.ly/3u1JtRx